BuySellBA

Administrator

Residential property prices after each presidential election - Gateway To South America

www.gatewaytosouthamerica-newsblog.com

www.gatewaytosouthamerica-newsblog.com

November 24, 2023

After four years of declining property prices, values have stabilized, and there are promising signs of recovery: the analysis of the last 46 years in the Argentine real estate market.

A few days before the presidential elections in Argentina, the real estate market is beginning to show signs of an imminent change in trend. To understand the complex behaviour of the sector, it is vital to contextualize the historical fluctuations of different economic moments, such as growth and recession cycles.

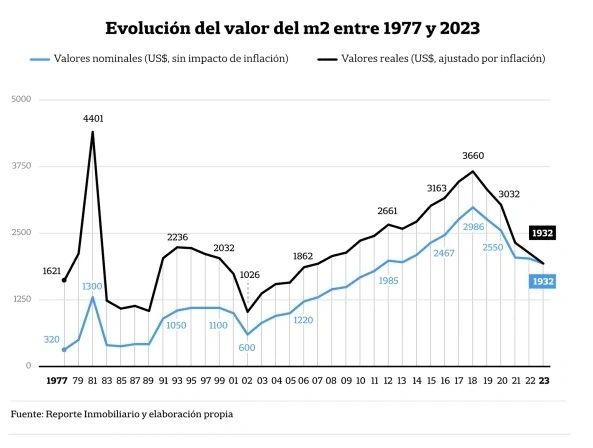

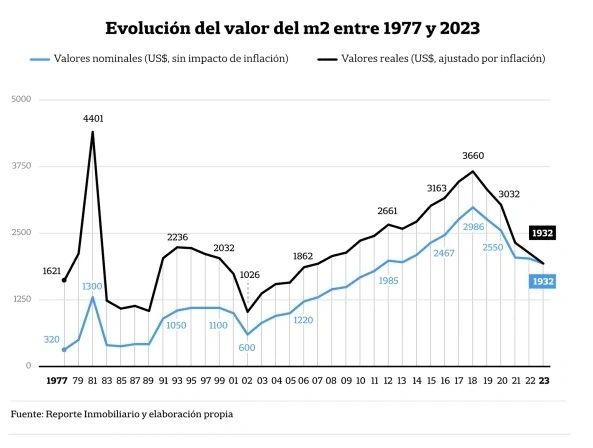

To carry out this comparative analysis, a Real Estate Report study is taken as a starting point that covers from 1977 to 2023 with the price per square meter of two- and three-bedroom apartments located in the northern area of the city of Buenos Aires (Belgrano, Colegiales, Nuñez, Palermo, Recoleta, Retiro, Villa Devoto and Villa Urquiza). To make a property price comparison representative, dollar values were adjusted using the most recent Consumer Price Index (CPI) data provided by the United States government (updated through September and published on October 12). past) to calculate that country’s inflation in the value of its currency.

Before beginning to analyze what happened to the value of the square meter in recent decades, it is essential to remember that until 1975, the price of property in Argentina was estimated in pesos, and transactions were carried out in equal and consecutive fixed installments. This benefited buyers who paid in devalued pesos and led to the bankruptcy of the first construction companies, mainly cooperatives, which were the big losers. From this scenario, with the Rodrigazo of ’75, properties began to be sold in dollars.

In 1976, during the military dictatorship and with the economic plan known as the “tablita,” which implied a programmed and gradual devaluation, there was high inflation with a stable USD dollar. As a consequence of this, the value of properties increased progressively until in 1981, at the height of the dictatorship, the value of property in dollars reached its highest point in history, with one square meter having an approximate real value of US$4041 (due to the low price of the dollar at that time).

However, in 1982, when Argentina went to war over the Malvinas with a world millary power at the time like England, the dollar began to rise, causing the value of property in dollars to decrease significantly until reaching a historic low of US$1,236. /m².

When democracy returned with the government of Raúl Alfonsín in 1983, properties were at historically low values due to losing this war. And, at the end of the mandate, in ’89, hyperinflation affected, although not proportionally so much, the property’s value. In the 90s, with Carlos Menem and a dollar at a “one-to-one” value, property value began to increase and continued to rise during the 90s. On the other hand, convertibility gave the necessary confidence for people accessing mortgage loans (which arrived in 1996). The highest value during the Menemist decade occurred in 1993, with a value per square meter at US$2,236.

