BuySellBA

Administrator

The sale of building materials decreased by 11.2%: When is a recovery expected - Infobae

Source:

Disminuyó un 11,2% la venta de materiales para edificar: cuándo se espera una recuperación

Así lo confirmó el Índice Construya (IC) que mide la evolución de los volúmenes vendidos al sector privado por las empresas participantes. El relevamiento también marcó que se mantuvo un 40% por debajo del nivel de marzo de 2023

April 9, 2024

This was confirmed by the Construya Index (IC), which measures the evolution of volumes sold to the private sector by participating companies. The survey also noted that it remained 40% below the level of March 2023

By José Luis Cieri

Although private works continue at a slower pace due to increases in costs, the biggest problem is observed in public works, where there is an almost complete paralysis that complicates the sales of materials.

The crisis and paralysis of public works are negatively influencing the acquisition of construction materials. The sale of building supplies experienced a decrease of 11.2% last March, according to monthly seasonally adjusted data provided by the Construya Index (IC).

This index, which tracks the evolution of volumes sold to the private sector by the companies that comprise it, also revealed a drop of 40% compared to the same period in 2023.

“In March the drop in demand for inputs continues, due to the reduction in public works construction and expectations about the evolution of our market,” explained Construya, a civil association that brings together several national companies dedicated to the production and marketing of materials.

These figures reflect a challenging situation for the sector, since the cumulative figure from January to March closed 31.6% below the same period in 2023, signaling a persistent downward trend in activity.

Pedro Brandi , president of Grupo Construya, created in 2002, told Infobae that “since October of last year, sales of construction materials registered a downward trend, affecting both thick materials (such as cement, lime or sand) as well as finishing (floors, faucets, painting, among others) equally. “This decline in sales is primarily attributed to the current economic recession.”

