All the Answers

Well-known member

The 2% adjustment of the official dollar is once again under scrutiny and the IMF suggested a more flexible exchange rate policy - Infobae

Source:

El ajuste de 2% del dólar oficial vuelve a ser puesto bajo la lupa y el FMI sugirió una política cambiaria más flexible

El organismo no dio mayores detalles en el comunicado de prensa divulgado ayer, pero sí hizo referencia al futuro de la política cambiaria. Ni se habla de una posible dolarización, pero menciona la futura competencia de monedas que impulsa Milei

May 14, 2024

The organization did not give further details in the press release released yesterday, but it did make reference to the future of exchange rate policy. There is no talk of possible dollarization, but it mentions the future currency competition promoted by Milei

By Pablo Wende

FILE PHOTO: A man walks next to the logo of the International Monetary Fund (IMF) at its headquarters in Washington, United States REUTERS/Yuri Gripas/File

The IMF once again put the discussion on the table regarding how the official dollar will be managed in the coming months. In the press release released yesterday by the organization - in which it confirms the eighth successful review of the agreement - it is stated that "the exchange rate policy will become more flexible", although without specifying what these possible changes consist of.

Other references are also made about what is coming for the Argentine market. The organization refers to a “new monetary regime, which involves currency competition.” And it goes on to indicate that “exchange restrictions and controls will continue to be reduced as conditions allow.” Therefore, there is no deadline for the release of the exchange rate and it is made quite clear that it will not happen from one day to the next.

"The priority - the organization noted - is to continue strengthening the disinflation process and strengthening international reserves."

Now we will have to wait for the report prepared by the staff, which is the official document of the organization, which will surely include some additional details on these aspects.

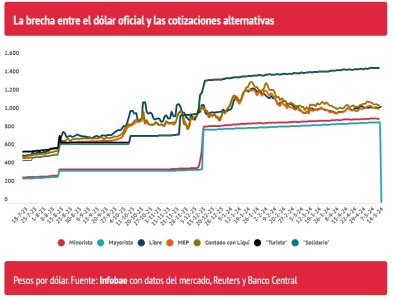

In relation to the greater exchange rate flexibility, everything suggests that the focus is on the monthly adjustment of the exchange rate proposed by the government, which has remained at 2% per month practically since the end of last year.

It may interest you:Milei inaugurated a bust of Carlos Menem in the Casa Rosada: “Even though it hurts, he was the best president in history”

This “crawling peg”, as it is called in financial jargon, is considered insufficient by the IMF, which already warned at the beginning of the year about the danger of falling into a new exchange rate delay.

Javier Milei, however, has another view. The President considered that the causes of the increase in dollar prices that Argentina is experiencing has to do with other factors, such as excess taxes and bureaucracy that affect costs. And he also states that the official dollar plus the PAIS tax is equivalent to the cash with settlement, so in reality there is no exchange gap.

On the other hand, the Government maintains that the exchange rate appreciation goes hand in hand with economic recovery and improved expectations, as has already happened at other times in Argentina.

From this it follows that, at least from the official perspective, it would not make sense to speed up the pace of increase in the exchange rate , despite the fact that inflation remains well above 2% monthly.

One of the most relevant paragraphs of the statement released yesterday by the IMF is the one related to the future of the Government's exchange rate policy, where it also makes it clear that there is no explicit date for the exit of the exchange rate trap. There will be a reconditioning of the goals, which will surely be known in the coming days

Surely when the technicians' report is released it will be reflected what the organization's vision is on this issue and whether they insist on the need to avoid another episode of exchange rate delay. It is likely that they will at least make some explicit mention of it, judging by the statement released yesterday.

On the other hand, no reference is made to the possibility of advancing dollarization, something that the Government itself recognizes is not in the plans. But the IMF does refer to a possible currency competition. This implies that in the future operations in dollars or any other currency chosen by the parties will be allowed, maintaining the peso as another option, something that the organization obviously supports. This is a scheme similar to that which exists in other countries in the region, such as Peru and Uruguay.

The statement indicated that the objectives and conditionality of the program “have been updated” with the aim of “reflecting the best recent developments and the new economic program.” This implies that the reserve accumulation and fiscal result objectives that would have to be met could be modified as the year progresses. “Financing guarantees are also being obtained from official creditors,” although without giving further details in this regard.