BuySellBA

Administrator

Dissociated: In AMBA, while apartment prices have already overcome the crisis, house prices have not yet recovered their value - Infobae

Source:

Disociados: en el AMBA, mientras los precios de los departamentos ya superaron la crisis, los de las casas aún no logran recuperar su valor

Un informe privado confirmó la recuperación de precios en el primer segmento. En qué zonas de CABA y Gran Buenos Aires se apreciaron más los valores de compra-venta y cuáles son las tendencias actuales en el mercado de alquileres

November 17, 2024

A private report confirmed the recovery of prices in the first segment. In which areas of CABA and Greater Buenos Aires did purchase-sale values appreciate the most and what are the current trends in the rental market?

By Jose Luis Cieri

Apartments have appreciated more than houses in recent months. Mortgage loans boost real estate purchase and sale transactions in the AMBA

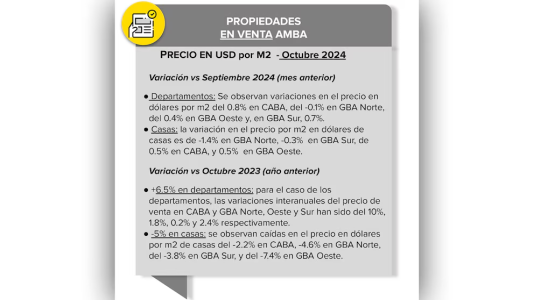

In the Buenos Aires Metropolitan Area (AMBA), the real estate market shows disparate values in the purchase and sale prices of properties. A private analysis confirmed that apartment prices registered a 6.5% year-on-year increase. Although the percentage may seem low, it represents a firm recovery when compared to the five years of crisis that the sector went through: the prices of used units fell by 42% since August 2018.

On the other hand, housing prices have not yet recovered and are down 5% compared to October 2023, with no signs of improvement in the last month.

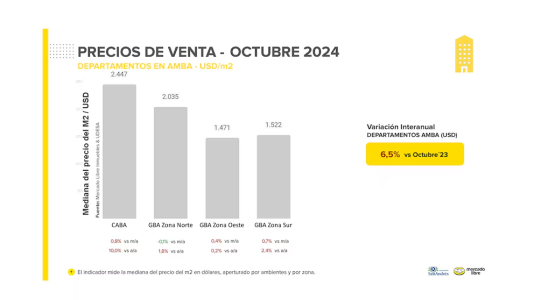

According to a report based on data from Mercado Libre Inmuebles and the University of San Andrés (Udesa) , apartment prices, when broken down by area, show that the largest increase occurred in CABA, with a 10% year-on-year rise. In comparison, the variations in the last twelve months in the sale price of apartments in the GBA North, West and South were 1.8%, 0.2% and 2.4%, respectively.

Daniel Salaya Romera told Infobae that the factors behind the rise include the increase in construction costs, the exchange rate lag, the reappearance of mortgage credit, a reduced supply and the greater volume of money available after the money laundering. “In the areas where our branches operate, such as Olivos, Vicente López and Recoleta, we have observed an increase in prices for both apartments and houses, a trend that has accelerated in the last 90 days,” added Salaya Romera.

Apartments in a pit or recently completed, whose value is adjusted according to the replacement cost, registered a rise of 20% in the last year, with no room for counteroffers

The housing sales segment shows a 1.4% drop in GBA Norte in dollars per square meter, while CABA and GBA Oeste experienced a slight increase of 0.5 percent. Meanwhile, GBA Sur had a minimal 0.3% inter-monthly drop.

Source: Mercado Libre Real Estate and University of San Andrés (UDESA)

On an interannual basis, prices decreased by 5%, with the GBA West being the most affected, falling by 7.4 percent.

Southern zone

Ariel Bechara Aded , from Bechara Inmobiliaria, warned that “the rise in apartment prices in areas such as Lanús, Temperley and Lanús is mainly due to the increase in demand for these properties, driven by mortgage loans.”The revival of mortgage lending has boosted demand, especially for two-room apartments in the range of USD 50,000 to USD 70,000: “However, greater lending activity is expected next year, as confidence in these types of financing grows,” said Bechara Aded.

Three-room apartments are also in high demand for purchase with bank financing and prices from USD 60,000 upwards, in areas such as Piñeyro and the center of Avellaneda.

Preferences

Two- and three-room apartments are becoming the most sought-after options for investors, a trend that has intensified with the re-emergence of mortgage lending and money laundering.“Demand has grown significantly, especially for two-room units with a bathroom and a toilet, and two-bedroom units with two bathrooms, or two bathrooms and a toilet. This format is attractive for both investors and end consumers, who prioritize comfort and functionality,” said Salaya Romera.

Source: Mercado Libre Inmuebles and Universidad de San Andrés (UDESA). Here you can see the average price per m2 of apartments for sale in the AMBA

The areas of Olivos, Vicente López and Núñez - considered today as "the 15-minute city", with the Innovation Park as the axis - are among the most privileged in terms of demand. In these areas, one- and two-bedroom apartments on high floors, with river views, amenities and good architecture, can be priced at up to USD 6,000 per square meter in premium developments .

Salaya Romera added: “Further away from the river, properties between 20 and 30 years old, close to train stations, can be purchased for around $2,000 per m2, a price that will probably be difficult to find next year.”

The most requested

The report also highlights that neighborhoods such as Caballito , Recoleta and Belgrano are the most sought after in CABA for purchase, while in GBA, localities such as Olivos and Martínez in the North, and Lanús and La Plata in the South are the most consulted.Locations

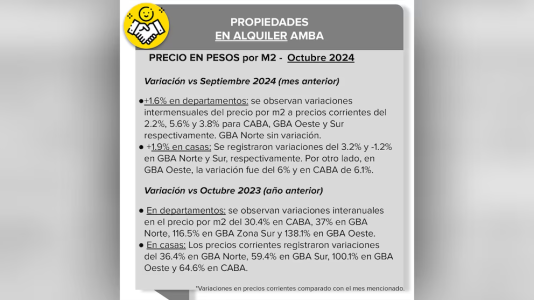

According to Mercado Libre and UDESA's analysis of rentals, apartment prices rose 1.6% in October compared to September 2024. Monthly variations were 2.2% in CABA, 5.6% in GBA West and 3.8% in GBA South, while GBA North registered no changes.

Source: Mercado Libre Real Estate and University of San Andrés (UDESA)

Currently, in the GBA Norte, a two-bedroom apartment averages $700,000 per month in Vicente López and $650,000 in Tigre. In Ramos Mejía, in the western zone, the average is $550,000, while in Quilmes, in the south, it reaches $535,000 per month.

Bechara Aded explained that the DNU that repealed the Rental Law allowed for a normalization in the rental market, achieving a balance between supply and demand.

“Currently, the average period to rent a property is 15 to 20 days in the GBA, and contracts are usually established for two years, with adjustments based on the Consumer Price Index (CPI) that can be quarterly or four-monthly,” he concluded.

www.buysellba.com