BuySellBA

Administrator

Housing: what are the closing prices per square meter in purchase-sale operations in CABA - Infobae

Source:

www.infobae.com

www.infobae.com

September 23, 2024

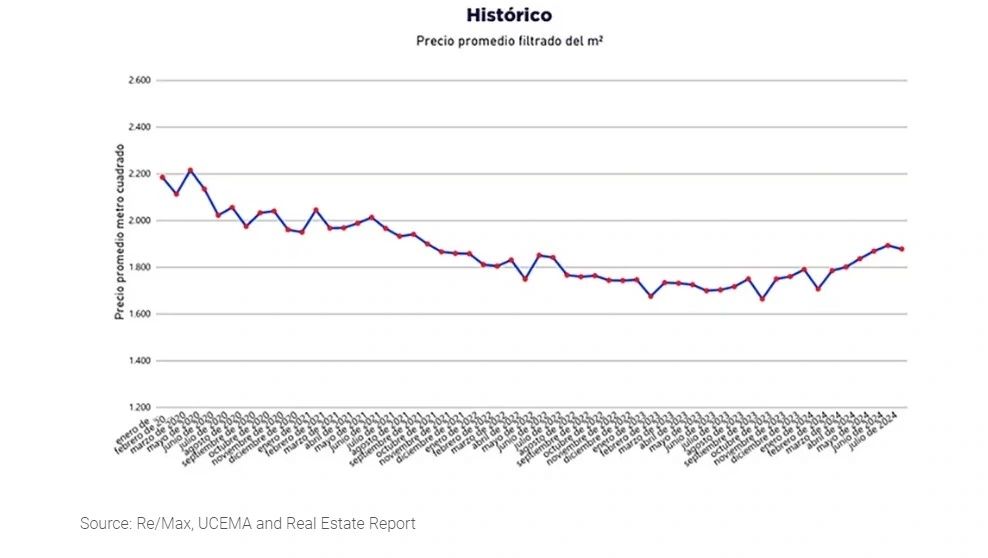

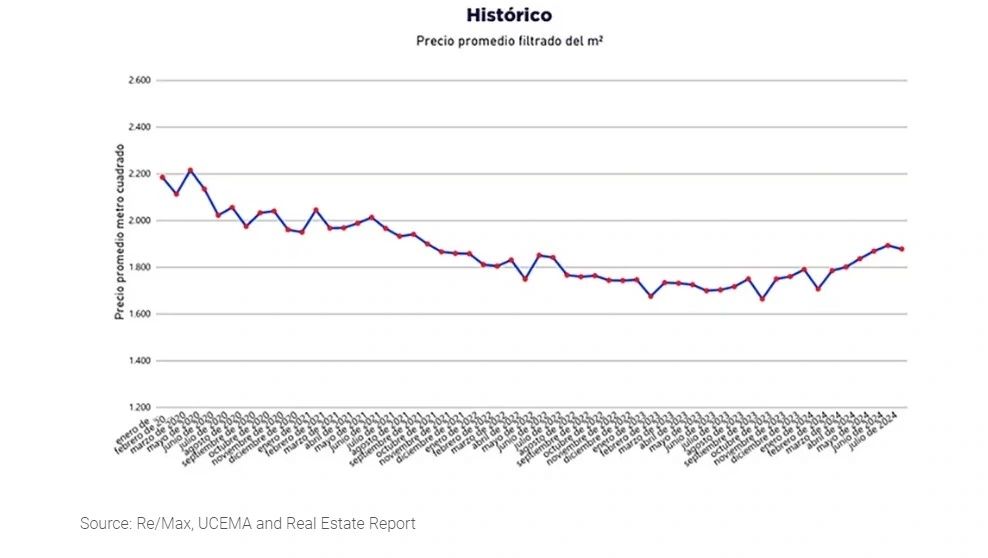

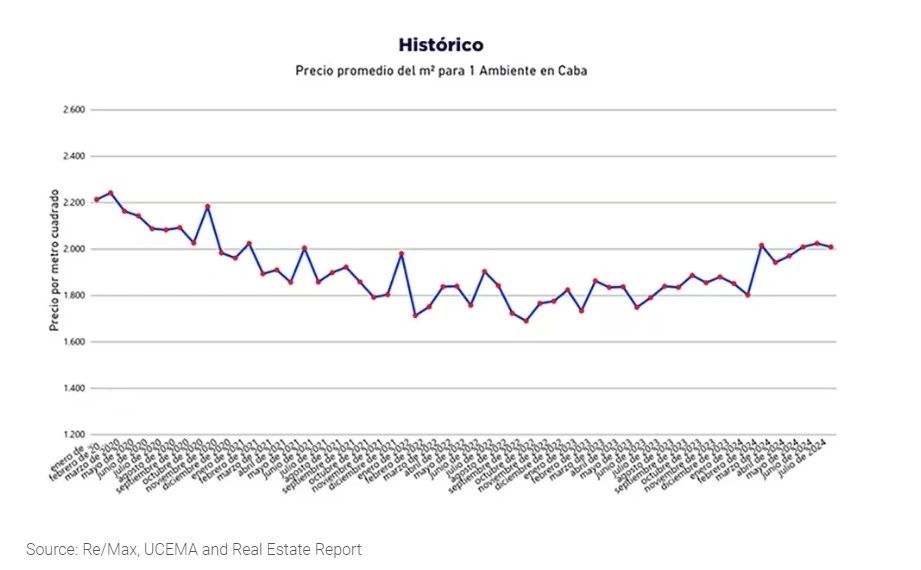

The sharp decline has been reversed and prices have now stabilized and have minimal variations. Prices of studio, one-bedroom and two-bedroom apartments

By Jose Luis Cieri

The gap between the value per square meter of the transactions completed in July 2024 and the last published value of the property - known as the counteroffer range - was an average of 5%.

