BuySellBA

Administrator

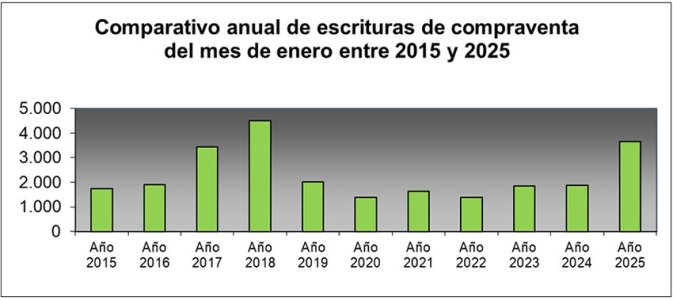

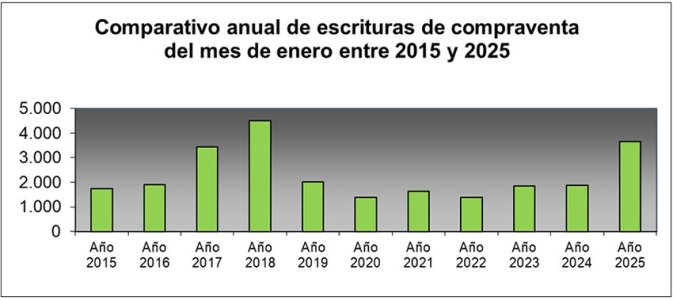

Real Estate Market in Buenos Aires: Property Deeds Increased by 93.7% Year-on-Year in January, with 25% Now Using Mortgage Loans

Mortgage-backed deeds jumped by almost 1,300%

The real estate market in the Autonomous City of Buenos Aires (CABA) showed significant growth in January 2025:

Property sale deeds increased by 93.7% year-on-year, reaching 3,645 registrations.

25.9% of transactions were made with mortgage loans, representing 945 deeds.

The total amount of transactions rose to 433,177 million pesos, an increase of 202.9% compared to the previous year.

The average value per transaction was 118,841,472 pesos, 56.4% higher than in January 2024.

Mortgage-backed deeds experienced a 1,269.5% increase compared to the same month last year.

Jorge De Bártolo, president of the College of Notaries, highlighted that this is the best start to a year since 2018, only surpassed by the credit boom of that year.

This was EXACTLY what our firm @BuySellBA predicted would happen in mid-2023 when we correctly called the bottom after the falling prices of 5 years. We nailed it!

Mortgage-backed deeds jumped by almost 1,300%

The real estate market in the Autonomous City of Buenos Aires (CABA) showed significant growth in January 2025:

Property sale deeds increased by 93.7% year-on-year, reaching 3,645 registrations.

25.9% of transactions were made with mortgage loans, representing 945 deeds.

The total amount of transactions rose to 433,177 million pesos, an increase of 202.9% compared to the previous year.

The average value per transaction was 118,841,472 pesos, 56.4% higher than in January 2024.

Mortgage-backed deeds experienced a 1,269.5% increase compared to the same month last year.

Jorge De Bártolo, president of the College of Notaries, highlighted that this is the best start to a year since 2018, only surpassed by the credit boom of that year.

This was EXACTLY what our firm @BuySellBA predicted would happen in mid-2023 when we correctly called the bottom after the falling prices of 5 years. We nailed it!