BuySellBA

Administrator

Renting: a bad business? - La Nación Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

September 25, 2023

The rental law distorted a market with fewer and fewer properties on offer.

The new rental law causes owners to charge 24% less per contract

In July three years passed since the enactment of the rental law which, among other changes, extended contracts from two to three years and enabled only an annual update based on an index established by the Central Bank. Since its entry into force, in July 2020, the rental market entered a crisis that seems to have no end and the threat of “zero supply”.

But those who have an apartment to rent prefer to sell it and give up the price in a real estate market with sales values for the apartment, and in some cases even leave it empty. The main reason why many owners withdrew their homes from the traditional rental market is because of the loss of money it means. In other words, there was a silent devaluation of the rental fee.

This is due to a combination of three factors:

The weak point of the index that harms owners is that it is calculated based on the average of inflation and salaries from two months ago. For example, those who have to update the annual rental price in August do so based on June prices and salaries. In a context of rampant inflation, this means that “the rent systematically loses against inflation because instead of being updated according to the reality of the moment, it is adjusted based on delayed inflation and salary figures,” maintains Federico González Rouco, economist and author of the Owners or Tenants book.

The ICL calculation is two months out of date

A concrete example could be a contract that was signed in June 2022, in which during the first 12 months you paid a fixed amount and in June of this year you had to update. Although the interannual inflation in June 2023 was 115.6%, as the ICL is two months behind, the rental price will be adjusted based on the values of April, when the interannual inflation was lower and had reached 108. .8%. So, in the first adjustment the owner loses 6.8% of the original value of the contract due to the delay of the ICL, a fact that is repeated the following year in the second annual update.

But the economist points out that there is a more serious factor than the delay of the ICL: the fact that the fees are fixed for one year. He explains that, as inflation progresses throughout the year and the fee is not updated, that amount loses its purchasing power and causes the owners to gradually charge less in real terms.

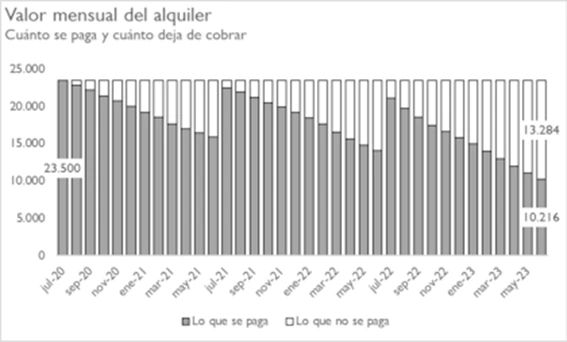

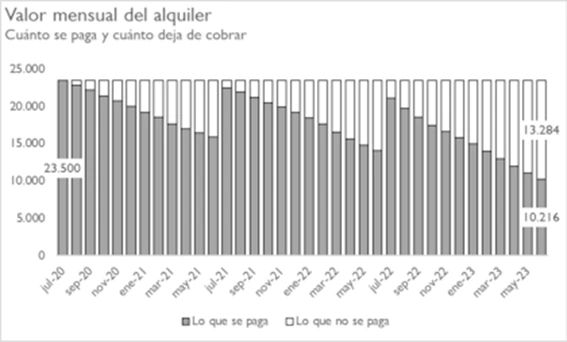

González Rouco takes as an example the average rental value in the city of Buenos Aires in July 2020, when according to Argenprop it is $23,500. From July 2020 to June 2021 there was more than 40% inflation and those $23,500 went from being 100% of the value to 58.6% in 11 months.

The first installment of the contract is the most profitable for the owner because in the following 11 months inflation devalues it and when it is updated in the second year it is based on an ICL delayed two months.

