All the Answers

Well-known member

What's coming for the dollar: 6 conditions to lift the exchange rate - Infobae

Source:

Lo que viene para el dólar: 6 condiciones para levantar el cepo cambiario

El presidente Milei se comprometió a eliminar el esquema de controles “lo antes posible” . La baja de las cotizaciones libres anticipa un escenario de unificación cercano

March 10, 2024

President Milei promised to eliminate the control scheme “as soon as possible.” The drop in free contributions anticipates a near unification scenario

By Juan Gasalla

President Milei promised agricultural producers to lift the trap "as soon as possible"

President Javier Milei participated last week in the Expoagro agricultural exhibition that was held in San Nicolás, province of Buenos Aires. There he affirmed before rural businessmen that freedom will allow them to be the engine of growth in Argentina and promised to lift the stocks on the dollar "as soon as possible."

“Now we have USD 9 billion more, what you see is that the system is healthier. As a result of this set of measures, it is transferred to inflation. When it gave 25% in December it was a success, because the truth is that prices fell in the second week. This month it seems that inflation is going to be 15% ,” argued the president.

“Milei only made reference to the fact that the elimination of exchange controls is getting closer, but without specifying a date. Given that the latest IMF Staff Report required the presentation of a roadmap to dismantle the 'traps' before the end of June, the market believes that this may occur at some point in the second half of the year," observed the Personal Investment Portfolio analysts.

Exiting the strict exchange control scheme is considered in the market to be a financial milestone, with important effects on the real economy in this first stretch of the libertarian's management.

The Government weighs the convenience and opportunity of the measure, given the inflationary risk that a free floating exchange rate entails.

Unlike what happened with the exit of the stocks in December 2015, the Government weighs the convenience and opportunity of the measure, given the inflationary risk that a free exchange rate entails.

To avoid volatility that could further affect an economy in a state of crisis, it is estimated that there are at least six conditions that should be consolidated:

1) Accumulation of reserves

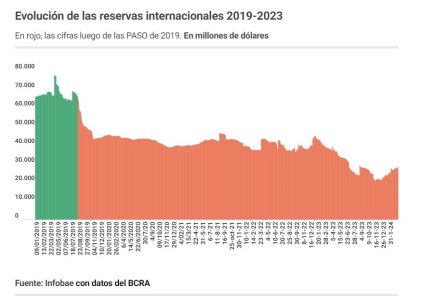

In three months, the Central Bank accumulated some USD 10,000 million in net purchases in the market and gross international reserves approached USD 28,000 million. It is great progress but even in the net estimate - discounted private loans and deposits - they remain in negative territory. The BCRA needs foreign currency to face a release of controls.

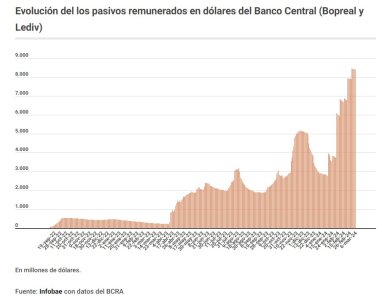

“If we look carefully at the synthetic balance sheet of the Central Bank, measured in dollars, it shows us a negative net position of USD 7,733 million. We must take into account that new Bopreal series will soon be issued and this could raise the balance to much more negative levels. than the current ones, taking into account that there is still a month left until the arrival of dollars from the harvest. It would be very necessary to increase the stock of reserves,” said economist Salvador Di Stefano .

“The monetary and exchange scenario looks very complicated, based on the shortage of reserves and the noise generated by a liability in dollars in the Central Bank,” added the analyst.

2) Narrowing the gap

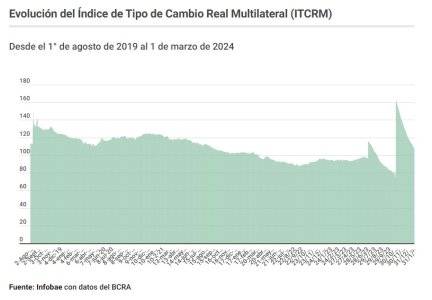

The Government's goal is to progressively reduce the gap between the official exchange rate and the “cash with settlement” so that the exchange rate unification is as traumatic as possible in terms of subsequent devaluation.In this aspect, and having overcome the initial impact of the exchange rate jump in December, it is a complete success for the management of Minister Luis Caputo that the gap was corrected "from top to bottom", with a surprising decline in alternative dollars, which fell more than 20% from its maximum values at the end of January.

