BuySellBA

Administrator

There are 2,520 beneficiaries of Procrear II Construction line without funds to continue and this month they must decide what to do: what did the government offer them - Infobae

www.infobae.com

www.infobae.com

October 05, 2024

The Secretariat of Territorial Development, Habitat and Housing of the Nation is contacting the beneficiaries to offer them an alternative that allows them to continue with the construction of their homes. Those who have already started their works, now paralyzed, are raising their claims

By Jose Luis Cieri

The Government's intention is that the beneficiaries of the Procrear II Construction line can resume their unfinished works

The Secretariat of Territorial Development, Habitat and Housing of the Nation recently informed 2,520 beneficiaries of the Procrear II Construction Line program that the disbursements of their building loans will no longer be made as before. The “Chainsaw” and the lack of resources to maintain state financing impacted the housing sector.

By the end of 2023, the previous government had granted 2,520 Procrear loans at zero interest rates, a measure that, according to the current authorities, was irresponsible and - together with other electoral announcements - contributed to increasing public spending, the fiscal deficit and inflation.

Given the lack of funds to continue with these disbursements, the secretariat headed by Rodrigo Aybar proposed converting mortgage loans into personal loans, a conversion that would allow the beneficiaries (who started works that are currently unfinished) to cancel the mortgage and request a new mortgage loan from any bank if they so wish. The proposal includes a six-month grace period for the return of the nominal capital under the original conditions of the disbursements already made.

This period seeks to alleviate the financial burden of beneficiaries who choose to accept the offer, giving them time to manage new financing with one of the more than 20 financial institutions that currently offer mortgage loans.

The deadline for accepting this offer expires on October 30, 2024. Those who do not accept the offer will be subject to the availability of funds, which does not guarantee the continuity of disbursements and will prevent them from accessing other mortgage loans available on the market.

To ensure that beneficiaries understand the implications of waiving pending disbursements and possible claims, the Secretariat of Territorial Development, Habitat and Housing of the Nation has enabled communication channels through email ( desarrollosurbanísticos@hipotecario.com.ar ) and telephone consultations.

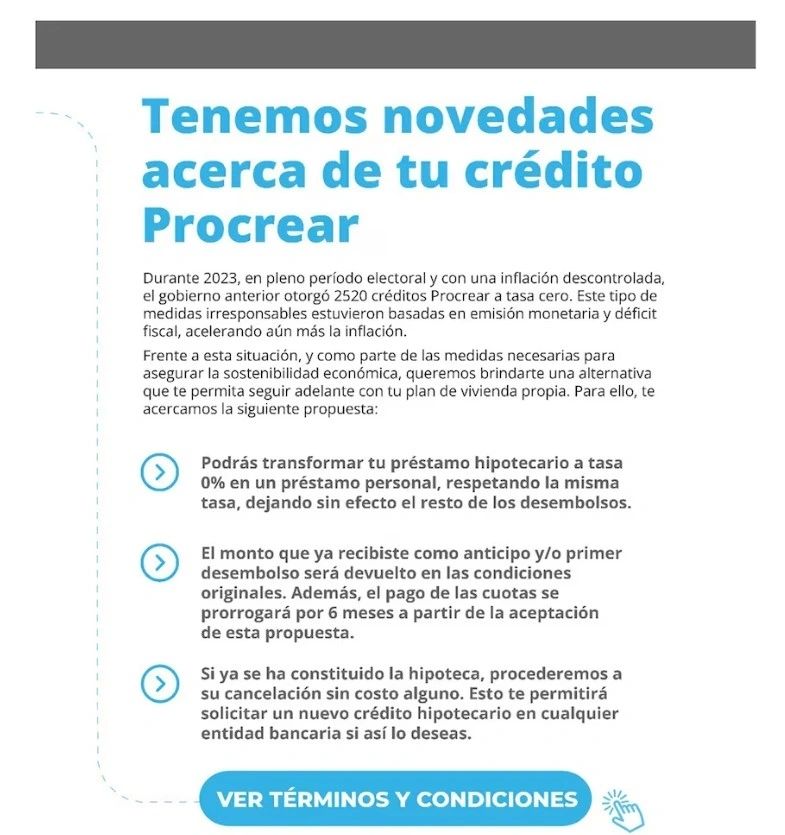

The terms and conditions of the proposal are clearly specified to clear up any doubts that may arise (see image below).