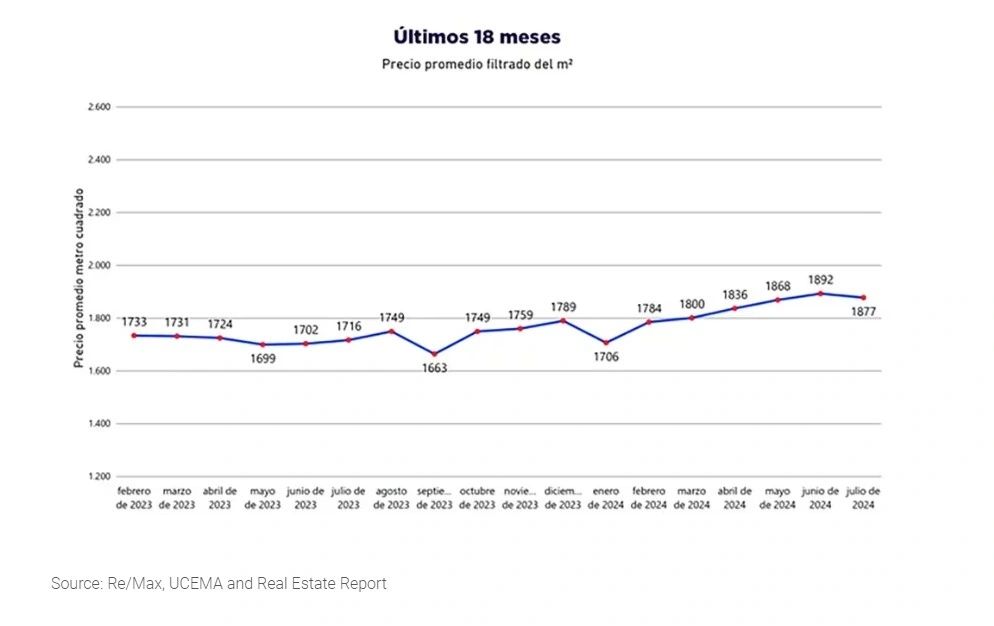

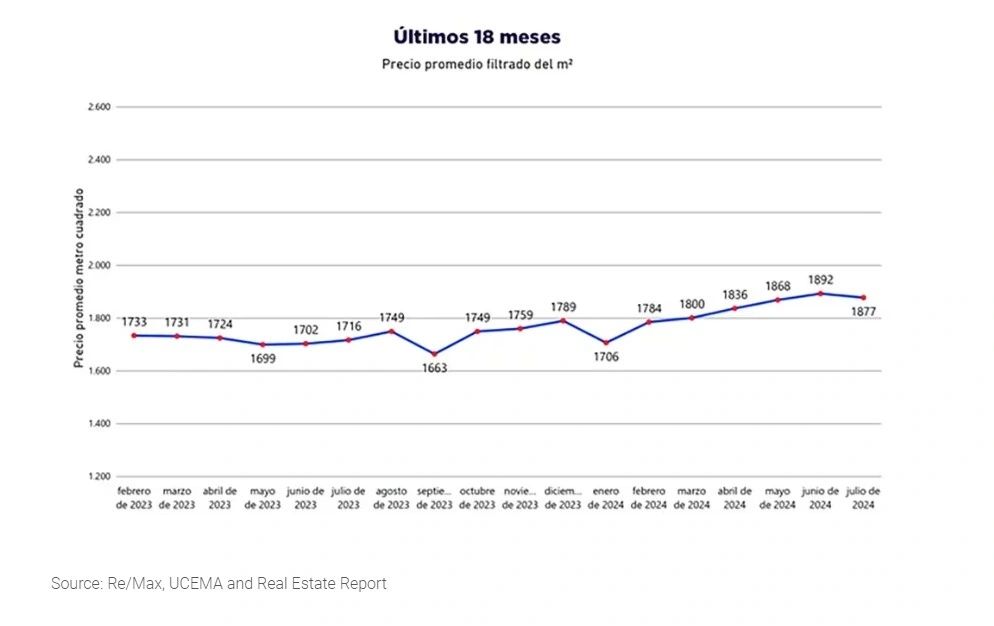

According to a private report, closing prices for apartment sales in the city of Buenos Aires have stabilized. The most recent measurement, in July, revealed a slight decrease in the prices agreed by buyers and sellers in relation to the list prices. The gap between the listing price and the counteroffer reached one of its lowest levels, close to 5%, the report noted.

The study found a slight decrease of 0.80% in the value of apartments compared to June.

These data come from the “M2 Real” Index, developed in collaboration between the University of the Center for Macroeconomic Studies of Argentina (Ucema) and RE/MAX Argentina, with the support of Reporte Inmobiliario. The work creates an index representative of the average price per square meter in CABA, which allows having a reference of real value and its evolution over time and facilitates the comparison between the average sale price and that of the published m2.

According to data released last July, prices for studio apartments reached USD 2,008 per m2, while one-bedroom apartments are at USD 1,825 and two-bedroom apartments at USD 1,831; compared to the previous year, an increase is observed, with costs in 2023 being USD 1,838 for studio apartments, USD 1,674 for one-bedroom apartments, and USD 1,799 for two-bedroom apartments.

Sebastián Sosa , president of Re/Max Argentina and Uruguay, told Infobae : “In terms of macroeconomic factors, the slowdown in inflation and the stabilization of the exchange rate have visibly influenced real estate market prices. The recent financial and exchange rate stability creates a more reliable environment, which motivates people to make investments.”

In addition, Sosa pointed out that the reactivation of mortgage loans adds a crucial tool for those who wish to achieve their dream of buying a home.

Another relevant fact revealed by the study is that used apartments as a whole (units from studio to 2 bedrooms in CABA) had an increase in their value of more than 9% compared to the same one in July 2023.

Source: Re/Max, UCEMA and Real Estate Report

“The Argentine real estate market has much greater potential compared to other countries in the region such as Chile or Colombia. Argentina should be carrying out four or five times the amount of real estate transactions it currently does,” Sosa added.

The market became more honest and several owners who previously offered their homes for sale, after the DNU that repealed the Rental Law, returned to offering them for rent, and are no longer part of the sales offer.

