BuySellBA

Administrator

UVA Mortgages: Installments and income according to the bank - Reporte Inmobiliario

Source:

Hipotecas UVA: Cuotas e ingresos según el banco, noticias sobre FINANCIAMIENTO en Reporte Inmobiliario

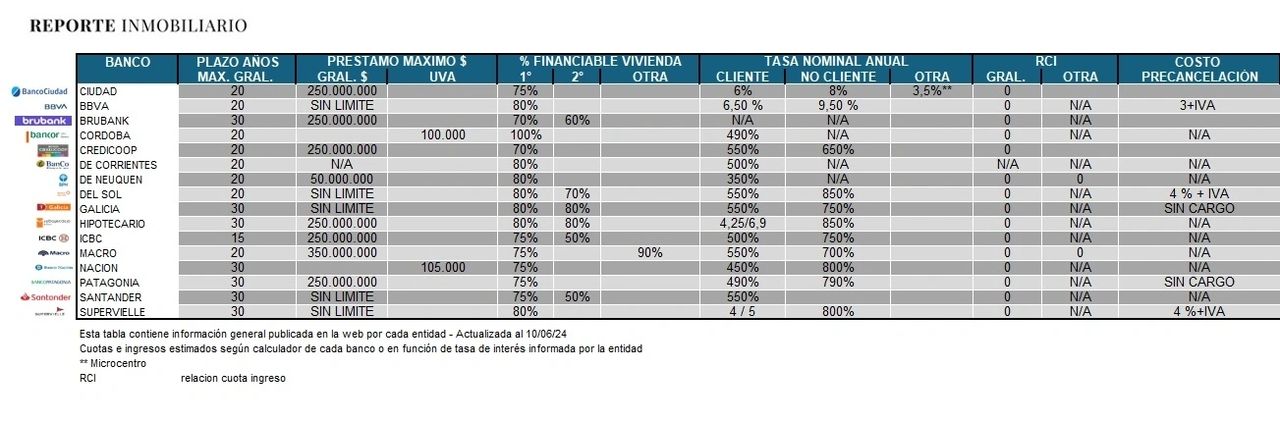

Resumen de la oferta hipotecaria actual. Calculador de cuota e ingreso necesario para comparar según cada banco.

July 12, 2024

Summary of current mortgage offers. Calculator of the installment and income required to compare each bank.

Just over two months after its launch, mortgage credit is once again an alternative for accessing housing. Quickly, at an unusual and unthinkable pace, most of the banking entities in the Argentine financial system already have mortgage lines in operation and in the process of processing applications.

In this new credit cycle that has just begun, the offer is already varied in terms of terms, conditions and rates. Given the little or no use of this type of fundamental tool to access housing in Argentina, it is worth reviewing some characteristics and concepts of the UVA mortgage loan.

Loans are granted in pesos that can be updated by the UVA (Purchasing Value Unit) unit of account, the price of which is set daily by the Central Bank of the Argentine Republic based on the variation of the CER (Reference Stabilization Coefficient), which is in turn based on the evolution of the consumer price index (CPI).

The initial installment and the total debt are converted to a certain amount of UVA at the time of granting and both the subsequent installments and the outstanding capital balance are updated according to the evolution of this unit of account.

Banks set the ratio of installment to income for each of their lines. This is expressed in a maximum admissible percentage that the debtor can assume based on the demonstrable monthly income. In general, although there are exceptions, most current lines establish this ratio at a maximum of 25%.

On the other hand, each bank also has a specific policy on what is the admissible income to be considered valid to set the installment and amount of the loan. In general, reliable documentation is required to prove it and a certain age, with varied and changing conditions depending on whether it is income from an employment or self-employment relationship. On the other hand, it also depends on each particular bank whether or not it is flexible to add other additional income from the debtor(s).

As for the maximum financing period, the current offer ranges from 15 to 30 years depending on the bank.

Another of the limitations that banks generally establish is the one known as LTV (Loan to Value). The LTV is the maximum limit of the loan to be granted in relation to the appraisal value of the property. Currently, depending on the bank, this limit is between a maximum of 75% and reaches, for certain conditions and depending on the bank, up to 100% of the value of the property.

Likewise, financial institutions generally establish a maximum amount of credit to be granted, which varies greatly from one institution to another. It should be noted that within the current offer there are banks that have not established a maximum limit for the loan.

As can be seen from this brief summary, the current offer is varied and obviously each potential borrower or their advisor must weigh up which one best suits their current access possibilities and projections of future income development, among others.

Thus, in order to facilitate a summary of the lines of each bank and obtain a comparative pre-calculation of installments and income necessary according to the amount of the loan to be requested, Real Estate Report makes available in its Virtual Library in Excel format a comparative calculator, which contains what is currently reported publicly by each entity.

www.buysellba.com