BuySellBA

Administrator

How elections impact the real estate market - Infobae

Source:

www.infobae.com

www.infobae.com

October 29, 2023

According to experts, the growing uncertainty can encourage those who have savings to allocate them to the brick. There is a market of opportunity, the best price options and neighborhoods

By José Luis Cieri

During electoral periods, both before and after the elections, decisions tend to be frozen. But it was not the case today (Getty)

The presidential elections last weekend and the upcoming runoff have an influence on the real estate market. Despite a change in the political cycle in sight (even if the ruling party wins), the current scenario is permeated with uncertainty, accentuated by the recent rise of the dollar in the parallel market.

Property purchase and sale transactions had experienced notable growth both in the Autonomous City of Buenos Aires and in various regions of the country, including the province of Buenos Aires and Santa Fe capital. However, the unknown that prevails is what the immediate future holds.

From the sector they recognize a historical pattern, in which during electoral periods, both before and after the elections, decisions tend to be frozen. But this was not the case today, if we take into account what happened after PASO and in September, where more than 8,000 deeds were made in CABA according to the survey of the Buenos Aires College of Notaries.

For now, the sector is going through the best moment since mid-2018 to date and until last September, 27,450 deeds were made in the current year. Experts anticipate that the total number for 2023 could exceed 33,753 operations.