As a result, prices respond to this natural dynamic between supply and demand. “However, while the value of m2 in Argentina remains relatively affordable compared to other markets, it is still far from the reach of the average wage earner,” said Sosa.

Source: Re/Max, UCEMA and Real Estate Report

Since 2018, one of the main challenges has been the lack of mortgage financing, which was brief in 2017 and caused a collapse in prices (they rose by more than 45% in just 12 months between June and April 2017 and 2018).

Although there are now more than 21 banks that have reintroduced financing for the purchase or refurbishment of units, it is still difficult for this tool to take off.

Sosa said that a full recovery requires “economic stability, a government that inspires confidence, a more stable currency and a decrease in inflation.”

“After periods of crisis, the segments that are reactivated first are those with lower prices, such as studio apartments” and, therefore, “these units tend to attract buyers who are looking to invest in a more accessible way or who are more urgently looking to protect their capital,” said Sosa.

According to Real Estate Report, in CABA, the average offer price for a used studio apartment is USD 69,800, while USD 78,000 and USD 110,000 are the average prices for one- and two-bedroom apartments.

Larger units, with higher prices, tend to recover more slowly, as they depend on a different buyer profile, with greater savings capacity or access to credit.

With the exchange rate slightly down, demand increased, mainly due to the need to protect the value of savings, thus consolidating properties as a solid investment opportunity before values appreciate more strongly.

According to Sosa, the current situation represents an opportunity for buyers and investors. “After a crisis, the current money laundering offers low costs, tax benefits and potential for profits from rents in dollars and pesos, creating a favorable environment for investing in various types of properties, from residential to commercial and industrial,” he concluded.

www.buysellba.com

Source:

Vivienda: cuáles son los precios de cierre por metro cuadrado en operaciones de compra-venta en CABA

El descenso pronunciado se revirtió y ahora las cotizaciones de los departamentos fijadas por compradores y vendedores son mínimas: ¿cuánto valen los monoambientes, dos y tres ambientes?

September 23, 2024

The sharp decline has been reversed and prices have now stabilized and have minimal variations. Prices of studio, one-bedroom and two-bedroom apartments

By Jose Luis Cieri

The gap between the value per square meter of the transactions completed in July 2024 and the last published value of the property - known as the counteroffer range - was an average of 5%.

According to a private report, closing prices for apartment sales in the city of Buenos Aires have stabilized. The most recent measurement, in July, revealed a slight decrease in the prices agreed by buyers and sellers in relation to the list prices. The gap between the listing price and the counteroffer reached one of its lowest levels, close to 5%, the report noted.

The study found a slight decrease of 0.80% in the value of apartments compared to June.

These data come from the “M2 Real” Index, developed in collaboration between the University of the Center for Macroeconomic Studies of Argentina (Ucema) and RE/MAX Argentina, with the support of Reporte Inmobiliario. The work creates an index representative of the average price per square meter in CABA, which allows having a reference of real value and its evolution over time and facilitates the comparison between the average sale price and that of the published m2.

