BuySellBA

Administrator

The last installment of the Provincial property tax will have an additional 100%: who should pay it? - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

The ARBA property tax will have an updated value in installment 5 with an additional fee, but it would not reach all taxpayers

By Candle Contreras

ARBA: quota 5 will have a 100% increase Freepik

The amount of the last installment of the urban property tax in the province of Buenos Aires is now known , in which the amount to be paid generates concern among taxpayers: the figure that is published doubles the value of the previous installment and exceeds the accumulated inflation so far this year .

According to Arba, 9% of real estate items will be impacted by this additional fee, which may not exceed 20% of the total annual tax and represents an increase of around 100% of the last fee . This extra is applied -according to the tax law- when in the urban real estate tax on buildings the taxable base corresponding to the property or the sum of the taxable base of all of them, exceeds $31,465,000. For the rest of the taxpayers, the fee will have the same value as the previous ones .

It should be noted that the taxable base should not be confused with the fiscal valuation or the market value . According to Arba's information to LA NACION, properties with a taxable base of more than $31,465,000 are equivalent to a market value of around US$650,000. However, there are taxpayers with properties whose market value is much lower but who are still receiving this additional fee, since their taxable bases exceed $31,465,000.

To calculate the taxable base of a property and know if a taxpayer enters within the percentage that must pay the extra fee, the fiscal valuation must be multiplied by the coefficient 11.41876 . Therefore, when making the calculation , all properties in the province of Buenos Aires that have a fiscal valuation less than $2,755,553 would not be impacted by the additional .

"I went to the ARBA website to see the amount of the last installment to be paid and the next payment is listed for October 10th for double what I paid in August."

ARBA explains that it is not an increase but rather the increase in the amount “is equivalent to an additional fee,” and they base this on the Tariff Law, which establishes that the responsible areas of the Government can decide to apply an additional amount to certain goods and services. Therefore, “ the value reflected in installment 5 does not represent a 100% adjustment on the previous one , but is an additional fee that is added to this installment ,” they say from the organization. This increase, one way or another, hits taxpayers hard in the pockets and is not broken down on the bill or on the taxpayer's website but rather represents an additional amount included in the amount of installment 5 and must be paid on the October due date .

To understand the amount to be paid at the next due date, below you can see two specific cases of real updates to the property tax :

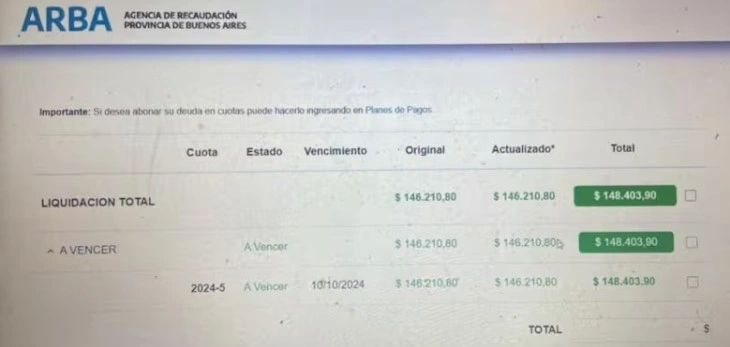

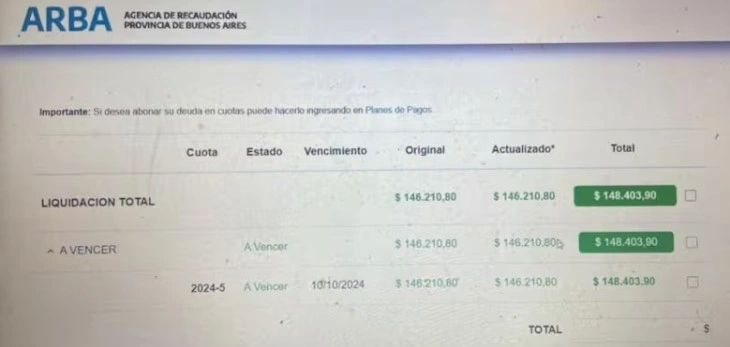

A real case: this taxpayer was paying around $70,000 and now he will have to pay $148,403

Now, many are wondering what happens to those who paid the tax annually . In this case, taxpayers who paid the tax in advance will have to pay that additional fee, which, like the 5th fee, also expires on October 10.

