BuySellBA

Administrator

Money laundering: Javier Milei's proposal that generates the opportunity to buy an apartment - La Nacion Propiedades

Source:

Blanqueo: la propuesta de Javier Milei que genera la oportunidad de comprar un departamento

Milei promueve un régimen de regularización que permitiría declarar dinero en negro

January 8, 2024

Milei promotes a regularization regime that would allow black money to be declared

By Mercedes Soriano

The money laundering project proposed by Javier Milei in the “omnibus” law would allow the purchase of an apartment with undeclared money without paying the fine

The “omnibus” bill presented by President Javier Milei proposes a measure that could benefit the real estate market. This is a new money laundering plan designed by the Ministry of Economy, which would allow those who have undeclared money to buy a property without having to pay a fine.

As? The regularization project would grant the opportunity to declare up to US$100,000 without paying any penalty . That amount, for example, is enough to buy a single-room apartment in the city of Buenos Aires , which, according to the latest Zonaprop report , is worth US$95,538. An amount that reflects the collapse that property prices experienced and was unthinkable before the pandemic or in the times of UVA credits.

A key fact is that the amount of money that citizens keep “in the mattress” already exceeds US$271,499 million, according to the Balance of Payments report published by Indec, with figures corresponding to the third quarter of 2023.

In any case, it is worth clarifying that the law and its different points promoted by Milei must be approved by Congress for the opportunity to materialize. The treatment will begin this week in the extraordinary sessions of the Lower House.

Market expectations

“This measure could positively impact the market. It is definitely not going to go unnoticed,” estimates Diego Cazes, general manager of LJ Ramos Brokers. Gabriela Goldszer, director of Ocampo Propiedades, agrees with him: “I think that a new money laundering will attract investment for the real estate sector , depending on how it is regulated.”

The laundering project would grant the opportunity to declare up to US$100,000 without paying any penalty

The past bears witness to the success of some laundering projects in the sector. Martín Pinus, owner of the homonymous real estate company, remembers that “the effects of the tax amnesty had a positive impact on the real estate world, generating in the short term a growth in the volume of real estate sales operations , especially in the city of Buenos Aires. Aires. According to sources that follow trends in the sector, in the first two months of 2017, the number of deeds executed in the city grew by almost 70% compared to the same period of the previous year,” he points out.

For his part, the president of the Business Chamber of Urban Developers (CEDU), Damián Tabakman, states that “we are trying to encourage the government to make investment in real estate projects free of charge ,” and believes that “if we succeed, we are very optimistic.” regarding the result it could have.” In dialogue with LA NACION, he believes that many people would join the money laundering because of that possibility.

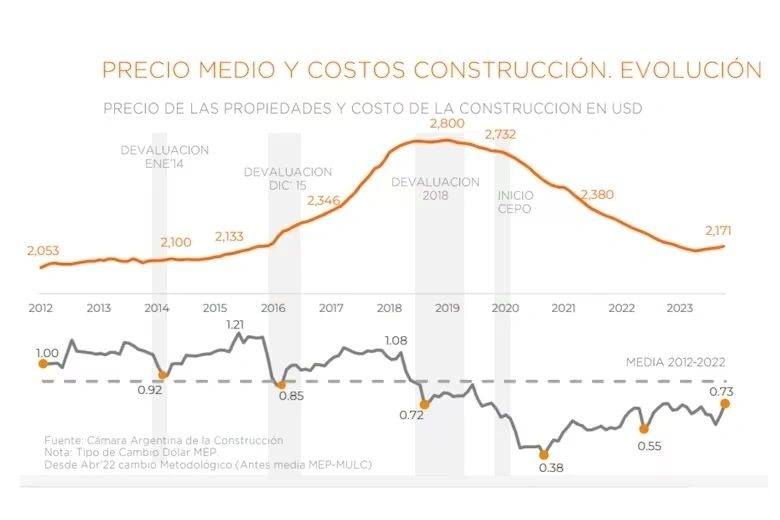

Tabakman also projects how the policy could impact the construction market : “In the coming months the cost of construction, in dollars, will no longer be as attractive as it was until now, but will become more expensive .” However, he believes that investors will find in bricks their best coverage for their savings precisely in the face of that circumstance.

“In the coming months the cost of construction will no longer be as attractive as it was until now, but rather it will become more expensive,” studies Damián Tabakman.

In 2023, the construction cost measured in dollars fell 0.2% while the average price of apartments decreased 1%,” says Leandro Molina, Country Manager of Navent in Argentina and Peru, based on data collected by the Argentine Chamber of Construction.

Along the same lines, he adds that “ building today costs 91.2% above the values of October 2020 (minimum of the series) but remains 32.7% below April 2018 (pre-devaluation of the administration). by Mauricio Macri) and 17.4% below the 2012-2022 average.”

Building today costs 91.2% above the values of October 2020 (minimum of the series) but remains 32.7% below April 2018, according to data collected by the Argentine Chamber of Construction

One aspect that he does not stop analyzing is the behavior of the currency against the project. “ The dollar will lose purchasing power because everything will become more expensive in our country in hard currency and there will be no financial coverage against it. Therefore, if whitewashing is enabled to invest in bricks, I am sure that many will take it,” she concludes.

What the laundering project says

The regularization project includes properties, movable assets, money and cryptocurrencies. This applies to Argentine tax residents until December 31, 2023 who have assets both in the country and abroad.The deadline to join the regime will be extended until November 30 of next year, and can be accessed in three stages:

- 1st stage: until March 31, 2024, an advance of the 5% rate must be paid . After that date there will be time until May 31 to regularize the rest of the tax.

- 2nd stage: from April 1 to June 30 the rate would be 10%.

- 3rd stage: between July and September the maximum rate of 15% would be charged.

It should be noted that 75% of these rates will be paid in advance. For example, if it was entered on May 31, when the 5% rate would apply, around that date 75% of the tax would be paid and the rest later.

“The laundering proposed by the Milei government proposes freedom in the amount to be laundered, for example, if you have US$300,000 undeclared and can only launder US$30,000. This is going to make people want to buy things that they couldn't, it is going to move the economy and without a doubt that is going to hit real estate,” Cazes considers.

The thorn of regularization

In theory, the possibility of regularizing money without having to pay taxes is idyllic. However, the measure has a thorn in the foot that does not allow it to move forward and discourages those who have undeclared capital.“Laundering is becoming more and more complicated because there are no policies that are maintained over time and they contradict each other,” says Cazes. Goldszer is on the same page, since he believes that "due to lack of continuity and because the bases of legal security are not established , the conditions are not in place to make major statements."

“Laundering is becoming more and more complicated because there are no policies that are maintained over time and they contradict each other,” argues Diego Cazes.

The inconsistency they refer to is clear in the latest regularization policies. “Macri's laundering was one of the best in Argentine history, although if they discovered that you did not launder all of the informal assets, the fine could be equivalent to the entire amount laundered. The attraction was that they promised to gradually lower the Personal Property Tax until it reached zero. But when Alberto Fernández's government took office, they backed down and said that they were never going to remove the tax. That strongly scares the credibility of money laundering ,” Cazes muses.

Because in the laundering plan promoted by Macri “a large number of properties were laundered,” according to Cazes, “ there would now be a small backlog of unregistered properties that have accumulated since that moment.” For this reason, he predicts that regularization will mean more money to buy real estate.”

www.buysellba.com