All the Answers

Well-known member

The surplus is not touched: Milei ratified the economic direction in the run-up to the university march - Infobae

Source:

El superávit no se toca: Milei ratificó el rumbo económico en la previa a la marcha universitaria

“Ya estamos a mitad de camino” y “esta vez el esfuerzo va a valer la pena” sintentizaron los argumentos con los que el Gobierno pretende dar batalla a las presiones para evitar el ajuste del gasto público

April 23, 2024

“We are already halfway there” and “this time the effort will be worth it” summarized the arguments with which the Government intends to fight the pressures to avoid the adjustment of public spending.

By Virginia Porcella

President Javier Milei and the economic team, yesterday, after the recording of his message

Almost on the brink but without falling into the trap of “the worst is over,” President Javier Milei assured yesterday that “we are halfway there.” The definition has two obvious readings: chainsaw and blender, in a few months half of the hard journey to lower inflation and stabilize the economy was achieved. But the other half is still missing. And it is there where, with the excuse of announcing the result of the public accounts that for the first time in almost 20 years once again show a financial surplus, the president made a firm ratification of the course.

A few hours before the march that promises to be massive and transversal for the cut to the university budget, the message was clear: the surplus is not touched. What's more, he defined the positive result of 0.2% of GDP (about $275,000 million) as an “economic miracle” that responds more to the “chainsaw” than to the blender. Accompanied by the Minister of Economy, Luis Caputo, the president of the Central Bank, Santiago Bausili, the vice president of the entity, Vladimir Werning, and the Secretary of Finance, Pablo Quirno, the phrase seemed to respond to the criticism that has been coming from the market for months and which, in recent days, were also heard from the mouths of former minister Domingo Cavallo or the economist Carlos Rodríguez, at some point references for Milei.

“A worldwide feat” and the description of the zero deficit as a “commandment” completed the heart of a national channel that had generated strong expectations and that targeted multiple recipients. Without a doubt, above all, the message to society regarding that the adjustment effort “this time is going to be worth it,” which from the official perspective is already reflected in figures that the Milei highlighted is the “only starting point to end the inflationary hell.” It is obvious that the message was also clearly political by refusing to increase public spending, which reflects positively on the market where, perhaps today, the problem is different.

The proliferation of versions regarding the announcements was so ambitious, from the exit of the stocks to international credit support at reasonable rates, that probably in light of the presidential statements the strong increases in bonds and stocks that were recorded yesterday seem unjustified, with a drop in country risk that reached 1,200 basis points. Worse, in addition to correcting optimism, investors may perceive some level of “overacting” in order to hide what is likely to be a greater difficulty. The thing is that, although they celebrate the fiscal adjustment and the President's conviction in the zero deficit, it is also a fact that they are beginning to take for granted and that was even known since last week, although without details.

To a certain extent, the same as the Monetary Fund, and in the antipodes of what will happen today in the streets with those who join the university demonstration, the market now expects to see an improvement “in the quality” of the adjustment. That is, less blender and more chainsaw.

(Fountain)

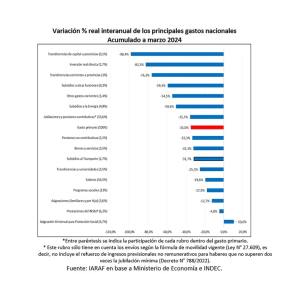

As published by the Ministry of Economy after the presidential speech, in March the primary surplus was $625,034 million and, when adding the payment of debt interest, it had a financial surplus of $276,638 million. According to an analysis by the Institute of Fiscal Analysis (IARAF), in the first three months of the year, 15 of the 16 spending components recorded decreases in real terms, with the exception of the AUH, which increased 10.6%, unlike of what happened with the retirements that only as of this month began to accompany inflation, which is why it is the item that made the greatest contribution to the surplus. Although they were not the only ones: also capital transfers to provinces (-98.4%), real direct investment (-82.5%) and current transfers to provinces (-76.3%) were the other three items that fell the most in real terms.