All the Answers

Well-known member

A government decision sank the returns of funds such as Mercado Pago: what is the new investment that is growing - Infobae

Source:

Una decisión del Gobierno hundió los rendimientos de fondos como el de Mercado Pago: cuál es la nueva inversión que crece

El recorte de los intereses que decidió el BCRA afectó los rendimientos de billeteras virtuales y los fondos “money market”. Hay migración a fondos con más riesgo, pero que le dan pelea a la inflación

May 20, 2024

The interest cut decided by the BCRA affected the returns of virtual wallets and money market funds. There is migration to funds with more risk, but that fight inflation

Financial investments in pesos have a tough adversary in inflation.

After the last drop in the reference rate ordered by the Central Bank, banks reduced the yield they pay for fixed terms and currently most offer a nominal rate of 30% per year, which translates into a profit of 3.3% monthly interest, negative compared to inflation. The movement is part of the strategy of the Minister of Economy, Luis Caputo , to disarm the remunerated liabilities of the Central Bank . The Treasury pays a higher rate than the monetary authority and that changes the game.

With this cut in fixed-term rates - today deregulated -, a “star” of the financial world begins to go out: these are the “money market” mutual funds. Other common names for the same type of vehicle are the “fixed-term ” common fund or, the more technical, “T+0 . ” The most widespread are the paid accounts of digital wallets such as Mercado Pago .

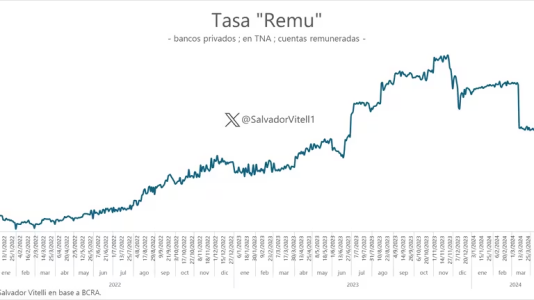

“The rate on paid accounts drops to 26.9% annually after the BCRA rates drop. It is at minimum levels not seen since May 2022. This implies lower performance for the FCI Money Market,” said Salvador Vitelli , Head of Research at Romano Group.

Fuente: Salvador Vitelli ("X": @SalvadorVitell1)

In this context, the “T+1” Common Investment Funds (FCI) , which allow money to be accessed within 24 hours , became an attractive option that could serve to improve the profitability of savings, since they diversify in several assets, and in addition, you can choose which one to invest in according to the profile. FCIs are an investment instrument made up of contributions from a group of investors who share the same profitability and risk objective.

The “T+1” funds invest in fixed rate instruments, such as Lecap, Negotiable Obligations, Badlar rate, checks, sureties, fixed terms, but they mainly position a large percentage of their portfolio in short-term CER bonds, which, In a context of lower rates, they are more convenient in terms of returns than other fixed rate instruments.

Given that the BCRA ordered four rate cuts in just over a month, and that each of these is applied almost immediately to the returns of virtual wallets, the T+1 FCIs are beginning to be convenient and much more attractive, even for those risk-averse and more conservative investors who housed their pesos in fixed terms or even in money market funds.

“T+1” funds invest in fixed rate instruments, but mainly position a large percentage of their portfolio in short-duration CER bonds

However, the investor has to take into account that the “T+1” are more exposed to volatility , due to the fluctuation in the market price of the assets that make up the menu, at the same time it must be taken into account that These placements do not have immediate liquidity . On the other hand, the “T+0” have a guaranteed rate of return - which in any case is losing against inflation - and the money can be used immediately. In digital wallets, money is accessible 24 hours a day, every day of the week.

The T+1 offer, now the most chosen, has a variety of versions, including with a 24-hour redemption period, although the recommended permanence time horizon is 90 to 180 days . Within the portfolios there are instruments from different issuers and with different degrees of liquidity that remain suitable for conservative profiles.

“These assets allow for higher returns in pesos and represent an attractive alternative for those investors looking for higher returns than those offered by a money market or fixed term,” said Roberto Silva , Asset Management analyst at Cohen.

The interest paid by the Mercado Pago wallet depends on the performance of the BCRA's passive repos, which have already suffered six rate cuts

The key to this search for profitability for placements in pesos is inflation. Although the rise in prices is losing speed month by month, it was only in April that it reached below 10% monthly. If measured in dollars, the performance of the T+0 and T+1 funds remains positive, but the purchasing power of that invested money has been eroding.

Therefore, outside of the UVA fixed-term option, which adjusts for inflation but requires immobilizing the money for six months, with a dollar that adjusts to 2% monthly and interest rates in constant decline, from the ALyC (Settlement Agents and Compensation) already recommend investing in T+1 funds and even going for less conservative options, such as CER bonds, which are indexed by the Reference Stabilization Coefficient, an indicator created with the objective of adjusting the capital of deposits and credits for inflation .

An example of the latter is the CER TX26 bond , an inflation-adjustable title (CER index) maturing on November 9, 2026 but amortizable in five installments starting this year. In monthly terms it pays inflation from the previous month -0.4% monthly, so it is expected that in one month it will yield 7.8% monthly, far exceeding the fixed term alternative. And the CER T4X4 bond , maturing on October 14, 2024, projects a monthly yield of 4.25% , also above the yield of a fixed term.

“We observed exits from Money Market funds looking for other alternatives, for example, in stock market promissory notes in pesos; and that causes rates to drop more and more. As we always say, the premise here is to compare rates. Banks sometimes offer very good levels and are competitive, but on other occasions, the capital market improves them. Hence, the importance of analyzing different options and using the channel, depending on the moment, that is appropriate,” defined Pablo Debernardi , Corporate Director of PPI (Personal Investment Portfolio).