Source: Mariela Capezzuoli ("X": @marucape_ )

“Financial dollars continue to deflate, with a gap already close to 20%, a level that raises expectations about an exchange rate unification in the future, perhaps after the liquidation of the harvest, in order to continue strengthening the BCRA balance during that stage” , stated Gustavo Ber , director of the homonymous Studio.

3) Current account surplus

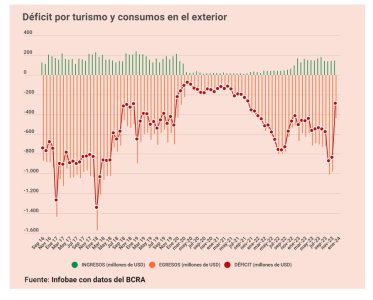

The historic December devaluation did its “dirty work” in January to balance Argentina's balance of payments. It turns out that not only was the trade surplus of goods recovered by force through exchange honesty; The surplus on the services account also returned - after more than a decade - with a drastic reduction in the red due to the imbalance between outbound and inbound tourism.An eventual equilibrium exchange rate is related to a flow of foreign exchange that is also balanced in terms of exports of goods and services.

An eventual equilibrium exchange rate is related to a flow of foreign exchange that is also balanced in terms of exports of goods and services.

“Considering the set of movements within the balance of payments, what would allow ending 2024 with net reserves close to zero - a modest goal, in itself - is a significant cut in the deficit of real services, of the order of USD 3,000 million - driven by tourism - and move to a neutral balance in the flows with the IMF, after a negative close to USD 8,000 million in 2023," said Jorge Vasconcelos , Chief Economist of the IERAL of the Mediterranean Foundation.

“The lack of possibility of access to international financing in some way puts a limit on the ability to continue delaying the exchange rate, unless a loan from some multilateral organization is implemented through political means,” explained Santiago Giraud , economist at the CREA Research and Development Unit.

“The lack of possibility of access to international financing in some way puts a limit on the ability to continue delaying the exchange rate, unless a loan from some multilateral organization is implemented through political means,” explained Santiago Giraud , economist at the CREA Research and Development Unit.

Another alternative is to modify the “export dollar” scheme, in such a way as to give a greater proportion to the “cash with liquid” with respect to the official exchange rate to apply a selective devaluation aimed, precisely, at the export sector in general and agroindustrial sector in particular. .

Logic indicates that the exchange rate stimulus should be implemented starting next April, when the early corn harvest begins (Giraud)

Giraud said that “logic indicates that the exchange rate stimulus should be implemented starting next April, when the early corn harvest begins, with the purpose of encouraging agricultural sales that allow shipments to be managed and, therefore, accelerate the flow of income from agrocurrencies”.

Walter Morales , strategist at Wise Capital, assured that “an increasing number of economic agents expect that unification will take place towards the middle of the year, but we estimate that so soon it would be risky because the Rosario Grain Exchange revised downwards the soybean production (-4.8%), so although the value of the harvest would be USD 9.8 billion higher than that of 2023, it would be USD 13 billion lower than that of 2022. This is why we see the unification from September".

4) Inflationary slowdown

“Milei said that there is a consensus that in February the indicator will be at 15% and that if the delayed price corrections were cleared, inflation would be around 10%. We believe that with that 10% she was referring to core inflation and that in a context of relative price adjustment it is to be expected that in February the regulated prices will continue to advance above core inflation, as was already seen in January. We do highlight that one of the shock absorbers of inflation today is the strong recession and the considerable drop in real income, which with February inflation would be between 14% and 16%," said Juan Manuel Franco , economist. Head of SBS Group.

“The implicit devaluation in the Matba Rofex dollar futures shows that the market considers that it is not likely that the 2% monthly devaluation currently in force can be maintained,” said Julián Frakiel , economist at ConoSur Investments.

“For the exchange rate scheme to be sustainable, it is essential that inflation slow down starting in the months of March and April of this year, aiming for single-digit inflation for April or May,” Frakiel added.

The economist considered that the honesty of relative prices still has a long way to go due to the deep macroeconomic imbalances inherited from the previous government.Some services have not yet adjusted everything they should have adjusted, while other sectors have not yet been able to validate adjustments due to low purchasing power (Frakiel)

“Some services have not yet adjusted everything they should have adjusted, while other sectors have not yet been able to validate adjustments due to the low purchasing power of the population,” highlighted Frakiel.

