After the stop to the DNU, financial dollars suffered their first sharp jump since Milei took office - Infobae

Source:

www.infobae.com

www.infobae.com

January 04,2023

They remained above $1000 in all their variants, even being above the free dollar. The political resistance that the Government faces to advance with its plan began to impact the exchange market.

By Pablo Wende

A supporter of Argentina's elected president Javier Milei holds a representation of a $100 bill with his image. REUTERS/Agustin Marcarian

Financial dollars had a significant jump yesterday, which represented the first major increase since Javier Milei took office. Both the MEP dollar and the cash settlement dollar (CCL) exceeded $1,000, marking nominal highs since the libertarian government took office. The exchange market suffered the impact of the judicial brake on the labor chapter of the Decree of Necessity and Urgency published a couple of weeks ago.

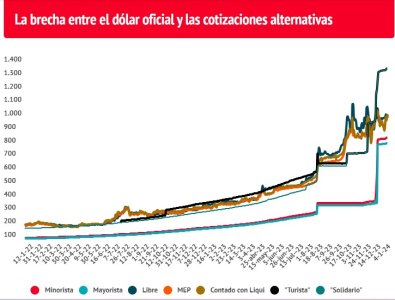

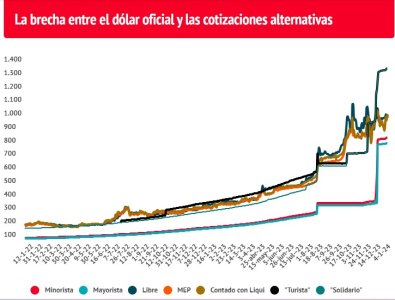

This movement was a warning sign for the political difficulties that the new government will encounter in moving forward. Investors' search for coverage was reflected above all in the 5% rise of the CCL, which ended at $ 1050, while the MEP dollar closed at 5% 1031. Both remained above the free dollar, which remained still at $ 1005. But in recent days the distance between the different quotes has narrowed to minimum values, so it would not be strange if it adjusts today.

The gap with the retail dollar grew to 25% and with respect to the wholesale dollar it rose to 28%. This also reveals that in these months it will not be easy for Luis “Toto” Caputo to maintain exchange rate stability.

Beyond the expected difficulties and political resistance that Milei encounters, the market is beginning to take into account that some decisions adopted by the Government at the start of the emergency plan present some problems. For example, the sharp drop in interest rates helps to liquidate liabilities in pesos, but at the same time it is an invitation to dollarize portfolios.

On the other hand, the Central Bank also reported that it will “temporarily” maintain the 2% adjustment of the nominal exchange rate to use it as an anti-inflationary anchor. This was revealed by the institution in a report released at the end of the year, where it indicates that this monthly increase pattern is necessary until the market contemplates the effects of the fiscal austerity plan.

With very negative real rates (since they are strongly below inflation) and an official dollar that also tends to lag after the strong adjustment in December, it is almost natural that the exchange gap tends to increase. In fact, the drop to almost 15% of the exchange gap in the middle of last month was something exceptional and surprised even the economic team itself, which expected a much smaller reduction, around 40%.

Of course, the behavior of the dollar at the local level this summer will be very dependent on what happens in political matters, not only with the DNU but with the omnibus bill that the Government sent for legislative approval.

One of the most important points ahead in this sense is the approval of the tax package, which includes the reimplementation of the Income tax for high salaries, a moratorium, money laundering and the possibility of paying Personal Assets for five years all together before mid-year. It is also proposed to leave aside retirement mobility and temporarily establish increases by decree, until a new adjustment scheme is established. These reforms seek to significantly improve the fiscal front and reach the objective of balance throughout 2024.

Source:

Tras el freno al DNU, los dólares financieros sufrieron su primer salto fuerte desde que asumió Milei

Quedaron por encima de los $ 1000 en todas sus variantes, quedando incluso por encima del dólar libre. La resistencia política que enfrenta el Gobierno para avanzar con su plan empezó a impactar en el mercado cambiario

January 04,2023

They remained above $1000 in all their variants, even being above the free dollar. The political resistance that the Government faces to advance with its plan began to impact the exchange market.

By Pablo Wende

A supporter of Argentina's elected president Javier Milei holds a representation of a $100 bill with his image. REUTERS/Agustin Marcarian

Financial dollars had a significant jump yesterday, which represented the first major increase since Javier Milei took office. Both the MEP dollar and the cash settlement dollar (CCL) exceeded $1,000, marking nominal highs since the libertarian government took office. The exchange market suffered the impact of the judicial brake on the labor chapter of the Decree of Necessity and Urgency published a couple of weeks ago.

This movement was a warning sign for the political difficulties that the new government will encounter in moving forward. Investors' search for coverage was reflected above all in the 5% rise of the CCL, which ended at $ 1050, while the MEP dollar closed at 5% 1031. Both remained above the free dollar, which remained still at $ 1005. But in recent days the distance between the different quotes has narrowed to minimum values, so it would not be strange if it adjusts today.

The gap with the retail dollar grew to 25% and with respect to the wholesale dollar it rose to 28%. This also reveals that in these months it will not be easy for Luis “Toto” Caputo to maintain exchange rate stability.

Beyond the expected difficulties and political resistance that Milei encounters, the market is beginning to take into account that some decisions adopted by the Government at the start of the emergency plan present some problems. For example, the sharp drop in interest rates helps to liquidate liabilities in pesos, but at the same time it is an invitation to dollarize portfolios.

On the other hand, the Central Bank also reported that it will “temporarily” maintain the 2% adjustment of the nominal exchange rate to use it as an anti-inflationary anchor. This was revealed by the institution in a report released at the end of the year, where it indicates that this monthly increase pattern is necessary until the market contemplates the effects of the fiscal austerity plan.

With very negative real rates (since they are strongly below inflation) and an official dollar that also tends to lag after the strong adjustment in December, it is almost natural that the exchange gap tends to increase. In fact, the drop to almost 15% of the exchange gap in the middle of last month was something exceptional and surprised even the economic team itself, which expected a much smaller reduction, around 40%.

The international context did not favor the local exchange market either. Wall Street opened the year down, long-term interest rates in the United States rose and emerging currencies generally suffered. The exchange rate in Brazil jumped from 4.85 reais to 4.92 in the first two days of the year. The dollar index, which adjusts against a basket of developed currencies, also appreciated at the start of 2024.Beyond the political and judicial resistance to the plan carried out by Javier Milei, the chosen strategy from a financial point of view is beginning to make noise among investors. With very negative real rates and an official dollar rising only 2% monthly, it is difficult to contain the exchange gap

Of course, the behavior of the dollar at the local level this summer will be very dependent on what happens in political matters, not only with the DNU but with the omnibus bill that the Government sent for legislative approval.

One of the most important points ahead in this sense is the approval of the tax package, which includes the reimplementation of the Income tax for high salaries, a moratorium, money laundering and the possibility of paying Personal Assets for five years all together before mid-year. It is also proposed to leave aside retirement mobility and temporarily establish increases by decree, until a new adjustment scheme is established. These reforms seek to significantly improve the fiscal front and reach the objective of balance throughout 2024.