BuySellBA

Administrator

Changes in the real estate market: the properties that sell the most and what their prices are - Infobae

Source:

www.infobae.com

www.infobae.com

September 22, 2024

During the second quarter of the year, there was a 3.5% increase compared to the first quarter, marking three consecutive periods of growth in the prices of used units.

By Jose Luis Cieri

The ROI confirmed which homes were sold the most during the first half of the year and which types of units were preferred by the demand (Illustrative Image Infobae)

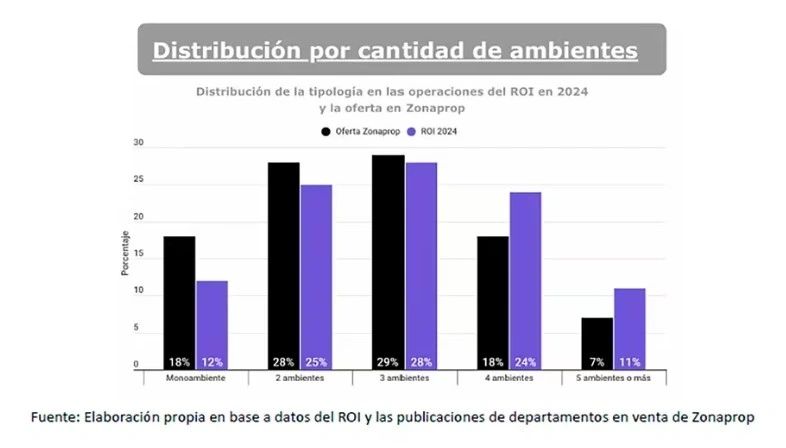

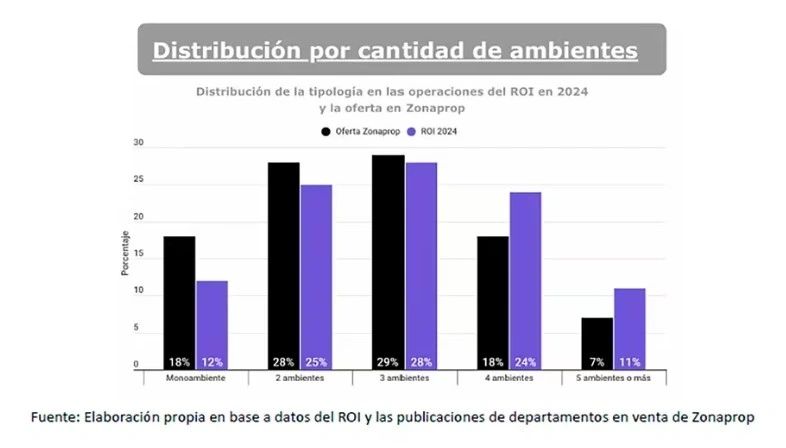

The analysis of the Real Estate Operations Survey (ROI) carried out by 26 real estate agencies operating in different neighborhoods of the city of Buenos Aires confirmed that the most sold properties during the first half of 2024 were 3-room apartments, representing 28% of sales.

The ROI compiles information on the sale of used properties and new developments. However, the data in the report correspond to properties sold used. The work revealed that during the first half of the year, prices per square meter in the used residential sector increased by 2.4% compared to the same period of the previous year, thus confirming that valuations have stopped falling.

Fabián Achával , CEO of Fabián Achával Properties, explained to Infobae the factors behind the rise in the value of the m2 of apartments. “Behind the increase in prices is the strong increase in demand. The real estate market is operating at its highest levels since the devaluation of May 2018. This advance also responds to a strong change in the expectations of end users.”

During the second quarter of the year, a 3.5% increase was observed compared to the first quarter of 2024, accumulating three consecutive quarters of growth in values.

Two-bedroom apartments were the most sold in CABA during the first half of the year

This average hides a heterogeneous dynamic, with the increase more concentrated in tickets of up to USD 100,000, while in tickets greater than USD 200,000 price stability is still observed.

Sabrina Furné , from Bresson Brokers, highlighted the importance of the money laundering system that allows the purchase of units in the current market. “This tax tool encouraged the purchase of more affordable properties.”

Additionally, the report indicated that demand for larger properties with higher ticket prices is outstripping supply, creating demand pressure that stabilizes prices.

