All the Answers

Well-known member

How money laundering continues: dollar deposits rose again after a fall of almost USD 1 billion in October - Infobae

Source:

Cómo sigue el blanqueo: volvieron a subir los depósitos en dólares tras una caída de casi USD 1.000 millones en octubre

El stock recuperó el jueves USD 73 millones y se prevé que siga aumentando hacia fin de mes. El dato contribuye a la suba de acciones y a la baja del riesgo país

October 16, 2024

The stock recovered USD 73 million on Thursday and is expected to continue increasing towards the end of the month. The data contributes to the rise in shares and the decrease in country risk.

By Virginia Porcella

In the image, dollar bills. EFE/ Sebastiao Moreira

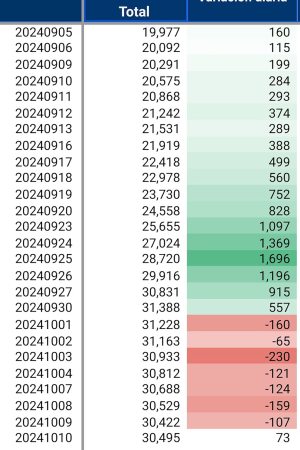

After seven consecutive days of decline, dollar deposits have risen again . According to the latest available data, from last Thursday, deposits resulting from money laundering totaled some USD 73 million compared to the previous day, which reduces the outflow of dollars from banks, which now reaches USD 893 million.

The data may mark a new turning point and it is expected that, at least until the end of the month, when the deadline for depositing up to USD 100,000 in cash without penalty expires, they will continue to rise. The same phenomenon occurred at the end of last month, when that deadline originally expired, which was later extended for a month.

What did not change at that time was the possibility, starting on the first day of October, of withdrawing dollars deposited during the previous months. Thus, from that date, some USD 966 million were withdrawn, a figure that has already begun to shrink. This is because, although the outflow of some of the deposits continues, the flow of income to the banks more than compensated for this drain. In net terms, then, the variation in deposits was again positive. Hence, it is not ruled out that in the next few days it could reach the peak that was reached at the end of September of the total stock, with some USD 31,388 million, just below the maximum of August 2019. That figure, at USD 32,400 million, could also be exceeded.

The increase is good news for the Government, as these dollars are fuelling the calm in the exchange rate and boosting the prices of Argentine assets. This is despite the fact that, so far, the Central Bank's reserves have not reflected a major impact.

In any case, the most marked effect, beyond the rise in stocks, is that of sovereign bonds, which brought the country risk to the lowest level in 5 years. It fell 6% yesterday and was just 44 basis points away from breaking through the psychological barrier of 1,000 points. This performance is combined with a fall in the exchange rate gap, at least with respect to financial dollars, which have also remained below $1,200 for days.

Source: BCRA

At the same time, the laundered dollars allow the Central Bank to extend its foreign currency buying streak. While yesterday it bought only USD 11 million, in October it has accumulated purchases for USD 632 million, twice as much as in August and September. This is a completely unexpected result since expectations pointed to an increase in demand for dollars by importers, which did not occur.

What was verified, instead, was an increase in the supply, thanks essentially to the fact that it allowed large companies to obtain financing in hard currency and that the greater liquidity in dollars of the banks stimulated the level of credit in dollars.

That variable still has a lot to grow. In fact, according to an analysis by the consulting firm 1816, dollar loans to the private sector have grown by about USD 4 billion since the government took office, less than 40% of the increase in deposits in the last two months. “Assuming that the ratio between loans and deposits in dollars can return to 60%, then the dollar cushion that could generate new loans would currently be USD 10.7 billion,” the consulting firm noted in a report in which it focused on the high level of liquidity in dollars that banks have versus the small amount of pesos.

If the evolution of credit were to approach this projection, the supply for the foreign exchange market would be practically guaranteed until the end of the year, which would help the Central Bank to reach the end of the year with an improved net reserves picture. This is because these credits, essentially intended for the pre-financing of exports, become the official foreign exchange market, which would contribute to a favorable intervention for the BCRA and help it accumulate reserves.