All the Answers

Well-known member

The Government announced that it achieved a fiscal surplus of $3.5 billion in August - Infobae

Source:

El Gobierno anunció que alcanzó un superávit fiscal de $3.500 millones en agosto

El ministro de Economía Luis Caputo anticipó que el sector público nacional tuvo un excedente primario de 0,9 billones de pesos. En lo que va del año acumula 1,5% del PBI de superávit primario y 0,4% fiscal

September 19, 2024

The Minister of Economy, Luis Caputo, anticipated that the national public sector had a primary surplus of 0.9 trillion pesos. So far this year, it has accumulated a 1.5% primary surplus of GDP and a 0.4% fiscal surplus.

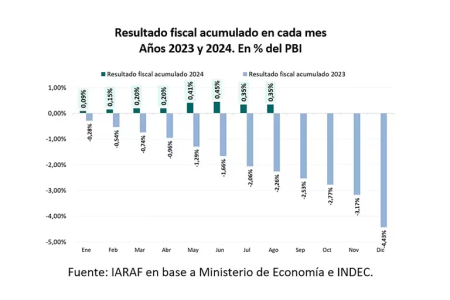

The accumulated primary surplus is 1.5% of GDP in the first eight months of the year and 0.4% of GDP taking into account debt interest expenses (Reuters)

Economy Minister Luis Caputo announced that the national public sector ended August with a primary surplus of almost $890 billion , and that after the payment of debt interest it ended with a financial surplus of $3.5 billion . “In this way, the fiscal anchor of the government program continues to be consolidated ,” indicated the Ministry of Finance.

You may be interested in:Another private indicator confirms that mass consumption fell by nearly 17% in August

This would imply an accumulated surplus of 1.5% of GDP in the first eight months of the year and 0.4% of GDP taking into account debt interest expenses. “The financial surplus achieved last month contrasts with the deficit recorded in August 2023, which at current prices was equivalent to almost $1,300,000 million,” Caputo reported.

Regarding revenue, the Ministry of Economy estimated that in August it was 8.7 trillion pesos, which implies an interannual increase of almost 190 percent, below the rate of inflation. “With regard to tax collection, it showed a growth of 199.6% explained mainly by the variation of the PAIS Tax and the income corresponding to Contributions and Contributions to Social Security (215.0%) and Export Duties (317.4%),” they stated, always with nominal numbers.

"Among the taxes linked to domestic economic activity, it is worth mentioning the collection corresponding to the Tax on Debits and Credits (232.2%), the VAT net of refunds (188.1%), and the Income Tax (142.0%)," they continued.

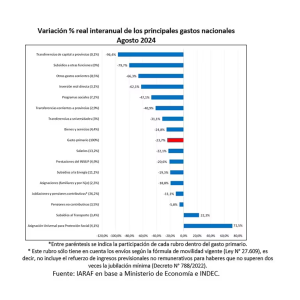

In terms of expenditure, they amounted to $7.8 billion, an annual increase of almost 157 percent. Spending on pensions and social benefits grew by 202.7%, which also implies a fall in real terms. Public salaries fell by 162.4 percent, so the trend was the same.

“Economic subsidies increased by $752.726 billion (192.2%), with energy subsidies increasing by $550.289 billion (171.7%), while those for transportation increased by $204.172 billion (311.7%),” continued the Ministry of Finance.

“From the analysis of the cash-based budget execution of the Non-Financial National Public Sector (SPNNF) for the month of August, it emerges that total income had a negative real year-on-year variation of 14%. This is due to the fact that tax income fell by 11% in real terms year-on-year and the drop in non-tax income was 40% in real terms year-on-year,” stated a report by Iaraf. “On the side of primary expenditure, a 23.7% real year-on-year reduction was recorded,” they estimated.

“The fiscal adjustment rate was 27% in the previous month and 33% in June. The most notable points so far this year were the 39% reduction in spending in March and, at the other extreme, a 22% drop in April,” said Nadin Argañaraz , an economist at the consultancy firm .

“During the first 8 months of the year, total revenues fell by 6% in real terms year-on-year, while primary expenditure fell by 30% in real terms year-on-year. As a result, the primary surplus amounted to $8.7 trillion , equivalent to 1.5% of GDP. The fiscal surplus, for its part, amounted to $2 trillion , equivalent to 0.35% of GDP,” he calculated.

August was the last month in which the Government had the PAIS tax at a rate of 17.5 percent. It coincided with a month of weak tax collection , which according to the consulting firm 1816 with data from AFIP implied a contraction of the income to the treasury of 13.7% in real terms.

The last day of September will mark the last fiscal surplus target that Argentina committed to and the Government will seek to remain in compliance zone in a month that will be more complex for public accounts due to a double effect that acts in opposite directions: the reduction of the PAIS tax will affect tax collection that already showed signs of weakness in August; and an increase in income due to measures such as the recomposition of Profits or the tax moratorium.

According to the latest data available for August, the primary surplus of $ 8.7 billion was well above the guideline set in the program. This number is the one that will be observed in the technical round-trip that is expected to begin in the coming weeks, after the summer recess in the United States that interrupted activity in international organizations. These conversations could channel a disbursement, the second to last of this program, for USD 540 million .

But at the end of the month, the target scheme will end. The reserve target, as reflected by Infobae, will require an extra effort to collect dollars from the Central Bank. The fiscal target has a better profile, since with the data up to July the primary surplus level, before the payment of debt interest and which is the number that the IMF will take into consideration, is almost a billion pesos above the September target.