5) Fiscal balance

Javier Milei called on governors, former Presidents and leaders of political parties to “deposit interests” and promoted the signing of “a new social contract” with ten State policies, one of them, “non-negotiable fiscal balance.”Maximiliano Donzelli , Research Manager at IOL (InvertirOnline), commented that “the Government seems to be putting aside its most conflictive position with the Legislative branch and the governors, and will be more willing to generate consensus, as long as these are in line with your long-term goals. Although it is most likely that not all proposals will come to fruition, the truth is that the simple fact of setting up the debate to generate a consensus is already significant. At the same time, if some of the ten measures are achieved, such as, for example, the non-negotiable fiscal balance, it can already be defined as a very important advance for the country's macroeconomy in the long term."

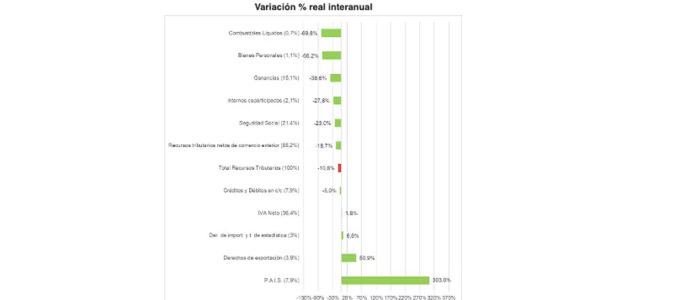

However, the immediate lifting of the stocks collides with the relevant role assumed by the Tax for an Inclusive and Solidarity Argentina (PAIS) in the collection scheme, after it was extended to foreign trade operations as of December 13.

A report from Iaraf (Argentine Institute of Fiscal Analysis) specified that in February “ national tax collection would have decreased by a real 11% compared to February 2023. When excluding collection from taxes linked to foreign trade, the drop would be 19%. It is important to remember that in February the placement of the Bopreal bond generated extra revenue in the PAIS tax.”

The entity headed by Nadín Argañaraz added that “the taxes that would have increased the most in real terms would be the PAIS tax with 303%, followed by export duties with 50.9% and import duties and statistical tax with 6.6%. For its part, VAT collection would have increased 1.8 percent.”

6) Cleaning of the Central balance sheet

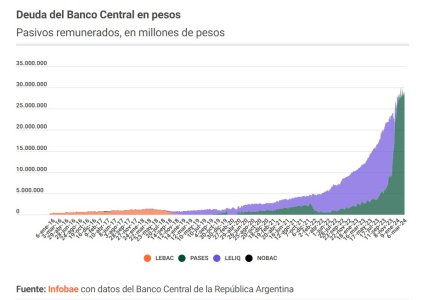

The President expressed during his visit to Expoagro that his government hopes to lift the restrictions that exist in the exchange market in the middle of the year once it manages to clean up the Central Bank's balance sheet. Both the inflationary acceleration and the devaluation contributed from the beginning of the administration to almost halve the “quasi-fiscal” deficit in real terms, that is, the remunerated liabilities accumulated on the entity's balance sheet, a quick way to deactivate this “bomb.” ” of debt.

On December 7 , 2023, remunerated liabilities reached $21,516,576 million (Liquidity Bills -Leliq- and BCRA Notes -Nobac) plus USD 5,051 million in Lediv (BCRA Internal Bills in dollars liquidable in pesos tied to the evolution of the official exchange rate). All of these concepts added up to some USD 64,096 million at the official exchange rate of $364.41 according to BCRA communication A3500.

On December 13, remunerated liabilities accounted for $24,404,144 and USD 4,913 million, respectively, for a total of USD 35,420 million after the jump that took the wholesale dollar to 799.95 pesos.

At this point, the passage of time works against the BCRA, since the slow devaluation plus an increase in the debt in dollars on the balance sheet due to the placement of the Bopreal (Bond for the Reconstruction of a Free Argentina) to regularize the commitments assumed by importers with suppliers from abroad neutralize the improvement in the asset by the purchase of foreign currency in the exchange market.

As of March 4, the stock of Pases, Leliq and Nobac totaled $28,667,961 million, and that of liabilities in dollars (Bopreal and the remainder of Lediv) reached USD 8,415 million, for a total of USD 42,382 million at the official exchange rate . This is an increase of almost USD 7 billion since the day of the devaluation.