monkey

New member

Wall Street warns Milei not to divert focus from the adjustment and that a plebiscite would negatively impact the market - Infobae

Source:

www.infobae.com

www.infobae.com

February 08, 2024

The repercussion of the failure of the Omnibus Law abroad was immediate and bonds and stocks fell. Analysts from the main investment banks predict greater volatility

By Virginia Porcella

The president of Argentina, Javier Milei. EFE/EPA/ABIR SULTAN

Tuesday's failure in the treatment of the Omnibus Law had a wide and immediate impact on Wall Street, not only with the unappealable verdict on asset prices but also in the almost real-time analyzes of the most influential North American investment banks.

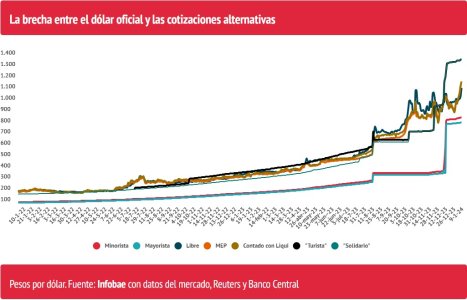

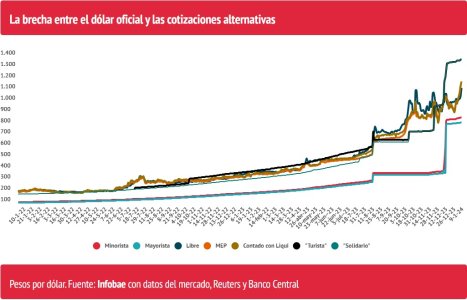

In addition to warning about the impact of the defeat, the gaze rested on the paths that are now open to President Javier Milei to advance his reform agenda and the new sources of conflict that these same alternatives could generate, at least in the market. In that sense, the possibility that seems to be emerging that the Government decides to move forward with a plebiscite to achieve with the popular vote what it did not achieve with the votes of the deputies causes concern abroad. It would herald - they believe - a period of high volatility. More political noise with an impact on prices, particularly that of the dollar.

It is the main warning, for example, of JP Morgan. “The setback (in Congress) today now opens a political bifurcation: they insist on negotiating with governors with additional concessions, or they seek to mobilize voters who supported Milei's proposals in the second round taking advantage of their still high approval rating,” he said. the influential entity. “This second route would be consistent with the non-binding popular consultation route. But it should be noted that such a strategy per se does not solve the challenge posed by the legislative branch. Furthermore, the Court could challenge the call. “We are thus facing the first period of greater political uncertainty, with possible implications on the exchange rate gap in the short term.”

In the first reaction to the political cataclysm that was unleashed not only by the fall of the bill, the dollar market reacted relatively calmly. The rise in the bill in all its variants was moderate and did not exceed the $1,300 barrier. In bonds and stocks, however, the reflection was forceful. Debt securities lost 4% and Argentine stocks collapsed with losses that exceeded 10 percent. It wasn't a surprise to anyone. Since the last hour of the previous day, local analysts were predicting the bad weather that was confirmed yesterday in operations.

With the skid after weeks of recovery of Argentine assets already consummated, the English bank Barclays also highlighted the blow for Milei in Congress and warned about the renewed pressures that will begin to be felt, which should prompt the Government to resume the initiative regarding the path to follow. “Market pressure could push the Government to demonstrate that it has a path forward with a revised fiscal package sooner rather than later,” the entity also estimated in a report, which considered that the central focus should not deviate from fiscal adjustment.

Deeply knowledgeable about how investors think and operate, that was precisely the central axis of the recent public appearances of the Minister of Economy, Luis Caputo. The official repeated again and again that the fiscal adjustment does not depend on the approval of the law and that in the preparation of that plan the possibility that the project was not accompanied by the legislators was contemplated. He even anticipated, with the intention of showing results more than statements, that in January the public accounts are in balance not only primary, but also financial.

His statements are in line with Barclays for which, if the Government “focuses on promoting the rest of the general bill instead of prioritizing the fiscal package, we believe that the risks to a successful trajectory of stabilization could increase.”

