All the Answers

Well-known member

Why did the free dollar rise again and what are the factors that can limit its rise? - Infobae

Source:

Por qué volvió a subir el dólar libre y cuáles son los factores que pueden ponerle límite al alza

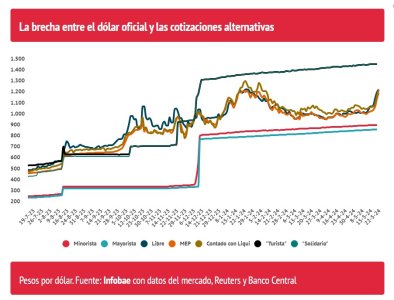

La divisa alternativa anota un alza de 190 pesos o 18,3% en mayo, muy por encima de la inflación esperada. En $1.230 se aproxima a su récord histórico de enero

May 22, 2024

The alternative currency recorded an increase of 190 pesos or 18.3% in May, well above expected inflation. At $1,230 it is approaching its historical record in January

By Juan Gasalla

The BCRA hoarded more than half of the currencies on offer.

The free dollar rose strongly again yesterday by 50 pesos or 4.2%, to $1,230 for sale. This is its highest price since January 25 ($1,245 at closing) and close to its intraday record of $1,260 on that day, four months ago.

The informal currency accumulated an increase of 190 pesos or 18.3% in May , above estimated inflation. With a wholesale dollar at 889 pesos, the exchange gap reaches 38.4% , the widest since February 7, 2024 (40.9%). The recent rise was also transferred to financial dollars, with a “settled cash” again at $1,200, a maximum since February 9.

Several reasons converged for the recent surge in the free dollar, which in May defeated inflation for the first month since October 2023:

- Lower rates. Behind the rise in the free dollar is the new cut in the Central Bank's reference rates , given the determined path of reducing inflation. With the monetary policy rate at 40%, the banks left the rate for fixed terms at 3.3% monthly, below expected inflation. This discourages placements in pesos and, indirectly, provides more liquidity to the demand for foreign currency.

- Delay relative to inflation. It must be emphasized that the free dollar has been losing ground against the general price increase in 2024. So far this year it has gained 205 pesos or 20%, against an inflation close to 70%, since the recent rebound could be considered an adjustment of that gap.

-More weights available. In the last two months, the Monetary Base grew by $5.4 trillion or 51.4% , from $10.5 trillion on March 15 to $15.9 trillion on May 15. And monetary circulation - the main component of the base - increased by $1.6 trillion or 20.5% , from 7.8 trillion to 9.4 trillion pesos. As there is more money on the street, part of the demand for foreign currency can go through alternative channels to the official “stock.”

“The fact that rates in pesos remain negative in real terms could begin to awaken demand for dollarized assets, which causes the persistence of the stocks to be prolonged. Likewise, a trade-off continues to be raised between the accumulation of reserves by the monetary authority and the containment of the exchange gap. Without the blend dollar , the supply of cash with settlement (CCL) would stop being fed with 20% of the settlement of exports, a relevant vector along with the MULC-CCL cross restrictions in moderating the volatility of the free dollar," detailed the analysis prepared by economists Jorge Vasconcelos and Maximiliano Gutiérrez , from the IERAL of the Mediterranean Foundation.

“Exchange run is when the BCRA sells dollars instead of buying and until now it has only been buying. Alarming people with the word exchange rate bullfight is ill-intentioned,” said Marcelo Trovato , Stock Market Forecast expert.

Is there a ceiling for the free dollar?

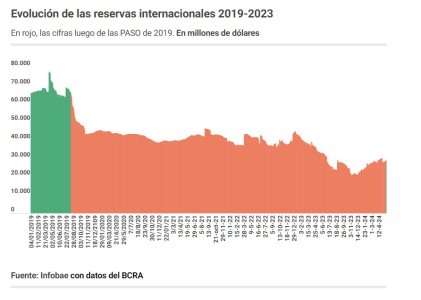

Beyond the shock of these days there are financial conditions that could put a limit on this surge in the free dollar and financial markets in the short term.1) Greater agricultural liquidations. A slow performance in the liquidation of exports is evident in the last rounds, when a greater influx of foreign currency was expected from the heavy harvest. Export income is lining up in the area of USD 300 million per day, when in the autumn months it is common for wheels to follow one another with a volume of operations around USD 600 million in the cash segment of the exchange market .

With the reference for soybeans in grain, which has advanced 8.4% in the last month, sales could be activated and reach the levels expected for this time of year. For economist Gustavo Ber , in the current exchange rate "the lower settlements recorded in the last rounds would be contributing, which conditions the pace of BCRA purchases, beyond the fact that said dynamic should be transitory in the midst of the stage of greatest seasonality" .

“Even though the realignment of financial dollars has been more intense than in previous rate cuts, in the current economic-financial context it should soon find a respite, being the area of 1,200 pesos - with a gap already close to 35% - an important level to monitor to prevent more agents from being inclined to close placements in pesos and seeking coverage due to the implications for expectations,” explained Gustavo Ber.

2) There is no inflationary impact. According to financial analyst Christian Buteler , "when looking at the rise of the dollar these days we cannot forget how flat it was in the last four months while the rest of the prices and services in the economy were flying - and continue to fly -." At the same time, he ruled out an inflationary effect due to the rise in alternative dollars: “Firstly because of the strong recession we are having and secondly because many had established prices with an expectation of a higher dollar. For now, at these levels, there should be no impact on prices.”

3) The rate beats the devaluation. Although it is true that in the last six months inflation beat the returns obtained from the placement of fixed-term deposits, the Government's commitment to maintaining the rate of increase in the official exchange rate below the returns was also reaffirmed. in pesos. The reduction in BCRA rates - four cuts in just over a month - did not modify this expectation.

“The reduction in the monetary policy rate has also been a signal in the exchange rate: the interest rate is currently 1.3 percentage points above the monthly devaluation figure, while two months ago this differential was 4 .7 points”, highlighted the IERAL report of the Mediterranean Foundation.

4) Stay firmly on the fiscal path. In recent years, the issuance financing that the Central Bank was providing to the Treasury to cover its deficit has pressured the rise of the dollar, and the prices of goods and services in general. This spurious issuance was interrupted with Milei's management and is a signal that influences the decision-making of exchange agents.

“We evaluated the first five months well on the macro level, especially due to the ordering of the fiscal and monetary accounts; but regular in the micro since there are no measures to stop the sharp drop in the level of activity. There must be improvements in this aspect so that the support it has from society does not liquefy. The Government knows this, which is why it reversed the liberalization of regulated prices and began to establish increases for each of them, as a method of putting floors to the fall in the purchasing power of the salary, something that is not minor, because 66% of the Economy is driven by consumption,” described Walter Morales , president and strategist of Wise Capital.

“Now, even though 'partially sitting' on regulated prices implies stretching subsidies, fiscal and financial surpluses are not negotiated, so if the Bases Law is not approved, Milei will still go ahead with the chainsaw because it does not is going to give in to the pressures of the political class. This is what will keep investors positively expectant about the future of Argentina,” said Morales.