In the months in which the annual adjustment is made, the economist illustrates that “the rental price came to represent 96% (2021) and 90% (2022)” of the real value of the first installment. He indicates that in the following 11 months the purchasing capacity of the installment falls and “the 36th month of rent represents the lowest value of the three years: 43% of the initial value.” For example: what the owner charges in June 2023 represents $10,216 of the initial $23,500.” In other words, with the last month of rent on the contract the owner can buy less than half of the things he bought three years ago by renting that same unit to the same tenant.

In this context, the economist points out that the month that yields the most to the owner is the first, followed by the first months after the adjustment; The rest give a loss, the least fruitful are those prior to the update (quota 11 and 23) and the worst of all is quota number 36.

What the owner charges in June represents $10,216 of the initial $23,500 for the devaluation of the currency added to the bimonthly delay of the ICL adjustment

In summary, González Rouco summarizes that “over the three years, the owner should have collected $846,000 (equivalent to 36 months of $23,500 in real terms), but ends up collecting $643,171, which can be read as charging nine months less. of the 36 total or that charges 24% less than the original amount.”

Throughout the rental, the landlord actually charges 9 months less than the total 36

Based on this line of deduction, the economist suggests that the law makes renting less profitable. Although the first sensation when seeing the increase in rents is to think that it directly improves the profitability of the properties, González Rouco demystifies it and says that “this rent improvement account is made with the initial value, assuming that the owner always goes to charge the same rent in real terms. However, from that initial profitability value we must subtract the 24% that it loses in the three years and that is the real profitability.”

The actual profitability is lower than that estimated based on the initial value of the contract due to the devaluation of the installments over the duration of a traditional contract.

For example, Villa Crespo is considered the neighborhood with the best profitability for two-room units since it gives a profit margin of 6.9% annually, according to the Real Estate Report. According to the survey, the average monthly rent is $225,250, so if the rental payments maintained the purchasing capacity of that base amount each month, the owner would receive $8,109,000. However, it would charge $6,162,840 in real terms for the 24% loss and therefore the profitability would be lower than originally expected.

Furthermore, the profitability of a traditional rental - which in the city averages 4.44% according to the Real Estate Report - is extremely disadvantageous when compared to that of a temporary rental. “In terms of income, temporary apartments generate an average of US$656 gross per month, compared to the US$289 generated by a traditional rental. This indicates greater profitability for owners, with an annual return of 7.5%,” analyzes Daniel Bryn, creator of the real estate monitor Invertire.

Over the last three years, owners increased 289% above the ICL increase to remain competitive and profitable.

On the other hand, in a context of devastating inflation, the fact that rents are updated annually scares away landlords. “The rent of current contracts is the only price in the economy that is not adjusted until the year, it is unsustainable” says Soledad Balayan, owner of Maure Inmobiliaria.

This rigidity scares away those who have a home in their name. The specialist highlights that among the disadvantages that weigh the most on the owners is the low flexibility imposed by the three-year contract.” On the other hand, “the temporary one, although it is a different business since it requires an initial investment to equip it, allows greater flexibility and payment in dollars,” she resolves.

Disadvantages

The disadvantages of renting a home under the new law sow uncertainty and fear among owners. In short, getting involved in a three-year contract with an unknown tenant means betting that the tenant will not damage the property or delay payments in the midst of a serious macroeconomic context like the current one.

For economist González Rouco, “one of the effects of the law is that it brought the market to degrees of proximity, something that did not happen before. The selection process was modified and owners are beginning to prioritize renting to well-known people. They want the relationship to save them problems, prevent the apartment from breaking down, stop paying and a possible eviction.”

Along the same lines, landlords who have managed to establish a good relationship with their tenant often want to keep them. However, those who rented their property in July 2020 and now wish to renew the contract with the same tenant intend to recover the loss caused by the consequences of the annual adjustment and charge competitive market values. For example, the owner who rented an apartment for $16,000 in July 2020 in a sought-after neighborhood like Palermo and today charges $60,480 per month will want to considerably increase the initial amount of the new contract during the renewal taking into account the more than $210,000 that They are requested on average in the neighborhood.