As a backdrop to a path that is beginning to steepen, the collapse of economic activity appears in a context of high inflation that sooner rather than later could erode the support obtained in the elections, further complicating the chances of advancing the reforms. “Since the Milei government took office, we have highlighted two main challenges. First, governance. Secondly, the population's tolerance for adjustment (both in fiscal accounts and in relative prices). Today, the first risk factor becomes the center of attention,” described JP Morgan.

Source:

Wall Street advierte a Milei que no desvíe el foco del ajuste y que un plebiscito impactaría negativamente en el mercado

La repercusión del fracaso de la Ley Ómnibus en el exterior fue inmediato y cayeron bonos y acciones. Los analistas de los principales bancos de inversión vaticinan mayor volatilidad

February 08, 2024

The repercussion of the failure of the Omnibus Law abroad was immediate and bonds and stocks fell. Analysts from the main investment banks predict greater volatility

By Virginia Porcella

The president of Argentina, Javier Milei. EFE/EPA/ABIR SULTAN

Tuesday's failure in the treatment of the Omnibus Law had a wide and immediate impact on Wall Street, not only with the unappealable verdict on asset prices but also in the almost real-time analyzes of the most influential North American investment banks.

In addition to warning about the impact of the defeat, the gaze rested on the paths that are now open to President Javier Milei to advance his reform agenda and the new sources of conflict that these same alternatives could generate, at least in the market. In that sense, the possibility that seems to be emerging that the Government decides to move forward with a plebiscite to achieve with the popular vote what it did not achieve with the votes of the deputies causes concern abroad. It would herald - they believe - a period of high volatility. More political noise with an impact on prices, particularly that of the dollar.

It is the main warning, for example, of JP Morgan. “The setback (in Congress) today now opens a political bifurcation: they insist on negotiating with governors with additional concessions, or they seek to mobilize voters who supported Milei's proposals in the second round taking advantage of their still high approval rating,” he said. the influential entity. “This second route would be consistent with the non-binding popular consultation route. But it should be noted that such a strategy per se does not solve the challenge posed by the legislative branch. Furthermore, the Court could challenge the call. “We are thus facing the first period of greater political uncertainty, with possible implications on the exchange rate gap in the short term.”

In the first reaction to the political cataclysm that was unleashed not only by the fall of the bill, the dollar market reacted relatively calmly. The rise in the bill in all its variants was moderate and did not exceed the $1,300 barrier. In bonds and stocks, however, the reflection was forceful. Debt securities lost 4% and Argentine stocks collapsed with losses that exceeded 10 percent. It wasn't a surprise to anyone. Since the last hour of the previous day, local analysts were predicting the bad weather that was confirmed yesterday in operations.

With the skid after weeks of recovery of Argentine assets already consummated, the English bank Barclays also highlighted the blow for Milei in Congress and warned about the renewed pressures that will begin to be felt, which should prompt the Government to resume the initiative regarding the path to follow. “Market pressure could push the Government to demonstrate that it has a path forward with a revised fiscal package sooner rather than later,” the entity also estimated in a report, which considered that the central focus should not deviate from fiscal adjustment.

Deeply knowledgeable about how investors think and operate, that was precisely the central axis of the recent public appearances of the Minister of Economy, Luis Caputo. The official repeated again and again that the fiscal adjustment does not depend on the approval of the law and that in the preparation of that plan the possibility that the project was not accompanied by the legislators was contemplated. He even anticipated, with the intention of showing results more than statements, that in January the public accounts are in balance not only primary, but also financial.

His statements are in line with Barclays for which, if the Government “focuses on promoting the rest of the general bill instead of prioritizing the fiscal package, we believe that the risks to a successful trajectory of stabilization could increase.”

As a backdrop to a path that is beginning to steepen, the collapse of economic activity appears in a context of high inflation that sooner rather than later could erode the support obtained in the elections, further complicating the chances of advancing the reforms. “Since the Milei government took office, we have highlighted two main challenges. First, governance. Secondly, the population's tolerance for adjustment (both in fiscal accounts and in relative prices). Today, the first risk factor becomes the center of attention,” described JP Morgan.