All the Answers

Well-known member

Is there an exchange delay? Why the Government denies it and some economists warn about this trend - Infobae

Source:

¿Hay atraso cambiario? Por qué el Gobierno lo niega y algunos economistas alertan sobre esa tendencia

El presidente Javier Milei insistió con desmentirlo en su último discurso y tildó de “chantas” a los analistas que lo contradicen. Qué opina el Fondo Monetario

May 17, 2024

President Javier Milei insisted on denying it in his last speech and called the analysts who contradict him “chantmen.” What does the Monetary Fund think?

By Mariano Boettner

Santiago Bausili, president of the Central Bank and Luis Caputo, Minister of Economy

Does the economy currently function with an exchange rate delay ? The question has multiple answers depending on the interlocutor, but the issue seems to be important enough that President Javier Milei dedicated most of his speech to a businessman at Cicyp to deny it and accuse the economists and consultants who support that idea of being “scammers.” .

The head of state assured that it is impossible to know what the equilibrium price level of the exchange rate is because to determine it, an analyst would have to have such a large amount of information on the preferences of economic agents that it would imply “fatal arrogance” to affirm that The exchange rate advances with a delay. An argument that Milei recognized as symptomatic of a trend of this style is that “Argentina is expensive in dollars .”

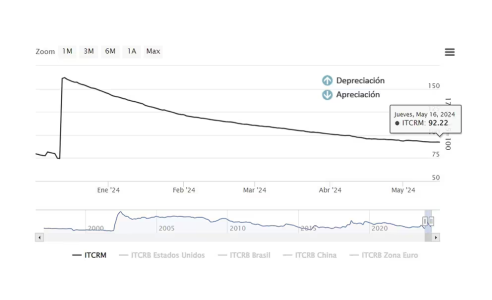

But in any case he assured that it is not corrected by devaluation but with "structural reforms" that make Argentina more competitive without having to go through the instance of an exchange rate jump that aborts the slowdown in inflation. The Central Bank has its own numbers to show. The multilateral real exchange rate index measured by the monetary authority shows that this indicator experienced a clear appreciation but with a curve that flattens with the lowering of rates and the inflationary deceleration.

In numbers: with a base of 100 in December 2015 at the exit of the stocks, before the change of Government and the arrival of Javier Milei the index was 74.46 , with the devaluation of December 13 it jumped to 162.18 and after five months Updated at 2% monthly that number fell to 92.22 . Thus, under this criterion the exchange rate would have lost 80% of its competitiveness.

The Government assures that it is not corrected by devaluation but with “structural reforms” that make Argentina more competitive without having to go through the instance of an exchange rate jump that aborts the slowdown in inflation.

“When the economic situation is very bad, the exchange rate reflects that. The dollar becomes very expensive and goods become cheap in dollar terms. When the situation is fixed the opposite happens , which is what we are seeing now. “This is happening in a very short time,” responded Economy Minister Luis Caputo in an interview with LN+ this Wednesday. The head of the Treasury Palace reiterated on different occasions in public and private that there will be no exchange correction. “Don't wait for the shock,” he said a few weeks ago at the Stock Exchange.

Central Bank Multilateral Real Exchange Rate Index

The Government, through the Chief of Staff Nicolás Posse, assured in his first report to Congress that the exchange rate devaluation path will remain at 2% monthly until the end of the year . No government anticipates when it would make an exchange rate movement, but in the private sector they already work with the expectation that there will not be one, and even more so in sectors whose profitability depends largely on the price of the North American currency.

“The agricultural sector is not considering that the dollar is behind . The margins are within the historical average. I consider that without a doubt the countryside is going to liquidate,” said Marcos Pereda , vice president of the Rural Society. That is one of the signals that economists identify as clearest to know if the delay is serious enough.

“There are two strong bets that the government makes: lowering the interest rate and maintaining a flat official dollar. Beyond the discussion of whether or not there is an exchange rate delay, the question is whether it can maintain the 2% monthly depreciation. Lowering the interest rate makes the gap potentially more volatile. That is why he worries about denying an exchange rate jump . In addition, it requires agricultural producers to liquidate the harvest. If they liquidate, there could be more margin and greater stability, on the other hand, if there are expectations of an exchange rate event, there may possibly be complications in the accumulation of reserves and that generates instability,” said Fernando Morra , former vice minister of Economy and economist at Suramericana Visión.

"While we share and have expressed many times that this type of analysis does not make much sense and that most of the time the discussion about the real exchange rate is a Byzantine crusade , we cannot fail to point out that the government itself has entered into more than one opportunity in the type of arguments that he claims to criticize to defend his crawling of 2% per month,” recalled the consulting firm Outlier.

“Caputo, in a meeting with businessmen, compared the current real exchange rate level with that of the 90s and concluded that there was no delay. Therefore, it is difficult to contradict the President's arguments that these analyzes have technical flaws, but at the same time it is difficult to validate that, consequently, in our opinion a better focused formulation, there are no profitability problems in the tradable sectors in "Argentina has a clear comparative advantage as a result of the set of measures that gave rise to the current economic policy scheme," they explained.

The consulting firm LCG, founded by the current radical senator Martín Lousteau , estimated that “in real terms, the official dollar fell 42% compared to December, while the exporter, the one that arises from the average 80% of the official and 20% of the CCL, reaches $915, it suffered a delay of 39 percent . Measured in the base index December-01=1, it is located at 1.67″, they calculated in a recent report.

The recurring question about the exchange rate delay is also regularly discussed before the International Monetary Fund, Argentina's main creditor. The IMF's position in recent months was to prevent the accumulation of an exchange rate delay from forcing the economic team into a correction in a single movement later. In the last hours, in addition to a general support for the direction of the economic policy of the libertarian government, the organization spoke of a “flexibility” of the exchange rate policy.

“The agricultural sector is not considering that the dollar is behind. The margins are within the historical average. I consider that without a doubt the field is going to liquidate” (Pereda)

Economist Carlos Melconian , one of those targeted by Milei for the public discursive duel, said that “at this stage of a program, falling in love with an instrument like the exchange anchor is dangerous. I'm not talking about any tragedy. There is a smell (of exchange delay) . As long as they do not have a sustainable inflation plan, they are not going to fall into that trap,” said the former president of Banco Nación in dialogue with FM Milenium . This “trap” of exchange rate delay is part of a trio that Melconian identifies as recession and relative prices that have not yet been updated. “It generates very short-term results even if there is euphoria,” he indicated.

Miguel Angel Broda , one of the country's most respected economic analysts, shared his thoughts on the current situation of the Argentine economy and offered some proposals that could help stabilize the economy. Among his ideas, the suggestion of returning to an exchange rate that recalls the Néstor Kirchner era stands out, adjusting the value of the dollar to 1,500 current pesos.

As Broda argued during an interview with LN+ , the current exchange rate policy, which adjusts the value of the dollar by 2% per month, is insufficient to counteract the inflation that, he predicts, will continue in May and June, especially if the adjustments are delayed. in service rates. “In October we are going to have the same real exchange rate that we had on December 12 , when we devalued 118% , ” Broda estimated during the interview.