All the Answers

Well-known member

The Central Bank projects that inflation will fall to 3.5% in September after the reduction of the PAIS tax - Infobae

Source:

El Banco Central proyecta que la inflación bajará a 3,5% en septiembre tras la reducción del impuesto PAIS

La estimación surge de una presentación hecha por el vicepresidente del BCRA, Vladimir Werning. El IPC núcleo caería hasta 3%, todavía lejos del 2% de depreciación cambiaria. Las consultoras creen que podría haber un impacto en la mayorista

The estimate comes from a presentation made by the vice president of the BCRA, Vladimir Werning. The core CPI would fall to 3%, still far from the 2% exchange rate depreciation. The consulting firms believe that there could be an impact on the wholesale market.

By Mariano Boettner

The president of the Central Bank, Santiago Bausili, and the Minister of Economy, Luis Caputo (Gustavo Gavotti)

The economic team projects that in September , the first month that the PAIS tax rate was reduced, inflation would be 3.5% , so there would not be a very marked impact on the pace at which prices are already moving. In July, the official figure was 4% and for August, a figure that will be announced tomorrow, the estimates speak of a slightly lower CPI .

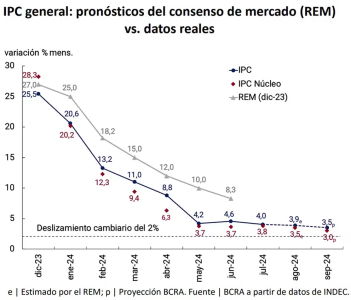

The Central Bank's projection comes from a presentation made by the bank's vice president Vladimir Werning last Friday at the summit of the Argentine Institute of Finance Executives (IAEF), in which various officials from the economic team spoke. In a table included in his presentation, Werning highlighted the distance between the projections of the Market Expectations Survey (REM) and the final inflation data, to argue that inflation is slowing at a faster pace than expected by the consensus of private analysts.

But the graph also included a projection of the entity itself, which shows that for September, the first month in which the reduction of the PAIS tax rate from 17.5% to 7.5% for the payment of imports and freight had a full impact, the CPI would slow down to the 3.5% zone , some 0.4 percentage points of the 3.9% expected for August by the REM. And that in September, in addition, core inflation would fall to 3% monthly . This last projection was added on Friday at IAEF, since in the previous version of Werning's usual presentations to investors the data only went up to July.

The BCRA's inflation projection

The economic team hopes that the tax reduction that began to take effect on September 2 will act as a battering ram to break the inflationary inertia of the last three months, in which the rise in core prices remained stable. The bet is that September will show a lower pace of prices than July (4%) and August, a month for which Minister Luis Caputo anticipated that a similar figure is expected.

The market is somewhat more skeptical about a clear effect on prices and finds it difficult to measure in these terms. “The impact on inflation is difficult to estimate: it will depend on the cost structure of the different goods and services that incorporate imported goods, and on the degree of competition that the rest present to enable or not the recomposition of profit margins. We understand that it will not be significant, we do not expect nominal price reductions , in any case a slowdown in scheduled adjustments,” LCG stated in a report.

The CPI would slow down in September to the 3.5% zone, some 0.4 percentage points from the 3.9% expected for August by the REM. And in September, in addition, core inflation would fall to 3% monthly.

“The clearest impact should be seen in wholesale prices, not only of imported products that have a weighting of 7.3% in the Indec IPIM and that had already been rising below the rate of the crawling peg since March, but also of national manufactured products that have an imported cost component,” 1816 mentioned, meanwhile. That is why he estimated that “the magnitude of the transfer to prices is inherently difficult to estimate for the simple fact that in our economic history we have no experience of nominal appreciation in a managed exchange rate regime,” he pointed out.

Vladimir Werning, vice president of the BCRA, spoke to finance executives in Mendoza last Friday

The IEB Group also emphasized this particularity: that the impact on prices could be more delayed than immediate. “It provides a certain cushion to avoid markups without loss of margins, which could push future inflation data downwards ,” they said. “However, this is not the only way in which the reduction of the tax could help control inflation. By lowering the cost of importing not only intermediate goods, but also final goods, it will put pressure on local producers,” they said. Part of that conversation already took place last week between supermarket entrepreneurs and the national government.

Another idea that Werning supported in his presentation is that according to a new measurement carried out by the Central Bank, economic activity “changed its cycle” and that after having touched a bottom it should begin to show signs of reactivation. This is an ILA (leading indicator of activity) that according to a methodology developed by the North American think tank The Conference Board would have shown that “in July the three conditions were met that indicate that the ILA-BCRA would have verified a turning point in March .”

Those three conditions would be:

- Duration , which measures the number of months with positive monthly variations in the last four.

- Diffusion , that is, the percentage of sectors with positive monthly variation (measured as a moving average of the last four months).

- Depth , which implies the percentage variation of the BCRA's leading index.