All the Answers

Well-known member

Argentina expensive: the purchasing power of Chilean and Brazilian tourists plummeted 40% this year - infobae

Source:

Argentina cara: el poder de compra de turistas chilenos y brasileños se desplomó 40% este año

Según un informe privado, en los últimos 5 meses los turistas internacionales perdieron poder adquisitivo en el país, mientras que los argentinos lo ganaron en el exterior

May 15, 2024

According to a private report, in the last 5 months international tourists lost purchasing power in the country, while Argentines gained it abroad

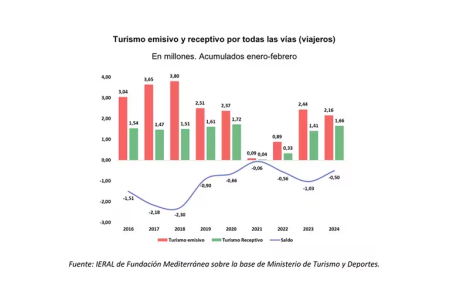

Tourism flows with neighboring countries explained 62% of incoming tourism so far this year

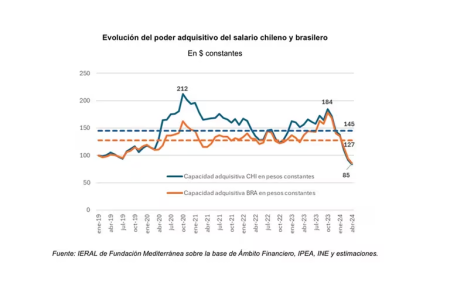

The purchasing power of Chileans and Brazilians to buy in Argentina fell between 38% and 42% in the last 5 months, respectively, which is expected to impact the dynamics of international tourism, especially in the near future.

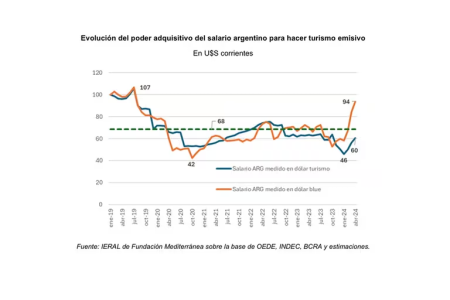

In turn, according to a report by the IERAL of the Mediterranean Foundation , in the same period the ability to purchase tourist goods and services abroad by Argentine employees grew 57% (measured in blue dollars) and 20% (measured in blue dollars). at the value of “tourist” dollars). “This will not necessarily translate quickly into an increase in outbound tourism, because the population suffers the consequences of the macro adjustment of recent months. But it could happen in the medium term,” the study said.

For example, in the first two months of 2024, outbound tourism reached 2.16 million tourists (86% of that observed in January-February 2019, with 2.51 million tourists), while incoming tourism was 1 .66 million tourists in the same period, reaching 103% of pre-pandemic levels (1.61 million tourists). In this way, the deficit in the tourism balance (in travelers) in January - February 2024 was around half a million tourists, resulting in the lowest record of the decade, if 2021 is excepted, the year in which flows tourism were low due to the pandemic.

“If the evolution of flows with neighboring countries is examined, which explained 62% of incoming tourism so far this year and 84% of outbound tourism, we have a panorama similar to that previously reflected. In both cases, the year 2024 had begun with less outbound tourism and more inbound tourism than in 2023. However, these trends could begin to change, depending on the trajectory of the macro variables,” stated the report prepared by Marcelo Capello and Marcos Cohen Arazi .

In this sense, 2023 was a year of important foreign exchange generation from inbound tourism due to an increase in the purchasing power of international tourists as a result of the exchange gap.

Taking the two countries that represented 37% of foreign visitors during 2023, Chileans were able to buy, on average, 12% more than the average of the last 5 years, and Brazilians were able to buy 16% more than the average.

But now Chileans have lost 42% of their purchasing capacity from December to the present, while Brazilians have lost 38%. This can be extrapolated to the majority of international tourists, regardless of their origin, and although this situation does not immediately impact tourism flows, it will certainly have medium-term effects on the level of activity, indicated IERAL.

Evolution of the purchasing power of Chileans and Brazilians in the country

The flip side is that, although Argentines suffered a drop in purchasing power in the domestic economy and that contains spending on international tourism, outbound tourism is becoming cheaper due to the real appreciation of the peso , especially if the price of "Dolar blue". When the value of the “tourist dollar” is considered (official plus surcharges associated with PAIS Tax and perceptions), the situation changes because this quote would maintain the purchasing power around the average level of 2023, which was between 5% and 11% lower to that of the last 5 years (depending on whether it is considered the value of the blue dollar or the value of the “tourist” dollar, respectively). This explains why outbound tourism was somewhat contained during the last year.

However, “from December to today, this capacity to purchase tourist goods and services abroad grew 57% (measured in blue dollars) and 20% (measured in the value of “tourist” dollars). Logically, this will not automatically translate into an increase in outbound tourism, because the context of generalized loss of purchasing capacity to acquire goods and services locally will be dominant in most cases. But it could generate greater incentives to carry out outbound tourism in the medium term, especially if it continues for several more months with a crawling peg of 2% per month,” the study said.

For the moment, the increase in outbound tourism would seem contained: according to the Atrápalo travel agency, during the Hot Sale, package sales for national destinations grew by 23.55%, while international sales fell 12% compared to the previous year. last year.

The economic impact

Regarding the macro impact of this situation, the report observed: “Historically, inbound tourism has been a generator of foreign currency, which is made up of the expenses made by international travelers in the country. The total revenue flow from inbound tourism has remained close to US$5 billion over the last decade, except for 2020 and 2021, which were years of travel restrictions. In 2023, the income generated by inbound tourism reached USD 5,442 million and was higher than in 2019, being the second best record in two decades.”“In the case of outbound tourism, the outflow of foreign currency has fluctuated more erratically, responding more elastically to changes in relative prices that favored tourism abroad. In 2023, residents' trips abroad explained an outflow of US$ 7,258 million. The balance, although negative, is among the lowest of the decade,” he added.

“In general, inbound tourism has historically been more stable, with outbound tourism exhibiting greater fluctuations, as a result of exchange rate appreciations/depreciations. In the first two months of 2024, the trading figures in the foreign exchange market also reflect important trend changes. With the notable decrease in the exchange gap, tourism income settled through the exchange market multiplied by 3 compared to the same period in 2023, while expenses (now made more expensive by a higher exchange rate, but also with taxes on consumption abroad) was reduced by around 23%,” he concluded.