JennyBack

New member

What is going to happen to the dollar: is it possible to achieve exchange rate unification by mid-year? - Infobae

Source:

www.infobae.com

www.infobae.com

February 26, 2024

President Milei confirmed that he could lift the “traps” in the short term. What are the three necessary conditions to be able to achieve this objective?

By Juan Gasalla

The exchange rate was imposed on September 1, 2019 and has accumulated successive adjustments to the present (Reuters)

While the Government rigorously maintains the gradual devaluation of the peso, with a “ crawling peg ” that does not budge at its level close to 2% per month, market agents are making their projections regarding what could happen in the coming months, given the official conviction of reaching exchange rate unification this year .

These perspectives become more relevant if we take into account that President Javier Milei revealed that in June of this year he could eliminate the dollar stocks as the previous step to dollarization: “The estimates of the International Monetary Fund say that we can open the stocks to mid-year,” confided the libertarian leader.

In the last week, the Minister of Economy, Luis Caputo , assured that his roadmap includes eliminating the PAIS tax on operations that are paid in dollars and on the purchase of foreign currency in the official market "before the end of the year." In addition, he confirmed that there are plans to dismantle the exchange rate “in the middle of the year.”

“We are committed to reducing the COUNTRY Tax. We have set out to get it out as soon as possible and it should not happen later than this year,” said Caputo.

“We must rebuild the balance sheet of the Central Bank , which is being done strongly” as a condition for eliminating exchange controls. “To the extent that conditions remain very favorable, it is a possibility. The condition is the cleaning up of the Central Bank's balance sheet. The more we manage to lower inflation, the faster and stronger it will go,” said the minister.

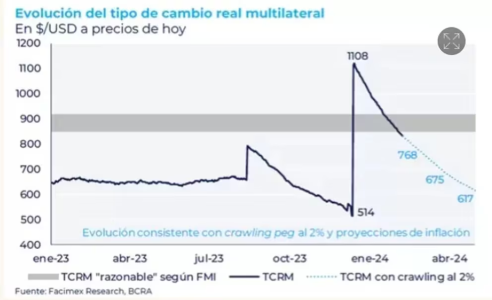

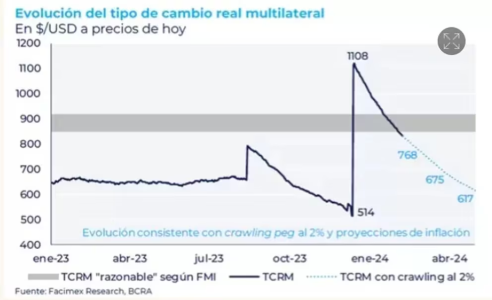

Facimex Research analysts pointed out that “the BCRA will have to recalibrate the exchange rate policy to reach the beginning of the harvest with a real exchange rate that has not appreciated excessively and with an exchange gap that is not substantially larger than the current one. We do not believe that it will maintain the devaluation rate of 2% monthly, with rate adjustments in process, inflation will remain high in the coming months.”

Gap between the real exchange rate and the theoretical one of the IMF

“Cash with settlement tends to flatten out over the next two months. That is, seasonality, of a transitory nature, may be working in its favor. The novelty is that the 80-20 scheme will expand the supply with the arrival of the thick harvest and could remove even more pressure on cash with settlement in the short term,” indicated a report from Consultatio Financial Services.

A report from the JP Morgan bank stated that inflation in Argentina will continue in double digits per month this first quarter and anticipated that there will be another devaluation jump in the official market next June, “after which we expect the economy to stabilize at a rate of single-digit inflation if the stabilization program turns out to be successful.”