“In previous reports, these properties also led the ranking of the most sought-after category. They remain the most popular choice for families and are also attractive because they offer an additional space that can be used for professional development, using it as a desk,” explained Furné.

Source: Real Estate Operations Survey (ROI)

The 1-bedroom segment is the second with the most operations, with 25%, followed by the 3-bedroom segment with 24%; the smallest (studios) and the largest (5 rooms or more) turned out to be the apartments with the lowest demand.

Other data:

The study stated that 64% of the apartments sold in CABA have a balcony (Illustrative Image Infobae)

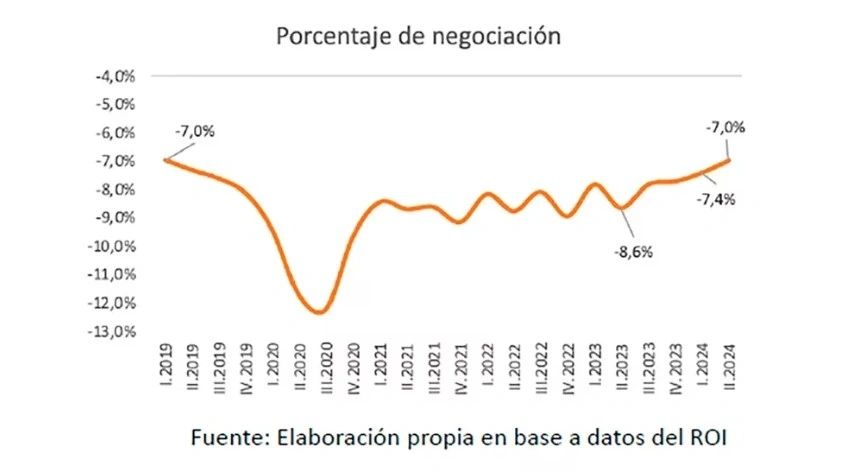

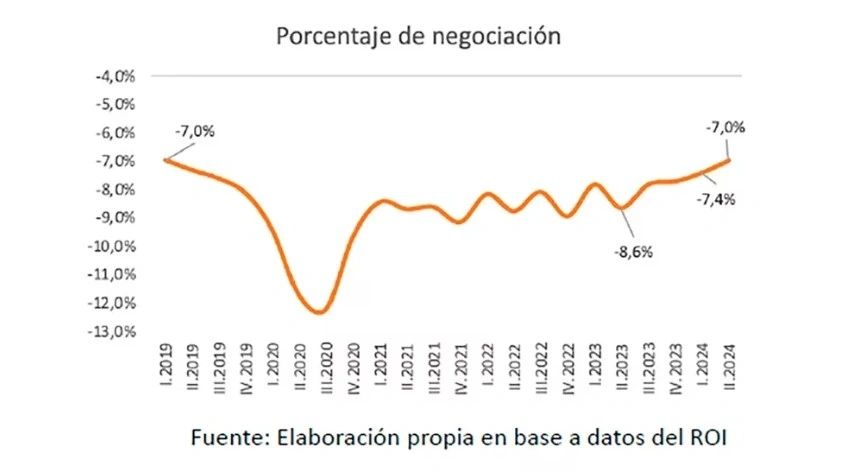

After five years, the haggling finally converged to the same value as during the first quarter of 2019.

In July this year, the trading spread (the difference between the buy and sell prices indicated for an asset) continued to decrease, standing at 6.5 percent.

“Whenever the closing ratio between the listing price and the sales value decreases, it is a sign that the market is more balanced, that buyers are responding favorably to what sellers are expecting,” Furné said.

Source: Real Estate Operations Survey (ROI)

It is important to note that ROI transactions have a high average ticket, while lower value properties show lower negotiation percentages.

Achával added: “The reduction in trading percentages is excellent news. In the premium market, the highest tickets reflect this average, while in the lowest ones the trading percentage reached historic levels of 5% or less.”

