earlyretirement

Moderator

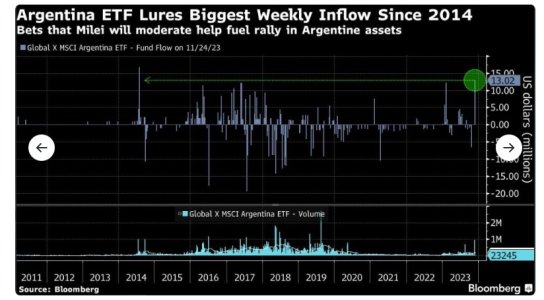

Traders Buy Argentina ETF at Fastest Pace in Almost a Decade

Vinícius Andrade and Kevin Simauchi

Mon, Nov 27, 2023 at 7:53 AM PST

(Bloomberg) -- An exchange-traded fund tracking Argentine stocks attracted its biggest weekly inflow in nine years after firebrand Javier Milei was elected the South American nation’s president and then presented a more moderate stance ahead of his inauguration next month.

The $78 million Global X MSCI Argentina ETF, which trades under the ticker ARGT, saw a weekly inflow of $13 million last week. That’s the second largest since the fund was launched in 2011, lagging only the $16.7 million inflow seen in mid-2014.

Signs that libertarian Milei might be more pragmatic and deviate from some of his more controversial proposals have fueled a sharp rally across Argentine assets, including dollar bonds, ADRs and local stocks. Luis Caputo, a Wall Street veteran who is leading Milei’s economic transition team, told bankers the new administration will focus on reaching a fiscal surplus next year, Bloomberg News reported last week.

Caputo Tells Bankers Argentina Dollarization Is Medium-Term Goal

The ARGT ETF closed at a record high on Friday, extending its year-to-date gain to over 44%.

Investors are betting “Milei will be able to deliver on correcting the fiscal deficit and the reigning macro-imbalances,” said Juan Manuel Vazquez, a fixed income sales trader at Puente, a brokerage in Buenos Aires. “Whether this rally will be sustained or fade in the future will rely on his administration delivering and regaining market confidence.”