The strong price increases slowed consumption in supermarkets and some promotions are slowly returning - Infobae

Source:

www.infobae.com

www.infobae.com

January 10, 2024

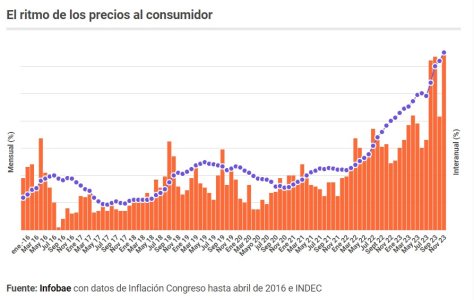

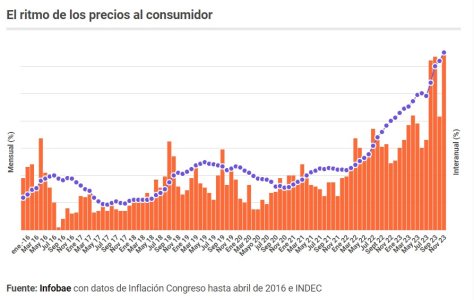

Tomorrow Indec will release December inflation, which would be around 25%, and a similar figure is expected for this month. How it impacts sales and what companies analyze and anticipate.

By Natalia Donato

Supermarket chains warn that in the first days of January there is a drop of up to 15% in units compared to the same period in 2023

Although the December sales data in supermarket chains will be positive – this is what the consulting firms that carry out these measurements estimate – the slowdown in consumption as a result of the inflationary acceleration began to be perceived already in the last week of the month. During those days before New Year's, one of the usual times of greatest demand for food, especially those alluding to the Holidays, sales in large chains fell about 2% compared to the same week of the previous year; a sign that the pocket crisis began to be felt. In this way, 2024 started with a coldness that has been sustained, or even worsened, in these first ten days of January, even in the tourist cities par excellence, supermarket sources assured.

The price increases in the large chains have intensified since the president Javier Milei ended the controls (Fair Prices) and there were companies that presented increases of up to 100%. This situation generated a strong dispute between several large suppliers and some chains, which meant that there were still shortages of some brands on the shelves. In some cases, the chain covers itself and, through a poster, points out the “disproportionate increases” of some suppliers.

The truth is that beyond the resistance of some chains with certain suppliers, the increases applied during December exceeded 100% in many cases and this immediately translated into a drop in sales. It was not immediate because consumption accumulated a positive inertia, added to the fact that December is the month of the Holidays and in which salaries are increased by the bonus. Therefore, although the recessionary effect did not take long to arrive with the sharp rise in prices, as the first two weeks were good for the chains, the month would have ended positive around 9% in the modern channel, according to preliminary data from the consulting firm Scentia.

Sources from the firm specified that although the performance of the traditional channel (independent warehouses and supermarkets) is still unknown, the figure would have to be very negative for the chains' data to be reversed. But in January the scenario would be different. According to information from several supermarkets, year-on-year losses so far this first month of the year range between 10 and 15 percent.

“The positive data for December was going to occur because of what happened in the first two weeks. After the 10th it slowed down noticeably. Then it resumed a little on the 24th, and afterward many people left for the Coast, where little movement is being seen,” they noted on a network. Regarding the evolution of sales during January, he added that "it started weakly, with a slower pace than expected" and that "some promotions that were not there before are beginning to return, stronger in some categories to move units." For example, quotas on some electronic products and offers on items such as meat and dairy.

The "fronted" gondolas, which predominated so much in recent months, will now return to normal due to the drop in sales and greater delivery from suppliers

The market expects that this start of some promotions will become more acute in the next two or three months, "when volumes fall sharply and the fight between suppliers and chains over price lists ends." “When that happens, the industry is going to relax a little this war it has with the supermarkets and they are going to activate the promos so as not to lose so much,” said a consultant.

In another chain they agreed that promotional activations will begin to be seen, but “maintaining the regular price” of the products. “What is going to start to be seen, more towards the end of January surely, are circumstantial price drops,” said a source from that retailer. On the other hand, he stressed that the prominence of own brands or second brands will also return, which were stagnant due to price controls - which meant that there was no difference with the first brands - and lately due to the lack of deliveries by suppliers. .

