BuySellBA

Administrator

Is it worth renting a property in the city of Buenos Aires today? - La Nacion Propiedades

Source:

¿Conviene poner en alquiler una propiedad hoy en la ciudad de Buenos Aires?

La rentabilidad bruta anual promedio por alquiler de inmuebles en 2024 mejoró la del año 2023 casi en el doble

February 11, 2025

The average annual gross profitability from property rentals in 2024 improved that of 2023 by almost double

The profitability obtained from renting has improved in the last year, almost doubling Fabian Marelli

Ana and Bruno bought a one-bedroom apartment 10 years ago with the idea of renting it out and having a supplementary income. At first they were happy with the decision they made, but since the pandemic, they began to distrust the tenants , they lost money with the adjustments that were rapidly depreciating due to inflation, and they left it empty. In 2024 they put it up for rent again with their trusted real estate agency and today they are happy with the result of their initial investment.

Last year ended with strong growth in the number of sales transactions and also with a substantial improvement in profitability for owners of rented properties.

Last year ended with strong growth in the number of sales transactions and also with a substantial improvement in profitability for owners of rented properties. Fabian Marelli

During 2022 and 2023, the number of properties available for rent had decreased significantly, mainly because owners feared that prices would lag behind the rise in the dollar and because of the unfavorable provisions of the Rental Law.

From January 2024 , with the inflation rate falling throughout the year, the stability in the price of the dollar and the repeal of the rental law in December 2023, landlords regained confidence and the rental supply increased.

According to a recent report by Zonaprop, in January 2024 the supply of traditional rental apartments in CABA increased by 62% compared to the previous month . However, throughout last year, the growth in supply moderated and in January of this year it fell by 6% .

Did the profit increase?

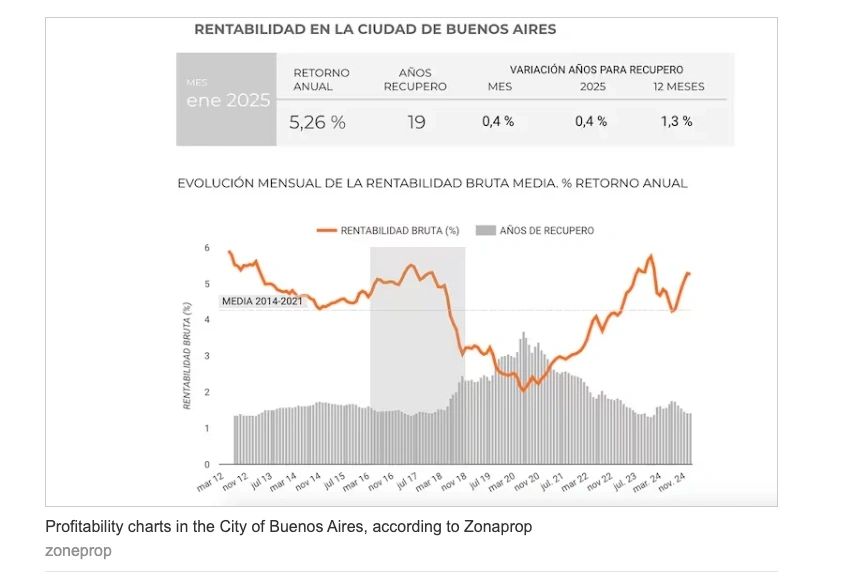

According to the latest Index of CABA published by Zonaprop, analyzing the advertisements published by advertisers on its portal, last January rental prices increased by 2.8% and have accumulated a 39.7% increase in the last 12 months.This has led to an increase in profitability due to several factors: the drop in the exchange rate, the decrease in inflation since January 2024 and the increased interest of investors in purchasing properties as an asset.

According to several consulting firms, the profitability of rental apartments in CABA was up to 6.35%; this percentage represents the annual profit that the owner obtained by renting out his property. The index for 2023 was 3.9%, so it is noted that the current index has improved significantly.

According to the Zonaprop report, the gross profitability in dollars measured by the platform at 5.26% is similar to that of 2017, when there was a significant increase in sales due to the appearance of UVA mortgage loans.