In 1999, the government of Fernando de la Rúa arrived, and in 2001, with the end of convertibility, the value of real estate fell. Economic uncertainty led the population to buy dollars instead of properties and caused the second most significant drop in the value of the square meter since 1977, which reached US$1,026/m² in 2002.

After the crisis, ownership gradually increased as the economy recovered and the dollar remained stable relative to inflation. In addition, the value of the square meter began to rise because they were on a technical floor, and the devaluation had reduced construction costs, reactivating the market and encouraging people to buy.

This increase in property value continued with the governments of Eduardo Duhalde, Néstor Kirchner and Cristina Fernández de Kirchner. However, in 2012, a turning point was reached, and a small drop occurred due to the implementation of the exchange rate trap by Cristina’s government. The upward trend resumed in 2015 when the Government of Mauricio Macri introduced the UVA mortgage loan. The property continued its rise, even with some inflation, and reached an all-time high in 2018 with a value of US$3,360/m².

However, since that moment, the value of the property began to experience a significant decrease in 2019 with the Government of Alberto Fernández, which intensified starting in 2020 due to the COVID pandemic. Currently, the property’s value is similar to that of 2007 (US$1,932/m²), representing a setback in terms of price per square meter, already reaching a floor and maximum honesty in appraisals.

With all this data collected, how could the real estate future be interpreted based on history and the present? Daniel Mintzer, the founding partner of G & D Developers, points out that to analyze the behaviour of the real estate market, it is key to understand that “the value of the property measured in dollars is intrinsically related to the perception of the value of the dollar compared to the peso.” He maintains that when the dollar tends to be high, property tends to be low and vice versa. “Clear examples of this relationship occurred in 1981 and during the Malvinas War. In the Alfonsín government, property remained at its lowest value then increased under Menem, continuing its rise with the governments of Duhalde, Néstor, Cristina and Macri. There was a decrease, especially during the pandemic, but in general, property in Argentina tended to increase after each election,” assures the expert.

Mintzer highlights that with the arrival of a new Government, regardless of the political faction to which it belongs, expectations are generated.

In his analysis, he considers that people’s perception of whether Argentina will be better, the same or worse, influences the real estate market trends. And, generally, the first months of a new Government are favourable. “Sometimes, there are external factors that influence it. For example, in Israel, property fell and not because of a monetary phenomenon, but because it is much less attractive to live there today than it was six months ago,” he argues.

In recent times, when there has been a construction boom, the real estate market is warming up and preparing for the new President and the direction the country will take starting in December. This is explained by Alan Mohadeb, partner at CEK, the developer with 11 projects in execution: “We developers are positioning ourselves in premium land in the face of the incoming Government which, among other things, we believe will come with a greater expectation of growth, whatever it may be.” the political force that it assumes. We feel that the projects chosen for the residential segment, regardless of who wins, will be those that differentiate themselves by type of product and in places where there continues to be more demand than supply.”

This would already be happening because in the last weeks before the elections, real estate agencies and developers received a flood of inquiries and completed sales operations for new projects like never before in an electoral period.

Despite high annual inflation, experts in the sector see renewed activity.

Martín Boquete, director of Toribio Achával, states that “it is alarming how the elections are influencing people’s interest in buying properties.” Far from the market stopping, we notice that interest, inquiries and business closings are increasing. It is evident that demand is eager to buy, which has never happened at another electoral time because election periods always generate a parenthesis of consultations. “There is an acceleration in sales before the elections.”

Gabriela Goldszer, director of Ocampo Propiedades, who received countless inquiries this week, also believes that “the interest began in the middle of the year and continued after the PASO. “I am optimistic about what will happen to the real estate market regardless of who wins the elections.”

His colleague, Miguel Ludmer, director of Interwin, has the same view. “Despite high annual inflation, we see renewed activity. There is no wait and see as usually happens in the months leading up to the general elections.”

