BuySellBA

Administrator

The 10 key questions about the property tax in the Province and the additional fee that leads to paying double in October - La Nacion Propiedades

Source:

ARBA: las 10 preguntas clave para entender por qué se duplicó la última cuota del impuesto inmobiliario en Provincia

La última cuota que recauda Arba por el impuesto inmobiliario en la provincia de Buenos Aires llegó con valor de hasta un 100% más que las anteriores

September 2, 2024

The latest installment collected by Arba for the property tax in the province of Buenos Aires arrived with a value of up to 100% more than the previous ones

By Candle Contreras

Some taxpayers in the province of Buenos Aires were surprised by an extra payment in the last installment of the property tax that doubles its value

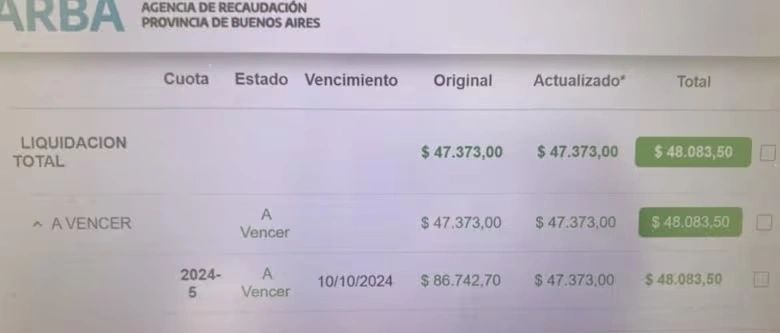

Last week it was learned that some taxpayers will have to pay an additional fee on the 5th installment of the property tax collected by Arba : news that surprised and generated concern among those who will pay this extra, since the figure that was known represents up to 100% more than the value of the fee to be paid in October .

As early as the second installment of the tax, the procedure used to determine the adjustment coefficients generated controversy: between the first installment that expired in February and the second installment that expired in April , there was an increase equivalent to 20% . For their part, installments 3 and 4 that expired in June and August did not suffer increases . But the last installment , which will expire in October, reflects an amount of 100% more than the previous ones (2, 3 and 4) because an additional installment is added . But Arba assures that this additional amount does not impact all taxpayers.

Below are some key questions to consider :

1) Who must pay the additional amount of up to 100% on installment 5 of the property tax?

According to Arba, 9% of real estate assets will be affected by this additional fee. This extra fee is applied -according to the tax law- when in the urban real estate tax on buildings, the taxable base corresponding to the property or the sum of the taxable base of all of them, exceeds $31,465,000 . While, for the rest of the taxpayers, the fee will have the same value as the previous ones.

The agency says that it is not an increase, but rather the increase in the amount “is equivalent to an additional fee,” and they base this on the Tariff Law, which establishes that the responsible areas of the Government can decide to apply an additional fee to certain goods and services. Therefore, “ the value reflected in fee 5 does not represent a 100% adjustment on the previous one , but rather it is an extra fee that is added to this fee ,” they say.

2) What is the market value of the properties that pay the extra tax?

It should be noted that the taxable base should not be confused with the fiscal valuation or the market value . According to Arba's information to LA NACION , properties with a taxable base exceeding $31,465,000 are equivalent to a market value of around US$650,000 . However, there are taxpayers with properties whose market value is much lower but who are still receiving this additional fee , since their taxable bases exceed the reported amount.

It is recommended to know the taxable base of each property to know whether the extra must be paid or not.

The extra to pay for the property tax arrived together with the 5th installment

3) How much do I have to pay for the additional fee and how is it calculated?

The additional amount to be paid may not exceed 20% of the total annual tax and represents an increase of up to 100% on the last installment .

To calculate the taxable base of a property and know if a taxpayer enters within the percentage that must pay the extra fee, the fiscal valuation must be multiplied by the coefficient 11.41876 . Therefore, when making the calculation, all properties in the province of Buenos Aires that have a fiscal valuation less than $2,755,553 would not be impacted by the additional .

The taxable base of a property appears on the invoice or on the Arba website with the property data. In this case, it must exceed $31,465,000 to be affected by the additional tax.

4) When is this extra paid?

This additional fee, which will be applied to approximately 9% of the total built urban real estate items in the Province, is expected to be paid jointly with the fifth and last installment of the Built Real Estate Tax for the year (installment 5). For the rest of the real estate items , this installment will have the same value as the previous installments (2, 3 and 4).

5) How do I know if a taxpayer must pay the additional fee in installment 5?

Anyone with only the batch number can find out the amount to be paid for the Real Estate Tax on the Arba website . Below is the step-by-step guide to follow:- Enter the ARBA website

- Click on the menu where it says “Pay” and then on the “Real Estate” button

- Enter the batch number , press “Submit” and then “Continue”

- Once this step is completed, the amount to be paid will appear.

6) What happens if I have two or more properties in the Province?

Article 138 of the 2024 Tax Law establishes that, for those properties of the built urban area, both in its basic and complementary component, whose taxable base of the property or of the set of them exceeds $31,465,000 .

The tax is paid per property . Therefore, if the taxable base of that property does not exceed the established amount, the extra will not have to be paid . Now, in case of owning two or more properties , as expressed in the article of the law, if between them they add up to $31,465,000, the extra would be paid with the complementary tax . The latter is the difference that arises from the sum of all the properties that a person has in his name, subtracting what was paid for each of them individually.

Therefore, specialists believe that the additional amount to be paid in the event that the sum of the properties exceeds $31,465,000, would come as an extra in the complementary tax.

7) Is the extra fee only for this year? What could happen in 2025?

The property tax is calculated from a taxable base , on which a rate determined by the Buenos Aires Legislature is applied annually and is paid in 5 installments. This year, the Tax Law enabled an additional fee for the “most expensive” properties in the province of Buenos Aires. “It is an extra in this year's tax, the additional is only for this year, it is not known if there will be something next year because it depends on the tax law that is passed for 2025 ,” explained the provincial agency to LA NACION.

8) Can these increases impact the property market?

Real estate market analysts do not believe that this type of increase in tax rates will have any impact on the demand for properties . “It is not significant enough to discourage a convinced demand for purchase,” says José Rozados, director of Reporte Inmobiliario.

9) What happens in cases where the tax was paid in full in advance (annual payment)?

In the event that a taxpayer paid the full tax in advance, he or she must pay that additional installment , which, like installment 5, also expires on October 10 .

This taxpayer paid the entire tax in advance at the beginning of the year and now he has received the "extra fee" to pay next month

10) Who pays the property tax?

In all properties, the payment of the property tax corresponds to the owner . In the case of rentals, according to the contracts signed under the now repealed law, the property tax was the responsibility of the owners, so those who have valid contracts signed under the rental law sanctioned in July 2020 and repealed in December 2023 but which remain in force until its termination, it will be the owner who will have to assume this additional cost.www.buysellba.com