BuySellBA

Administrator

What is better: pay the mortgage or continue renting? - La Nacion Propiedades

Source:

¿Comprar una vivienda con crédito UVA o alquilar?: estos son los factores a tener en cuenta

En el actual contexto económico argentino, tanto pagar la cuota de un crédito hipotecario como seguir alquilando presentan sus desafíos y ventajas

July 12, 2024

In the current Argentine economic context, both paying the installment of a mortgage loan and continuing to rent present their challenges and advantages.

By Candle Contreras

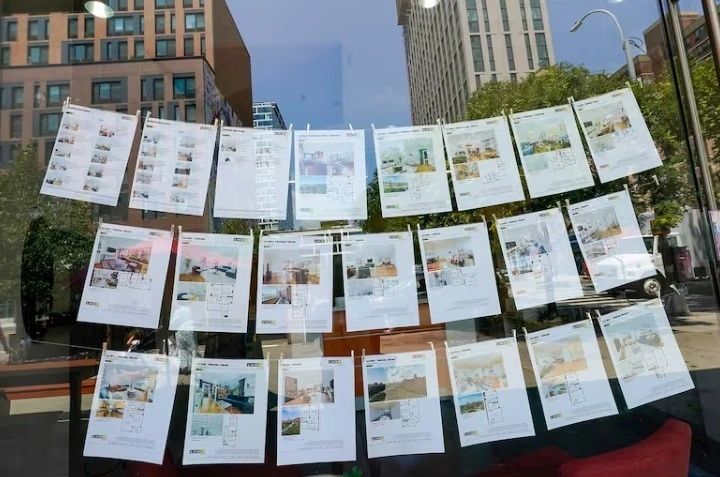

Pay the mortgage or continue renting? FreePik

In the complex labyrinth of financial decisions , where the dream and the opportunities of owning a home are still very difficult to achieve, different banks have entered the complex universe of the real estate market, offering opportunities to access a home through a mortgage loan . Therefore, many people are faced with a crucial decision: is it better to pay the installment of a loan or continue renting? This dilemma is exacerbated by the return of UVA loans in Argentina , a financing option that generated both hope and concern in the years in which it was active.

UVA-adjusted mortgage loans emerged in April 2016, during Mauricio Macri's government, with the aim of facilitating access to home ownership . The main characteristic of these loans is that the installment is adjusted for inflation , which initially allows for paying a low balance, but with an economy characterized by high rates, the risk of increases is significant over time . "From its beginning to the present, the UVA grew almost 64 times its value and the initial installments were 25% of the taker's income, but then, due to high inflation, it came to represent up to 40%," explained José Rozados, director of Reporte Inmobiliario. But, in turn, he reflected: " That percentage is very similar to what a person must allocate from their salary to pay rent ."

Currently, there are already 21 entities that have launched their new credit lines , after five years of almost non-existence of the same. “This news is a very good sign that nobody wants to be left out of the market and that the banks are betting heavily on the normalization of the economy,” analyzes Federico González Rouco, an economist from the Empiria team , the consulting firm of Hernán Lacunza, who recently launched the book El sueño de la casa propia (The Dream of Owning a House) .

The economist adds that the inclusion of private banks means that financial institutions began to compete to offer the best rates , which translates into more affordable installments to pay. Competition between banks means not only lower rates, but also a greater variety of options and flexibility for potential borrowers.

Mortgage loans: 21 banks now offer their lines Mary Altaffer - AP

In this context, the rates of mortgage loans launched range between 3% and 9.5% . The amounts to be lent reach up to $250 million , although in some cases there is no limit. In general, these loans finance between 75% and 80% of the value of the property , with a single entity, and the Bank of Córdoba (Bancor), which lends 100% with a limit of $90 million. The financing terms vary between 5 and 30 years, and the installments , being UVA loans, are adjusted for inflation . In addition, the installment committed by the borrower must represent between 20% and 30% of the monthly income .

The situation of the rental market

At the same time, the rental market in Argentina has also undergone significant changes in recent times, after the law was repealed - on December 29, 2023 - which led to the rules of the game being modified:- Increased supply : Property listings for rent have increased by 190% so far this year, according to data from the Real Estate Association.

