BuySellBA

Administrator

Rentals: More than 60% of tenants have debts and contract terms are shortened - Ambito

Source:

Alquileres: más de 60% de los inquilinos tienen deudas y se acortan los plazos de contrato

El informe socioeconómico de Inquilinos Agrupados reveló que creció la participación del alquiler en los egresos de las familias y el 15% reveló que se mudó por dificultades para afrontar el alquiler.

June 30, 2024

The socioeconomic report of Tenants Grouped revealed that the share of rent in families' expenses grew and 15% revealed that they moved due to difficulties in paying the rent.

38% of tenants are behind on their payments.

Javier Milei's Decree 70/2023 entitled " Bases for the Reconstruction of the Argentine Economy" brought about numerous changes. One of them, and the most important for the almost 8 million people who rent , was linked to the repeal of the Rental Law. A recent document revealed what the difficult outlook is for this group of people in the month of June.

The Socioeconomic Report of the National Tenant Survey prepared by Inquilinos Agrupados revealed the following points:

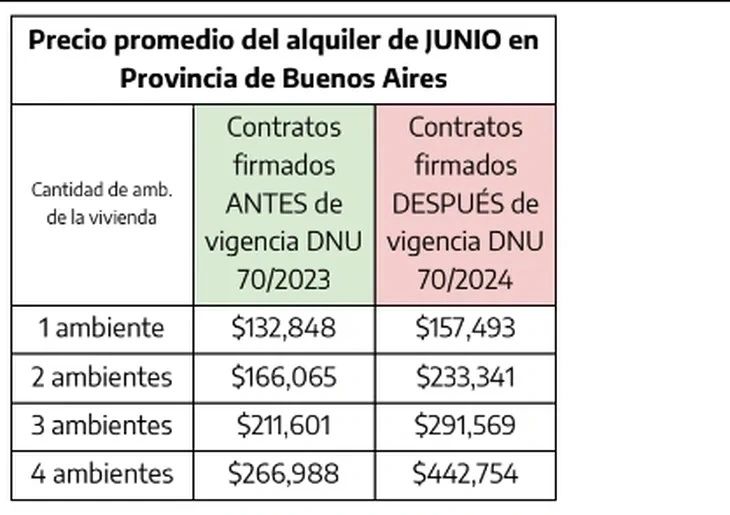

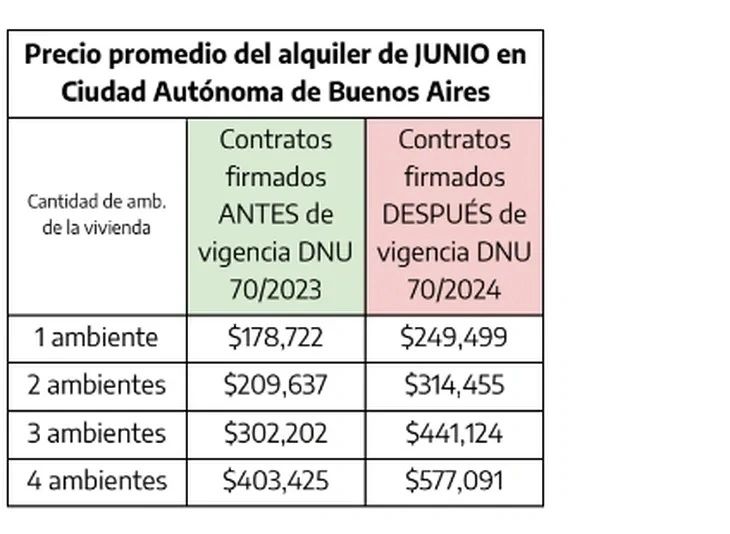

- For the same month of rent and for a home with the same number of rooms, it is observed that in CABA tenants with contracts started in 2024 under DNU 70/2023 pay approximately between 40 % and 50 % more than those that began under the Rental Law . In the provinces of Buenos Aires, Santa Fe and Córdoba this difference is even greater: the average value of June rent is between 41% and 52% higher compared to those who did so before the decree.

- In the most recent contracts, the 3-year term is present in only 9.7% of cases. On the other hand, the share of short-term rental contracts grew sharply. Those with a duration of less than or equal to 1 year represent 27.2% of cases. And contracts between 1 and 2 years are the most frequent, in 57.7% of the cases surveyed in June.

- 15% of respondents said they had to move in recent months because they could not pay their rent.

- 7 out of every 10 tenants who signed their contracts after the decree have increases monthly or every 3-4 months.

- 62 % of renter households surveyed currently have debt of some kind.

- The vast majority (more than 80%) responded that the housing situation and the evolution of their salaries/income are the main reasons for concern today.

- 42.2% of the tenants surveyed believe that they will have difficulties in paying their rent in the coming months and 46.2% responded that they may have difficulties.

What is the average rental price in CABA and Buenos Aires?

With the data from the survey for the month of June, average rental values are observed to be 30% and up to 48% higher than in March - considering that three months passed between each survey.

Regarding the mechanism or reference index for updating the rental price, the most frequent among the responses of the tenants is the Consumer Price Index (CPI) and, secondly, the Rental Contracts Index. Location (ICL).

In particular, when the cases of rentals initiated before the decree are compared with those initiated later, it is observed that in the newer contracts the use of the ICL or the Casa Propia coefficient - indices that take into account salary variations - is less frequent and that the share of rentals that are updated based on the CPI or the dollar rate grew.

Household income spent on rent

Currently, the share of rent and utility bills in the income of surveyed households represents 34.4%, a similar proportion to that recorded in the March survey.The increase in debt among tenants

In the January report, 53.1% of respondents said they had debts of some kind, while the data for June show that 62% are in debt. That is, at the same time that a greater proportion of income is spent on paying rent, the number of tenants who are in debt is also higher.Regarding the creditor entity or the people with whom the tenants are indebted, the results for June are similar to those of March: the banks that issue credit cards stand out in first place, at 44.3% of the cases. This is followed by indebtedness with family and friends (15.7%), bank for personal loan (15%) and platform companies such as Mercado Pago, Ualá, etc. (13.3%).

Another important issue to highlight is that within this group of indebted tenant households , 31.3% do not have just one creditor, but have debts with two, three or more entities at the same time , combining debts with credit cards, platforms and other informal modalities, mainly relying on loans from family and/or friends.

In this edition of the survey, a question was incorporated that asks tenants who claim to be in debt if they know the interest rate they pay. 58.4 % do not know the interest rate they pay for the debts they contracted. In particular, those people who indicated they go into debt mainly with virtual wallets and credit platforms, with family and friends and with informal means are those who do not know the interest rate to pay.

When asked about whether or not they are punctual in paying their debts, 38% of tenants who are in debt state that they are late with their payments.

https://buysellba.com/news-/-media/f/more-than-60%-of-tenants-have-debts

https://buysellba.com/news-/-media/f/more-than-60%-of-tenants-have-debts

www.buysellba.com