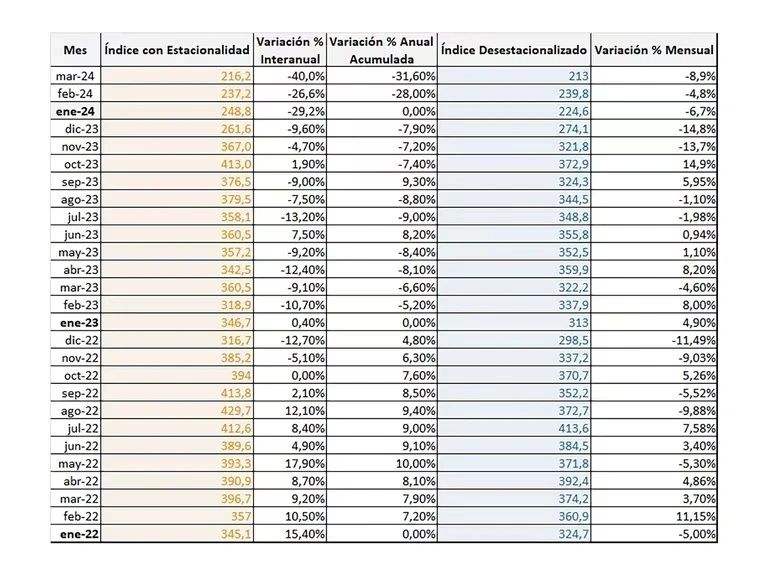

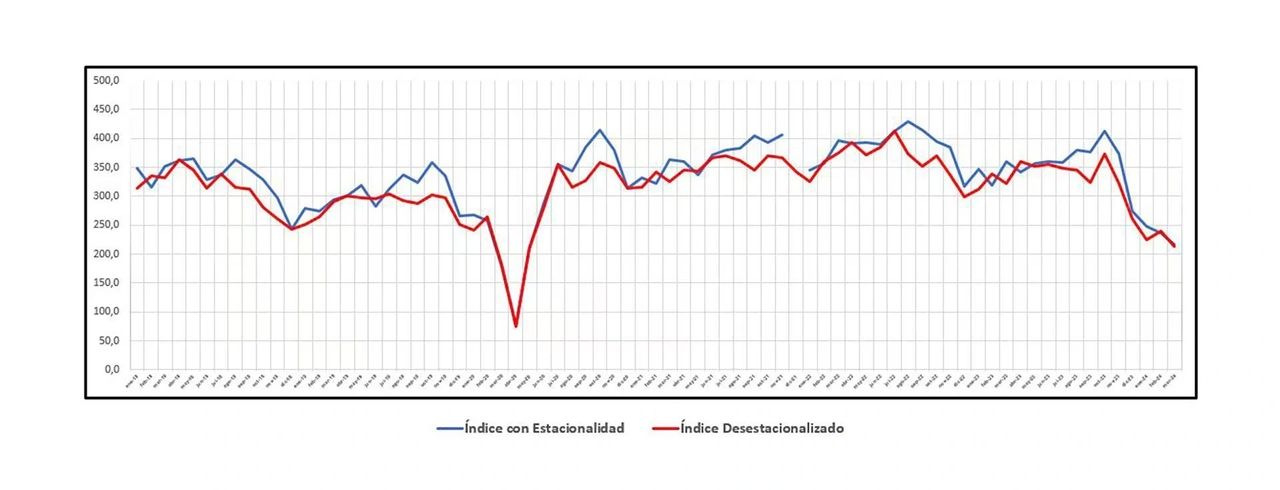

Situation table of the Construya Index in the last two years (Source: Grupo Construya)

It is important to keep in mind that the level of activity in the construction sector usually increases or decreases approximately 2.5 times faster than the evolution of the Gross Domestic Product (GDP) in response to changes of up to 3.5 percentage points. “In the face of more significant variations in GDP, the construction industry tends to adjust at rates higher than 3%,” Brandi said.

The sale of construction materials is experiencing a general decline in all products, attributable to a series of factors, including the perception of recession in the economy and the increase in construction costs, which slows down the progress of works and reduces the start of new projects.

The recession and high construction costs create an unfavorable environment for the sector. This increase in the cost of construction, combined with the lack of adjustment in sales prices, discouraged the demand for goods

Damián Tabakman , president of the Business Chamber of Urban Developers, highlighted that “the increase in late payments, particularly in the context of fees with adjustment by Index of the Argentine Chamber of Construction (CAC) in trusts in operation, contributed to a slower pace in the completion of works, which translates into lower sales of construction materials in the public sector in general.”

When would the situation be reversed?

According to the Association of Construction SMEs (Apymeco), the current construction cost is $1,161,766.47 per square meter, which represents an increase of 288.4% year-on-year. However, a decrease in the price of certain materials is observed due to lower sales; For example, paints, fixtures, machines and coatings decreased between 7% and 12% when comparing March with February.

Source: Grupo Construya

This situation responds to the usual dynamics of supply and demand, especially in a context of high construction costs and a stable exchange rate.

“It is important to highlight that the prices of materials increased considerably even before the devaluation, and showed no signs of decrease after it,” said Carlos Spina , head of the Association of Housing Entrepreneurs.

From the sector they emphasized that it is key to reactivate activity because jobs are also at risk.

Spina added: “The exit from the stocks, incipient investments and single-digit monthly inflation are part of a normalization process that will take time. The increase in the value of assets, as has been happening in the financial sector, could serve as a stimulus to accelerate this process beyond expectations.”

Construction is expected to be driven by various factors, including economic stability, growth, the purchasing power of the population, employment stability, low interest rates, access to long-term credit and investment in public works.

It is demanded that all public works be resumed, including those of the Procrear II plan

Brandi added: “These conditions could gradually begin to manifest starting in the last quarter of the year.”

The sale of materials is waiting for improvements that can reactivate the activity. Uncertainty persists about when it will happen and the segment maintains that the Government is making the necessary efforts to stabilize the economy.

Tabakman concluded: “When the sale of materials will improve is difficult to know, the Government is very well on its way. And if what needs to be done is done, it is possible that it will bring results in the next semester and that the economy will begin to rebound. Hopefully this will be the case and our sector, which is procyclical, should benefit. We believe that it is vital to progressively return to mortgage credit starting in the second half of the year, which is likely for various reasons, among others because banks no longer have the possibility of continuing to issue debt to the State and will have to look to the real economy. . Furthermore, the real estate sector is always seen favorably to place financial funds. So let's hope to reverse the trend, although it won't be so fast."

www.buysellba.com