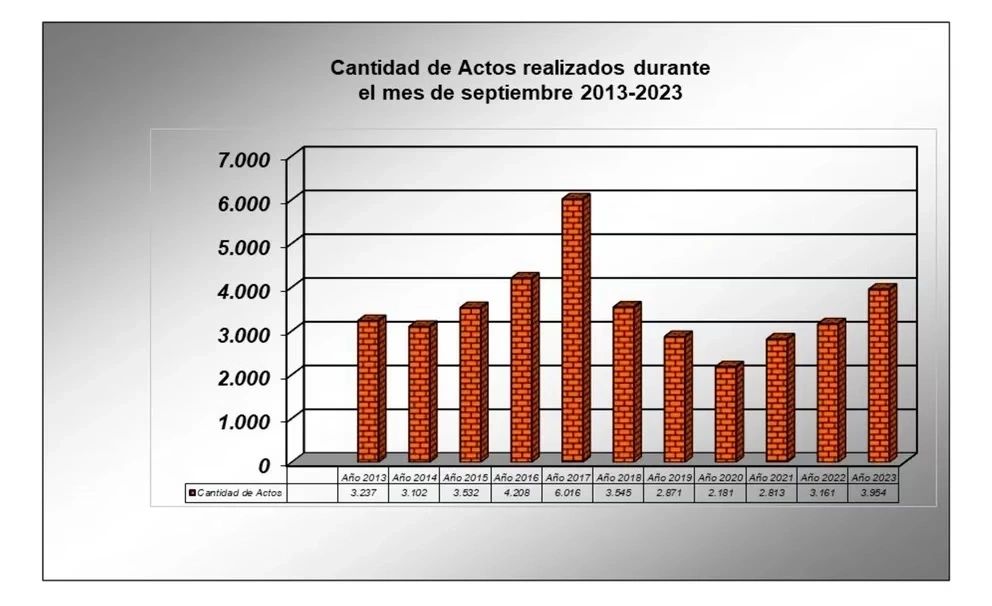

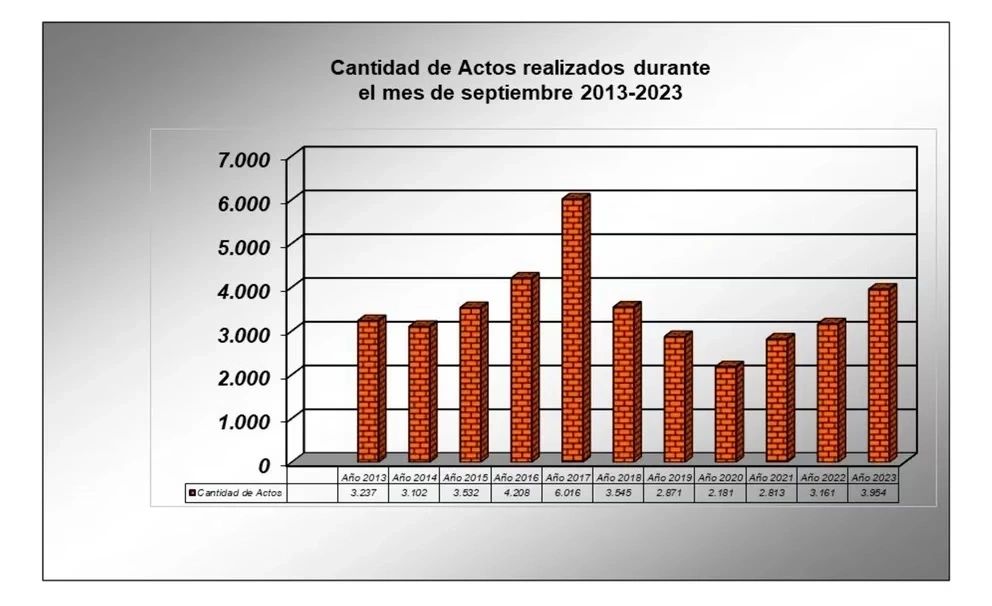

Source: College of Notaries of the City of Buenos Aires. Here you can see the comparison of the months of September between 2013 and 2023, the last one recorded exceeded the number of deeds that 5 years ago.

It is notable that, following the post-PASO devaluation, the second half of August saw outstanding performance. According to data from the College of Notaries of CABA, 1,723 deeds were registered from August 1 to 13 and 2,412 from August 14 to 31.

Bernardo Mihura de Estrada, notary and member of the entity, commented to Infobae : “It is true that real estate buying and selling activity usually increases in the second half of the year, especially in the last quarter.”

If it is considered that this improvement occurred in the most volatile months of the year, it can be confirmed that 2023 can be a pivotal year and that the purchase and sale segment should grow more next year.

“What we see in the notary offices is that there is a willingness to reach agreements: families who have already allocated their savings for housing know that it is their priority. There is still a long way to go to rebuild the market, but we appreciate that we have had 17 months of year-on-year growth. The new government elected on November 19 must be clear that a housing stimulus would generate a virtuous circle and that mortgage credit must return,” Jorge De Bártolo , president of the Buenos Aires College of Notaries, told Infobae.

Experts trust that 2024 could be a pivotal year and would attract more purchase and sale operations (Getty)

Experts suggest that the increase in writings in August and September was due to greater transparency in market prices, adjusted to Argentina's current economic reality. Despite political and economic uncertainty, the market has demonstrated activity in cases with competitive prices.

Mariano García Malbrán , president of the Chamber of Real Estate Services Companies, told Infobae : “After almost five years of stagnation in the real estate sector, recent months show signs of revitalization. This is attributed to the return to post-pandemic urban areas, investment opportunities in premium areas at historically low prices and technological modernization in the real estate sector.”

“The stability and dynamism of the real estate panorama will depend in part on the next government, which must focus on stabilizing the macroeconomy and executing a stabilization plan. However, once this transition period has passed, the prospects for the sector are promising,” Fabián Achával, from Fabián Achával Propiedades and creator of Radar Inmobiliario, highlighted to Infobae.

“Once the next president and his team are defined, the perspectives will be clearer. Only then can we understand how future economic policy will impact the real estate market,” Martín Cesarsky told Infobae.

Looking ahead, there is concern in the segment that focuses on housing.

Martín Cesarsky , of Martín Cesarsky Propiedades, commented to Infobae : “Once the next president and his team have been defined, the perspectives will be clearer. Only then can we understand how future economic policy will impact the real estate market.”

Experts argue that real estate prices for sale are near their lowest point. This is due to the perception that prices have already gone through a significant fairing process.

Currently, it is estimated that in CABA there are more than 30,000 properties available at prices below USD 50,000, values that are similar to those registered in 2005. Experts do not anticipate a hyperinflation scenario and suggest that only in such a situation could valuations decline more strongly than what was observed between 2018 and the beginning of this year.

Experts observe an increase in activity in the sector, driven by investors who consider real estate investment as a haven of value and a way to protect their capital .

The used market is very subject to the exchange rate reality and, for its part, in CABA, works continue to advance, totaling more than 50,000 homes under construction in different neighborhoods.

“Given the absence of mortgage credit, it is investors who generate movement in the market. Argentine history has repeatedly shown that, after a crisis, property prices can decline, but they tend to recover over time. Brick continues to be a solid and reliable investment,” Florencia Miconi, CEO of the construction company IMASA, told Infobae .

Furthermore, it is a very noble sector in terms of job creation and urban landscape.

Cesarsky added: “A market of opportunity persists.” We recommend the location/location strategy to investors. For those who need to sell and buy simultaneously, it is important to remember that even if you sell below your expectations, you will also buy at a lower value. “The real estate sector remains a safe long-term investment.”

2-bedroom apartments among those that sold the most in 2023

Regarding geographical investment, Argentina as a various opportunity. However, in the specific context of CABA and Greater Buenos Aires, projections suggest that the properties acquired at this time not only offer competitive returns, but are likely to recover their historical value within 3 to 4 years, resulting in a high return on investment.

Below are the best-selling apartments in CABA according to the distribution of sales by number of rooms according to the Real Estate Operations Survey (ROI) was as follows: 2-bedrooms 29%; 1-bedrooms 27%; 3-bedrooms 20%; Studio apartments 15%; and more than 5 environments 9 percent.