One of the main questions is whether property in Argentina is expensive or extremely good value. The answer depends on the reference value. “If you compare it with other capitals in the region, such as Montevideo, which historically was cheaper in terms of real estate than Buenos Aires and today considerably exceeds Argentine values, property is very cheap,” explains Mintzer. Another perspective is the comparison with the population’s income; in this case, the property is perceived as expensive. However, if housing is evaluated based on people’s savings, it is seen that it is affordable and explains the recent momentum in the real estate market. “Currently, there is a feeling that the dollar is high about the peso or, seen another way, that property is cheap,” he points out.

Mintzer says the market reflects this with increased sales motivated by the belief that the property is undervalued. As he points out, “people are buying properties because they believe they are at an affordable price – I understand the market like the people who call me on the phone to buy apartments – and there is an upward expectation.” “In fact, the sales we made in the last month are equivalent to what we usually sell in six months,” she adds.

Real estate could maintain its value if the country faces hyperinflation in which the increase in prices is in line with the increase in the dollar.

For his part, Germán Gómez Picasso, founder of Reporte Inmobiliario, analyzes the impact of devaluations on the value of the square meter and points out that if the dollar keeps pace with inflation, it is unlikely that properties will suffer a negative impact. However, the situation could become problematic if the dollar soars relative to inflation. He also considers that the value of the square meter in Argentina is at historically low levels, which suggests that “there are more probabilities that values will remain or increase rather than decrease.” In his opinion, if the next Government implements reasonable measures and mortgage credit policies, there is real potential for an increase in the value of the square meter, especially given the growing need for housing in the country.

Mintzer provides that real estate could maintain its value if the country faces hyperinflation in which the price increase is in line with the rise in the dollar since property in Argentina has been valued in dollars for decades. Although there are economic challenges, such as inflation and unemployment, Mintzer does not believe that the financial situation will worsen drastically and assures that the general perception is that “property will probably continue to increase in value, especially after the elections.”

Leandro Soldati, director of the real estate company of the same name, relies on the irrefutable evidence of the data and maintains that “if one looks at the historical data to project where we are, it shows that the prices we have today were lower only in 2002 and 1989.” in constant currency than in recent years.”

Each economic crisis is unique and cannot be compared with the previous one. Furthermore, the Argentine real estate market is incredibly complex due to the many variables involved, including the psychological factor, which is the most difficult to measure. Mohadeb refers to this point when he comments, “it is no longer news that real estate prices have not only hit a floor but have begun to rise. The psychological factor is the most intangible, and today, it has to do with the expectation of a new Government, which also influences the formation of new sales values. Both clients, end consumers, and investors closely following the real estate market feel that it is a great moment of opportunity and are determined to carry out operations.”

Regarding the possible dollarization of the economy, those in the sector consider that, in principle, this would not hurt the value of the property. Gómez Picasso maintains that “the real estate and construction sectors would be among the least affected economic activities,” since they have been dollarized for decades. He adds that although what will happen cannot be predicted with certainty, the Argentine real estate market is in a relatively solid position against this scenario.

Consequently, the expert argues that although the real estate market has been affected by four consecutive years of declines due to lack of demand, declining dollar wages and lack of access to mortgage credit, construction nevertheless remains highly active. “The market has focused on serving a more affluent sector of the population that seeks investments and a refuge of value. However, in the last six months, there has been a slowdown in the decline in prices in the Federal Capital, indicating that the market could have reached a turning point,” says Llambías.

About the current elections, it suggests that the next Government must send quick and effective signals to the market. He assures that “the biggest challenge will be dealing with missing input suppliers, and if these challenges are adequately addressed, it is possible that stability will be maintained and prices will increase, boosting economic activity.”

However, “if the next government does not send clear signals and makes mistakes,” the current improvement could quickly unravel and “the green shoot of improvement we are seeing now could collapse instantly.” He assures that in the event of hyperinflation and significant shortages, a fierce recession and a significant price drop would follow. In any case, Llambías does not consider that this critical situation will be reached, regardless of the electoral result. “I don’t think this possibility is going to happen, whether any of the three candidates win, even Milei, whose plans are not entirely clear,” said the expert.