Regarding the price gap between the chains and independent self-service stores, the market expects it to be reduced because the supplier companies, once the controls were released, sought to equate the lists between both channels to prevent further generation. distortions. Until December, the gap remained at about 40 points - when measuring a comparable basket - but a reduction in that difference is expected this month. “Anyway, prices in neighborhood businesses also rose a lot, so the gap is not going to go down from 40 to 10,” they considered at Scentia.

Source:

Las fuertes subas de precios frenaron el consumo en los súper y de a poco vuelven algunas promociones

Hoy el Indec dará a conocer la inflación de diciembre, que rondaría el 25%, y una cifra similar se espera para este mes. Cómo impacta en las ventas y qué analizan las empresas y cadenas hacia adelante

January 10, 2024

Tomorrow Indec will release December inflation, which would be around 25%, and a similar figure is expected for this month. How it impacts sales and what companies analyze and anticipate.

By Natalia Donato

Supermarket chains warn that in the first days of January there is a drop of up to 15% in units compared to the same period in 2023

Although the December sales data in supermarket chains will be positive – this is what the consulting firms that carry out these measurements estimate – the slowdown in consumption as a result of the inflationary acceleration began to be perceived already in the last week of the month. During those days before New Year's, one of the usual times of greatest demand for food, especially those alluding to the Holidays, sales in large chains fell about 2% compared to the same week of the previous year; a sign that the pocket crisis began to be felt. In this way, 2024 started with a coldness that has been sustained, or even worsened, in these first ten days of January, even in the tourist cities par excellence, supermarket sources assured.

The price increases in the large chains have intensified since the president Javier Milei ended the controls (Fair Prices) and there were companies that presented increases of up to 100%. This situation generated a strong dispute between several large suppliers and some chains, which meant that there were still shortages of some brands on the shelves. In some cases, the chain covers itself and, through a poster, points out the “disproportionate increases” of some suppliers.

The truth is that beyond the resistance of some chains with certain suppliers, the increases applied during December exceeded 100% in many cases and this immediately translated into a drop in sales. It was not immediate because consumption accumulated a positive inertia, added to the fact that December is the month of the Holidays and in which salaries are increased by the bonus. Therefore, although the recessionary effect did not take long to arrive with the sharp rise in prices, as the first two weeks were good for the chains, the month would have ended positive around 9% in the modern channel, according to preliminary data from the consulting firm Scentia.

Sources from the firm specified that although the performance of the traditional channel (independent warehouses and supermarkets) is still unknown, the figure would have to be very negative for the chains' data to be reversed. But in January the scenario would be different. According to information from several supermarkets, year-on-year losses so far this first month of the year range between 10 and 15 percent.

“The positive data for December was going to occur because of what happened in the first two weeks. After the 10th it slowed down noticeably. Then it resumed a little on the 24th, and afterward many people left for the Coast, where little movement is being seen,” they noted on a network. Regarding the evolution of sales during January, he added that "it started weakly, with a slower pace than expected" and that "some promotions that were not there before are beginning to return, stronger in some categories to move units." For example, quotas on some electronic products and offers on items such as meat and dairy.

The "fronted" gondolas, which predominated so much in recent months, will now return to normal due to the drop in sales and greater delivery from suppliers

The market expects that this start of some promotions will become more acute in the next two or three months, "when volumes fall sharply and the fight between suppliers and chains over price lists ends." “When that happens, the industry is going to relax a little this war it has with the supermarkets and they are going to activate the promos so as not to lose so much,” said a consultant.

In another chain they agreed that promotional activations will begin to be seen, but “maintaining the regular price” of the products. “What is going to start to be seen, more towards the end of January surely, are circumstantial price drops,” said a source from that retailer. On the other hand, he stressed that the prominence of own brands or second brands will also return, which were stagnant due to price controls - which meant that there was no difference with the first brands - and lately due to the lack of deliveries by suppliers. .

Regarding the price gap between the chains and independent self-service stores, the market expects it to be reduced because the supplier companies, once the controls were released, sought to equate the lists between both channels to prevent further generation. distortions. Until December, the gap remained at about 40 points - when measuring a comparable basket - but a reduction in that difference is expected this month. “Anyway, prices in neighborhood businesses also rose a lot, so the gap is not going to go down from 40 to 10,” they considered at Scentia.