All the Answers

Well-known member

The forecast of the largest investment bank in the region on Argentine stocks: how much they can earn and what they depend on - Infobae

Source:

El pronóstico del mayor banco de inversión de la región sobre las acciones argentinas: cuánto pueden ganar y de qué dependen

La entidad brasileña BTG Pactual anticipa una mejora en la cotización en dólares de los activos domésticos, aunque supeditada a una baja más amplia para el riesgo país y la estabilización de la economía

May 20, 2024

The Brazilian entity BTG Pactual anticipates an improvement in the dollar price of domestic assets, although subject to a broader decline in country risk and the stabilization of the economy.

Argentine stocks are the ones that rise the most in 2024. (REUTERS/Brendan McDermid)

The Brazilian entity BTG Pactual , the largest investment bank in Latin America, drew an optimistic projection for Argentine stocks in the short term. “We believe local stocks can rise more than 50% in the next 12 to 18 months .” Country risk is the key factor,” the report summarized.

Argentine stocks are going through a very favorable 2024 in the markets. The ADRs of Argentine companies listed on Wall Street advance up to 100% in dollars, such is the case of banks, an extraordinary performance in global comparison.

“In a scenario of economic stabilization, we expect local stocks to increase +50% - in US dollars - in the next 12 to 18 months , driven by lower country risk, reflecting economic stability and better expectations for structural growth” , considered the BTG Pactual study.

Source: Rava Bursátil-prices in dollars.

After hitting a floor in valuations during the pandemic, Argentine stocks recorded broad gains for three consecutive years and although the trend is not being accompanied by local macroeconomic conditions, in 2024 they also lead the increases in international comparison, now with the push for a turn in economic policy with the arrival of Javier Milei to the Presidency.

“Midterm elections will also be held in 2025. If the Government can maintain its approval ratings and perform well in the elections , the possibility of positive changes in the LT ( long term) structure of the economy will improve further , which is likely to provide greater growth potential . As the visibility of success improves, assuming that is the case, those companies with relevant exposure to Argentina should also begin to assess the structural improvement of their operations,” defined the Brazilian entity.

Fuente: Infobae con datos de Reuters

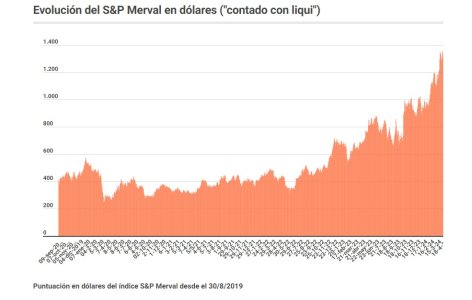

It should be noted that the S&P Merval index of the Buenos Aires Stock Exchange shows an improvement in pesos of 57% this year - somewhat below domestic inflation - and 39% in dollars , according to the "cash with settlement" parity. implicit in the ADRs operated in New York. Compared to other markets, it is a notable benefit, given the increases in the S&P 500 on Wall Street (+12%), the technology Nasdaq (+10%) and the Dow Jones Industrial Index (+6%). The Bovespa index of San Pablo lost 10 percent in the same period.

However, the profit potential outlined by the Brazilian financial giant for Argentine equities is conditional on the stabilization of the economy, expectations of structural growth of activity and also a consistent decrease in country risk , which would allow the Government access financing in dollars in voluntary debt markets.

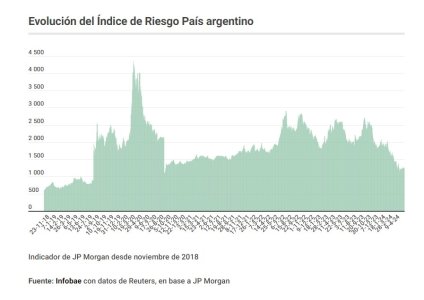

“The country risk has fallen in recent months, but remains well above the levels reached during the Macri government and compared to its Latin American peers. We are not making any predictions about the evolution of country risk, but it is clear that an improvement in macroeconomic fundamentals can cause a new significant drop in risk . Such an improvement would be a major driver of rising asset prices ,” the BTG Pactual report stated.

BTG Pactual obtained a net profit of 2,889 million reais (about USD 520 million) in the first quarter, 27.6% more than in the same period of 2023, the company reported this Monday. This is the highest volume of profits obtained in a quarter by this leading institution in the region. According to the financial balance released by the entity, its gross income in the first three months of 2024 increased by 22.7%, to a record of 5,891 million reais (about USD 1,144 million).