Boquete, for his part, prefers not to give future forecasts but admits that “if we base ourselves on theory and experience when people go to buy a product, it is because they believe that its price is going to rise, and perhaps that is what that is accelerating the current demand for properties in pre-election times.”

Llambías closes with a positive message a few hours after knowing the results of October 22: “As developers, we are naturally optimistic, and we bet that circumstances will turn favorably. For this reason, we continue to invest long-term in Argentina despite the recurring challenges. Nobody wants things to go wrong. There is a general interest in the sector to continue producing,” he expresses and envisions “a challenging 2024, a year in which we will have to be patient and observe, with a constant effort to carry the projects forward.”

www.buysellba.com

From 1977 to 2023: what happened to residential property prices after each presidential election in Argentina?

After four years of declining property prices, values have stabilized, and there are promising signs of recovery: the analysis of the last 46 years in the Argentine real estate market. A few days before the presidential elections in Argentina, the real estate market is beginning to show signs of...

www.gatewaytosouthamerica-newsblog.com

www.gatewaytosouthamerica-newsblog.com

November 24, 2023

From 1977 to 2023: What happened to residential property prices after each presidential election in Argentina?

After four years of declining property prices, values have stabilized, and there are promising signs of recovery: the analysis of the last 46 years in the Argentine real estate market.

A few days before the presidential elections in Argentina, the real estate market is beginning to show signs of an imminent change in trend. To understand the complex behaviour of the sector, it is vital to contextualize the historical fluctuations of different economic moments, such as growth and recession cycles.

To carry out this comparative analysis, a Real Estate Report study is taken as a starting point that covers from 1977 to 2023 with the price per square meter of two- and three-bedroom apartments located in the northern area of the city of Buenos Aires (Belgrano, Colegiales, Nuñez, Palermo, Recoleta, Retiro, Villa Devoto and Villa Urquiza). To make a property price comparison representative, dollar values were adjusted using the most recent Consumer Price Index (CPI) data provided by the United States government (updated through September and published on October 12). past) to calculate that country’s inflation in the value of its currency.

Before beginning to analyze what happened to the value of the square meter in recent decades, it is essential to remember that until 1975, the price of property in Argentina was estimated in pesos, and transactions were carried out in equal and consecutive fixed installments. This benefited buyers who paid in devalued pesos and led to the bankruptcy of the first construction companies, mainly cooperatives, which were the big losers. From this scenario, with the Rodrigazo of ’75, properties began to be sold in dollars.

In 1976, during the military dictatorship and with the economic plan known as the “tablita,” which implied a programmed and gradual devaluation, there was high inflation with a stable USD dollar. As a consequence of this, the value of properties increased progressively until in 1981, at the height of the dictatorship, the value of property in dollars reached its highest point in history, with one square meter having an approximate real value of US$4041 (due to the low price of the dollar at that time).

However, in 1982, when Argentina went to war over the Malvinas with a world millary power at the time like England, the dollar began to rise, causing the value of property in dollars to decrease significantly until reaching a historic low of US$1,236. /m².

When democracy returned with the government of Raúl Alfonsín in 1983, properties were at historically low values due to losing this war. And, at the end of the mandate, in ’89, hyperinflation affected, although not proportionally so much, the property’s value. In the 90s, with Carlos Menem and a dollar at a “one-to-one” value, property value began to increase and continued to rise during the 90s. On the other hand, convertibility gave the necessary confidence for people accessing mortgage loans (which arrived in 1996). The highest value during the Menemist decade occurred in 1993, with a value per square meter at US$2,236.

In 1999, the government of Fernando de la Rúa arrived, and in 2001, with the end of convertibility, the value of real estate fell. Economic uncertainty led the population to buy dollars instead of properties and caused the second most significant drop in the value of the square meter since 1977, which reached US$1,026/m² in 2002.

After the crisis, ownership gradually increased as the economy recovered and the dollar remained stable relative to inflation. In addition, the value of the square meter began to rise because they were on a technical floor, and the devaluation had reduced construction costs, reactivating the market and encouraging people to buy.

