BuySellBA

Administrator

Is it profitable to buy an apartment to rent?: How long does it take to recover the investment? - Infobae

Source:

www.infobae.com

www.infobae.com

September 03, 2024

Given the growing interest in acquiring properties in CABA, what are the opportunities and challenges of the current real estate market? Practical tips to maximize the return on investments in rental properties

By Jose Luis Cieri

The market for buying and selling apartments in CABA has been activated for rental purposes. Investors consider this new dynamic when evaluating opportunities in the traditional rental sector (Illustrative Image Infobae)

The rental market in Buenos Aires is showing favorable signs for real estate investors. Following the repeal of the Rental Law through a DNU, the relaunch of mortgage loans, and the implementation of the money laundering system that allows undeclared funds to be invested in properties, a notable increase in real estate inquiries and transactions was observed.

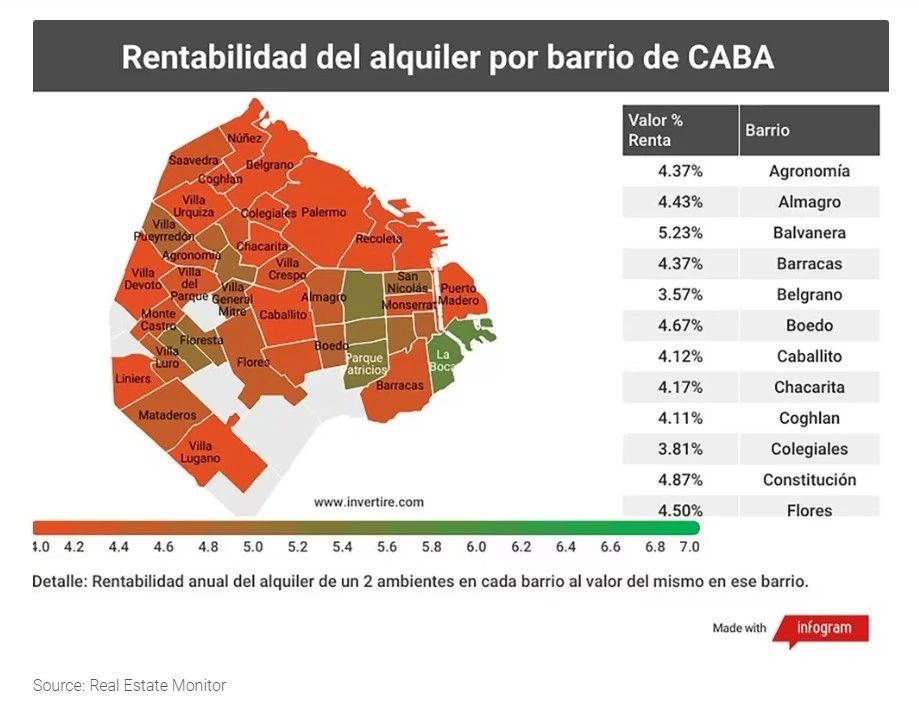

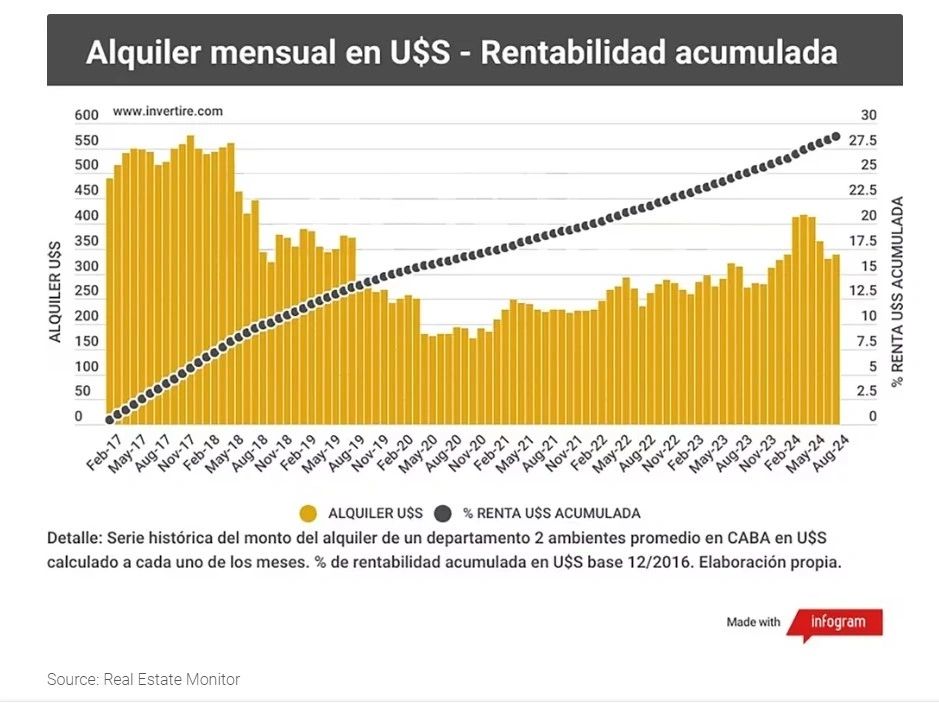

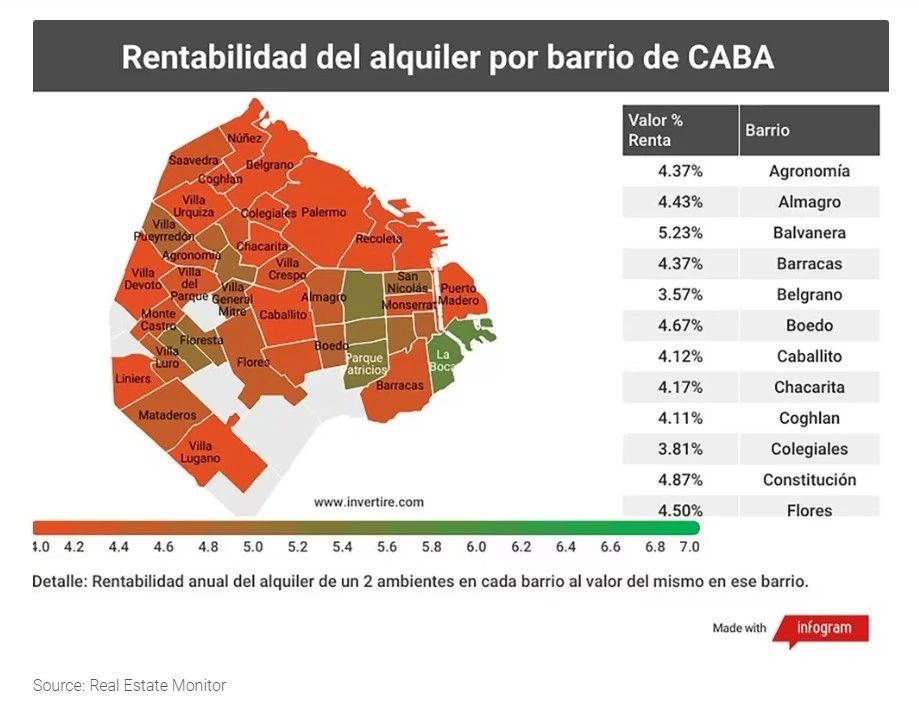

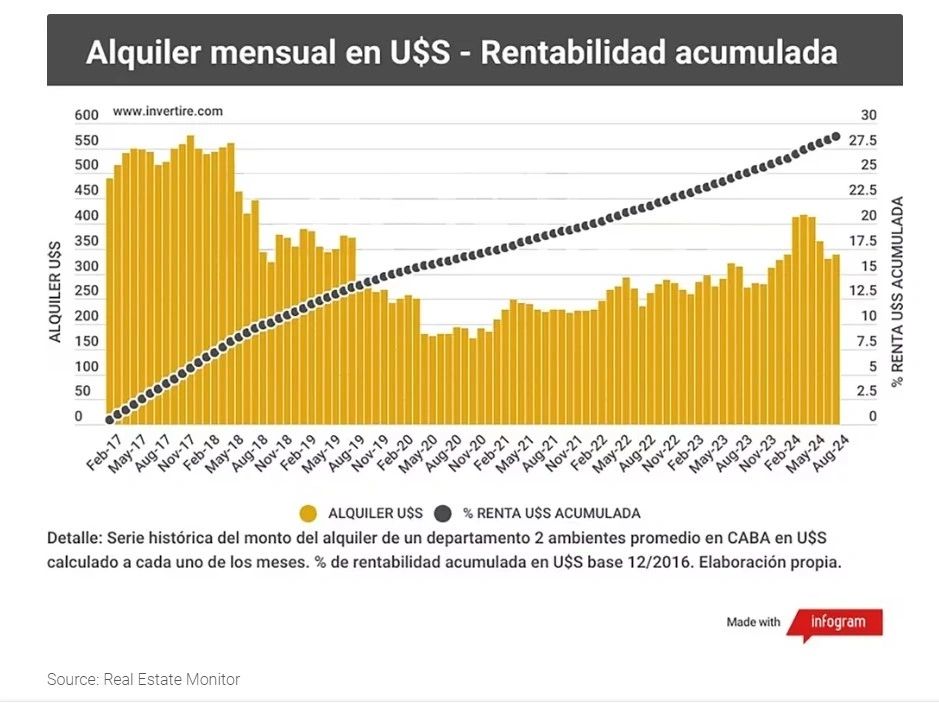

This situation generated greater dynamism and increased interest in the purchase and sale of units for rental. The rent/price ratio for housing contracts, according to data from Zonaprop, currently stands at 4.29% annually .