- Slowdown in price growth : listing prices have stopped rising above inflation. In June, for example, rents rose by 2.2% and in May by 2.3%, while inflation was 4.2% in the same month (the data is not yet known in June).

- New contractual conditions : there is now freedom between the parties who usually close contracts for two years, in pesos, and with quarterly or four-monthly adjustments based on the Consumer Price Index (CPI).

Despite these changes, the increase in listing prices on the main real estate portals reached 34% in the first half of the year . In concrete numbers , the average rent for a studio apartment in the city is $391,910 per month, a one-bedroom apartment can be rented for $449,915, while a two bedroom apartment can be rented for $601,830 , according to Zonaprop data from June.

Now, in the midst of this panorama, the eternal question arises: should I pay a loan installment or continue paying rent?

Rentals: Since the repeal of the law, the panorama in the real estate market has changed Prostock-studio - Shutterstock

The installment of a loan vs. the rent of an apartment in CABA

The choice between buying and renting depends not only on the initial value of the installments, but also on other factors such as: job stability, the initial amount needed (from 20% to 35%, depending on the bank) and the long-term projection (20 or 30 years) of what you want to acquire as a home. What weighs more when making the decision and what do you give up ?In specific cases, taking a UVA mortgage loan -with an average rate of 5.5% to be paid in 30 years-, and a rent in the city of Buenos Aires , an example would be like this: a family acquired a UVA loan of $100,000,000 , for the purchase of an average one-bedroom, 40 m² apartment in Palermo, which costs US$125,000 (around $125,000,000) , so they had to have US$25,000 in savings initially (25% of the value of the home requested by the bank). In this case, the value of the first installment would be $567,789 , and will be adjusted monthly for inflation variations.

On the other hand, an average rent for a unit with the same characteristics in Palermo (the second most expensive in the city), implies a monthly rent of around $505,329 , that is, 12.36% less than the loan installment . Although, in this case, the adjustment will also be for inflation, but every three or four months depending on the contract signed.

Another case, using the same amount to borrow, can be seen in the purchase of a two-bedrooms apartment in Caballito . In this area, the value of a rental with similar characteristics is around $588,100 , 3.45% more than the value of the loan installment.

So what is best?

The answer to this question depends on several factors:- Ability to pay and job stability : If you have a stable income that allows you to meet the increasing installments of a UVA loan, it can be a good option to ensure your own home in the long term. However, in situations of job instability, renting offers greater flexibility, mainly because the contracts are short-term.

- Risk tolerance : UVA credits involve an inflationary risk that not everyone is willing to assume. Those who prefer certainty may lean towards renting, despite its increases.

- Long-term goals : Buying a home involves a long-term commitment. Renting, on the other hand, can be more convenient for those who do not want to live in one place for too long or do not want to take on long-term debt.

The data show that in many cases, monthly mortgage payments can be higher, comparable or even lower than rental costs , especially if one considers the possibility of obtaining preferential rates as a bank customer.

The final decision will depend on the particular circumstances of each person or family , their financial situation and their long-term goals. Carefully evaluating both options and, if possible, seeking advice from a financial expert, is essential to make the best decision in this uncertain scenario.

Rent or buy with credit? The dilemma of those who rent and want to own their home Pompi Gutnisky

What will happen to the rental market with credit competition?

Sources consulted by LA NACION clarify that if the previous rental law had been maintained, the effect would have been immediate , but today, with greater freedom to establish the conditions of the contracts and an improvement in annual profitability that is between 4% and 5% - during the pandemic it was 2% - the owners will not make the decision to sell the property they are offering for rent: "They will think about it."Ultimately, the decision to migrate from renting to selling will depend on each case and whether the owner has the “need to get rid of the property” at an advantageous price for the buyer . “There may be specific situations, but in a country with three million people who rent and only 100,000 mortgage loans generated at the time of the greatest boom in the last 25 years, which was 2017-2018, I don’t think it will change the compass,” Rouco concludes.

Along these lines, Germán Gómez Picasso, founder of Reporte Inmobiliario , adds that there are very few apartment owners who decide to take their units off the market to rent them out. “Today there is more demand and there are owners who prefer not to sell at current prices, since they see that there is a clear rebound in prices and also the arrival of credits generates a lot of additional expectations,” he concludes.

www.buysellba.com