Ron

Well-known member

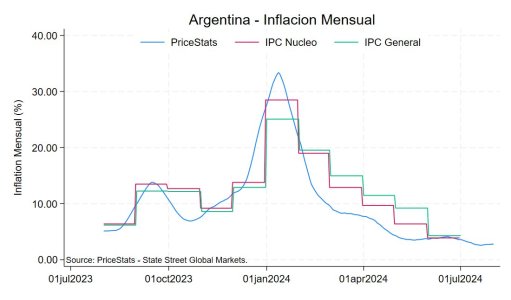

Milei is doing a good job. This shows how important his economic measures regarding fiscal adjustment have been. Finally, the sacrifices made by the Argentine people to endure this adjustment will pay off. Morgan Stanley predicted that inflation will be 207% this year and will drop sharply to 31% next year (compared to the 210% and 58% estimated in the latest market expectations survey (REM) published by the Central Bank).

www.infobae.com

www.infobae.com

Un gigante de Wall Street estimó un derrumbe de la inflación argentina y sorprendió a todos: qué cifra calculó para 2025

El banco de inversión Morgan Stanley analizó la situación macroeconómica de la Argentina y las oportunidades de inversión en términos financieros y reales