BuySellBA

Administrator

Real Closing Price per m² in August - Reporte Inmobiliario

Source:

Precio del m2 real de cierre en Agosto , noticias sobre RESIDENCIAL en Reporte Inmobiliario

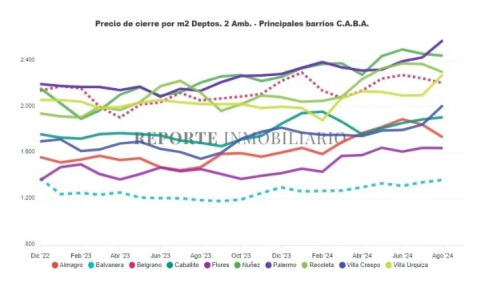

El valor de cierre del m2 general se ubicó por encima de los U$S/m2 1.900. El rango de contraoferta se redujo a menos del 4,5 %

September 11, 2024

The closing value of the general price per m² stood above U$S 1,900/m². The counteroffer range reduced to less than 4.5%.

The University of CEMA and RE/MAX Argentina, in collaboration with Reporte Inmobiliario, publish a monthly index of closing prices, providing information on the actual prices at which real estate transactions are settled in the market.

The monthly preparation and publication of this index, representing the average effective price per square meter in the City of Buenos Aires, not only offers a reference of the real average value and its evolution over time but also establishes the difference between the average listing price per square meter.

The Real m² Index for August 2024 increased by 2.8% compared to the previous month.

Compared to the price per m² of the same month last year, the general sales price per m² for used apartments, ranging from one to three rooms in the City of Buenos Aires, appreciated by 10.3%.

Since January 2020, the starting point of this series, the current value remains 8.8% below that of January 2020.

It's worth noting that in March of this year, a streak of 20 months was broken, during which the price per m² was below U$S 1,800/m². Since that month until July, the price exceeded that amount, surpassing U$S 1,900/m² in August.

Breaking it down by room count, the closing price per m² for studio apartments was 2,041 dollars, while the closing value for two-room and three-room units was 1,979 U$S/m² and 1,869 U$S/m², respectively.

The gap between the price per m² for completed transactions in July compared to the last listing price of the property, commonly known as the counteroffer range, was –4.52% on average, the lowest percentage since the series began. This marks five consecutive months where it has remained below 5%.