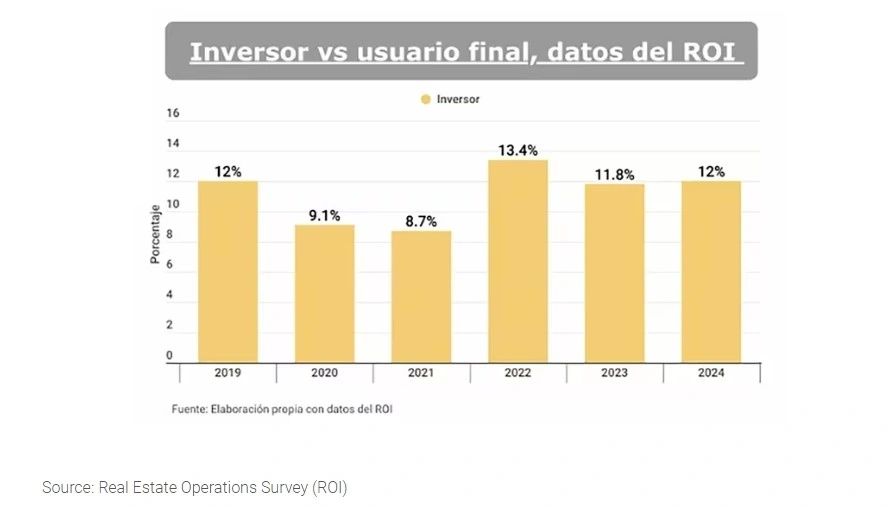

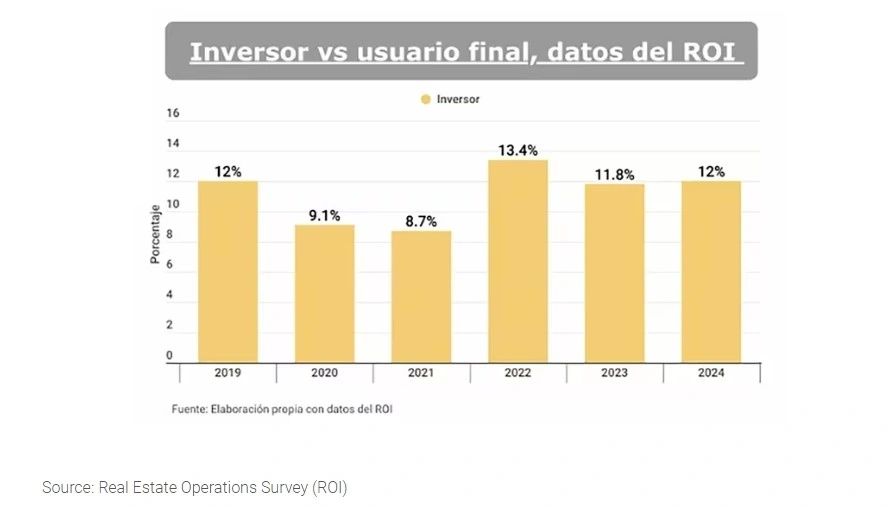

Among the types of properties chosen by the investor client, 2-room apartments predominate (48%) and then studio apartments (23%).

