BuySellBA

Administrator

Buying a home with credit or renting?: which is the best alternative today, according to a private report - Infobae

Source:

¿Comprar una vivienda con crédito o alquilar?: cuál es hoy la mejor alternativa, según un informe privado

Con el auge de los créditos hipotecarios, un informe de la UADE determinó cuál es la mejor opción. Los factores clave a considerar al enfrentar el pago de cuotas mensuales y tomar una decisión financiera a largo plazo

November 14, 2024

With the rise of mortgage loans, a UADE report determined which is the best option. The key factors to consider when facing the payment of monthly installments and making a long-term financial decision

By Jose Luis Cieri

Until September, more than USD 100,000,000 in new loans were granted in Argentina, something that had not happened since August 2018

This year marked a turning point for the housing sector. More than 20 banking entities launched UVA (Unidad de Valor Adquisitivo) mortgage loans, a trend that reflects the response of the financial sector to the growing demand for financing for the purchase of homes. And many tenants began to face the dilemma of evaluating whether it is better for them to continue renting or to take advantage of UVA loans, even in the face of negative experiences in the past.

A recent private analysis confirmed that today it is more convenient to take out a mortgage to access one's own roof instead of renting. Little by little more people and families are willing to take the risk: last September a volume of loans exceeded USD 100 million , a level that had not been recorded since August 2018 ($125,704 million were granted and the graph below, based on data from the BCRA, shows the rapid evolution of these lines).

This move is taking place in a context of high economic uncertainty in the country, where citizens face significant fears of going into long-term debt, which intensifies the doubts between opting for rent or applying for a mortgage loan and makes this choice a crucial decision for many families.

Advantages of credits

According to the report by the Institute of Economics (INECO) of the Argentine Business University (UADE), opting for a UVA mortgage loan represents the most convenient option for those who have the initial capital necessary to cover the unfinanced percentage of the home.In addition, this type of credit is especially attractive if the country's economic conditions remain relatively stable.

The detailed analysis revealed that, although the UVA mortgage loan installments and rents evolve in a similar way, the monthly mortgage payment ends up being higher than the rental value, with differences ranging between 6% and 11%. However, this difference is not significant when one considers that the family becomes the owner of a property, turning it into an asset that can increase its value over time.

The report underlines the importance of the debtor's capitalization capacity. A disproportionate increase in the UVA in comparison with income can negatively affect the family budget.

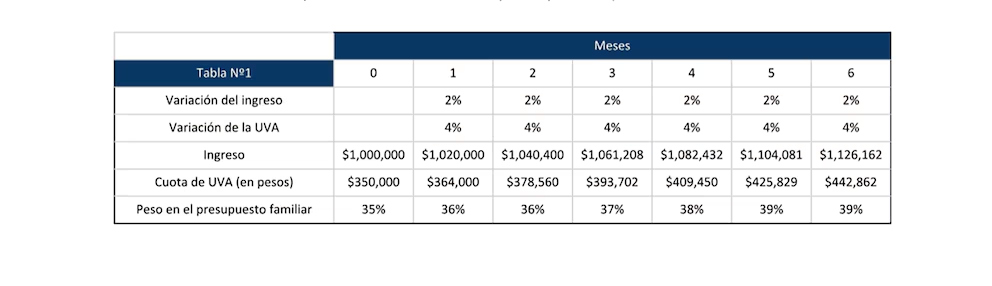

For example, if the “price” of the UVA increases twice as much as income or wages, in just six months the weight of the mortgage payment in the family budget can go from 35% to 39%; therefore, it is crucial to evaluate whether family income will be able to keep pace with inflation and variations in the UVA to ensure the sustainability of the credit in the long term.

Source: Institute of Economics (INECO) of the Argentine Business University (UADE)

Fausto Spotorno , an economist and director of INECO, told Infobae that “one advantage of opting for a UVA loan is that, at the end of the loan, the apartment becomes the property of the owner, allowing any investment made, such as painting or bathroom repairs, to belong to the owner.”

Although UVA loan payments are usually higher than those for rent, some argue that inflation compensates for this difference.

"The key is to evaluate how much the cost of rent differs from that of credit, considering whether the difference is significant for the family budget," Spotorno added.

Conditions

To participate in the UVA credit market, it is essential to understand certain technical concepts. Banks finance between 75% and 80% of the purchase or appraisal value of a home, offering financing terms that vary between 5 and 30 years, depending on the bank. The applicable interest rates range between 4% and 8%, to which is added the daily variation of the UVA.

Source: Institute of Economics (INECO) of the Argentine Business University (UADE)

This is calculated daily by the Central Bank of the Argentine Republic (BCRA), based on the monthly variation of the Consumer Price Index (CPI).

