All the Answers

Well-known member

Surprising data emerge on the evolution of core inflation in April and there are already sectors with deflation - Infobae

Source:

Surgen datos sorprendentes sobre la evolución de la inflación núcleo en abril y ya hay sectores con deflación

Los precios sobre todo de alimentos y bebidas prácticamente dejaron de crecer en la tercera semana del mes. Muchos productos muestran caídas de precios. El índice general podría ubicarse debajo del 8%, en un contexto de fuerte retracción de las ventas

April 25, 2024

Prices, especially for food and beverages, practically stopped growing in the third week of the month. Many products show price drops. The general index could be below 8%, in a context of sharp decline in sales

By Pablo Wende

Supermarkets advertise their promos, although they are not always convenient for the consumer (NA)

The slowdown in the price variation was notably consolidated as April progressed. Not only is it practically a fact that the month will end in single digits, but also core inflation shows a surprising evolution due to its downward trend.

According to Alphacast, led by Luciano Cohan, in the last four weeks it has registered a 0% increase. “It is the lowest since we started measuring high frequency in 2013,” added the economist.

Core inflation does not include regulated prices (that is, rate increases are not included) or items affected by seasonal issues such as tourism. The Central Bank has already made it clear that future decisions related to the interest rate will be based on this measurement, which measures what happens with greater certainty.

The measurement is not very far from others that track food and drink prices in supermarkets, with increases of just 1% so far this month. Taking into account the seasonal behavior of prices, it is possible that this trend will consolidate in the last days of the month. It is generally the period with the most marked discounts, since people arrive at these dates with just enough, so it becomes necessary to promote sales.

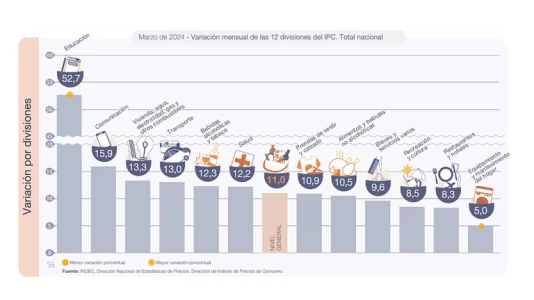

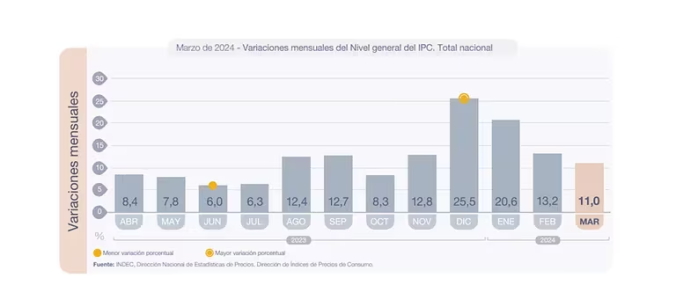

The general price index showed, for the same consultancy, a deflation of 0.8% in the third week of the month compared to the previous one. According to estimates, the general index would be around 7.6% this month, a significant drop after the 11.2% in March. The same study reflected price drops in 25% of the products analyzed and half of them with drops greater than 1%.

The collapse in inflation in April would have been much greater if it had not been for the sharp increase in gas, of around 350%. This increase has a direct impact on around 2 points in the index, but it is possible that it will also generate pressure in other sectors that use this input intensively (for example bakeries, restaurants and industrial ovens).

Interpretations about the reason for such an abrupt drop in inflation are the order of the day. On the one hand there is the Government's reading, which observes how the maintenance of the fiscal surplus and the strong control of monetary aggregates is already generating a clear impact on prices. Furthermore, the projections indicate optimism about the continuity of the inflationary deceleration, which may possibly occur even more quickly.

However, there are other factors that obviously accelerate the process, in particular the fall in the purchasing power of wages and sales. Given the need to make cash and be able to cover salaries and operating expenses, many companies in different sectors choose to offer steep discounts.

This phenomenon is sometimes not captured by the INDEC measurement, since it involves specific offers or negotiations between suppliers and clients. But it is happening, for example, in supermarkets and also in other punished sectors such as construction materials.

In addition, companies had accumulated a lot of stock last year to take advantage of access to the very cheap official dollar, with a gap of more than 150%. It was also the best way to face the strong devaluation that occurred in December and the subsequent rise in prices.

Of course now, unlike what happened in 2023, it is no longer a business to keep the stock. To sell this merchandise in a depressed market, there is no choice but to lower prices. In most areas, furthermore, the remarkings had been excessive at the beginning of the year, largely due to the fear of a new increase in the gap and devaluation jump that did not happen.