Tessa

New member

Profits: the Government clarified that the non-taxable minimum will be $1,350,000 and 800 thousand people would pay again - Infobae

Source:

www.infobae.com

www.infobae.com

January 23, 2024

Today the Executive will send to Congress the project for the reversal of the tax that Sergio Massa had eliminated. He named it the “Personal Income Tax Law.”

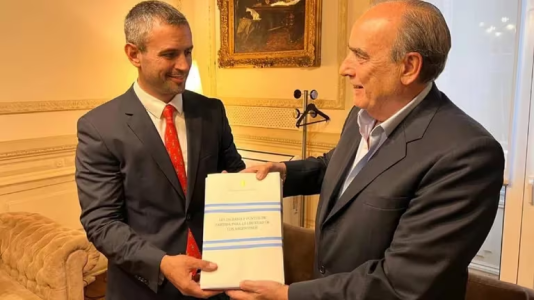

Martín Menem and Guillermo Francos

The Executive Branch will send to Congress this Tuesday the personal income bill to reverse the elimination of the fourth category of the Income Tax that legislators had repealed at the end of 2023. As Infobae learned , the tax will reach the salaries of starting from 1.3 million pesos per month although initially the Government had let it be known that it would be 2.3 million pesos .

The restitution of Profits was one of the tug-of-war between the provinces and the Casa Rosada, since in this way the Government could recompose tax revenues but in addition the governors would also get a cut as it was a co-participatory tax, unlike the PAIS tax and withholdings.

“The same governors who voted for Massa to lift the tax for electoral purposes are now the ones asking for it to return,” official sources assured this medium. It is expected to be updated quarterly based on inflation and would be retroactive to September 2023 .

The return of the tax for high salaries was a priori part of Economy Minister Luis Caputo 's initial plan to achieve fiscal balance this year. A relevant part of the adjustment was explained, according to the original roadmap of the head of the Treasury Palace, in greater income to the treasury through this means.

The objective is to increase collection starting in 2024, since according to official data, the reform applied implied a loss of $1 billion for the coffers of the National State and the same for the provinces, since it is a co-participatory tax.

Milei, in a meeting with provincial governors a few weeks ago

Close to the economic team of former Minister of Economy Sergio Massa , who had promoted the elimination of the fourth category, they assured that with these changes some 800,000 employees and retirees who do not pay it today will once again pay Profits . And an additional collection of 0.5 points of GDP will be generated .

“On average, each worker would suffer a withholding of $315,000 per month that would be deducted from their salary ,” calculated a former Tigrense official.

Presidential spokesperson Manuel Adorni recently referred at a press conference to Javier Milei's change of position regarding the Income Tax . “In his previous capacity as a deputy he actually voted for the reduction or modification of Profits, he never failed to say and clarify that it had to be accompanied by a reduction in spending and that it had to be executed at that time by the national State. “He acted in his capacity as a legislator in line with his thoughts,” he noted.

“Any upward correction in taxes, as in this case of Profits, will first be very short-term. It is the curtain for what is to come, and we will always speak with the truth and be the first that when there is an increase in a tax, that in the very short term we correct it and return to the previous state,” Adorni said.

With the latest increase in the minimum wage, currently only those who receive gross salaries of more than $1,980,000 pay Earnings. But these regulations were in force until December 31 since law 27,725 sanctioned by Congress began to take effect in January.

Among the most notable changes, the initiative exempts the Annual Complementary Salary (SAC) from the tax, and includes exceptions for certain public positions and company directors, as well as new tax scales based on minimum salaries. In total, it was estimated that approximately 88,000 taxpayers would continue to pay the tax, less than 1% of the total number of employees, retirees and pensioners in the country.

The fine print of the initiative that will reach Congress this Tuesday is not yet known. In any case, the Executive Branch has already let it be known that there are more political than economic or fiscal reasons for this decision, that is, the back and forth with the governors, who at the time supported the elimination of the fourth category.

The provincial leaders need to reinforce their co-participation income in the face of the announced cut in current and capital transfers that Caputo anticipated, and which threatens to put pressure on the governors' public accounts. The province of La Rioja , without going any further, has already made official its intention to issue a quasi-currency .

