Benny

New member

Which were the areas in which consumption fell the most during January, according to businessmen? - Infobae

Source:

www.infobae.com

www.infobae.com

February 21, 2024

The Argentine Chamber of Commerce and Services (CAC) published its report on the results of the first month of the year, which confirm the reduction in purchases

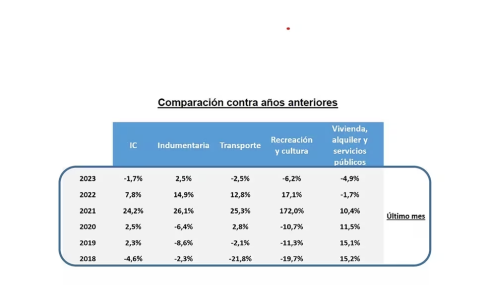

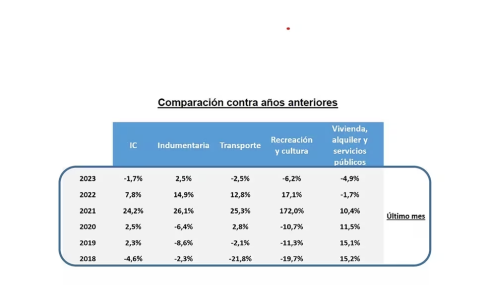

Clothing and footwear consumption grew 2.5% year-on-year in January

With inflation of 20.6%, consumption fell 1.7% year-on-year in January and 1.1% compared to December as a result of high inflation rates and the consequent drop in purchasing power, according to a report from the Argentine Chamber of Commerce and Services (CAC)

The CAC pointed out that the downward trend in consumption is verified in the interannual variations, with a negative sign in two of the last three months.

It is worth remembering that in December consumption grew 4.1% compared to November, which is mainly explained by an advance in consumption decisions due to inflation, which was 25.5% in that month.

As for January, “the persistent inflation at high levels since mid-2023 has notably deteriorated the purchasing power of Argentine households, making it difficult to save as a spending buffer,” said the CAC.

“Despite moderate increases in nominal wages, the ability to advance consumption is limited by the constant increase in prices, exceeding the speed of wage adjustment. The moderation not only of inflation, but also of the fall in consumption, depends on the possible implementation of increases in public rates and transportation,” he indicated.

The loss of purchasing power of Argentine households makes it difficult to save as a spending buffer. Source: CAC

“Likewise, the new government has been slowing the rate of increase in allocations and subsidies to families, which should continue to negatively impact consumption capacity,” the report projected.

When analyzing the performance of some items in particular, a general dynamic of interannual decrease was recorded compared to the values of January 2023, with the exception of the clothing sector.

In this sense, clothing and footwear showed an estimated increase of 2.5% year-on-year in the first month of the year. The continuous lowering of the price of this item explains the opposite dynamics that clothing experienced with respect to aggregate consumption.

On the other hand, the transportation and vehicles chapter presented a decline of 2.5% year-on-year in January. In parallel with a great growth in the relative price of gasoline, automobile registration fell sharply.

Recreation and culture stood out , registering a decrease of 6.2% year-on-year (explained by the notable decrease in real household income.

Recreation and culture was the category with the lowest consumption in January with a drop of 6.2% year-on-year

Regarding housing, rents and public services , it fell 4.9% year-on-year, which is mainly explained by the decrease in disposable income and lower electricity demand.

Regarding the rest of the items, these experienced an estimated contraction of 0.3% year-on-year, positioning themselves at levels 3.6% above pre-pandemic levels.

It is worth mentioning that in January sales in retail stores surveyed by CAME contracted 28.4% year-on-year, strongly accelerating their rate of decline (-13.7% in December and -2.9% in November).

Indeed, the real income of private sector workers was at the lowest level since May 2003 in December, and the outlook for the future points only to a moderation of the falls without recovering the lost ground.

“Thus, we foresee a real drop in formal income of 10% year-on-year, with the drop in activity limiting salary claims. Even more, the authorities estimated a significant cut in operating expenses to reach the fiscal goal (-0.5 points of GDP), an item where public salaries predominate, which we expect to drop by 19.5% in real terms for the year," said Capital Foundation.

Source:

Cuáles fueron los rubros en los que más bajó el consumo durante enero, según los empresarios

La Cámara Argentina de Comercio y Servicios (CAC) publicó su informe sobre los resultados del primer mes del año, que confirman la reducción en las compras

February 21, 2024

The Argentine Chamber of Commerce and Services (CAC) published its report on the results of the first month of the year, which confirm the reduction in purchases

Clothing and footwear consumption grew 2.5% year-on-year in January

With inflation of 20.6%, consumption fell 1.7% year-on-year in January and 1.1% compared to December as a result of high inflation rates and the consequent drop in purchasing power, according to a report from the Argentine Chamber of Commerce and Services (CAC)

The CAC pointed out that the downward trend in consumption is verified in the interannual variations, with a negative sign in two of the last three months.

It is worth remembering that in December consumption grew 4.1% compared to November, which is mainly explained by an advance in consumption decisions due to inflation, which was 25.5% in that month.

As for January, “the persistent inflation at high levels since mid-2023 has notably deteriorated the purchasing power of Argentine households, making it difficult to save as a spending buffer,” said the CAC.

“Despite moderate increases in nominal wages, the ability to advance consumption is limited by the constant increase in prices, exceeding the speed of wage adjustment. The moderation not only of inflation, but also of the fall in consumption, depends on the possible implementation of increases in public rates and transportation,” he indicated.

The loss of purchasing power of Argentine households makes it difficult to save as a spending buffer. Source: CAC

“Likewise, the new government has been slowing the rate of increase in allocations and subsidies to families, which should continue to negatively impact consumption capacity,” the report projected.

When analyzing the performance of some items in particular, a general dynamic of interannual decrease was recorded compared to the values of January 2023, with the exception of the clothing sector.

In this sense, clothing and footwear showed an estimated increase of 2.5% year-on-year in the first month of the year. The continuous lowering of the price of this item explains the opposite dynamics that clothing experienced with respect to aggregate consumption.

On the other hand, the transportation and vehicles chapter presented a decline of 2.5% year-on-year in January. In parallel with a great growth in the relative price of gasoline, automobile registration fell sharply.

Recreation and culture stood out , registering a decrease of 6.2% year-on-year (explained by the notable decrease in real household income.

Recreation and culture was the category with the lowest consumption in January with a drop of 6.2% year-on-year

Regarding housing, rents and public services , it fell 4.9% year-on-year, which is mainly explained by the decrease in disposable income and lower electricity demand.

Regarding the rest of the items, these experienced an estimated contraction of 0.3% year-on-year, positioning themselves at levels 3.6% above pre-pandemic levels.

It is worth mentioning that in January sales in retail stores surveyed by CAME contracted 28.4% year-on-year, strongly accelerating their rate of decline (-13.7% in December and -2.9% in November).

What is expected

For its part, for the first quarter of 2024 Fundación Capital foresees a drop in private consumption of 10 points and for the rest of the year, of 7.4% year-on-year, within a framework of greatly deteriorated purchasing power after the inflationary shock.Indeed, the real income of private sector workers was at the lowest level since May 2003 in December, and the outlook for the future points only to a moderation of the falls without recovering the lost ground.

“Thus, we foresee a real drop in formal income of 10% year-on-year, with the drop in activity limiting salary claims. Even more, the authorities estimated a significant cut in operating expenses to reach the fiscal goal (-0.5 points of GDP), an item where public salaries predominate, which we expect to drop by 19.5% in real terms for the year," said Capital Foundation.