All the Answers

Well-known member

The IMF removed a key director questioned by Milei from negotiations with Argentina - Infobae

Source:

El FMI desplazó de las negociaciones con la Argentina a un director clave cuestionado por Milei

Se trata de Rodrigo Valdés, director del Departamento del Hemisferio Occidental del organismo y, hasta ahora, principal funcionario a cargo del programa argentino. Había sido apuntado por el Presidente argentino por tener “mala intención”

September 12, 2024

This is Rodrigo Valdés, director of the Western Hemisphere Department of the organization and, until now, the main official in charge of the Argentine program. He had been singled out by the Argentine President for having “bad intentions.”

By Augustin Maza and Mariano Boettner

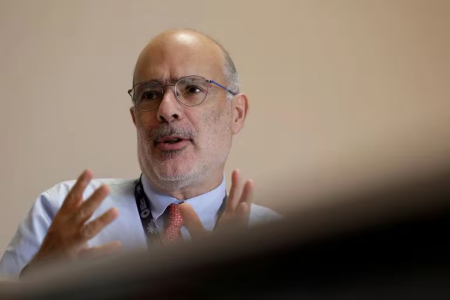

Argentine President Javier Milei and the director of the Western Hemisphere Department of the IMF, Rodrigo Valdés

The director of the Western Hemisphere Department of the International Monetary Fund (IMF) , Rodrigo Valdés , has withdrawn from negotiations with Argentina, the organization announced during a press conference on Thursday. The Chilean economist had been until now the main negotiator with the country and was accused by President Javier Milei of having “bad intentions” towards his government.

The talks were led by Luis Cubbedu , Deputy Director of the Fund's Western Hemisphere Department, and Ashvin Ahuja , Chief of Mission for Argentina, who report directly to the management team headed by Director Kristalina Georgieva and her deputy, Gita Gopinath .

“To better support ongoing constructive engagement with the Argentine authorities, Western Hemisphere Director Rodrigo Valdez has fully delegated program negotiations to Luis Cubeddu , Deputy Director of the Western Hemisphere Department, and Ashvin Ahuja , Chief of Mission for Argentina, whose work is directly supervised by IMF management,” IMF spokesperson Julie Kozack said .

Recently, Milei had publicly attacked Valdés in harsh terms for his alleged complicity with the former Minister of Economy, Sergio Massa , and according to this media, talks were underway between the Argentine Government and representatives of the organization to remove him from the discussions.

“Rodrigo Valdés has obvious bad intentions. He doesn’t want Argentina to do well. He has another agenda”

“There was complicity between the head of the Argentine mission of the IMF and the previous government. Rodrigo Valdés has obvious bad intentions. He doesn’t want Argentina to do well. He has another agenda. We are over-compliant with everyone but they preferred to support Massa’s disaster. Why did the IMF allow Massa to do everything? We over-comply with everything and they are always putting objections. He supported Massa’s entire disaster and he is doing to us what he did to us,” Milei said.

The director of the Western Hemisphere Department of the International Monetary Fund (IMF), Rodrigo Valdés (REUTERS/Susana Vera)

Asked whether these statements could harm the negotiations with the international organization, the head of state responded: “It is not my boss, my boss is the Argentine people. It is a decision of the IMF, who knows why the IMF put us in a Sao Paulo Forum there. We over-fulfilled everything and they are putting objections all day long. The IMF had a set of goals, we set stronger goals and we over-fulfilled ours.”

The Extended Fund Facility (EFF) program is coming to an end in the coming weeks, as the last cut-off date for reserve, fiscal and monetary emission targets of the program that began in 2022 under the government of Alberto Fernández and was continued, in this last year of validity, by that of Javier Milei, will take place.

The goals of currency accumulation in the Central Bank and fiscal surplus will be the most closely watched, since the monetary objective, which implied a limit on the financing of the Treasury through the BCRA, was met when the Executive Branch cut off this path of monetary expansion to zero.

According to a survey by the consulting firm PxQ, the public sector had reached a primary surplus, before debt interest payments - which is the figure taken into consideration by the IMF - of $6.9 trillion at the end of June. The target for that cut-off date was $4.6 trillion.

According to the latest available data, as of July, the primary surplus of $7.8 billion was well above the guideline set in the program. This number is the one that will be observed in the technical back-and-forth that began in recent days. These conversations could channel a disbursement, the second to last of this program, of USD 540 million.

But at the end of the month, the target scheme will end. The reserve target, as reflected by Infobae, will require an extra effort to collect dollars from the Central Bank. The fiscal target has a better profile, since with the data up to July the primary surplus level, before the payment of debt interest and which is the number that the IMF will take into consideration, is $167 billion above the September target.

International Monetary Fund (IMF) Managing Director Kristalina Georgieva and Argentina's President Javier Milei talk before a working session at the G7 summit in Borgo Egnazia, Italy, June 14, 2024. REUTERS/Louisa Gouliamaki

Officials prefer not to say whether the upcoming negotiations will be more or less frictional, but they assert, defensively, that the Fund raises objections to the economic plan despite the Government having met its goals, and they see a different yardstick compared to the Frente de Todos administration, which ended its mandate with a program outside any zone of compliance with objectives.

Of course there is a difference, and that is that the IMF would be tougher in its demands in view of the possibility of increasing its debt exposure to Argentina, something that it will have to be able to justify to its board of directors and shareholder countries. The bureaucracy of the IMF will return to activity after the summer recess in the United States and will resume its agenda, which will soon have a stopover in Buenos Aires.

In this context, the market still has a cloud of doubts about the continuity of the economic program and this is reflected in the country risk. Will the new phase come with a contribution of dollars from the International Monetary Fund or not? And even more relevant: What will the IMF ask for in exchange for fresh funds?

Various market reports addressed precisely this question and sought answers in the latest agreements signed by the organization. A report by the consultancy firm 1816 stated that “a priori we think that there will not be a new program (which is what would be needed to have disbursements from 2025) unless the exchange market is freed, a prior action required by the Fund to approve recent disbursements to Egypt and Ethiopia.”

In a more extensive report, PxQ stated that “The organization's 'manual' is not very different from that of the past: the arrival of financing is conditional on the implementation of a currency unification, elimination of trade and capital account controls, implementation of clear rules of intervention and contractionary monetary policy (increase in interest rates) to contain the inflationary effect.”

“The Fund will ask for some extra effort to grant new disbursements. Based on the agreements with the three countries, eliminating exchange controls will most likely be an unavoidable condition for accessing a new agreement and more disbursements. As the government already aims to lift the restrictions and eliminate the country tax, this should not be an obstacle. It will also be important to meet the goals in the two remaining reviews of the current program,” FMyA said.