All the Answers

Well-known member

Income Tax : who and how will pay the tax after the changes introduced in Deputies - Infobae

Source:

Ganancias: quiénes y cómo pagarán el tributo tras los cambios introducidos en Diputados

Se mantiene el piso de $1.800.000 para empleados solteros sin hijos. El tratamiento en Comisión sólo incorporó un beneficio extra para contribuyente, que es la actualización semestral de las deducciones personales en lugar de anual

April 26, 2024

The floor of $1,800,000 is maintained for single employees without children. The Commission treatment only incorporated an extra benefit for the taxpayer, which is the semi-annual update of personal deductions instead of annually.

If the new Earnings project is approved, a single employee will not be taxed on earnings if his gross remuneration is up to $1,800,000

Yesterday the Chamber of Deputies gave a committee opinion to the bill on Palliative and Relevant Fiscal Measures , better known as the “ Fiscal Package .” Among the different issues addressed by the proposed rule is a modification to the Income Tax that attempts to reverse, with changes, the reduction in the payment of that tax decided during the last presidential campaign. The chapter dedicated to Profits did not encounter great resistance in the Commission's treatment and had a minimal change that, in addition, is favorable for the taxpayer .

“Some modifications were included in the Tax Project: The updating of personal deductions (Non-Taxable Minimum, Family Burdens and Special Deduction), such as the rate scales, will be semi-annual. In 2024 by exception, in September,” explained tax official César Litvin through his X account (the former Twitter).

Proyecto Ley Medidas Fiscales. Dictamen de mayoriIÌ_a.pdf

drive.google.com

drive.google.com

The change is an improvement for taxpayers compared to the original text, which provided for annual updates . By being able to update this point semiannually, the nominal amounts will feel less the effect of inflation and the weight of the tax will be reduced. However, a draft prior to sending the project to Congress contemplated quarterly adjustments. With which, the resolution moves in the direction of being halfway between those two extremes.

Reinstatement of Earnings

Last September, the fourth category of Profits had been eliminated, which exempted more than 800,000 taxpayers from paying the tax. The law passed by Congress raised the non-taxable minimum floor for workers and retirees who receive 15 minimum vital and mobile salaries (SMVM). In addition, it stipulates that taxpayers will pay taxes according to the difference between their assets and the established minimum and the rates They will go from 27% to 35%, depending on income level.That will be reversed if the Fiscal Package ends up being approved by both chambers.

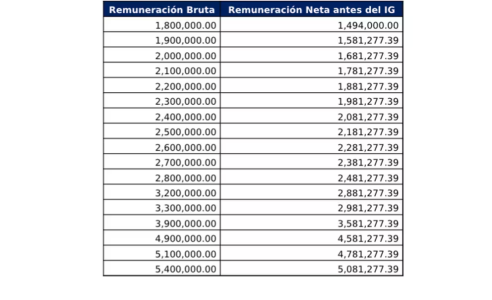

With the text as agreed upon in the Commission, this is how the 17 categories contemplated remain. The lowest, with a gross salary of up to 1,800,000 pesos - which represents a net or "in hand" remuneration of up to $1,494,000 - is exempt from the tax, which is usually called "the non-taxable minimum for single employees." ”.

Source: SDS Tax Advisors.

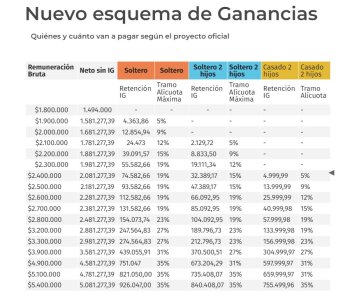

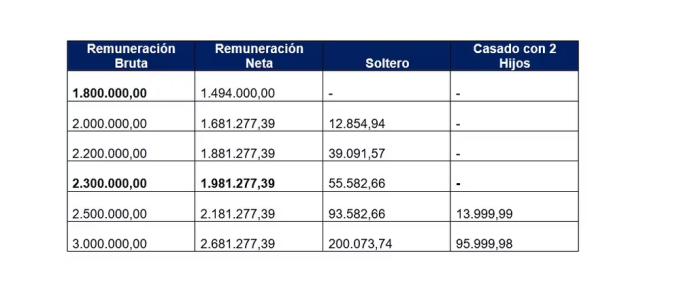

Sebastián Domínguez , head of SDC Asesores Tributarios, prepared a detailed analysis at the time of presentation of the original project that allows establishing the monthly withholding that would be made in each case and the respective rate, for single employees and singles with two children. Let's look at the examples:

An employee with a gross remuneration of $3,200,000 who does not have deductions for spouse or children, nor for expenses such as rent or domestic service, would pay a monthly tax of $247,564.83, if the bill that the Power is approved Executive sent to Congress. If it is someone with the same income and is single, but who declares deductions for two children under 18 years of age, then the amount would be $189,796.73 per month. Thus, the tax would be equivalent to 7.7% of the gross salary in the first case and 5.9% in the second. In the case of a married worker with two minor dependent children, the Earnings payment will be $133,999.98, 4.2% of his gross salary.

With a gross salary of $5,100,000 , the monthly Earnings discount would be $821,050 for a single person without children, while if a single employee with that income applies deductions for two children, the tax would be 735,408.07 pesos. In these cases, the tax would represent 16.1% and 14.4%, respectively, of the gross remuneration. For a married employee with two minor dependent children, the Earnings payment will be $659,999.97, 12.9% of his gross salary.

If the Government project is approved as it is, employees will pay income tax from a gross monthly remuneration of $1,800,000 (in net terms, it is a salary of $1,494,000) if no deductions for spouse or for children, nor for certain expenses that may be deducted from income for the purposes of calculating the tax.

In the case of a single employee who has two children under the age of 18 declared in their care, the lowest gross salary reached by the tax would be $2,100,000, which is equivalent to a net salary of 1,781,277.39 pesos. In the case of a married employee with two minor dependent children, he will be exempt from paying the tax with a gross salary of less than $2,400,000, that is, a net salary of 2,081,277.39 pesos.

The official project

This week the Government released the draft of its new project of fiscal measures, which includes the restitution of Income Tax for employees in a dependency relationship. The text, which still has a long legislative journey ahead, has several changes compared to the project that was presented in January of this year and that ultimately failed to pass Congress.The Minister of the Interior, Guillermo Francos , had anticipated that the new Earnings floor would reach $1,800,000 for single workers without children and $2,300,000 for married workers with two children. That is the threshold that was set. “The Government announced that single employees were not going to pay earnings for salaries of up to $1,800,000 and married employees with two children were not going to pay earnings for salaries of up to $2,300,000,” said Domínguez.

Withholdings from monthly earnings for single and married employees with two children (Source: SDC Asesores Tributarios)

Scales and deductions

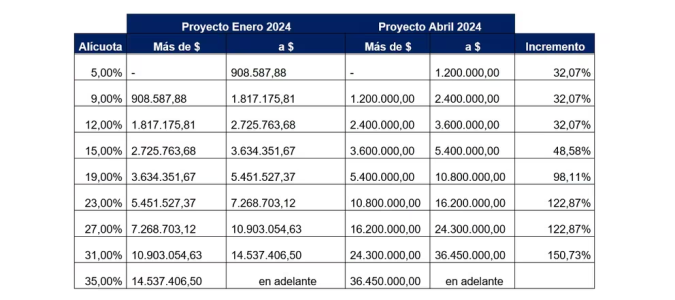

Regarding the aliquot scales, as they appear in the draft, they will be more progressive and will range between 5 and 35 percent . The maximum rate will begin to apply from an income of $36,450,000 and onwards.The sections of the scales present an increase of between 32.07% and 150.73% compared to the bill that the Government presented to Congress last January.

On the other hand, the project establishes that personal deductions and the sections of the tax scales will be adjusted semiannually due to the variation in the

For the moment, personal deductions will increase, if approved in Congress, between 183.75% and 186.65% and there are no changes regarding the special deduction for certain retirees and pensioners, which remains at 8 guaranteed minimum assets.

With the new project, deductions for mobility expenses, travel expenses and other compensation, for teaching materials paid to teachers, among others, are eliminated. Also, the 22% increase in personal deductions for employees and retirees who reside in the Patagonian area is repealed.

On the other hand , exemptions are eliminated for the Annual Complementary Salary, better known as bonus , for the difference in the value of overtime and hours worked on holidays, non-working days and during weekends, for certain supplements corresponding to personnel. military and for mandatory guards and overtime performed by professionals, technicians, assistants and operational personnel of health systems.