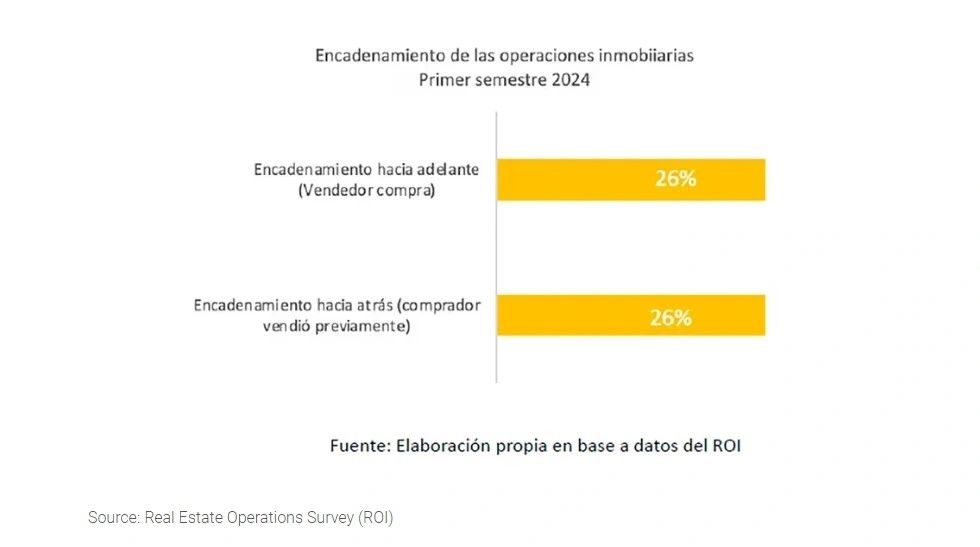

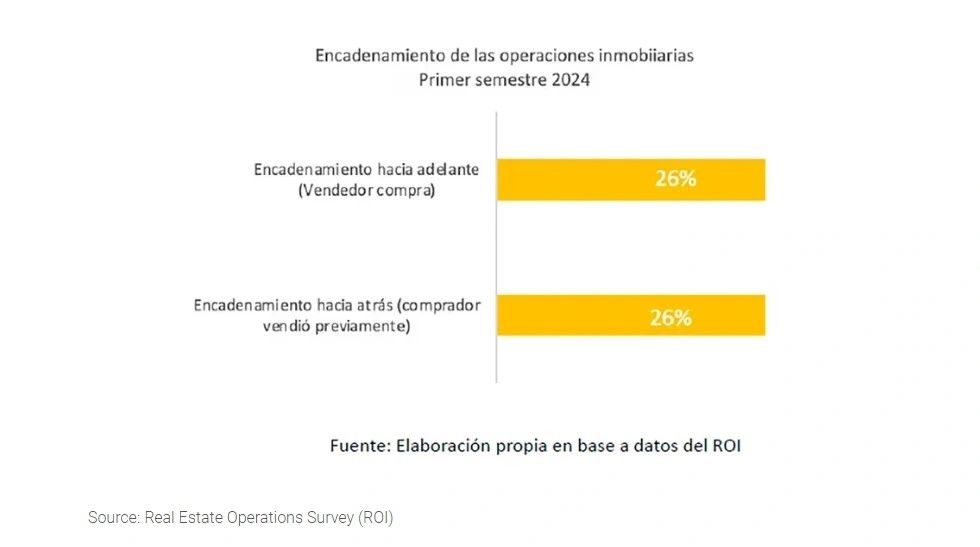

This gives an approximation of the “multiplier” of transactions that exists in the sector. Despite the fall, the linkage remains high: more than a third of property sellers sell in order to buy.

Also in high demand are Almagro, Villa Urquiza, Villa Crespo, Retiro, Caballito, Flores, Núñez, Balvanera, Villa Pueyrredón and Saavedra.

Source: Real Estate Operations Survey (ROI)

Prices are expected to recover in the coming quarters. “The market is operating at maximum levels and mortgage loans and money laundering have not yet had an impact. We expect the rise to continue, especially in tickets between USD 100,000 and 200,000. In the premium segment, the rise will be more gradual due to lower demand,” Achával concluded.

www.buysellba.com

Source:

Cambios en el mercado inmobiliario: las propiedades que más se venden y cuáles son sus precios

Durante el segundo trimestre del año se registró una suba del 3,5% respecto del primero, encadenándose tres consecutivos de crecimiento en los precios de unidades usadas

September 22, 2024

During the second quarter of the year, there was a 3.5% increase compared to the first quarter, marking three consecutive periods of growth in the prices of used units.

By Jose Luis Cieri

The ROI confirmed which homes were sold the most during the first half of the year and which types of units were preferred by the demand (Illustrative Image Infobae)

The analysis of the Real Estate Operations Survey (ROI) carried out by 26 real estate agencies operating in different neighborhoods of the city of Buenos Aires confirmed that the most sold properties during the first half of 2024 were 3-room apartments, representing 28% of sales.

The ROI compiles information on the sale of used properties and new developments. However, the data in the report correspond to properties sold used. The work revealed that during the first half of the year, prices per square meter in the used residential sector increased by 2.4% compared to the same period of the previous year, thus confirming that valuations have stopped falling.

Fabián Achával , CEO of Fabián Achával Properties, explained to Infobae the factors behind the rise in the value of the m2 of apartments. “Behind the increase in prices is the strong increase in demand. The real estate market is operating at its highest levels since the devaluation of May 2018. This advance also responds to a strong change in the expectations of end users.”

During the second quarter of the year, a 3.5% increase was observed compared to the first quarter of 2024, accumulating three consecutive quarters of growth in values.