This means that, on average, it would take 23.3 years of renting to recover the initial investment in a property .

According to Real Estate Report, the average profitability at the start of a rental contract in pesos for used unfurnished units varies according to the type of housing. Studio apartments offer a slightly higher profitability than the rest, reaching an average of 4.16% per year. In comparison, two-bedroom units have an average profitability of 4.15% per year, and one-bedroom apartments are at 4.12%; in turn, the largest units, with four rooms, register a slightly lower profitability, standing at 3.95% per year.

While Monitor Inmobiliario reported that today there are almost 15,300 properties for rent published in the city of Buenos Aires, when in the same month of 2023 there were only 5,622 (most were in dollars) with an expansion of the offer of 172.11% year-on-year.

Daniel Bryn , partner at Zipcode and who produces Monitor Inmobiliario, confirmed to Infobae that “rental profitability has recovered significantly compared to the last two years. This improvement is directly associated with the repeal of the Rental Law, allowing for more frequent adjustments adapted to the market situation.”

In 2022, profitability averaged 2.8%, and has now increased significantly, according to reports from the real estate market: there are neighborhoods in Buenos Aires that offer up to four points more.

As for current rental prices in CABA, a one-bedroom apartment now costs between $481,000 and $485,000 per month on average. While a three-room apartment costs around $580,000 on average.

Faced with this situation, Bryn offered a key recommendation for those with savings: “For those interested in buying properties as an investment, it is advisable to focus on high-demand areas such as Recoleta. These neighborhoods not only guarantee quick occupancy, but also help maintain the stability of rental prices over time.”

Palermo: 3,750.

Recoleta: 2,357.

Belgrano: 1,644.

Caballito: 845.

Puerto Madero: 779.

Nuñez: 543.

Balvanera: 461.

Villa Urquiza: 456.

Villa Crespo: 447.

Almagro: 436.

“This increase in supply is due in part to legislative changes and new practices in rental contracts, which now allow for more frequent adjustments based on the Consumer Price Index (CPI), inflation or according to what has been agreed between landlords and tenants, which can be every three, four or six months,” said Bryn.

Lisandro Cuello , a real estate expert, pointed out that neighborhoods such as Almagro, Constitución, La Boca, Once and Liniers, although less attractive to high-net-worth investors, offer higher returns due to affordable sales prices and competitive rental rates.

“By choosing responsible and solvent tenants, through a rigorous selection process that includes background checks and references, the property can be protected and a steady income can be ensured,” he recommended.

Comparatively, short-term rentals were once a popular option given their higher daily rates. However, they have declined today due to economic factors and the preference for traditional housing contracts.

Bryn said location is a determining factor in the performance of traditional rentals. “Belgrano and Palermo, due to their infrastructure, security and growth prospects, ensure both high demand and higher rental income.”

Managing the ongoing occupancy of properties is essential to maximising profitability.

Experts also advise investing in central and well-connected areas, those with high demand, to reduce the risk of having vacant units. Well-maintained and competitively priced properties attract more tenants.

Cuello said that although the average profitability reaches 6% annually, it currently takes longer for owners to rent out their equipped and furnished properties.

Until August 2023, a temporary rental was put on the market in about 15 or 20 days; now, these same properties take up to 45 days to be rented.

"This means that maintenance costs and expenses are not recovered as frequently as before, which puts the stability of the financial equation at risk," Cuello concluded.

www.buysellba.com

Source:

¿Es rentable comprar un departamento para alquilar?: en cuánto tiempo se recupera la inversión

Ante el creciente interés por adquirir propiedades en CABA, cuáles son las oportunidades y desafíos del mercado inmobiliario actual. Consejos prácticos para maximizar el retorno de las inversiones en propiedades destinadas a la renta

September 03, 2024

Given the growing interest in acquiring properties in CABA, what are the opportunities and challenges of the current real estate market? Practical tips to maximize the return on investments in rental properties

By Jose Luis Cieri

The market for buying and selling apartments in CABA has been activated for rental purposes. Investors consider this new dynamic when evaluating opportunities in the traditional rental sector (Illustrative Image Infobae)

The rental market in Buenos Aires is showing favorable signs for real estate investors. Following the repeal of the Rental Law through a DNU, the relaunch of mortgage loans, and the implementation of the money laundering system that allows undeclared funds to be invested in properties, a notable increase in real estate inquiries and transactions was observed.

