All the Answers

Well-known member

In the first quarter, 275,000 salary accounts were closed in banks due to the drop in employment - Infobae

Source:

En el primer trimestre se cerraron 275.000 cuentas sueldo en los bancos por la caída del empleo

La cantidad de cuentas bancarias para acreditar remuneraciones cayó tanto en los bancos públicos como en los privados. Otros informes señalan una reducción del 1,4% de los empleos totales entre enero y marzo, lo que implica una merma de 240.000 puestos de trabajo

May 21, 2024

The number of bank accounts to credit remunerations fell in both public and private banks. Other reports indicate a 1.4% reduction in total employment between January and March, which implies a loss of 240,000 jobs

By Fernando Meaños

Between 2 and 3% of the total bank accounts intended for the accreditation of salaries stopped working in the first 3 months of 2024

In the first quarter of the year, almost 275,000 salary accounts in the Argentine financial system ceased to have activity , a figure that represents between 2 and 3% of the total bank accounts intended for the accreditation of salaries. The massive closure of salary accounts, recorded in Central Bank statistics, is consistent with private data that indicates a disappearance of jobs of a similar magnitude in the first quarter of the year within the framework of a recessionary process that accompanied the strong fiscal and monetary adjustment implemented by the Government.

The official data indicates that in March there were 274,311 fewer salary accounts that have received some money income compared to December 2023. Even in the context of a strong adjustment in the public sector, with closure of organizations and layoffs of employees, as The national government itself usually highlights, the closure of salary accounts was replicated in both state and private banks. In the first quarter there were closures in Banco Provincia (47,700 salary accounts) and Nación (33,800), but also in large private banks such as Macro (36,100), Santander (27,300) or Galicia (23,900). “Many accounts were finalized contracts of cuts to public employees that not only happens in the nation but also in the provinces ,” they described from one of the entities.

The Central Bank statistics record each month how many salary accounts had accreditations, that is, they received money from employers. And it usually has a seasonal effect in the month of January: many companies usually pay the December salary before the end of the year holidays, along with the Christmas bonus. In that case, the account does not record income during January. But this seasonality is immediately corrected in the following month.

On the other hand, beyond this particularity, the number of salary accounts with movement had been registering an increase in the last months of last year, a situation that was completely reversed at the beginning of 2024. Regarding the number of companies that accredited salaries, the progression was similar to that of the number of accounts with one exception: in March there were 7,000 more employers who paid salaries than in December. This last data records both a large company and an MSME that paid at least one salary during that month.

On the other hand, these data of lower number of active salary accounts than the official figures fully fit with the loss of jobs highlighted by other reports. For the consulting firm Equilibra, according to its latest report, in the first quarter of this year, 1.4% of total jobs were lost , which includes, in addition to formal employment (public and private), black wage earners and non-black workers. salaried workers (monotributistas, self-employed, etc.). Salary accounts represent only formal employment in a dependency relationship.

As explained in Equilibra, 240,000 jobs were lost in the first quarter of the year , a drop that has not occurred since 2020 at the most critical moment of the quarantine decreed in the coronavirus pandemic. The figure arises from combining the data already provided by public organizations for formal work combined with estimates for unregistered employment.

The origin of the causes of employment difficulties does not require much analysis: Equilibra estimates that the first quarter of this year will end with a drop in GDP between 5% and 6% compared to the same period in 2023.

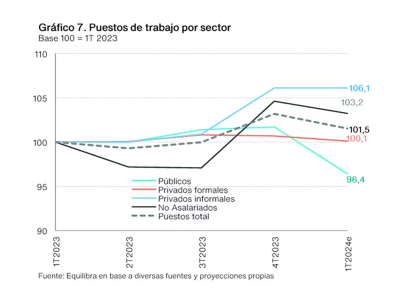

Positions by sector

“Using the employment data already observed for the first quarter of 2024 for the formal segment and the estimates mentioned for the non-salaried and informal, we can have an estimate of how jobs in the total economy evolved in the first quarter of the year. anus. This sectoral panorama describes a drop in total jobs of 1.4% between Q1-24 and Q4-23, a magnitude not observed in a quarter since the pandemic ,” explained Equilibra.

“This drop in jobs coincides with what many qualitative surveys began to perceive in recent months: job loss became the first economic concern along with inflation, with the particularity that the former is on the rise and the second, in decline,” the report added. And he left a forecast in the same sense: although the interannual measurement of total jobs still shows a growth of 1.8% in the first quarter of 2024 compared to the same period in 2023, it was estimated that “this increase will probably slow down.” ” in the current quarter.