Two-bedroom apartments were the most sold in CABA during the first half of the year

This average hides a heterogeneous dynamic, with the increase more concentrated in tickets of up to USD 100,000, while in tickets greater than USD 200,000 price stability is still observed.

Sabrina Furné , from Bresson Brokers, highlighted the importance of the money laundering system that allows the purchase of units in the current market. “This tax tool encouraged the purchase of more affordable properties.”

Additionally, the report indicated that demand for larger properties with higher ticket prices is outstripping supply, creating demand pressure that stabilizes prices.

They resist all two bedroom apartments

The best-selling properties according to ROI in its X-ray of the first half of 2024 were 3-room apartments, representing 28% of the operations.“In previous reports, these properties also led the ranking of the most sought-after category. They remain the most popular choice for families and are also attractive because they offer an additional space that can be used for professional development, using it as a desk,” explained Furné.

Source: Real Estate Operations Survey (ROI)

The 1-bedroom segment is the second with the most operations, with 25%, followed by the 3-bedroom segment with 24%; the smallest (studios) and the largest (5 rooms or more) turned out to be the apartments with the lowest demand.

Other data:

- On average, the studio apartments sold have a total area of 35 m2, the 1-bedroom apartments 48 m2, the 2-bedroom apartments 82 m2 and the 3-bedroom apartments 127 m2 (including uncovered areas).

- 67% of sales were for units without garages. Furné said: “Investors opt for properties without amenities or without garages because the costs of expenses are high . This represents a significant barrier for tenants with non-temporary contracts and decreases the demand for rentals of this type of properties, affecting investors' expectations of generating income.”

- The apartments at the front represented 60% of the sales during that year.

The study stated that 64% of the apartments sold in CABA have a balcony (Illustrative Image Infobae)

- 80% of sales are of units in buildings without amenities. “A condition that is always present in the choice of units without amenities or that do not have a garage is the maintenance cost that they entail,” argued Furné.

- 16% of the apartments sold have a unique view and 10% are located in a tower.

Trading percentages

During the second quarter of 2024, the average trading percentage with respect to the last published value was 7%, falling 1.7 percentage points compared to the same quarter of 2023 and 0.4 percentage points compared to the first quarter.After five years, the haggling finally converged to the same value as during the first quarter of 2019.

In July this year, the trading spread (the difference between the buy and sell prices indicated for an asset) continued to decrease, standing at 6.5 percent.

“Whenever the closing ratio between the listing price and the sales value decreases, it is a sign that the market is more balanced, that buyers are responding favorably to what sellers are expecting,” Furné said.

Source: Real Estate Operations Survey (ROI)

It is important to note that ROI transactions have a high average ticket, while lower value properties show lower negotiation percentages.

90% of investor purchases were in buildings without amenities. And 80% of investors bought properties without a garage.

Achával added: “The reduction in trading percentages is excellent news. In the premium market, the highest tickets reflect this average, while in the lowest ones the trading percentage reached historic levels of 5% or less.”

Who bought

The investor type of client represented 12% of sales in 2024. The rest of the purchases were made for the purpose of housing for personal use.Among the types of properties chosen by the investor client, 2-room apartments predominate (48%) and then studio apartments (23%).

Chaining of operations

During the second quarter of the year, 26% of buyers previously sold a property in order to carry out the purchase and sale transaction (backward chaining), while 26% of sellers declared interest in purchasing a new property (forward chaining).This gives an approximation of the “multiplier” of transactions that exists in the sector. Despite the fall, the linkage remains high: more than a third of property sellers sell in order to buy.

Trends by neighborhood

Regarding the most popular neighborhoods for buying homes, the ROI identified that Palermo, Belgrano and Recoleta are the most popular.Also in high demand are Almagro, Villa Urquiza, Villa Crespo, Retiro, Caballito, Flores, Núñez, Balvanera, Villa Pueyrredón and Saavedra.

Source: Real Estate Operations Survey (ROI)

Prices are expected to recover in the coming quarters. “The market is operating at maximum levels and mortgage loans and money laundering have not yet had an impact. We expect the rise to continue, especially in tickets between USD 100,000 and 200,000. In the premium segment, the rise will be more gradual due to lower demand,” Achával concluded.

www.buysellba.com