Interest in PHs is also maintained, because a large part of the demand favors them to avoid paying expenses that have also been rising sharply due to inflation.

Lisandro Cuello, from the real estate company of the same name, told Infobae that “we must keep in mind that in dynamic areas such as Colegiales, Mataderos or Saavedra, there are 2-bedroom apartments that are more than 20 years old, which three years ago were worth USD 250,000 and now They range between USD 145,000 and USD 125,000, and they fell between 40% and 50%, and they are being sold because their owners understood that they had to be lowered to current market prices.”

For buyers looking for family homes, current conditions allow them to access higher quality properties for the investment they are willing to make.

“We project that 2024 will be a transition year, due to the probable devaluation of the peso after the elections. However, we are confident that the market will recover towards the end of 2024 and during 2025," concluded Mariano García Malbrán."

www.buysellba.com

Source:

Cómo impactan las elecciones en el mercado inmobiliario

Según idóneos, la creciente incertidumbre puede favorecer para que quienes disponen de ahorros los destinen en el ladrillo. Hay un mercado de oportunidad, las mejores opciones de precios y barrios

October 29, 2023

How elections impact the real estate market

According to experts, the growing uncertainty can encourage those who have savings to allocate them to the brick. There is a market of opportunity, the best price options and neighborhoods

By José Luis Cieri

During electoral periods, both before and after the elections, decisions tend to be frozen. But it was not the case today (Getty)

The presidential elections last weekend and the upcoming runoff have an influence on the real estate market. Despite a change in the political cycle in sight (even if the ruling party wins), the current scenario is permeated with uncertainty, accentuated by the recent rise of the dollar in the parallel market.

Property purchase and sale transactions had experienced notable growth both in the Autonomous City of Buenos Aires and in various regions of the country, including the province of Buenos Aires and Santa Fe capital. However, the unknown that prevails is what the immediate future holds.

From the sector they recognize a historical pattern, in which during electoral periods, both before and after the elections, decisions tend to be frozen. But this was not the case today, if we take into account what happened after PASO and in September, where more than 8,000 deeds were made in CABA according to the survey of the Buenos Aires College of Notaries.

For now, the sector is going through the best moment since mid-2018 to date and until last September, 27,450 deeds were made in the current year. Experts anticipate that the total number for 2023 could exceed 33,753 operations.

Source: College of Notaries of the City of Buenos Aires. Here you can see the comparison of the months of September between 2013 and 2023, the last one recorded exceeded the number of deeds that 5 years ago.

It is notable that, following the post-PASO devaluation, the second half of August saw outstanding performance. According to data from the College of Notaries of CABA, 1,723 deeds were registered from August 1 to 13 and 2,412 from August 14 to 31.

Bernardo Mihura de Estrada, notary and member of the entity, commented to Infobae : “It is true that real estate buying and selling activity usually increases in the second half of the year, especially in the last quarter.”

In 2023, the first nine months record an increase of 25.1% and growth of 20% is anticipated for the year.In CABA, a 1-bedroom apartment of 50 m2 has a value of U$D 113,672 (Zonaprop)

If it is considered that this improvement occurred in the most volatile months of the year, it can be confirmed that 2023 can be a pivotal year and that the purchase and sale segment should grow more next year.

“What we see in the notary offices is that there is a willingness to reach agreements: families who have already allocated their savings for housing know that it is their priority. There is still a long way to go to rebuild the market, but we appreciate that we have had 17 months of year-on-year growth. The new government elected on November 19 must be clear that a housing stimulus would generate a virtuous circle and that mortgage credit must return,” Jorge De Bártolo , president of the Buenos Aires College of Notaries, told Infobae.

Experts trust that 2024 could be a pivotal year and would attract more purchase and sale operations (Getty)

Experts suggest that the increase in writings in August and September was due to greater transparency in market prices, adjusted to Argentina's current economic reality. Despite political and economic uncertainty, the market has demonstrated activity in cases with competitive prices.

Mariano García Malbrán , president of the Chamber of Real Estate Services Companies, told Infobae : “After almost five years of stagnation in the real estate sector, recent months show signs of revitalization. This is attributed to the return to post-pandemic urban areas, investment opportunities in premium areas at historically low prices and technological modernization in the real estate sector.”

Attractive values

The determining factors that have been constant over the years remain unchanged and visible. The continuous decrease in housing prices from 2018 to date, which is estimated at 45% in CABA and 50% in the interior of the country, continues to generate a market of opportunities. This allows you to acquire properties at prices that evoke past decades. This trend is increasingly evident, attracting both national and foreign investors who increase their real estate purchases.“The stability and dynamism of the real estate panorama will depend in part on the next government, which must focus on stabilizing the macroeconomy and executing a stabilization plan. However, once this transition period has passed, the prospects for the sector are promising,” Fabián Achával, from Fabián Achával Propiedades and creator of Radar Inmobiliario, highlighted to Infobae.

