All the Answers

Well-known member

Currency competition and dollarization: is Milei's economic plan going towards the Peruvian model or towards that of El Salvador? - Infobae

Source:

Competencia de monedas y dolarización: ¿el plan económico de Milei va hacia el modelo de Perú o hacia el de El Salvador?

Un análisis del Ieral dice que parece encaminado a la competencia de monedas, pero en el horizonte aparecen dos modelos muy diferentes, con distinto impacto sobre la economía nacional. Qué anticipan las grandes variables macroeconómicas

May 27, 2024

An analysis by Ieral says that it seems aimed at currency competition, but on the horizon two very different models appear, with different impacts on the national economy. What do the major macroeconomic variables anticipate?

With last week's mega tender, the government accelerated the pace in the direction of trying to introduce "currency competition", according to the statements of various authorities, by exchanging public debt in charge of the Central Bank (remunerated liabilities) for debt in the head of the Treasure. Several additional steps are missing to reach the objective but, above all, define the profile of the new exchange-monetary regime.

A report by the Ieral Mediterranean Foundation suggests that there are two possible scenarios, similar to those adopted by other countries in the past.

To simplify to the extreme, says an analysis prepared by economists Jorge Vasconcelos and Maximiliano Gutiérrez, there is the case of Peru in the early '90s, a bimonetarism that started with a “dirty float” and subsequently paved the way for remonetization in soles ( the local currency) of the economy, and the model that El Salvador followed since the beginning of this century, with the Central Bank prohibited from issuing, a fixed parity of 8.75 colones per dollar and a residual role for the local currency.

"The impact on the real sector of the economy would be very different, since a 'Peruvian-style' scheme would preserve the use of macro policy instruments, while the second (like El Salvador) would have the typical rigidity of dollarization." unilateral, but lacking the 'lender of last resort' that, for example, the countries that joined the eurozone did have," the paper says.

The big variables that come into play

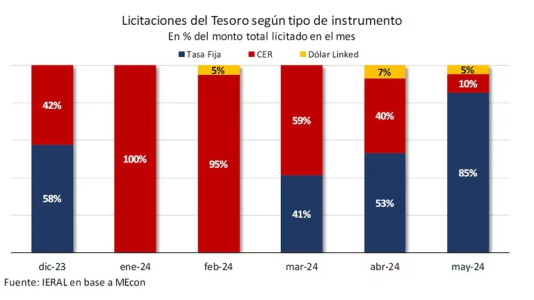

According to the authors, to understand where Argentina comes from and where it is going, it is necessary to analyze how some of the most relevant macroeconomic variables are behaving. Firstly, they highlight that, with the mega tender at the end of last week, Economía captured financing for $11.7 billion, with a positive net balance of $8.63 billion. “85% of the operation was concentrated in Lecaps with very short terms, when in previous tenders there had been an attempt to lengthen the maturities at the cost of indexing the Liabilities of the public sector. The objective is for the short-term Lecaps rate to be a substitute for the Passes as an instrument linked to the functioning of the money market,” they highlight.

After the exchange on May 16, the stock of passes was reduced by 35% to reach $21.9 billion, with 22% of that figure headed by private entities. “The sources of 'endogenous' monetary emission have been limited, but this does not imply absolute control of these variables. There remains the issuance potential derived from the puts (which is estimated to reach a stock equivalent to $20.5 billion) and possible interventions by the Central Bank in the open market, in the event that undesired behavior of bank deposits causes the parity to fall. of public securities,” highlights the study.

At present there is less “fuel” for exchange runs than before the change of government

Based on this, it can be concluded that at present there is less “fuel” for currency runs than before the change of government. “Note that the Monetary Base has gone from the equivalent of 21.9 billion dollars in November 2023 to 17.8 billion in May (at the official exchange rate), while the Remunerated Liabilities of the BCRA shrank from 70.7 billion to 47.8 billion dollars , ” Vasconcelos and Gutiérrez point out.

Inflation and exchange rate

Everything indicates, the work continues, that the deceleration of the monthly CPI will have to continue in May, but this time not due to a significant cut in the core measurement (the most relevant), but due to the suspension of the rate update. Thus, the downward trend in the monthly inflation rate will be less “worthy” in May. “The CPI for the current month could be around 6% and could even approach 5.5%. In April, the figure of 8.8% was explained in 6.3 percentage points by the core and in 2.5 points by the influence of the variation in regulated prices, while in May the incidence of this second segment would be minimal.

Now, for experts, the market reaction in recent days should not be surprising, since the transmission belts that operate on expectations have become more complex. “A new gap has appeared, that of interest rates, between the yield of short-term Lecaps (issued by the Treasury), BCRA repos and the remuneration of fixed terms and the surety rate, relevant for the capital market. Note that the remuneration for fixed terms covers half of a 'decaffeinated' monthly inflation rate due to the suspension of the adjustment of regulated prices," they noted.

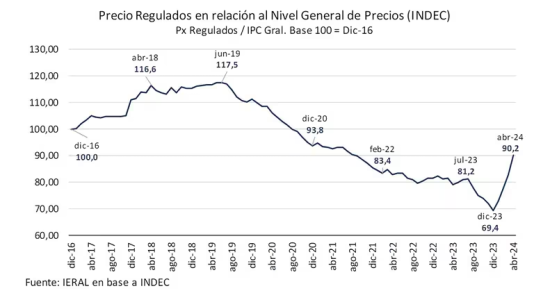

We are not close to the change in monetary-exchange regime announced as North by the government; The level of BCRA reserves is tiny and the task of correcting the distortion of relative prices has barely begun.

The current value of $1,256 per dollar (as of May 23) in the free market is far from the crisis levels of recent years ($2,633 upon exit from Covid isolation in 2020; $2,335 with Guzmán's departure in 2022, and the $2,716 prior to last year's general elections). “It seems more like a rearrangement based on the sustained fall in the interest rate in pesos, in a context in which questions remain about the trajectory of variables such as External Reserves and public accounts for the second half of the year,” they analyzed. the authors of the report.

The task of recovering reserves

So far in May, the monetary authority has accumulated a positive balance of USD 2.2 billion and USD 17.0 billion since the change of mandate. Consequently, gross reserves increased by USD 8.1 billion to reach USD 29,082 million, while net reserves were reduced from USD -11.3 to USD -1.67 billion (including payments corresponding to BOPREAL expected for the next 12 months), which translates into an improvement of just under USD 9.7 billion.“In summary, even though the volume of the mega-bidding was significant, that does not mean that we are close to the change in the monetary-exchange regime announced as North by the government. The level of reserves of the Central Bank is tiny, and the task of correcting the distortion of relative prices has barely begun. More important than that, it remains to know if the official 'model' is Peru or El Salvador,” conclude Vasconcelos and Gutiérrez.