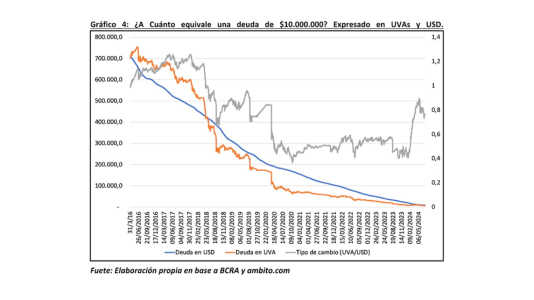

Specifically, the UVA is determined by multiplying the initial value of $14.05 (corresponding to March 31, 2016) by the daily variation of the CER index (Reference Stabilization Coefficient).

Historical comparison

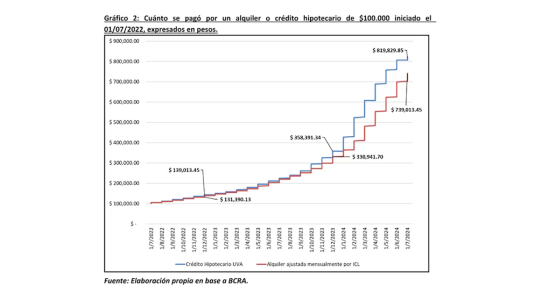

The report includes a historical comparative analysis that illustrates how, over time, UVA credits can be more favorable than rent. For example, for a rent of $100,000 starting in July 2022, the difference to be paid in 2024 was $19,730 in favor of the UVA credit.This analysis highlights the importance of considering not only monthly payments, but also the accumulation of an asset that can increase in value over time.

Source: Institute of Economics (INECO) of the Argentine Business University (UADE)

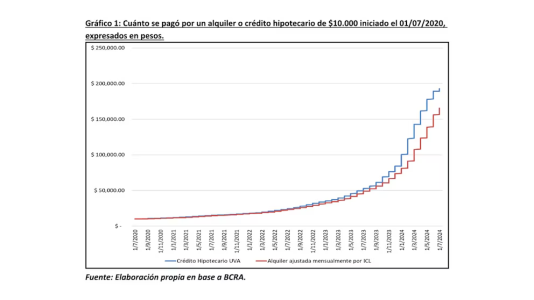

Additionally, the report presents graphs showing the evolution of rent payments versus mortgage loans over different periods, which shows that, although loan payments are usually higher than the initial rent, the long-term trend favors the acquisition of one's own home.

Recommendations

For those who decide to opt for a UVA mortgage loan, the report offers several strategies to minimize monthly payments and ensure greater financial sustainability:- Significant initial savings: Having a considerable initial capital reduces the amount financed, thus decreasing monthly payments.

- Choosing the right term: Selecting a longer financing term reduces monthly payments, although it increases the total cost of credit over time.

Source: Institute of Economics (INECO) of the Argentine Business University (UADE)

- Strategic refinancing: Evaluate the possibility of refinancing the loan in the future if interest rates decrease, thus optimizing the cost of credit.

- Income stability: Ensure a stable source of income that allows you to manage your payments without affecting other financial areas of the home.

- Expense control: Maintain a strict budget and reduce unnecessary expenses to allocate more resources to repay the loan.

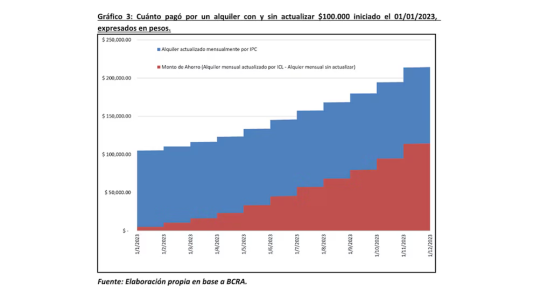

- Investment of differences: In cases of leases with annual updates, calculate the updated rental value on a monthly basis and invest the difference to minimize the impact of future updates.

Source: Institute of Economics (INECO) of the Argentine Business University (UADE)

In addition, it is advisable to purchase an apartment similar in size and location to the one you would rent, thus minimizing the financial difference between both options. “When evaluating a UVA loan, it is essential to consider the total financial cost rather than just the nominal interest rate, since insurance or other expenses that affect the real cost of the installment are often included,” added the economist.

The INECO-UADE report concludes that taking out a UVA mortgage loan is a more convenient option than continuing as a tenant, provided that one has the necessary initial capital and maintains economic stability. Ownership of the property and the possibility of building one's own asset compensate for the higher monthly payments than the rent, making this option a smart long-term financial strategy.

“However, to be a homeowner, it is essential to carefully evaluate the capitalization capacity and the evolution of family income in relation to UVA and inflation to ensure the viability of the mortgage loan,” the paper concluded.

www.buysellba.com