“Once the next president and his team are defined, the perspectives will be clearer. Only then can we understand how future economic policy will impact the real estate market,” Martín Cesarsky told Infobae.

Looking ahead, there is concern in the segment that focuses on housing.

Martín Cesarsky , of Martín Cesarsky Propiedades, commented to Infobae : “Once the next president and his team have been defined, the perspectives will be clearer. Only then can we understand how future economic policy will impact the real estate market.”

Experts argue that real estate prices for sale are near their lowest point. This is due to the perception that prices have already gone through a significant fairing process.

Currently, it is estimated that in CABA there are more than 30,000 properties available at prices below USD 50,000, values that are similar to those registered in 2005. Experts do not anticipate a hyperinflation scenario and suggest that only in such a situation could valuations decline more strongly than what was observed between 2018 and the beginning of this year.

Achával said that “exchange volatility could increase or decrease depending on the candidate who is victorious in the runoff. In this context, purchase decisions tend to be postponed until exchange stability is restored, a crucial requirement for the proper functioning of the real estate market. But we estimate that the final stretch of the year is always the most intense and where people make the greatest decision to bet on the brick. "That's historic."We estimate that the final stretch of the year is always the most intense and where people make the greatest decision to bet on the brick (Achával)

Experts observe an increase in activity in the sector, driven by investors who consider real estate investment as a haven of value and a way to protect their capital .

The used market is very subject to the exchange rate reality and, for its part, in CABA, works continue to advance, totaling more than 50,000 homes under construction in different neighborhoods.

“Given the absence of mortgage credit, it is investors who generate movement in the market. Argentine history has repeatedly shown that, after a crisis, property prices can decline, but they tend to recover over time. Brick continues to be a solid and reliable investment,” Florencia Miconi, CEO of the construction company IMASA, told Infobae .

Furthermore, it is a very noble sector in terms of job creation and urban landscape.

“The increase in construction prices is worrying; You take on a job and you have to go out and stock up on supplies that have high monthly increments. It is also worrying that the rulers do not take mortgage credit as a state policy, which transcends the government in power,” Miconi noted.After a crisis, property prices may decline, but they tend to recover over time. Brick remains a solid investment (Miconi)

What sells the most

Particularly in CABA and Greater Buenos Aires, properties acquired at this time not only offer competitive returns, but are likely to recover their historical value in 3 to 4 years, generating a significant investment return.Cesarsky added: “A market of opportunity persists.” We recommend the location/location strategy to investors. For those who need to sell and buy simultaneously, it is important to remember that even if you sell below your expectations, you will also buy at a lower value. “The real estate sector remains a safe long-term investment.”

2-bedroom apartments among those that sold the most in 2023

Regarding geographical investment, Argentina as a various opportunity. However, in the specific context of CABA and Greater Buenos Aires, projections suggest that the properties acquired at this time not only offer competitive returns, but are likely to recover their historical value within 3 to 4 years, resulting in a high return on investment.

Below are the best-selling apartments in CABA according to the distribution of sales by number of rooms according to the Real Estate Operations Survey (ROI) was as follows: 2-bedrooms 29%; 1-bedrooms 27%; 3-bedrooms 20%; Studio apartments 15%; and more than 5 environments 9 percent.

Interest in PHs is also maintained, because a large part of the demand favors them to avoid paying expenses that have also been rising sharply due to inflation.

Among the neighborhoods that lead the operations are Recoleta, Belgrano, Villa Urquiza, Villa Crespo, Palermo, Chacarita, Colegiales, Villa Devoto, Villa Pueyrredón, Floresta, Flores, Caballito, Almagro, Barracas and Montserrat, among others.Interest in PHs continues, because a large part of the demand favors them to avoid paying expenses that have also been rising sharply.

Lisandro Cuello, from the real estate company of the same name, told Infobae that “we must keep in mind that in dynamic areas such as Colegiales, Mataderos or Saavedra, there are 2-bedroom apartments that are more than 20 years old, which three years ago were worth USD 250,000 and now They range between USD 145,000 and USD 125,000, and they fell between 40% and 50%, and they are being sold because their owners understood that they had to be lowered to current market prices.”

For buyers looking for family homes, current conditions allow them to access higher quality properties for the investment they are willing to make.

“We project that 2024 will be a transition year, due to the probable devaluation of the peso after the elections. However, we are confident that the market will recover towards the end of 2024 and during 2025," concluded Mariano García Malbrán."

www.buysellba.com