BuySellBA

Administrator

Argentina: The impact of the devaluation on residential sales and the fine print of the new stamp duty tax - South American Real Estate News

Source:

www.gatewaytosouthamerica-newsblog.com

www.gatewaytosouthamerica-newsblog.com

December 28, 2023

Gateway to South America on 10/01/2024 - 23:17 in All categories of countries are, Argentina Lifestyle, Argentina Mendoza, Argentina-General, Argentine farms, Buenos Aires Residential, Commercial Argentina, Lifestyle Properties in Argentina

Specialists now speak of a “slight recovery” of the market, but the fever experienced in August to October that is beginning to cool down after the elections.

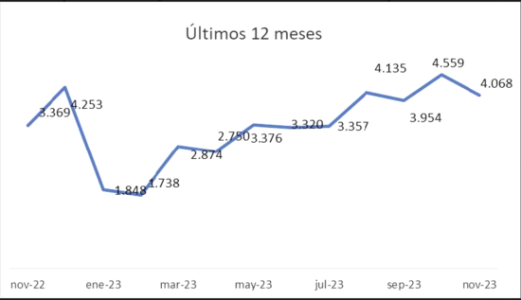

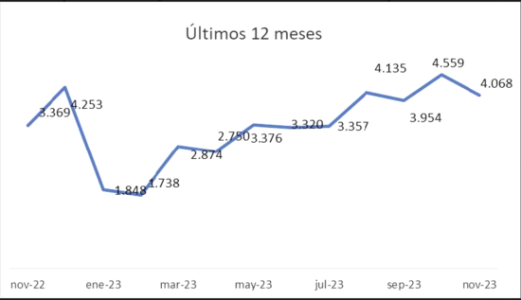

October once again smiled on the real estate market. Despite going through a change of government, with the uncertainty that this implies, 2023 was positive for purchasing and selling properties. The city of Buenos Aires is a clear example of the trend, since in the 11th month of the year, 4,068 operations were carried out. The number is celebrated by the sector, as it is consolidated as the best November since 2018.

In fact, the total number of property purchase deeds in November was 20.7% higher than last year’s level. Although it is far from the peak of 6,805 purchase and sale agreements signed in 2017, 2023 shows a good streak.

“In what is more seasonal, perhaps it can be read that it was a quarter (August-October) with more activity than usual and especially in an electoral year and now – with those operations completed – that escalation has softened. Hence, there is a 10 per cent decrease compared to the previous month,” analyzes Jorge De Bártolo, president of the College of Notaries of the City of Buenos Aires.

It is worth noting that the year generally continued with an upward trend in property sales. Since August, the monthly results have been around or even exceeded 4,000 monthly operations.

Even so, the December results are pending to make a complete and reliable summary of 2023.

"Another positive fact is that we have added 19 months of year-on-year growth, and that outlook is not a boom, but at least it is reassuring that there is a slight line of recovery. Beyond this data, what we want as an institution is that bases be generated so that a housing policy is reflected, a key factor for the aspirations of any family.”

This December, the Buenos Aires legislature updated the 2024 rate table and the amount of another tax to pay: the Stamp Tax for the purchase and sale of real estate. Buyers with more than one property in their name in the city are charged a 3.5% rate on the property’s value, to be paid equally between buyer and seller.

But those who do not have real estate in their name and, therefore, acquire this property for single-family housing and permanent occupancy are granted a tax exemption of a certain amount. If applicable, a fixed sum determined by the Government is subtracted from the property’s value, and a 3.5% rate is applied to the surplus.

That is the benefit figure that the legislature updated this December for next year. The $10,950,000 in 2023 will become $24,889,350 in 2024. At the current official exchange rate of $824.5, the amount went from covering US$13,280 in 2023 to US$30,187.2 in 2024, as long as the dollar’s value does not increase.

Santiago Levrio, institutional director of the community of Urban Developers -Alianza Urbana-, believes that the updated amount “toughens access to housing” , given that historically, the tax on stamps for a single home could cover US$110,000.

Julián González Mantelli, city notary and legal-notary-tax advisor, validates these data: “ Originally, these amounts represented figures closer to US$100,000, but due to the devaluation, they were liquefied .”

This year alone, the devaluation of the peso posed a different reality for the buyer who purchased their unique home at the beginning of the year compared to today. For example, whoever purchased a home for US$100,000 on January 2 when the official dollar was quoted at $184.75, the value of the pesified property was $18,475,000. Therefore, the tax was $646,625, and as the buyer and seller paid it equally, each would have paid $323,312.5 for this tax.

However, if that same property were purchased today for US$100,000, its value in pesos at the official exchange rate would be $82,450,000, from which the exemption of $10.95 million would have to be subtracted, and the total tax would be $2,502.500. That is to say, the buyer of his first and only home in the city would have to pay $1,251,250 in stamp tax (and the seller would pay the same amount), almost four times more than what he would have paid in January.

This reality would change – although not very significantly – if that same buyer decides to purchase the property in the first days of next year. Assuming that the exchange rate remained the same, the buyer could pay less for the same tax: $1,007,311.38 since the fixed amount would rise.