This situation generated greater dynamism and increased interest in the purchase and sale of units for rental. The rent/price ratio for housing contracts, according to data from Zonaprop, currently stands at 4.29% annually .

This means that, on average, it would take 23.3 years of renting to recover the initial investment in a property .

According to Real Estate Report, the average profitability at the start of a rental contract in pesos for used unfurnished units varies according to the type of housing. Studio apartments offer a slightly higher profitability than the rest, reaching an average of 4.16% per year. In comparison, two-bedroom units have an average profitability of 4.15% per year, and one-bedroom apartments are at 4.12%; in turn, the largest units, with four rooms, register a slightly lower profitability, standing at 3.95% per year.

While Monitor Inmobiliario reported that today there are almost 15,300 properties for rent published in the city of Buenos Aires, when in the same month of 2023 there were only 5,622 (most were in dollars) with an expansion of the offer of 172.11% year-on-year.

Daniel Bryn , partner at Zipcode and who produces Monitor Inmobiliario, confirmed to Infobae that “rental profitability has recovered significantly compared to the last two years. This improvement is directly associated with the repeal of the Rental Law, allowing for more frequent adjustments adapted to the market situation.”

In 2022, profitability averaged 2.8%, and has now increased significantly, according to reports from the real estate market: there are neighborhoods in Buenos Aires that offer up to four points more.

The regulatory change in traditional rentals allows owners to adjust prices more dynamically, improving the profitability of their real estate investments

As for current rental prices in CABA, a one-bedroom apartment now costs between $481,000 and $485,000 per month on average. While a three-room apartment costs around $580,000 on average.

Faced with this situation, Bryn offered a key recommendation for those with savings: “For those interested in buying properties as an investment, it is advisable to focus on high-demand areas such as Recoleta. These neighborhoods not only guarantee quick occupancy, but also help maintain the stability of rental prices over time.”

More offer

According to Monitor Inmobiliario, the ranking of the 10 neighborhoods with the most traditional rental apartments in CABA is presented as follows:Palermo: 3,750.

Recoleta: 2,357.

Belgrano: 1,644.

Caballito: 845.

Puerto Madero: 779.

Nuñez: 543.

Balvanera: 461.

Villa Urquiza: 456.

Villa Crespo: 447.

Almagro: 436.

“This increase in supply is due in part to legislative changes and new practices in rental contracts, which now allow for more frequent adjustments based on the Consumer Price Index (CPI), inflation or according to what has been agreed between landlords and tenants, which can be every three, four or six months,” said Bryn.

Higher and lower profitability and tips

Villa Lugano (according to Zonaprop) stands out as the neighborhood with the highest return for investors, registering an average profitability of 7.3%, followed by Balvanera and La Boca with 6.1%; however, high-demand neighborhoods such as Palermo, with 4%, and Belgrano, with 4.2%, show lower returns compared to the aforementioned neighborhoods, but benefit from a higher demand for traditional rentals.Lisandro Cuello , a real estate expert, pointed out that neighborhoods such as Almagro, Constitución, La Boca, Once and Liniers, although less attractive to high-net-worth investors, offer higher returns due to affordable sales prices and competitive rental rates.

“By choosing responsible and solvent tenants, through a rigorous selection process that includes background checks and references, the property can be protected and a steady income can be ensured,” he recommended.

Comparatively, short-term rentals were once a popular option given their higher daily rates. However, they have declined today due to economic factors and the preference for traditional housing contracts.

Bryn said location is a determining factor in the performance of traditional rentals. “Belgrano and Palermo, due to their infrastructure, security and growth prospects, ensure both high demand and higher rental income.”

Managing the ongoing occupancy of properties is essential to maximising profitability.

Experts also advise investing in central and well-connected areas, those with high demand, to reduce the risk of having vacant units. Well-maintained and competitively priced properties attract more tenants.

Less activity

Last July, short-term rentals, offered through platforms such as Airbnb or Booking, presented a higher potential profitability due to higher daily rates, although they lost demand due to the decrease in tourism and the change in student preferences towards traditional rentals.Cuello said that although the average profitability reaches 6% annually, it currently takes longer for owners to rent out their equipped and furnished properties.

Until August 2023, a temporary rental was put on the market in about 15 or 20 days; now, these same properties take up to 45 days to be rented.

"This means that maintenance costs and expenses are not recovered as frequently as before, which puts the stability of the financial equation at risk," Cuello concluded.

www.buysellba.com