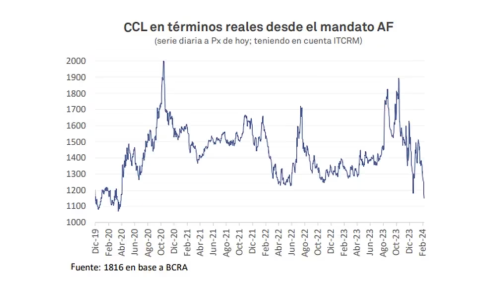

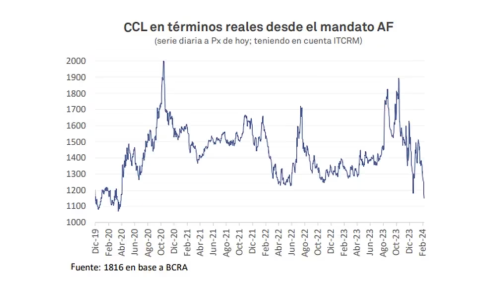

High volatility of the institutional free dollar

Invecq Consultora Económica highlighted in its reports the “shrinking of the exchange rate gap, which returned to levels slightly above 30%, when it had comfortably exceeded 50%. The current levels of the real exchange rate return financial dollars to levels from three years ago, while the real exchange rate continues in a process of real appreciation of practically 29% since the devaluation at the beginning of the government.

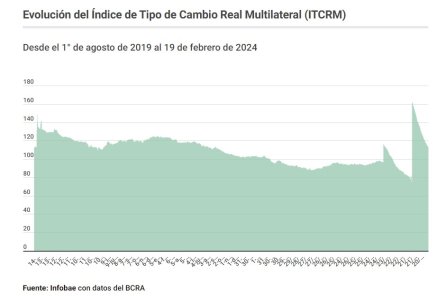

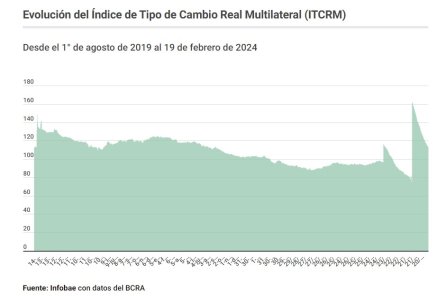

On the other hand, this competitiveness is still palpable. According to the Multilateral Real Exchange Rate Index (Itcrm) prepared by the Central Bank, with a wholesale dollar that stands at $839, the indicator is around 112 points, above a theoretical balance with a base of 100 on December 17. December 2015, at the beginning of Mauricio Macri 's government .

However, from the 162 points it reached on December 14, the fall was accelerated, about 60 points in two and a half months, a trend that forces devaluation projections to be adjusted in a dynamic 2024, according to some experts.

From Consulting 1816 they specified that "if the pace of crawling peg is maintained at 2% monthly until mid-April, the Real Exchange Rate - without taking into account the COUNTRY Tax for imports or the liquidation of 20% of exports in cash with liquidation - will be similar to the pre PASO levels - before the devaluation of the spot to $350 - and will be somewhat below the level at which the exchange rate was unified in the first days of the (Mauricio) Macri administration. The real appreciation so far did not have a notable impact on the Central's intervention in the MULC: purchases slowed down only at the margin and net reserves are already negative USD 5.5 billion.

The external assets of the monetary entity remain in negative territory

“After two months of the new monetary policy implemented by the new Government, it is interesting to wonder about the effects on the Central Bank's balance sheet and the possibilities of lifting the stocks in the short term. The 'liquefaction' through persistently negative interest rates and the exchange rate appreciation as a result of the crawling peg to 2% would remain firm during February. Questions about the sustainability of the appreciation will begin to grow as the second quarter and the liquidation of the thick harvest approach,” Delphos Investment warned.

The market validates a certain increase in the devaluation rate but a discrete jump in the exchange rate of magnitude like the one applied in December is not expected.

Future dollar contracts for the end of February show a price of $843.90. Given that the wholesale price started the month at $826.40, this projection implies a monthly increase of 2.1%, in line with the official objective.

