All the Answers

Well-known member

The free dollar is approaching 1,300 pesos: what are the four factors that caused the drop? - Infobae

Source:

El dólar libre se acerca a los 1.300 pesos: cuáles son los cuatro factores que provocaron la baja

El dólar “blue” cayó por tercer día y se pagó a $1.315, para quedar más cerca de los dólares financieros, debajo de $1.300. Estas cotizaciones tocaron un piso desde el 19 de junio. Los motivos

August 30, 2024

The bill fell for the third day and was paid at $1,315, to be closer to the financial dollars, below $1,300. These quotes hit a low since June 19.

The free dollar resumed its downward trend and continues to lose out against inflation.

The price of the free dollar fell this Thursday for the third day in a row, to settle at $1,315 for sale, the lowest level since June 19 , when it closed at 1,300 pesos. It also fell in August by 55 pesos or 4%, while it limits the rise in 2024 to 28.3%, well above an accumulated inflation of around 90% in the first eight months of the year.

Closer to 1,300 pesos and with an exchange rate gap with respect to the official dollar that fell below 40% for the first time since June, the outlook for the informal dollar in decline was due to four factors that occurred together in the short term:

1) Convergence of alternative dollars. The fall of the “blue” brings the price closer to those implied in stocks and bonds, the “settled cash” and MEP stock exchanges, now in the area of $1,292 and $1,275, respectively. These alternative parities to the “cepo” – that is, the free dollar and the financial ones – tend to converge and are now trading at their lowest since the third week of June, therefore it is reasonable that the free dollar approaches the other references.

2) “Zero emission” scheme. On July 13, the Minister of Economy, Luis Caputo, announced the “zero emission” scheme, which proposed the reabsorption of pesos issued by the Central Bank for the purchase of dollars in the spot market through the settlement of foreign currency via bond transactions in the stock market, at the parity of the spot settlement. Although this intervention did not involve considerable amounts, it served to more than supply the “liqui” and MEP segments. Together with the settlement of 20% of agricultural exports through the “blend” dollar scheme in effect since December, this intensive provision of foreign currency destined for the parallel market helped to contain prices below 1,300 pesos.

To illustrate this, it is enough to remember that on July 12 - prior to the announcement of “zero emission” - the free dollar reached a nominal record of 1,500 pesos and the “contado con liqui” reached 1,427 pesos. Since then, these quotes have decreased by 12.3% and 9.5% , respectively.

3) Money laundering. There is no official figure available on the inflow of foreign currency that is taking place in recent weeks to adhere to the regime of regularization of foreign assets. Private estimates consider that money laundering could capture up to USD 40 billion and behind this inflow of foreign currency to the economy there is also another explanation for the recent fall of the stock market dollars and the “blue” dollar. In the first case, because the dollars abroad can re-enter through the “cable” dollar that is negotiated on the Stock Exchange, and in the second, because the official proposal also contemplates the laundering of pesos, which could be encouraging the sale of dollars at the “blue” price - today the most expensive - to obtain more pesos and take advantage of this arbitrage.

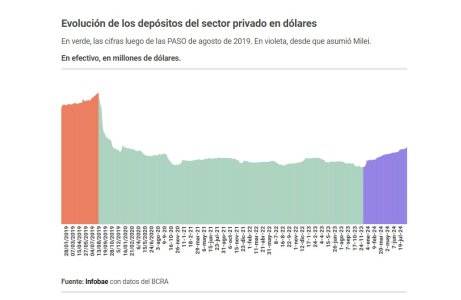

Private sector foreign currency deposits - in cash - amounted to USD 19,071 million on August 26, the latest data updated by the Central Bank. These placements, which grew by some USD 1,200 million in the last two months , reached a maximum since January 13, 2020 (USD 19,083 million). Since the administration of La Libertad Avanza took office, this stock increased by USD 4,945 million or 35%, from USD 14,126 million on Thursday, December 7, 2023.

4) More dollars for imports. Since August 1, energy-related goods, pharmaceutical products, other goods related to health care, fertilizers, phytosanitary products intended for local production, basic consumer basket products, luxury goods and finished cars have access to the MLC starting 90 days after their customs entry registration. The rest of the products - more than half of the imports - have access to foreign currency from the wholesale market to be paid in two installments, one starting 30 days and the second starting 60 days after their customs entry, for 50% each.

By allowing importers greater and faster access to foreign currency , complemented by the reduction of the PAIS tax rate by 10 points - from 17.5% to 7.5% - the Central Bank acknowledged that "it reduces the transfer to prices of the higher cost associated with the current calendar, which forced those companies that did not obtain commercial financing from their suppliers to pay them through the parallel exchange market." Therefore, everything leads to decompressing the demand for dollars in the stock market , which facilitates the stabilization of alternative quotes.

What do analysts say?

Analyst Salvador Di Stéfano told Infobae that “I have been predicting a fall in the dollar for some time now. We are in the process of money laundering and many dollars are going to appear together, which makes it very likely that the 'blue' dollar will fall to the levels of the MEP and the 'contado con liqui' or that it could even break through that value. The reality is that we are going to have a very important sale of dollars in the coming months if the money laundering is really successful. Every fall in the dollar tells you that the money laundering is successful. Every rise in dollar deposits is telling you that the money laundering is going to be successful.”Furthermore, Di Stefano calculated that “if the PAIS tax were lowered today, the import dollar would be at $1,021, while the export blend dollar would be at $1,018.50. The PAIS tax for services will be eliminated on December 23, 2024, when the 7.5% country tax on goods will also be eliminated. This will allow many goods to go down in price, and the Argentine economy will benefit and become more competitive.”

Gustavo Ber , an economist at Estudio Ber, said that "despite the expectations raised by this event, financial dollars continue to be flat, given that short-term flows - mainly due to tax factors - continue to play in their favor, and eventually when demand heats up, interventions immediately appear - within the sterilization plan - to regulate these references, and thus extend the climate of exchange rate calm."

Jorge Vasconcelos, Chief Economist at IERAL of the Fundación Mediterránea, considered that “the unification of the exchange rate would imply a devaluation of the peso with respect to the current parity in the official market, but not of a significant magnitude given the strict control of public spending and the current indicators of the external sector.”

The experts at Portfolio Personal Inversiones assessed that “the reduction of the PAÍS tax, together with the signals given with the Treasury tender menu, reinforce the view that the Government would seek to delay the exchange rate unification until after the mid-term elections. Additionally, the question remains open about the intention to close the gap “from top to bottom”. That is, that the different exchange rates of the economy converge to the official dollar and not the other way around, as usually happens. The million-dollar question is whether the external sector “closes” to the official exchange rate that is projected with a crawling of 2% and an inflation that is at least a few months away from reaching that speed.”

Soledad López , Head of Development at Rava Bursátil, commented that “the interest in money laundering is huge. We have been thinking for some time that money laundering is going to be a success. The Central Bank will at some point publish the amounts that are coming in. There is still no official information but there is a growth in dollar deposits.”

“In the coming days, the market will closely monitor the dynamics of the MULC following the Government’s announcement that it will reduce the PAIS Tax rate for imports of goods and freight starting in September. We believe that, so far in August, the expectation of this reduction has led to a lower demand for foreign currency by importers, but that it could increase once the lower import dollar is effective,” added Juan Manuel Franco , Chief Economist of the SBS Group.