If the owner considers that he has a good tenant, he could resign a part of the amount and close the contract at a value below the market value to keep it.

But the owner's desire to increase often collides with the possibilities of his tenant. “If the owner considers that he has a good tenant, he could resign a part of the amount and close the contract at a value below the market value to ensure that his property will remain healthy and that he will be paid in a timely manner. "Instead of ending the relationship and starting with a new tenant," concludes Verónica Balayan, co-owner of Maure Inmobiliaria.

Mercedes Soriano

www.buysellba.com

Source:

Alquilar: ¿un mal negocio? Cuánto dinero pierden los dueños porque los contratos se ajustan sólo una vez al año

La ley de alquileres desvirtuó un mercado con cada vez menos inmuebles en oferta

September 25, 2023

Renting: a bad business? How much money do owners lose because contracts are adjusted only once a year?

By Mercedes SorianoThe rental law distorted a market with fewer and fewer properties on offer.

The new rental law causes owners to charge 24% less per contract

In July three years passed since the enactment of the rental law which, among other changes, extended contracts from two to three years and enabled only an annual update based on an index established by the Central Bank. Since its entry into force, in July 2020, the rental market entered a crisis that seems to have no end and the threat of “zero supply”.

But those who have an apartment to rent prefer to sell it and give up the price in a real estate market with sales values for the apartment, and in some cases even leave it empty. The main reason why many owners withdrew their homes from the traditional rental market is because of the loss of money it means. In other words, there was a silent devaluation of the rental fee.

This is due to a combination of three factors:

- That rents are updated based on an index that is out of date with the reality of the market.

- That price adjustments are made every year.

- The incidence of inflation on the two previous factors.

The weak point of the index that harms owners is that it is calculated based on the average of inflation and salaries from two months ago. For example, those who have to update the annual rental price in August do so based on June prices and salaries. In a context of rampant inflation, this means that “the rent systematically loses against inflation because instead of being updated according to the reality of the moment, it is adjusted based on delayed inflation and salary figures,” maintains Federico González Rouco, economist and author of the Owners or Tenants book.

The ICL calculation is two months out of date

A concrete example could be a contract that was signed in June 2022, in which during the first 12 months you paid a fixed amount and in June of this year you had to update. Although the interannual inflation in June 2023 was 115.6%, as the ICL is two months behind, the rental price will be adjusted based on the values of April, when the interannual inflation was lower and had reached 108. .8%. So, in the first adjustment the owner loses 6.8% of the original value of the contract due to the delay of the ICL, a fact that is repeated the following year in the second annual update.

But the economist points out that there is a more serious factor than the delay of the ICL: the fact that the fees are fixed for one year. He explains that, as inflation progresses throughout the year and the fee is not updated, that amount loses its purchasing power and causes the owners to gradually charge less in real terms.

González Rouco takes as an example the average rental value in the city of Buenos Aires in July 2020, when according to Argenprop it is $23,500. From July 2020 to June 2021 there was more than 40% inflation and those $23,500 went from being 100% of the value to 58.6% in 11 months.

The first installment of the contract is the most profitable for the owner because in the following 11 months inflation devalues it and when it is updated in the second year it is based on an ICL delayed two months.

In the months in which the annual adjustment is made, the economist illustrates that “the rental price came to represent 96% (2021) and 90% (2022)” of the real value of the first installment. He indicates that in the following 11 months the purchasing capacity of the installment falls and “the 36th month of rent represents the lowest value of the three years: 43% of the initial value.” For example: what the owner charges in June 2023 represents $10,216 of the initial $23,500.” In other words, with the last month of rent on the contract the owner can buy less than half of the things he bought three years ago by renting that same unit to the same tenant.

In this context, the economist points out that the month that yields the most to the owner is the first, followed by the first months after the adjustment; The rest give a loss, the least fruitful are those prior to the update (quota 11 and 23) and the worst of all is quota number 36.