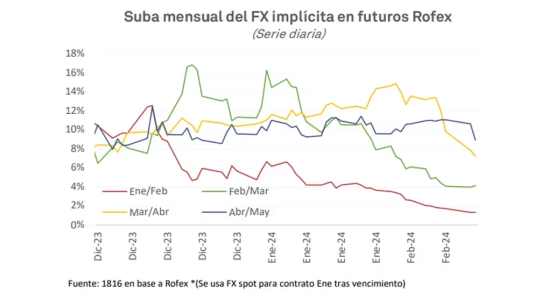

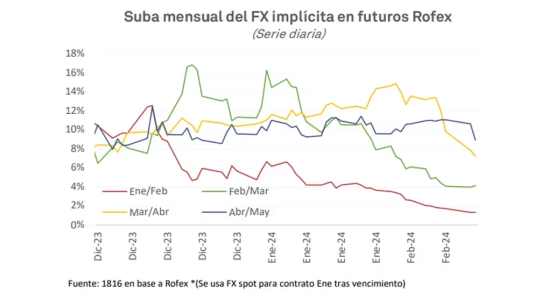

Devaluation rate in the wholesale band projected by the forward market

The contracts for March on the Rofex are agreed at $874.50, that is, with an expected monthly increase of 3.6% for the third month of the year, a moderate rate if the inflationary rhythm is considered.

For April, futures deals are traded at $923 per dollar, with an implicit rate of 5.5% monthly, while for May - a month that will see full settlements of the coarse harvest - they are set at $975.50 ( increase of 5.7 percent).

Rofex contracts for the end of June mark a price of $1,029, while for the end of July they reach $1,102, which allows us to conjecture that in the operators' vision an exchange rate unification for the middle of the year could be located in a range similar to that of of the prices of free dollars and MEP of the present.

Source:

Qué va a pasar con el dólar: ¿es posible llegar a la unificación cambiaria para mitad de año?

El presidente Milei ratificó que podría levantar el “cepo” en el corto plazo. Cuáles son las tres condiciones necesarias para poder concretar ese objetivo

February 26, 2024

President Milei confirmed that he could lift the “traps” in the short term. What are the three necessary conditions to be able to achieve this objective?

By Juan Gasalla

The exchange rate was imposed on September 1, 2019 and has accumulated successive adjustments to the present (Reuters)

While the Government rigorously maintains the gradual devaluation of the peso, with a “ crawling peg ” that does not budge at its level close to 2% per month, market agents are making their projections regarding what could happen in the coming months, given the official conviction of reaching exchange rate unification this year .

These perspectives become more relevant if we take into account that President Javier Milei revealed that in June of this year he could eliminate the dollar stocks as the previous step to dollarization: “The estimates of the International Monetary Fund say that we can open the stocks to mid-year,” confided the libertarian leader.

In the last week, the Minister of Economy, Luis Caputo , assured that his roadmap includes eliminating the PAIS tax on operations that are paid in dollars and on the purchase of foreign currency in the official market "before the end of the year." In addition, he confirmed that there are plans to dismantle the exchange rate “in the middle of the year.”

“We are committed to reducing the COUNTRY Tax. We have set out to get it out as soon as possible and it should not happen later than this year,” said Caputo.

“We must rebuild the balance sheet of the Central Bank , which is being done strongly” as a condition for eliminating exchange controls. “To the extent that conditions remain very favorable, it is a possibility. The condition is the cleaning up of the Central Bank's balance sheet. The more we manage to lower inflation, the faster and stronger it will go,” said the minister.

Three key factors

The possibility of unifying the exchange rate would lie in having a large influx of foreign currency due to trade surpluses in the second quarter, when the liquidation of agricultural exports is concentrated, and a reduction or containment of the exchange gap – today over 30%. –, a scenario in which a greater rate of devaluation from the current marginal 2% should not be ruled out.Facimex Research analysts pointed out that “the BCRA will have to recalibrate the exchange rate policy to reach the beginning of the harvest with a real exchange rate that has not appreciated excessively and with an exchange gap that is not substantially larger than the current one. We do not believe that it will maintain the devaluation rate of 2% monthly, with rate adjustments in process, inflation will remain high in the coming months.”

Gap between the real exchange rate and the theoretical one of the IMF

“Cash with settlement tends to flatten out over the next two months. That is, seasonality, of a transitory nature, may be working in its favor. The novelty is that the 80-20 scheme will expand the supply with the arrival of the thick harvest and could remove even more pressure on cash with settlement in the short term,” indicated a report from Consultatio Financial Services.