González Mantelli explains in dialogue with LA NACION that, since the 90s, each province can dictate its tax code and regulate the stamp tax therein. “In Buenos Aires, for example, they take into account the tax valuation of the property, which is $1,154,400, much lower than the city’s exemption amount, although this year they have not yet updated the rate law for 2024. On the other hand, in the province, the rate is 2%, lower than that of the city,” he says.

Source: La Nacion

www.buysellba.com

Source:

Argentina: The impact of the devaluation on residential sales and the fine print of the new stamp duty tax

This post is also available in: Español Specialists now speak of a “slight recovery” of the market, but the fever experienced in August to October that is beginning to cool down after the elections. October once again smiled on the real estate market. Despite going through a change of...

December 28, 2023

Gateway to South America on 10/01/2024 - 23:17 in All categories of countries are, Argentina Lifestyle, Argentina Mendoza, Argentina-General, Argentine farms, Buenos Aires Residential, Commercial Argentina, Lifestyle Properties in Argentina

Specialists now speak of a “slight recovery” of the market, but the fever experienced in August to October that is beginning to cool down after the elections.

October once again smiled on the real estate market. Despite going through a change of government, with the uncertainty that this implies, 2023 was positive for purchasing and selling properties. The city of Buenos Aires is a clear example of the trend, since in the 11th month of the year, 4,068 operations were carried out. The number is celebrated by the sector, as it is consolidated as the best November since 2018.

In fact, the total number of property purchase deeds in November was 20.7% higher than last year’s level. Although it is far from the peak of 6,805 purchase and sale agreements signed in 2017, 2023 shows a good streak.

“In what is more seasonal, perhaps it can be read that it was a quarter (August-October) with more activity than usual and especially in an electoral year and now – with those operations completed – that escalation has softened. Hence, there is a 10 per cent decrease compared to the previous month,” analyzes Jorge De Bártolo, president of the College of Notaries of the City of Buenos Aires.

It is worth noting that the year generally continued with an upward trend in property sales. Since August, the monthly results have been around or even exceeded 4,000 monthly operations.

Even so, the December results are pending to make a complete and reliable summary of 2023.

"Another positive fact is that we have added 19 months of year-on-year growth, and that outlook is not a boom, but at least it is reassuring that there is a slight line of recovery. Beyond this data, what we want as an institution is that bases be generated so that a housing policy is reflected, a key factor for the aspirations of any family.”

Your own home, a further and further away dream

When buying a home, the buyer has to face a series of taxes, such as real estate fees, notary fees, and deed costs.This December, the Buenos Aires legislature updated the 2024 rate table and the amount of another tax to pay: the Stamp Tax for the purchase and sale of real estate. Buyers with more than one property in their name in the city are charged a 3.5% rate on the property’s value, to be paid equally between buyer and seller.

But those who do not have real estate in their name and, therefore, acquire this property for single-family housing and permanent occupancy are granted a tax exemption of a certain amount. If applicable, a fixed sum determined by the Government is subtracted from the property’s value, and a 3.5% rate is applied to the surplus.

That is the benefit figure that the legislature updated this December for next year. The $10,950,000 in 2023 will become $24,889,350 in 2024. At the current official exchange rate of $824.5, the amount went from covering US$13,280 in 2023 to US$30,187.2 in 2024, as long as the dollar’s value does not increase.

Santiago Levrio, institutional director of the community of Urban Developers -Alianza Urbana-, believes that the updated amount “toughens access to housing” , given that historically, the tax on stamps for a single home could cover US$110,000.

Julián González Mantelli, city notary and legal-notary-tax advisor, validates these data: “ Originally, these amounts represented figures closer to US$100,000, but due to the devaluation, they were liquefied .”

This year alone, the devaluation of the peso posed a different reality for the buyer who purchased their unique home at the beginning of the year compared to today. For example, whoever purchased a home for US$100,000 on January 2 when the official dollar was quoted at $184.75, the value of the pesified property was $18,475,000. Therefore, the tax was $646,625, and as the buyer and seller paid it equally, each would have paid $323,312.5 for this tax.

However, if that same property were purchased today for US$100,000, its value in pesos at the official exchange rate would be $82,450,000, from which the exemption of $10.95 million would have to be subtracted, and the total tax would be $2,502.500. That is to say, the buyer of his first and only home in the city would have to pay $1,251,250 in stamp tax (and the seller would pay the same amount), almost four times more than what he would have paid in January.

This reality would change – although not very significantly – if that same buyer decides to purchase the property in the first days of next year. Assuming that the exchange rate remained the same, the buyer could pay less for the same tax: $1,007,311.38 since the fixed amount would rise.

González Mantelli explains in dialogue with LA NACION that, since the 90s, each province can dictate its tax code and regulate the stamp tax therein. “In Buenos Aires, for example, they take into account the tax valuation of the property, which is $1,154,400, much lower than the city’s exemption amount, although this year they have not yet updated the rate law for 2024. On the other hand, in the province, the rate is 2%, lower than that of the city,” he says.

Source: La Nacion

www.buysellba.com