All the Answers

Well-known member

Despite the reduction in the exchange gap, the Government is in no rush to lift the dollar clampdown

Source:

A pesar de la reducción de la brecha cambiaria, el Gobierno no tiene apuro para levantar el cepo al dólar

El FMI no quiere que suceda antes de mediados de año. Además, está el peligro de reactivar una demanda dormida de divisas, sobre todo por parte de los importadores ya que muchos de ellos no lograron aún cancelar deudas con los proveedores del exterior

March 08, 2024

The IMF does not want it to happen before the middle of the year. In addition, there is the danger of reactivating a dormant demand for foreign currency, especially on the part of importers since many of them have not yet managed to cancel debts with foreign suppliers.

By Pablo Wende

View of dollar bills, in an archival photograph. EFE/Sebastiao Moreira

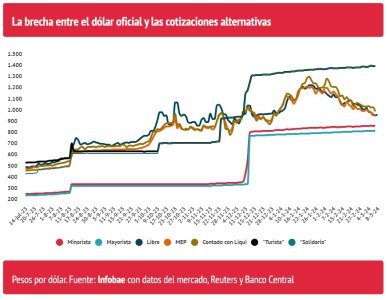

The strong and surprising decrease in the exchange gap to minimum values not seen since 2019 increased rumors in the market about the possibility of eliminating the exchange rate. But the Government has other plans: they are not willing to make premature decisions and they also consider that the conditions to do so do not yet exist.

Furthermore, the IMF also does not welcome this step being taken without it being clear what the future monetary and exchange rate regime will be, which would be substantially different from the current one. The future agreement and fresh disbursements that the agency may make depend on these decisions.

For now, both parties have already agreed that a possible dollarization of the economy is shelved. It was during the meeting held ten days ago by the organization's number two, Gita Gopinath , with the President, Javier Milei . There it was decided to move forward with the idea of “currency competition”, which would allow the free circulation not only of the peso, but also of the dollar or any other currency.

But that is still several months away. As Milei himself had acknowledged in interviews, the IMF believes that only by mid-year would the conditions be met to lift the exchange restrictions. And the economic team agrees with that diagnosis.

The highlight of the week regarding the behavior of the exchange market was the collapse of financial dollars, breaking the psychological barrier of $1,000. Yesterday the free quote ended at $985, while the MEP ended at $993. The gap with the official dollar is already at levels of 15%, when before last year's elections it had approached 200%.

Such a reduction in the gap also removes the possibility of a greater rate of devaluation of the official exchange rate. The Government has been maintaining an adjustment of only 2% monthly, despite an inflation rate that would have approached 15%. However, to the extent that the ceiling of the gap falls, there are no reasons to rush the increase of the floor, that is, the official exchange rate, which yesterday closed at $846.

The transition until June will not be easy. The Economy's diagnosis is that the problem of importers has not yet been resolved. Bopreal was a key piece to face the dollarization demand of those who bought inputs abroad and could not pay for them during the last part of 2023.Before lifting the stocks, there is still an intense journey in the coming months. On the one hand, there are many pesos left to absorb, particularly from importers who maintain debts with their suppliers abroad, and at the same time the Central Bank would continue with the accumulation of reserves, which could intensify from next month with the heavy harvest.

The total issuance of Bopreal is planned at USD 10,000 million, so there is still a relatively long road ahead, taking into account that just under USD 8,000 million has been placed so far. It is an instrument that was also very effective in absorbing market pesos, to such an extent that Javier Milei himself highlighted it in his message to the Legislative Assembly last week.

However, this volume of dollar bonds maturing in 2027 would not be enough to respond to the demand of the import sector. Therefore, the latent risk is that many payments have still not been made to foreign suppliers. Therefore, if restrictions are lifted, demand from the sector could be significant.

On the other hand, it is assumed that the permission that exporters currently have to settle 20% of the total through cash settlement would also be void, which generates much more supply in the market and pushes prices down.

The reduction of the gap removes the possibility of a greater rate of devaluation of the official exchange rate. The Government has been maintaining an adjustment of only 2% monthly, despite an inflation rate that would have approached 15%

There is another relevant point that is related to the need to maintain fiscal balance. It is assumed that with a unified exchange rate, the PAIS tax on imports would disappear (currently it stands at 17.5%), causing a huge hole in public accounts.

However, the latest report from the IMF staff, after a short visit to Argentina, suggests that this is not so. In fact, it is suggested that “only by the end of the year” would this tax disappear, which makes imports more expensive and at the same time generates a significant improvement in collection. The permanence of this tax is necessary at least until the end of the year given the decline in other sources of income as a result of the strong recession.

“If not now, with the gap at these levels, then when?” is one of the relevant questions from brokers and stock agents about the challenges facing Argentina in the short term. The return to “normality” will not be complete as long as there are exchange restrictions or control of maximum interest rates by the BCRA.