This increase in property value continued with the governments of Eduardo Duhalde, Néstor Kirchner and Cristina Fernández de Kirchner. However, in 2012, a turning point was reached, and a small drop occurred due to the implementation of the exchange rate trap by Cristina’s government. The upward trend resumed in 2015 when the Government of Mauricio Macri introduced the UVA mortgage loan. The property continued its rise, even with some inflation, and reached an all-time high in 2018 with a value of US$3,360/m².

However, since that moment, the value of the property began to experience a significant decrease in 2019 with the Government of Alberto Fernández, which intensified starting in 2020 due to the COVID pandemic. Currently, the property’s value is similar to that of 2007 (US$1,932/m²), representing a setback in terms of price per square meter, already reaching a floor and maximum honesty in appraisals.

With all this data collected, how could the real estate future be interpreted based on history and the present? Daniel Mintzer, the founding partner of G & D Developers, points out that to analyze the behaviour of the real estate market, it is key to understand that “the value of the property measured in dollars is intrinsically related to the perception of the value of the dollar compared to the peso.” He maintains that when the dollar tends to be high, property tends to be low and vice versa. “Clear examples of this relationship occurred in 1981 and during the Malvinas War. In the Alfonsín government, property remained at its lowest value then increased under Menem, continuing its rise with the governments of Duhalde, Néstor, Cristina and Macri. There was a decrease, especially during the pandemic, but in general, property in Argentina tended to increase after each election,” assures the expert.

Mintzer highlights that with the arrival of a new Government, regardless of the political faction to which it belongs, expectations are generated.

In his analysis, he considers that people’s perception of whether Argentina will be better, the same or worse, influences the real estate market trends. And, generally, the first months of a new Government are favourable. “Sometimes, there are external factors that influence it. For example, in Israel, property fell and not because of a monetary phenomenon, but because it is much less attractive to live there today than it was six months ago,” he argues.

In recent times, when there has been a construction boom, the real estate market is warming up and preparing for the new President and the direction the country will take starting in December. This is explained by Alan Mohadeb, partner at CEK, the developer with 11 projects in execution: “We developers are positioning ourselves in premium land in the face of the incoming Government which, among other things, we believe will come with a greater expectation of growth, whatever it may be.” the political force that it assumes. We feel that the projects chosen for the residential segment, regardless of who wins, will be those that differentiate themselves by type of product and in places where there continues to be more demand than supply.”

This would already be happening because in the last weeks before the elections, real estate agencies and developers received a flood of inquiries and completed sales operations for new projects like never before in an electoral period.

Despite high annual inflation, experts in the sector see renewed activity.

Martín Boquete, director of Toribio Achával, states that “it is alarming how the elections are influencing people’s interest in buying properties.” Far from the market stopping, we notice that interest, inquiries and business closings are increasing. It is evident that demand is eager to buy, which has never happened at another electoral time because election periods always generate a parenthesis of consultations. “There is an acceleration in sales before the elections.”

Gabriela Goldszer, director of Ocampo Propiedades, who received countless inquiries this week, also believes that “the interest began in the middle of the year and continued after the PASO. “I am optimistic about what will happen to the real estate market regardless of who wins the elections.”

His colleague, Miguel Ludmer, director of Interwin, has the same view. “Despite high annual inflation, we see renewed activity. There is no wait and see as usually happens in the months leading up to the general elections.”

One of the main questions is whether property in Argentina is expensive or extremely good value. The answer depends on the reference value. “If you compare it with other capitals in the region, such as Montevideo, which historically was cheaper in terms of real estate than Buenos Aires and today considerably exceeds Argentine values, property is very cheap,” explains Mintzer. Another perspective is the comparison with the population’s income; in this case, the property is perceived as expensive. However, if housing is evaluated based on people’s savings, it is seen that it is affordable and explains the recent momentum in the real estate market. “Currently, there is a feeling that the dollar is high about the peso or, seen another way, that property is cheap,” he points out.

Mintzer says the market reflects this with increased sales motivated by the belief that the property is undervalued. As he points out, “people are buying properties because they believe they are at an affordable price – I understand the market like the people who call me on the phone to buy apartments – and there is an upward expectation.” “In fact, the sales we made in the last month are equivalent to what we usually sell in six months,” she adds.

Real estate could maintain its value if the country faces hyperinflation in which the increase in prices is in line with the increase in the dollar.