Profitability neighborhood by neighborhood

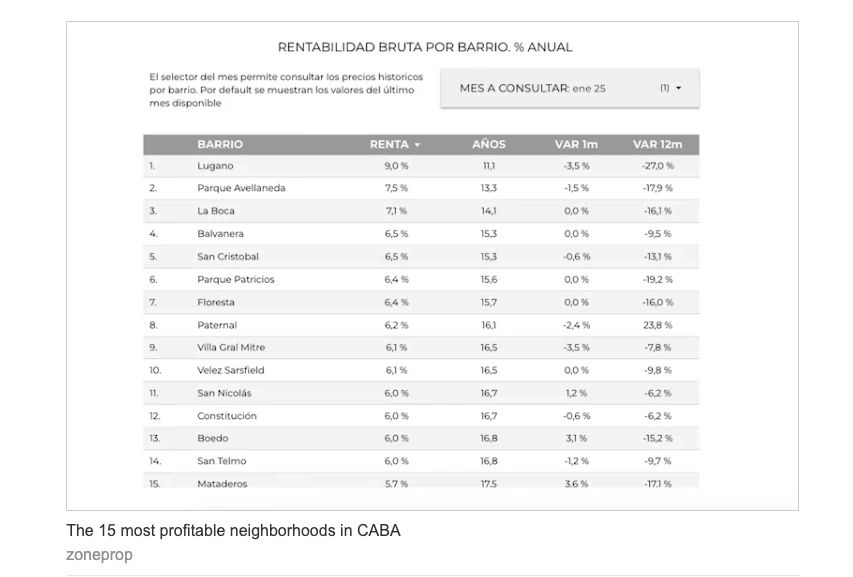

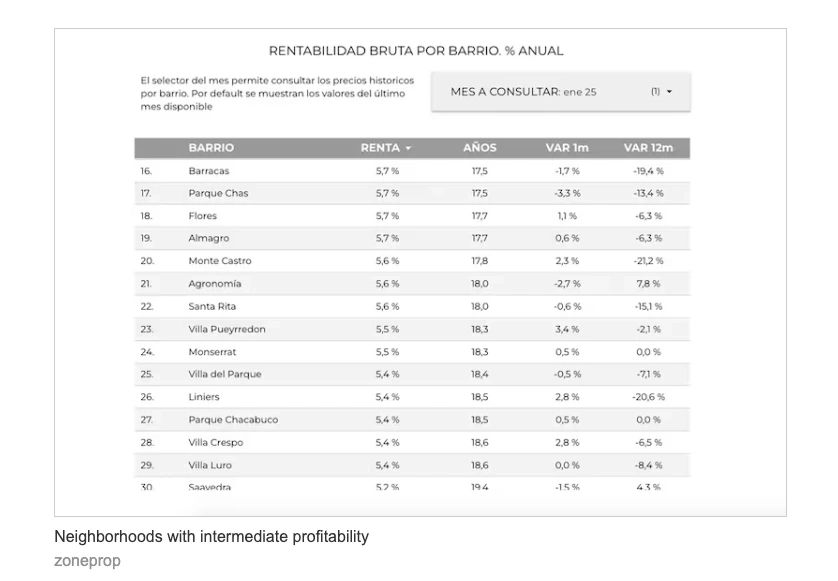

Since the repeal of the rental law, the supply of properties has increased mainly due to the improvement in prices and conditions of the rentals. This has also made the sector attract new investors who are looking to obtain a good income through rentals . Buying to rent is not a random decision, but rather the owners decide to obtain a good return in this way and, on the other hand, they decide to acquire properties with the expectation that they will increase in value.The data from the reports show that owners obtain greater profitability in neighborhoods with lower rental prices.

The neighbourhood with the highest profitability is Lugano, with a gross profitability of 9% per year, according to Zonaprop. One of the main reasons is that there is a large supply of properties with values below the common denominator of other neighbourhoods.

In second place is Parque Avellaneda, with an annual return of 7.5%, followed by La Boca, in third place (7.1% annual return). One of the main reasons for the index being higher than in many areas is that the value of a square meter is less than US$1,000.

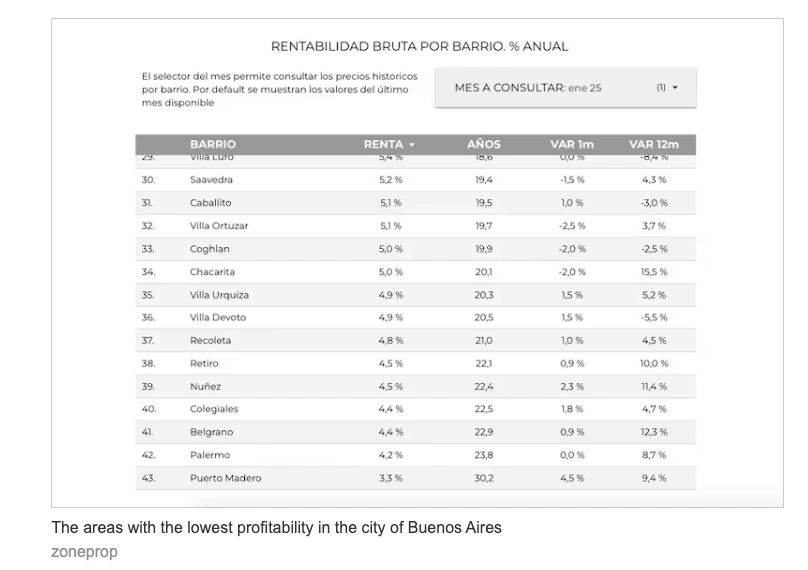

Among the neighborhoods with the lowest profitability, which is around 4.5% annually, are Belgrano, Núñez, Palermo and Colegiales , and the one with the lowest profitability is Puerto Madero with 3.3%.

The areas with the lowest profitability in the city of Buenos Aireszoneprop

How many years does it take to recover the investment?

It depends on the location and the value of the property. On average , the payback period is 19 years, but if we consider each neighborhood separately, the periods vary.The longest recovery period is 30.2 years if the property is located in Puerto Madero. An intermediate period is 18 years in the Agronomía neighborhood and the shortest recovery period is 11.1 years for a property located in Lugano.

What are the rental prices in CABA?

According to information published by ZonaProp, the most expensive neighborhoods to rent are Puerto Madero with an average price of $926,707 per month, followed by Palermo ($629,241 per month) and Núñez ($626,602 per month).

rent

The neighborhoods with the cheapest prices are Lugano (424,900 pesos per month), Floresta (486,183 pesos per month) and Mataderos (494,843 pesos per month).

On average in CABA the prices per month are:

- Studio: $ 474,633

- One bedroom: $ 566,025

- Two bedrooms: $ 761,505

www.buysellba.com