What the owner charges in June represents $10,216 of the initial $23,500 for the devaluation of the currency added to the bimonthly delay of the ICL adjustment

In summary, González Rouco summarizes that “over the three years, the owner should have collected $846,000 (equivalent to 36 months of $23,500 in real terms), but ends up collecting $643,171, which can be read as charging nine months less. of the 36 total or that charges 24% less than the original amount.”

Throughout the rental, the landlord actually charges 9 months less than the total 36

Based on this line of deduction, the economist suggests that the law makes renting less profitable. Although the first sensation when seeing the increase in rents is to think that it directly improves the profitability of the properties, González Rouco demystifies it and says that “this rent improvement account is made with the initial value, assuming that the owner always goes to charge the same rent in real terms. However, from that initial profitability value we must subtract the 24% that it loses in the three years and that is the real profitability.”

The actual profitability is lower than that estimated based on the initial value of the contract due to the devaluation of the installments over the duration of a traditional contract.

For example, Villa Crespo is considered the neighborhood with the best profitability for two-room units since it gives a profit margin of 6.9% annually, according to the Real Estate Report. According to the survey, the average monthly rent is $225,250, so if the rental payments maintained the purchasing capacity of that base amount each month, the owner would receive $8,109,000. However, it would charge $6,162,840 in real terms for the 24% loss and therefore the profitability would be lower than originally expected.

Furthermore, the profitability of a traditional rental - which in the city averages 4.44% according to the Real Estate Report - is extremely disadvantageous when compared to that of a temporary rental. “In terms of income, temporary apartments generate an average of US$656 gross per month, compared to the US$289 generated by a traditional rental. This indicates greater profitability for owners, with an annual return of 7.5%,” analyzes Daniel Bryn, creator of the real estate monitor Invertire.

Over the last three years, owners increased 289% above the ICL increase to remain competitive and profitable.

On the other hand, in a context of devastating inflation, the fact that rents are updated annually scares away landlords. “The rent of current contracts is the only price in the economy that is not adjusted until the year, it is unsustainable” says Soledad Balayan, owner of Maure Inmobiliaria.

This rigidity scares away those who have a home in their name. The specialist highlights that among the disadvantages that weigh the most on the owners is the low flexibility imposed by the three-year contract.” On the other hand, “the temporary one, although it is a different business since it requires an initial investment to equip it, allows greater flexibility and payment in dollars,” she resolves.

Disadvantages

The disadvantages of renting a home under the new law sow uncertainty and fear among owners. In short, getting involved in a three-year contract with an unknown tenant means betting that the tenant will not damage the property or delay payments in the midst of a serious macroeconomic context like the current one.

For economist González Rouco, “one of the effects of the law is that it brought the market to degrees of proximity, something that did not happen before. The selection process was modified and owners are beginning to prioritize renting to well-known people. They want the relationship to save them problems, prevent the apartment from breaking down, stop paying and a possible eviction.”

Along the same lines, landlords who have managed to establish a good relationship with their tenant often want to keep them. However, those who rented their property in July 2020 and now wish to renew the contract with the same tenant intend to recover the loss caused by the consequences of the annual adjustment and charge competitive market values. For example, the owner who rented an apartment for $16,000 in July 2020 in a sought-after neighborhood like Palermo and today charges $60,480 per month will want to considerably increase the initial amount of the new contract during the renewal taking into account the more than $210,000 that They are requested on average in the neighborhood.

If the owner considers that he has a good tenant, he could resign a part of the amount and close the contract at a value below the market value to keep it.

But the owner's desire to increase often collides with the possibilities of his tenant. “If the owner considers that he has a good tenant, he could resign a part of the amount and close the contract at a value below the market value to ensure that his property will remain healthy and that he will be paid in a timely manner. "Instead of ending the relationship and starting with a new tenant," concludes Verónica Balayan, co-owner of Maure Inmobiliaria.

Mercedes Soriano

www.buysellba.com