For his part, Germán Gómez Picasso, founder of Reporte Inmobiliario, analyzes the impact of devaluations on the value of the square meter and points out that if the dollar keeps pace with inflation, it is unlikely that properties will suffer a negative impact. However, the situation could become problematic if the dollar soars relative to inflation. He also considers that the value of the square meter in Argentina is at historically low levels, which suggests that “there are more probabilities that values will remain or increase rather than decrease.” In his opinion, if the next Government implements reasonable measures and mortgage credit policies, there is real potential for an increase in the value of the square meter, especially given the growing need for housing in the country.

Mintzer provides that real estate could maintain its value if the country faces hyperinflation in which the price increase is in line with the rise in the dollar since property in Argentina has been valued in dollars for decades. Although there are economic challenges, such as inflation and unemployment, Mintzer does not believe that the financial situation will worsen drastically and assures that the general perception is that “property will probably continue to increase in value, especially after the elections.”

Leandro Soldati, director of the real estate company of the same name, relies on the irrefutable evidence of the data and maintains that “if one looks at the historical data to project where we are, it shows that the prices we have today were lower only in 2002 and 1989.” in constant currency than in recent years.”

Each economic crisis is unique and cannot be compared with the previous one. Furthermore, the Argentine real estate market is incredibly complex due to the many variables involved, including the psychological factor, which is the most difficult to measure. Mohadeb refers to this point when he comments, “it is no longer news that real estate prices have not only hit a floor but have begun to rise. The psychological factor is the most intangible, and today, it has to do with the expectation of a new Government, which also influences the formation of new sales values. Both clients, end consumers, and investors closely following the real estate market feel that it is a great moment of opportunity and are determined to carry out operations.”

Regarding the possible dollarization of the economy, those in the sector consider that, in principle, this would not hurt the value of the property. Gómez Picasso maintains that “the real estate and construction sectors would be among the least affected economic activities,” since they have been dollarized for decades. He adds that although what will happen cannot be predicted with certainty, the Argentine real estate market is in a relatively solid position against this scenario.

The eternal safeguard of value

Gustavo Llambías, Founding Partner and Executive Director of RED Consulting and Management SA provides a personal vision of the Argentine real estate market. He highlights two key influencing aspects: on the one hand, Argentines tend to use the square meter as a store of value, while they also “use the dollar as a parameter for everything,” a trend that has intensified over time.Consequently, the expert argues that although the real estate market has been affected by four consecutive years of declines due to lack of demand, declining dollar wages and lack of access to mortgage credit, construction nevertheless remains highly active. “The market has focused on serving a more affluent sector of the population that seeks investments and a refuge of value. However, in the last six months, there has been a slowdown in the decline in prices in the Federal Capital, indicating that the market could have reached a turning point,” says Llambías.

About the current elections, it suggests that the next Government must send quick and effective signals to the market. He assures that “the biggest challenge will be dealing with missing input suppliers, and if these challenges are adequately addressed, it is possible that stability will be maintained and prices will increase, boosting economic activity.”

However, “if the next government does not send clear signals and makes mistakes,” the current improvement could quickly unravel and “the green shoot of improvement we are seeing now could collapse instantly.” He assures that in the event of hyperinflation and significant shortages, a fierce recession and a significant price drop would follow. In any case, Llambías does not consider that this critical situation will be reached, regardless of the electoral result. “I don’t think this possibility is going to happen, whether any of the three candidates win, even Milei, whose plans are not entirely clear,” said the expert.

Boquete, for his part, prefers not to give future forecasts but admits that “if we base ourselves on theory and experience when people go to buy a product, it is because they believe that its price is going to rise, and perhaps that is what that is accelerating the current demand for properties in pre-election times.”

Llambías closes with a positive message a few hours after knowing the results of October 22: “As developers, we are naturally optimistic, and we bet that circumstances will turn favorably. For this reason, we continue to invest long-term in Argentina despite the recurring challenges. Nobody wants things to go wrong. There is a general interest in the sector to continue producing,” he expresses and envisions “a challenging 2024, a year in which we will have to be patient and observe, with a constant effort to carry the projects forward.”

www.buysellba.com