Manuel38

New member

How much will the dollar and inflation reach at the end of this year according to local and international analysts - Infobae

Source:

www.infobae.com

www.infobae.com

February 16, 2024

The consultants that make up the LatinFocus Consensus predict a jump in the official dollar of 116% for this year and an end-to-end CPI of 226 percent

FocusEconomics panelists predict another strong jump in the official dollar in 2024 (EFE)

How much will the dollar and inflation in Argentina reach at the end of 2024, according to local and international analysts? FocusEconomics panelists predict a jump in the official dollar of 116% between now and the end of the year, to reach an exchange rate of 1,805 pesos by the end of December. They also projected a jump in inflation to 296.9% in the annual average and 226% end to end, above the 211.4% in 2023 that made Argentina the country with the highest inflation in the world.

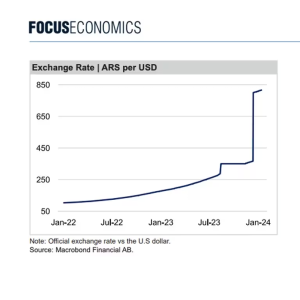

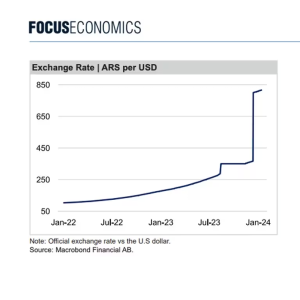

“The peso was trading at $831.3 per dollar on February 9, depreciating 2.0% month-on-month. The price in the parallel market was $1,145 ARS per unit on February 9, with a month-on-month depreciation of 2.2%. On December 12, the Government devalued the peso by 54%, placing it at $800 per dollar. The Central Bank has set a monthly devaluation target of 2%. Further devaluations are possible. FocusEconomics panelists consider that the peso will end 2024 at $1,804.6 per dollar and end 2025 at $2,488.2 per dollar,” the report stated.

Almost three months after the runoff that declared the candidate of La Libertad Avanza, Javier Milei , over the former Minister of Economy, Sergio Massa , the monthly report from LatinFocus that reveals the projections of thirty investment banks, consulting firms and trading agencies Financial advisor for the different Latin American countries outlined their forecasts for the Argentine economy in 2024.

The consensus of the document reflected a worsening of the main variables of the Argentine economy amid the acceleration of inflation, which is added to capital controls, a collapse of the peso, high interest rates and greater political uncertainty.

Analysts concluded that the official dollar will mark a jump of 116% by the end of the year from $808.45 at the end of 2023, after the devaluation applied by the Central Bank on Wednesday, December 13.

For this year, they expect the peso to weaken even further in 2024, with a fall of 52.5%, amid sustained monetary financing of the fiscal deficit. Among those expecting a higher price for the dollar at the end of 2024 are LCG with $3,635; the consulting firm Equilibra ($3,0000) and Econviews ($2,803) .

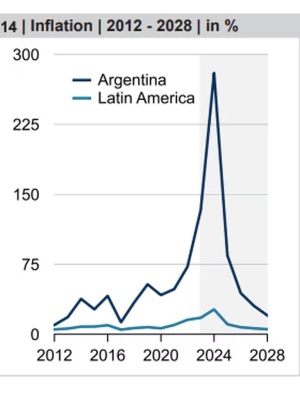

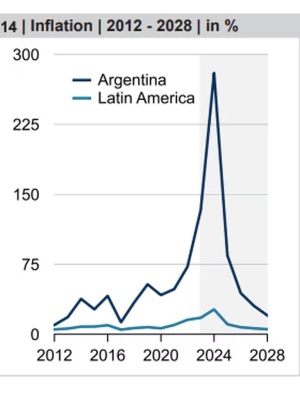

Regarding inflation , analysts anticipated an acceleration in inflation by the end of the year to 226.8%, the highest level in three decades. Among those consulted, the highest CPI was projected by the consulting firm Equilibra, with 475% , followed by EMFI (444%), Emerging Market Watch (350%) and LCG (404%).

The LatinFocus report noted that “Inflation shot up to 211.4% in December (November: 160.9%), the highest in Latin America. This year, inflation is expected to more than double from 2023, due to the removal of price controls and the narrowing of the gap between the official and parallel exchange rates. Fiscal tightening, the growth of the monetary mass and changes in the exchange rate regime are the key factors to monitor. FocusEconomics panelists consider that consumer prices will rise by 296.9% on average in 2024, which represents an increase of 16.8 percentage points compared to a month ago, and 85.6% on average in 2025.”