Source: Secretariat of Territorial Development, Habitat and Housing of the Nation

According to the authorities, this measure is necessary to ensure the economic sustainability of the country, allowing beneficiaries to continue with their housing plans in a context of financial constraints.

Although it is estimated that there are more than 8,000 homes under construction, many beneficiaries, faced with the lack of new disbursements, are becoming pessimistic and looking for alternatives to finance their projects.

In September and October 2023, beneficiaries received late advance payments of 30% of the loan, approximately $3 million, out of a total of $10 million. In addition, costs increased substantially due to inflation.

Romina Nievas , who left her home half-built in Paraná, Entre Ríos, expressed her deep concern at the recent request to cancel the signed contract. “This sowed uncertainty, anguish, anger and helplessness among the beneficiaries, who complied with the conditions of the program from the beginning,” she told Infobae.

The program participants were forced to build homes following a specific model and with dimensions required by Procrear, which in many cases, like Nievas', involved mortgaging their land.

Several houses under construction today look like this or with less progress in execution. The beneficiaries of Procrear II will have to initiate other measures to find a solution.

Now, they are being asked to sign a document that lacks clear information about the conditions imposed. There is no clarity regarding the amount of the installments, the possible cancellation of the mortgage or the deadline for delivery of the property deeds.

The lack of information on key aspects, such as the duration of the new financing (this depends on the banks that propose different plans for construction and in many cases they are for 20 or 30 years) and the implications for those who do not agree to sign, was described by the beneficiaries as unacceptable, generating a climate of mistrust and despair.

For the moment, the majority decision would be not to accept this proposal. The beneficiaries demand clarity and fair treatment from the State and the Mortgage Bank, which will respect the agreement and give them security regarding their homes.

Cristian Rubia , another affected person, was barely able to start his house in Chimbas, San Juan, and expressed his frustration with the current situation. “This measure leaves us in debt to the bank, while the State disengages from the loan.”

The lack of concrete solutions led several beneficiaries to take action. They filed complaints with the National Ombudsman's Office and sent letters to the Secretariat in charge of housing, demanding answers and solutions.

"The current proposal does not offer real solutions and leaves beneficiaries unprotected, generating discontent and concern among those who trusted Procrear to access housing," Rubia concluded.

www.buysellba.com

Hay 2.520 beneficiarios del Procrear II línea Construcción sin fondos para continuar y este mes deben decidir qué hacen: qué les ofreció el gobierno

La Secretaría de Desarrollo Territorial, Hábitat y Vivienda de la Nación está contactando a los beneficiarios para ofrecerles una alternativa que les permita continuar con la construcción de sus viviendas. Quienes ya iniciaron sus obras, hoy paralizadas, plantean sus reclamos

October 05, 2024

The Secretariat of Territorial Development, Habitat and Housing of the Nation is contacting the beneficiaries to offer them an alternative that allows them to continue with the construction of their homes. Those who have already started their works, now paralyzed, are raising their claims

By Jose Luis Cieri

The Government's intention is that the beneficiaries of the Procrear II Construction line can resume their unfinished works

The Secretariat of Territorial Development, Habitat and Housing of the Nation recently informed 2,520 beneficiaries of the Procrear II Construction Line program that the disbursements of their building loans will no longer be made as before. The “Chainsaw” and the lack of resources to maintain state financing impacted the housing sector.

