All the Answers

Well-known member

After the jump in the free dollar, what do analysts expect for this week? - Infobae

Source:

Tras el salto del dólar libre, ¿qué esperan los analistas para esta semana?

Si bien en los últimos días se observó una vuelta de la volatilidad cambiaria, aunque los analistas dudan que esta tendencia continúe

May 27, 2024

Although in recent days a return to exchange rate volatility has been observed, analysts doubt that this trend will continue.

The Blue dollar hit a record high of $1,300 last week. (REUTERS//Kim Hong-Ji)

Last week exchange rates rose again after several months of stability. The return of exchange volatility was, without a doubt, a yellow light on the board of Luis Caputo 's economic program , but analysts believe that the rise of the free dollar does not have much fuel left.

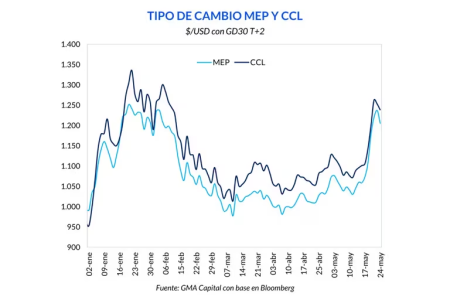

The Dollar Cashed with Settlement (CCL) reached a maximum of $1,256 and then closed on Friday at $1,234, the MEP reached $1,234 and fell to $1,205, while the Blue reached a record of $1,300 and closed the week with a price of $1,220 .

Among the main factors of the increases, analysts point out the slow agricultural liquidation of the coarse harvest, which is essential since 20% of the foreign exchange income is liquidated to the CCL, and the new lowering of rates by the Central Bank of 10 percentage points at 40% annual nominal.

MEP and CCL dollar evolution (GMA Capital)

“The striking thing was that despite all these declines, the exchange rates remained unchanged, without reaction. For some reason the last decline was the straw that broke the camel's back and the dollar responded . This increase occurs in the context of a discussion about whether there is an exchange delay. The risk is that if inflation remains above the depreciation rate of the official exchange rate for several months, the situation will become more complicated. For now, this rise in parallels is simply an alert that we hope will lead the Central Bank to reflect,” they said from Econviews.

However, the different consulting firms are optimistic and do not believe that an upward trend will continue in parallel dollars.

From Delphos Investment they assured: “In the short term we believe that the possibilities of increases in parallel exchange rates would be limited with greater chances of stabilization near current levels. Macroeconomic fundamentals do not support a greater escape from the CCL, but they fail to counterbalance the increase in uncertainty. New positive drivers would be needed (approval of the Bases Law, greater foreign exchange settlement, improvement in the external climate, etc.) to catalyze a more favorable movement for Argentine assets.”

“In the short term we believe that the possibilities of rising parallel exchange rates would be limited with greater chances of stabilization near current levels” (Delphos)

For its part, the GMA Capital report stated: “There are no macroeconomic reasons to think about greater volatility in the exchange rate: the main 'pipes' for issuing pesos were closed, the Treasury is on track to record the first year of fiscal surplus since 2008 and the BCRA is accumulating dollars.”

Meanwhile, Consultatio stated: “The spectacular real appreciation of the free exchange rate in recent months is fundamentally explained by the commitment shown by the government to achieve fiscal consolidation and progress in reducing macro imbalances. To the extent that this does not change, the rise in the exchange rate has a ceiling. And we understand that beyond the known difficulties, the government's conviction remains firm."

“The 80-20 scheme certainly gave depth to the appreciation, but it is the surplus that set the direction. Therefore, regardless of the volatility it may have, we rule out a spiralization of the gap. The risk of a greater rise is fundamentally political. At the close of the market, the possibility of a cabinet change after the treatment of the Bases law was known. “This will be an issue to monitor closely,” he added.

“There are no macroeconomic reasons to think about greater volatility in the exchange rate” (GMA)

With more caution, the consulting firm Outlier projected: “We believe that after last week's increases, it is likely that the CCL will push down given the best level of the export dollar that it has left (and in fact on the same Friday there was a considerable amount of agricultural liquidation).

“However, it will hardly be possible to operate below $1,100 again in the short term with these interest rates or, rather, interest rate differentials in dollars if there are no developments (advances) on any of the fronts that were mentioned in the previous section,” they added.

Gap between the official exchange rate and the CCL (Econviews)

“Consequently, the gap in the 30%-40% range may be here to stay as well as the higher level of financial volatility. Looking ahead to the second half of the year, both elements would have more fuel, since as the liquidation rate of agro-exporters slows down since mid-July, the commercial flow via blend that arrives at the CCL will decrease,” they concluded.