Source:

Ganancias: el Gobierno aclaró que el mínimo no imponible será $1.350.000 y volverían a pagar 800 mil personas

El Ejecutivo enviará hoy al Congreso el proyecto para la reversión del gravamen que había eliminado Sergio Massa. La bautizó “Ley de Impuesto a los Ingresos Personales”

January 23, 2024

Today the Executive will send to Congress the project for the reversal of the tax that Sergio Massa had eliminated. He named it the “Personal Income Tax Law.”

Martín Menem and Guillermo Francos

The Executive Branch will send to Congress this Tuesday the personal income bill to reverse the elimination of the fourth category of the Income Tax that legislators had repealed at the end of 2023. As Infobae learned , the tax will reach the salaries of starting from 1.3 million pesos per month although initially the Government had let it be known that it would be 2.3 million pesos .

The restitution of Profits was one of the tug-of-war between the provinces and the Casa Rosada, since in this way the Government could recompose tax revenues but in addition the governors would also get a cut as it was a co-participatory tax, unlike the PAIS tax and withholdings.

“The same governors who voted for Massa to lift the tax for electoral purposes are now the ones asking for it to return,” official sources assured this medium. It is expected to be updated quarterly based on inflation and would be retroactive to September 2023 .

Official sources initially reported that the new minimum from which the personal income tax would be paid was going to be 2.3 million pesos per month. Finally, the government itself clarified that in reality the remuneration floor that would be reached would end up being one million pesos lower .The restitution of Profits was one of the tug-of-war between the provinces and the Casa Rosada, since in this way the Government could recompose tax revenues but in addition the governors would also get a cut as it was a co-participatory tax

The return of the tax for high salaries was a priori part of Economy Minister Luis Caputo 's initial plan to achieve fiscal balance this year. A relevant part of the adjustment was explained, according to the original roadmap of the head of the Treasury Palace, in greater income to the treasury through this means.

The objective is to increase collection starting in 2024, since according to official data, the reform applied implied a loss of $1 billion for the coffers of the National State and the same for the provinces, since it is a co-participatory tax.

Milei, in a meeting with provincial governors a few weeks ago

Close to the economic team of former Minister of Economy Sergio Massa , who had promoted the elimination of the fourth category, they assured that with these changes some 800,000 employees and retirees who do not pay it today will once again pay Profits . And an additional collection of 0.5 points of GDP will be generated .

“On average, each worker would suffer a withholding of $315,000 per month that would be deducted from their salary ,” calculated a former Tigrense official.

Presidential spokesperson Manuel Adorni recently referred at a press conference to Javier Milei's change of position regarding the Income Tax . “In his previous capacity as a deputy he actually voted for the reduction or modification of Profits, he never failed to say and clarify that it had to be accompanied by a reduction in spending and that it had to be executed at that time by the national State. “He acted in his capacity as a legislator in line with his thoughts,” he noted.

“Any upward correction in taxes, as in this case of Profits, will first be very short-term. It is the curtain for what is to come, and we will always speak with the truth and be the first that when there is an increase in a tax, that in the very short term we correct it and return to the previous state,” Adorni said.

Through decree 473/2023 , the former Minister of Economy, Sergio Massa , had decided starting in October to raise the non-taxable minimum floor for workers and retirees who earn more than $1,770,000 per month or 15 vital and mobile minimum wages ( SMVM) , a measure that had exempted some 800,000 taxpayers from paying profits.The return of the tax was part of Caputo's plan to achieve fiscal balance. 0.5% of the GDP of the adjustment was explained by higher revenues to the treasury through this means

With the latest increase in the minimum wage, currently only those who receive gross salaries of more than $1,980,000 pay Earnings. But these regulations were in force until December 31 since law 27,725 sanctioned by Congress began to take effect in January.

Among the most notable changes, the initiative exempts the Annual Complementary Salary (SAC) from the tax, and includes exceptions for certain public positions and company directors, as well as new tax scales based on minimum salaries. In total, it was estimated that approximately 88,000 taxpayers would continue to pay the tax, less than 1% of the total number of employees, retirees and pensioners in the country.

The fine print of the initiative that will reach Congress this Tuesday is not yet known. In any case, the Executive Branch has already let it be known that there are more political than economic or fiscal reasons for this decision, that is, the back and forth with the governors, who at the time supported the elimination of the fourth category.

The provincial leaders need to reinforce their co-participation income in the face of the announced cut in current and capital transfers that Caputo anticipated, and which threatens to put pressure on the governors' public accounts. The province of La Rioja , without going any further, has already made official its intention to issue a quasi-currency .