This taxpayer paid the entire tax in advance at the beginning of the year and received the "extra fee" to pay next month

However, the agency assures that the additional fee has nothing to do with inflation but with what the tax law enables to do in article 138, which establishes the additional payment for those properties of the built urban area, both in its basic and complementary component, whose taxable base of the property or of the set of them, exceeds $31,465,000.

The situation is aggravated by the elimination of benefits for on-time payment and the adoption of electronic receipts or automatic debit , which further increased the value of the property tax for those who regularly met their tax obligations.

ARBA regulated the determination of the coefficient through Normative Resolution 8/2024 and its amendment, Normative Resolution 12/2024, but without establishing the formula or giving details on its calculation. “This last resolution caused greater uncertainty because it indicated that the collection agency will establish the update coefficient according to the weighting of the economic variables that it performs, up to the limit provided for in the law,” explains Domínguez. In other words, the way in which the adjustment would be made was changed, but the new formula had not been established nor had details been given on its calculation. Before this resolution, the five installments that were paid for the property tax were equal.

Before the 2024 resolution, the five installments of the property tax were equal.Archive

Domínguez explains what happens if the owner has more than one property in the province of Buenos Aires: “Each property is analyzed separately and then it is examined in which scale it falls according to the sum of taxable bases to determine the increase that corresponds to it.”

In the city of Buenos Aires, this same tax is updated based on the Consumer Price Index (CPI) of the same city. In detail, the index is applied from five months back. For example, in January 2024, the CABA CPI for August 2023 is applied, in February, the one for September, and so on.

For the specialist, the General Paz dividing line defines how abrupt the impact of the increase is. “ In the city there is an update but it is not as abrupt as the one intended in the Province ,” he says.

www.buysellba.com

Source:

La última cuota del impuesto inmobiliario de Provincia tendrá un adicional del 100%: quiénes deberán pagarlo

El impuesto inmobiliario de ARBA tendrá un valor actualizado en la cuota 5 con un adicional, pero no alcanzaría a todos los contribuyentes

The ARBA property tax will have an updated value in installment 5 with an additional fee, but it would not reach all taxpayers

By Candle Contreras

ARBA: quota 5 will have a 100% increase Freepik

The amount of the last installment of the urban property tax in the province of Buenos Aires is now known , in which the amount to be paid generates concern among taxpayers: the figure that is published doubles the value of the previous installment and exceeds the accumulated inflation so far this year .

According to Arba, 9% of real estate items will be impacted by this additional fee, which may not exceed 20% of the total annual tax and represents an increase of around 100% of the last fee . This extra is applied -according to the tax law- when in the urban real estate tax on buildings the taxable base corresponding to the property or the sum of the taxable base of all of them, exceeds $31,465,000. For the rest of the taxpayers, the fee will have the same value as the previous ones .

It should be noted that the taxable base should not be confused with the fiscal valuation or the market value . According to Arba's information to LA NACION, properties with a taxable base of more than $31,465,000 are equivalent to a market value of around US$650,000. However, there are taxpayers with properties whose market value is much lower but who are still receiving this additional fee, since their taxable bases exceed $31,465,000.

To calculate the taxable base of a property and know if a taxpayer enters within the percentage that must pay the extra fee, the fiscal valuation must be multiplied by the coefficient 11.41876 . Therefore, when making the calculation , all properties in the province of Buenos Aires that have a fiscal valuation less than $2,755,553 would not be impacted by the additional .

"I went to the ARBA website to see the amount of the last installment to be paid and the next payment is listed for October 10th for double what I paid in August."