On the other hand, these figures are going to occur on a par with a recessive year.

“We expect a GDP contraction of 2.5% by 2024, after an expected contraction of 1.5% in 2023. In our opinion, the expected acceleration of inflation following the sharp devaluation of the currency will affect real wages (in particularly in 1Q24), while an ambitious stabilization program should support fiscal consolidation efforts, although it will affect the dynamics of activity in the short term. On the other hand, the normalization of the agricultural sector after a serious drought in 2023 and the positive effects of the announced deregulation of the economy could boost activity over time,” analyzed Andrés Pérez and Diego Ciongo , analysts at Itaú Unibanco, in the report. from LatinFocus.

Source:

A cuánto llegarán el dólar y la inflación a fin de este año según analistas locales e internacionales

Los consultores que integran el LatinFocus Consensus prevén un salto del dólar oficial de 116% para este año y un IPC punta a punta del 226 por ciento

February 16, 2024

The consultants that make up the LatinFocus Consensus predict a jump in the official dollar of 116% for this year and an end-to-end CPI of 226 percent

FocusEconomics panelists predict another strong jump in the official dollar in 2024 (EFE)

How much will the dollar and inflation in Argentina reach at the end of 2024, according to local and international analysts? FocusEconomics panelists predict a jump in the official dollar of 116% between now and the end of the year, to reach an exchange rate of 1,805 pesos by the end of December. They also projected a jump in inflation to 296.9% in the annual average and 226% end to end, above the 211.4% in 2023 that made Argentina the country with the highest inflation in the world.

“The peso was trading at $831.3 per dollar on February 9, depreciating 2.0% month-on-month. The price in the parallel market was $1,145 ARS per unit on February 9, with a month-on-month depreciation of 2.2%. On December 12, the Government devalued the peso by 54%, placing it at $800 per dollar. The Central Bank has set a monthly devaluation target of 2%. Further devaluations are possible. FocusEconomics panelists consider that the peso will end 2024 at $1,804.6 per dollar and end 2025 at $2,488.2 per dollar,” the report stated.

Almost three months after the runoff that declared the candidate of La Libertad Avanza, Javier Milei , over the former Minister of Economy, Sergio Massa , the monthly report from LatinFocus that reveals the projections of thirty investment banks, consulting firms and trading agencies Financial advisor for the different Latin American countries outlined their forecasts for the Argentine economy in 2024.

The consensus of the document reflected a worsening of the main variables of the Argentine economy amid the acceleration of inflation, which is added to capital controls, a collapse of the peso, high interest rates and greater political uncertainty.

Analysts concluded that the official dollar will mark a jump of 116% by the end of the year from $808.45 at the end of 2023, after the devaluation applied by the Central Bank on Wednesday, December 13.

For this year, they expect the peso to weaken even further in 2024, with a fall of 52.5%, amid sustained monetary financing of the fiscal deficit. Among those expecting a higher price for the dollar at the end of 2024 are LCG with $3,635; the consulting firm Equilibra ($3,0000) and Econviews ($2,803) .

Regarding inflation , analysts anticipated an acceleration in inflation by the end of the year to 226.8%, the highest level in three decades. Among those consulted, the highest CPI was projected by the consulting firm Equilibra, with 475% , followed by EMFI (444%), Emerging Market Watch (350%) and LCG (404%).

The LatinFocus report noted that “Inflation shot up to 211.4% in December (November: 160.9%), the highest in Latin America. This year, inflation is expected to more than double from 2023, due to the removal of price controls and the narrowing of the gap between the official and parallel exchange rates. Fiscal tightening, the growth of the monetary mass and changes in the exchange rate regime are the key factors to monitor. FocusEconomics panelists consider that consumer prices will rise by 296.9% on average in 2024, which represents an increase of 16.8 percentage points compared to a month ago, and 85.6% on average in 2025.”

On the other hand, these figures are going to occur on a par with a recessive year.

“We expect a GDP contraction of 2.5% by 2024, after an expected contraction of 1.5% in 2023. In our opinion, the expected acceleration of inflation following the sharp devaluation of the currency will affect real wages (in particularly in 1Q24), while an ambitious stabilization program should support fiscal consolidation efforts, although it will affect the dynamics of activity in the short term. On the other hand, the normalization of the agricultural sector after a serious drought in 2023 and the positive effects of the announced deregulation of the economy could boost activity over time,” analyzed Andrés Pérez and Diego Ciongo , analysts at Itaú Unibanco, in the report. from LatinFocus.