By the end of 2023, the previous government had granted 2,520 Procrear loans at zero interest rates, a measure that, according to the current authorities, was irresponsible and - together with other electoral announcements - contributed to increasing public spending, the fiscal deficit and inflation.

Given the lack of funds to continue with these disbursements, the secretariat headed by Rodrigo Aybar proposed converting mortgage loans into personal loans, a conversion that would allow the beneficiaries (who started works that are currently unfinished) to cancel the mortgage and request a new mortgage loan from any bank if they so wish. The proposal includes a six-month grace period for the return of the nominal capital under the original conditions of the disbursements already made.

This period seeks to alleviate the financial burden of beneficiaries who choose to accept the offer, giving them time to manage new financing with one of the more than 20 financial institutions that currently offer mortgage loans.

The deadline for accepting this offer expires on October 30, 2024. Those who do not accept the offer will be subject to the availability of funds, which does not guarantee the continuity of disbursements and will prevent them from accessing other mortgage loans available on the market.

The proposal offers a 6-month grace period for the return of the nominal capital, maintaining the same original conditions of the disbursements made. This helps alleviate the financial burden of those who choose to accept it.

To ensure that beneficiaries understand the implications of waiving pending disbursements and possible claims, the Secretariat of Territorial Development, Habitat and Housing of the Nation has enabled communication channels through email ( desarrollosurbanísticos@hipotecario.com.ar ) and telephone consultations.

The terms and conditions of the proposal are clearly specified to clear up any doubts that may arise (see image below).

Source: Secretariat of Territorial Development, Habitat and Housing of the Nation

According to the authorities, this measure is necessary to ensure the economic sustainability of the country, allowing beneficiaries to continue with their housing plans in a context of financial constraints.

Between cuts and serious difficulties

The tax cuts affect 2,520 beneficiaries (a figure acknowledged by the Government) of the Construction line, distributed throughout the country.Although it is estimated that there are more than 8,000 homes under construction, many beneficiaries, faced with the lack of new disbursements, are becoming pessimistic and looking for alternatives to finance their projects.

In September and October 2023, beneficiaries received late advance payments of 30% of the loan, approximately $3 million, out of a total of $10 million. In addition, costs increased substantially due to inflation.

Romina Nievas , who left her home half-built in Paraná, Entre Ríos, expressed her deep concern at the recent request to cancel the signed contract. “This sowed uncertainty, anguish, anger and helplessness among the beneficiaries, who complied with the conditions of the program from the beginning,” she told Infobae.

The program participants were forced to build homes following a specific model and with dimensions required by Procrear, which in many cases, like Nievas', involved mortgaging their land.

Several houses under construction today look like this or with less progress in execution. The beneficiaries of Procrear II will have to initiate other measures to find a solution.

Now, they are being asked to sign a document that lacks clear information about the conditions imposed. There is no clarity regarding the amount of the installments, the possible cancellation of the mortgage or the deadline for delivery of the property deeds.

The lack of information on key aspects, such as the duration of the new financing (this depends on the banks that propose different plans for construction and in many cases they are for 20 or 30 years) and the implications for those who do not agree to sign, was described by the beneficiaries as unacceptable, generating a climate of mistrust and despair.

For the moment, the majority decision would be not to accept this proposal. The beneficiaries demand clarity and fair treatment from the State and the Mortgage Bank, which will respect the agreement and give them security regarding their homes.

Cristian Rubia , another affected person, was barely able to start his house in Chimbas, San Juan, and expressed his frustration with the current situation. “This measure leaves us in debt to the bank, while the State disengages from the loan.”

The lack of concrete solutions led several beneficiaries to take action. They filed complaints with the National Ombudsman's Office and sent letters to the Secretariat in charge of housing, demanding answers and solutions.

"The current proposal does not offer real solutions and leaves beneficiaries unprotected, generating discontent and concern among those who trusted Procrear to access housing," Rubia concluded.

www.buysellba.com