Neighbor of Escobar

The procedure used to determine the adjustment coefficients generated controversy: between the first installment of the tax that expired in February and the second installment that expired in April , there was an increase equivalent to 20% . Meanwhile, installments 3 and 4 that expired in June and August did not suffer increases . But the last installment , which will expire in October, reflects an amount of 100% more than the previous ones (2, 3 and 4) because an additional installment is added.ARBA explains that it is not an increase but rather the increase in the amount “is equivalent to an additional fee,” and they base this on the Tariff Law, which establishes that the responsible areas of the Government can decide to apply an additional amount to certain goods and services. Therefore, “ the value reflected in installment 5 does not represent a 100% adjustment on the previous one , but is an additional fee that is added to this installment ,” they say from the organization. This increase, one way or another, hits taxpayers hard in the pockets and is not broken down on the bill or on the taxpayer's website but rather represents an additional amount included in the amount of installment 5 and must be paid on the October due date .

To understand the amount to be paid at the next due date, below you can see two specific cases of real updates to the property tax :

- One case, for example, is that of a taxpayer who had a first installment due in February 2024 with a value of $90,474. The second installment, which was due in April, rose to $108,568, reflecting an increase of 20%. Installments 3 and 4, which were due in June and August respectively, did not undergo changes in their value. However, in installment 5, due in October, $217,434 must be paid, which represents an increase of just over 100% compared to the previous payment for the additional tax .

A real case: this taxpayer was paying around $70,000 and now he will have to pay $148,403

Now, many are wondering what happens to those who paid the tax annually . In this case, taxpayers who paid the tax in advance will have to pay that additional fee, which, like the 5th fee, also expires on October 10.

This taxpayer paid the entire tax in advance at the beginning of the year and received the "extra fee" to pay next month

Does this increase accompany inflation?

According to the National Institute of Statistics and Censuses (INDEC) , the accumulated inflation until July 2024 was 87%. “If the inflation of the next two months remains at levels of 4% per month, it is estimated that the accumulated inflation to September will be 102.25%,” explains Sebastián Domínguez, CEO of SDC Tax Advisors. If so, with these forecasts, in installment 5 of ARBA, there is a 140% more to pay with respect to installment 1 , considerably exceeding the inflation projected for the same period .However, the agency assures that the additional fee has nothing to do with inflation but with what the tax law enables to do in article 138, which establishes the additional payment for those properties of the built urban area, both in its basic and complementary component, whose taxable base of the property or of the set of them, exceeds $31,465,000.

The situation is aggravated by the elimination of benefits for on-time payment and the adoption of electronic receipts or automatic debit , which further increased the value of the property tax for those who regularly met their tax obligations.

Changes in property tax

The 2024 tax law , passed in 2023, established that ARBA would have the power to apply an update coefficient to the real estate tax rates - in its basic and complementary components - and the motor vehicle tax - with respect to motor vehicles and sports or recreational vessels -, with a limit that could not exceed the interest rate of the Bank of the Province of Buenos Aires , in 30-day discount operations, increased by up to 100%.ARBA regulated the determination of the coefficient through Normative Resolution 8/2024 and its amendment, Normative Resolution 12/2024, but without establishing the formula or giving details on its calculation. “This last resolution caused greater uncertainty because it indicated that the collection agency will establish the update coefficient according to the weighting of the economic variables that it performs, up to the limit provided for in the law,” explains Domínguez. In other words, the way in which the adjustment would be made was changed, but the new formula had not been established nor had details been given on its calculation. Before this resolution, the five installments that were paid for the property tax were equal.

Before the 2024 resolution, the five installments of the property tax were equal.Archive

Who pays the property tax?

In all properties , the payment of the property tax corresponds to the owner . In the case of rentals, according to the contracts signed under the now repealed law, the property tax was the responsibility of the owners, so those who have current contracts signed under the rental law sanctioned in July 2020 and repealed in December 2023 but which remain in force until its completion, it will be the owner who will have to assume this additional cost.Domínguez explains what happens if the owner has more than one property in the province of Buenos Aires: “Each property is analyzed separately and then it is examined in which scale it falls according to the sum of taxable bases to determine the increase that corresponds to it.”

In the city of Buenos Aires, this same tax is updated based on the Consumer Price Index (CPI) of the same city. In detail, the index is applied from five months back. For example, in January 2024, the CABA CPI for August 2023 is applied, in February, the one for September, and so on.

For the specialist, the General Paz dividing line defines how abrupt the impact of the increase is. “ In the city there is an update but it is not as abrupt as the one intended in the Province ,” he says.

www.buysellba.com