A report from the JP Morgan bank stated that inflation in Argentina will continue in double digits per month this first quarter and anticipated that there will be another devaluation jump in the official market next June, “after which we expect the economy to stabilize at a rate of single-digit inflation if the stabilization program turns out to be successful.”

High volatility of the institutional free dollar

Invecq Consultora Económica highlighted in its reports the “shrinking of the exchange rate gap, which returned to levels slightly above 30%, when it had comfortably exceeded 50%. The current levels of the real exchange rate return financial dollars to levels from three years ago, while the real exchange rate continues in a process of real appreciation of practically 29% since the devaluation at the beginning of the government.

And he added: "It is necessary to highlight that the export incentive is slightly higher given the blend that the government established in which 80% can be settled in the official market and 20% in cash with settlement, which leaves an exchange rate implicit of $887 as of today.”The export incentive is slightly higher given the blend that the government established in which 80% can be settled in the official market and 20% at the CCL (Invecq)

Exchange competitiveness

On the one hand, with monthly inflation that will be difficult to reduce below the double-digit threshold per month, the official exchange rate has been losing competitiveness very quickly. This means that the initial jump in the wholesale dollar to $800 as updated on December 13 is eroding rapidly and by April it would have consumed its effect to boost exports, private sector analysts agree.On the other hand, this competitiveness is still palpable. According to the Multilateral Real Exchange Rate Index (Itcrm) prepared by the Central Bank, with a wholesale dollar that stands at $839, the indicator is around 112 points, above a theoretical balance with a base of 100 on December 17. December 2015, at the beginning of Mauricio Macri 's government .

However, from the 162 points it reached on December 14, the fall was accelerated, about 60 points in two and a half months, a trend that forces devaluation projections to be adjusted in a dynamic 2024, according to some experts.

From Consulting 1816 they specified that "if the pace of crawling peg is maintained at 2% monthly until mid-April, the Real Exchange Rate - without taking into account the COUNTRY Tax for imports or the liquidation of 20% of exports in cash with liquidation - will be similar to the pre PASO levels - before the devaluation of the spot to $350 - and will be somewhat below the level at which the exchange rate was unified in the first days of the (Mauricio) Macri administration. The real appreciation so far did not have a notable impact on the Central's intervention in the MULC: purchases slowed down only at the margin and net reserves are already negative USD 5.5 billion.

The external assets of the monetary entity remain in negative territory

“After two months of the new monetary policy implemented by the new Government, it is interesting to wonder about the effects on the Central Bank's balance sheet and the possibilities of lifting the stocks in the short term. The 'liquefaction' through persistently negative interest rates and the exchange rate appreciation as a result of the crawling peg to 2% would remain firm during February. Questions about the sustainability of the appreciation will begin to grow as the second quarter and the liquidation of the thick harvest approach,” Delphos Investment warned.

What does the future dollar reflect?

A signal to observe then is the evolution of future dollar contracts that are operated in Matba-Rofex and the MAE (Electronic Open Market). These contracts are set in pesos tied to the expected evolution of the dollar price in the wholesale market and are exercised as a kind of exchange insurance to cover against devaluation and protect those holdings in domestic currency.The market validates a certain increase in the devaluation rate but a discrete jump in the exchange rate of magnitude is not expected.

The market validates a certain increase in the devaluation rate but a discrete jump in the exchange rate of magnitude like the one applied in December is not expected.

Future dollar contracts for the end of February show a price of $843.90. Given that the wholesale price started the month at $826.40, this projection implies a monthly increase of 2.1%, in line with the official objective.

Devaluation rate in the wholesale band projected by the forward market

The contracts for March on the Rofex are agreed at $874.50, that is, with an expected monthly increase of 3.6% for the third month of the year, a moderate rate if the inflationary rhythm is considered.

For April, futures deals are traded at $923 per dollar, with an implicit rate of 5.5% monthly, while for May - a month that will see full settlements of the coarse harvest - they are set at $975.50 ( increase of 5.7 percent).

Rofex contracts for the end of June mark a price of $1,029, while for the end of July they reach $1,102, which allows us to conjecture that in the operators' vision an exchange rate unification for the middle of the year could be located in a range similar to that of of the prices of free dollars and MEP of the present.