All the Answers

Well-known member

Monotributo, Profits and Personal Assets: everything you need to know about the project presented by the government - Infobae

Source:

April 18, 2024

After having been withdrawn from the original Base Law project, the ruling party presented a new fiscal package with changes in 3 key taxes. Scales, aliquots and floors

According to the government project, category A monotributists, with lower incomes, could bill up to $6,450,000 annually. (Illustrative Image Infobae)

The Government sent the fiscal package to Congress, which includes a series of changes in the Monotax regime, in the Personal Property Tax and the reestablishment of the Income Tax for workers in a dependency relationship.

The initiative promoted by President Javier Milei contains 101 articles called the Law of Palliative and Relevant Fiscal Measures. In the recitals, the project argues: “The Argentine fiscal system registers one of the highest rates of fiscal pressure in the world when the formal sector of the economy is analyzed. The existence of numerous distorting taxes makes it difficult and marginalizes many individuals, companies and undertakings in the formal sector.”

Monotribute

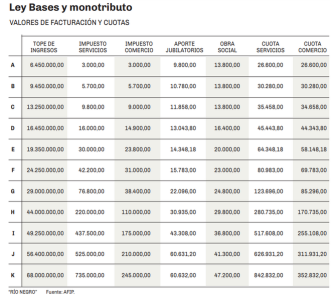

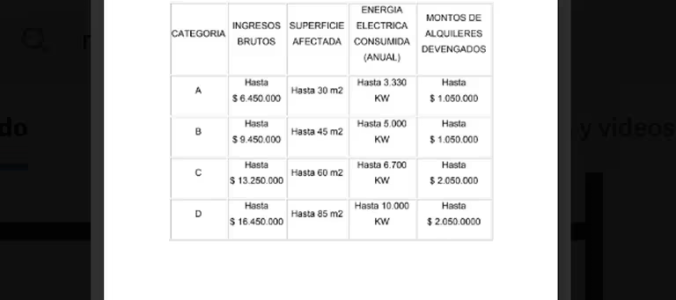

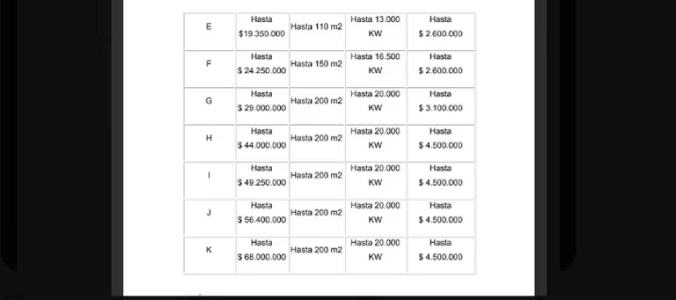

Regarding the monotributo , the Government's project involves an update of the billing and quota ceilings, with increases of between 300 and 330 percent. The annual income ceiling would be $68 million and eliminates the differentiation between activities (commerce and services) to be in the simplified regime. Also, the amounts of the entire scale and the amounts to be paid would rise.

If the project is approved, category A monotributists, with lower incomes, could bill up to $6,450,000 annually. For those who are in category K, the highest, the amount amounts to 68 million pesos.

In addition, there would be an increase in the amounts paid monthly by monotributistas in concept of the integrated tax, and in contributions to the retirement regime and social work. Likewise, the unit billing price is set at $385,000 for both those who offer services and those who sell products. And an annual update is established for inflation.

The new monotributo tables

The new monotributo tables

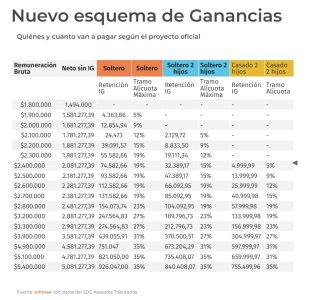

Income Tax

The government included the reversal of Profits in the fiscal package after the elimination of the fourth category last September in Congress. Single employees with a gross salary of up to 1,800,000 pesos - which represents a net remuneration of up to $1,494,000 - are exempt from the tax. Meanwhile, the floor for married workers with two children would be $2,300,000Regarding the aliquot scales, they will be more progressive and will range between 5 and 35 percent . The maximum rate will begin to apply from an income of $36,450,000. The sections of the scales would have an increase of between 32.07% and 150.73% and would then be adjusted by the Consumer Price Index (CPI), as well as personal deductions.

Personal property

Among the main changes that the government seeks to make for personal assets is the elimination of the treatment of differential rates depending on the location of the assets (in the country and abroad).Also, according to the report of the study by Lisicki, Litvin & Asociados , the modification of the progressive scales of the tax is proposed starting in the fiscal period 2023, with an initial rate of 0.50% and up to 1.50%, eliminating the last section of the scale for each period, until finally reaching the fiscal period 2027 with a single rate of 0.25%.” In turn, “the scales will be updated annually according to the CPI.

In addition, the project proposes a benefit for Compliant Taxpayers, that is, those who have complied with all of their obligations regarding Personal Assets for the fiscal periods 2020 to 2022 will have a reduction of 0.25% in the rate for the periods 2023 , 2024, 2025 and 2026. However, it should be noted that if the taxpayer adhered to the asset regularization regime, they could not be categorized as a compliant taxpayer.

The new values for the 2023 fiscal period would be:

- Non-taxable minimum: $100,000,000 (currently $27.3 million)

- Minimum for a residential home: $350,000,000