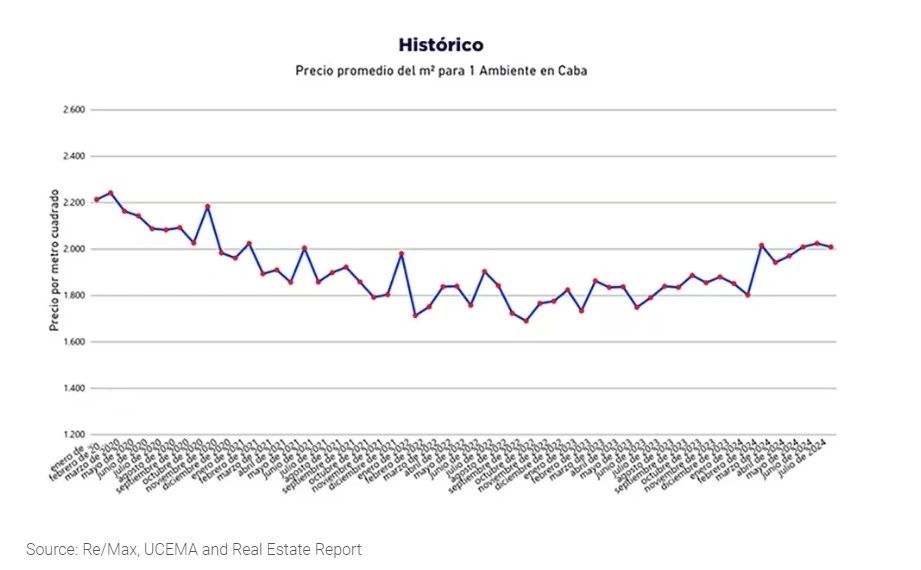

According to data released last July, prices for studio apartments reached USD 2,008 per m2, while one-bedroom apartments are at USD 1,825 and two-bedroom apartments at USD 1,831; compared to the previous year, an increase is observed, with costs in 2023 being USD 1,838 for studio apartments, USD 1,674 for one-bedroom apartments, and USD 1,799 for two-bedroom apartments.

Sebastián Sosa , president of Re/Max Argentina and Uruguay, told Infobae : “In terms of macroeconomic factors, the slowdown in inflation and the stabilization of the exchange rate have visibly influenced real estate market prices. The recent financial and exchange rate stability creates a more reliable environment, which motivates people to make investments.”

Current prices are still 14.5% below the levels recorded in January 2020

In addition, Sosa pointed out that the reactivation of mortgage loans adds a crucial tool for those who wish to achieve their dream of buying a home.

Another relevant fact revealed by the study is that used apartments as a whole (units from studio to 2 bedrooms in CABA) had an increase in their value of more than 9% compared to the same one in July 2023.

Source: Re/Max, UCEMA and Real Estate Report

“The Argentine real estate market has much greater potential compared to other countries in the region such as Chile or Colombia. Argentina should be carrying out four or five times the amount of real estate transactions it currently does,” Sosa added.

Scenery

The sector maintains that demand continues to increase, while supply continues to decrease. Up to July, almost 25,000 properties were sold in CABA.The market became more honest and several owners who previously offered their homes for sale, after the DNU that repealed the Rental Law, returned to offering them for rent, and are no longer part of the sales offer.

As a result, prices respond to this natural dynamic between supply and demand. “However, while the value of m2 in Argentina remains relatively affordable compared to other markets, it is still far from the reach of the average wage earner,” said Sosa.

Source: Re/Max, UCEMA and Real Estate Report

Since 2018, one of the main challenges has been the lack of mortgage financing, which was brief in 2017 and caused a collapse in prices (they rose by more than 45% in just 12 months between June and April 2017 and 2018).

Although there are now more than 21 banks that have reintroduced financing for the purchase or refurbishment of units, it is still difficult for this tool to take off.

Sosa said that a full recovery requires “economic stability, a government that inspires confidence, a more stable currency and a decrease in inflation.”

Types of properties

Taking into account variations, the differences in price increases between studio apartments and larger units are attributable to different buyer profiles.

“After periods of crisis, the segments that are reactivated first are those with lower prices, such as studio apartments” and, therefore, “these units tend to attract buyers who are looking to invest in a more accessible way or who are more urgently looking to protect their capital,” said Sosa.

According to Real Estate Report, in CABA, the average offer price for a used studio apartment is USD 69,800, while USD 78,000 and USD 110,000 are the average prices for one- and two-bedroom apartments.

Larger units, with higher prices, tend to recover more slowly, as they depend on a different buyer profile, with greater savings capacity or access to credit.

With the exchange rate slightly down, demand increased, mainly due to the need to protect the value of savings, thus consolidating properties as a solid investment opportunity before values appreciate more strongly.

According to Sosa, the current situation represents an opportunity for buyers and investors. “After a crisis, the current money laundering offers low costs, tax benefits and potential for profits from rents in dollars and pesos, creating a favorable environment for investing in various types of properties, from residential to commercial and industrial,” he concluded.

www.buysellba.com