BuySellBA

Administrator

Why is the Buenos Aires real estate market still active for transactions under USD 100,000? - Infobae

Source:

www.infobae.com

www.infobae.com

February 16, 2025

Demand in this segment remains stable, driven by mortgage credit and greater stability. Still affordable prices and shorter sales periods are in its favour, confirmed an analysis.

Units in the pit and properties for less than USD 100,000 lead the price increases (Illustrative Image Infobae)

The real estate market in Argentina shows signs of recovery after a period of more than 5 years of crisis. According to a private report, opportunities to acquire properties for less than USD 100,000 still persist and the coming months are expected to bring favorable dynamics for this segment.

Radar Inmobiliario, a work carried out by Fabián Achával Propiedades, calculated that in 2025 the number of operations could increase by 30%, driven mainly by mortgage loans, money laundering and -eventually- the elimination of the exchange rate restriction.

“Macroeconomic stability will be essential to sustain this growth,” Fabián Achával , CEO of the company, told Infobae .

One of the key aspects behind the current dynamics is the fluctuating supply of real estate, the paper highlighted.

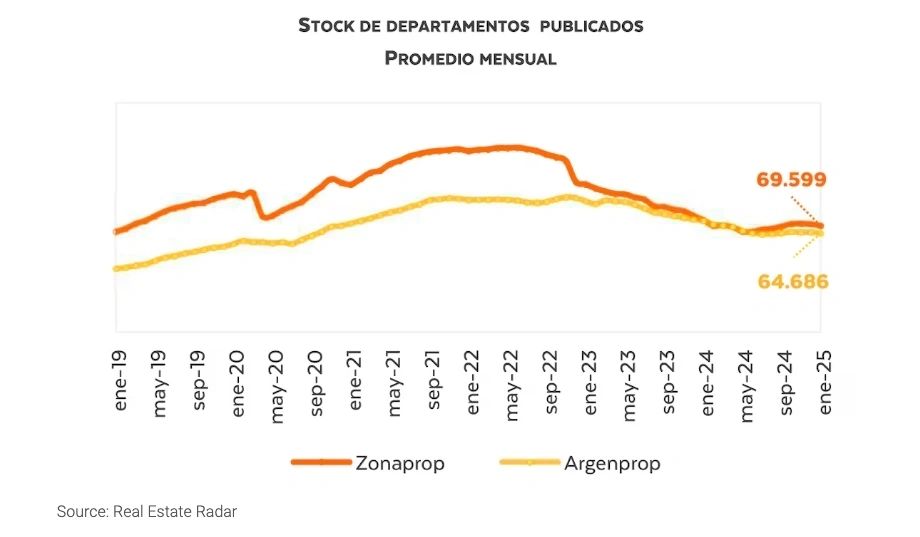

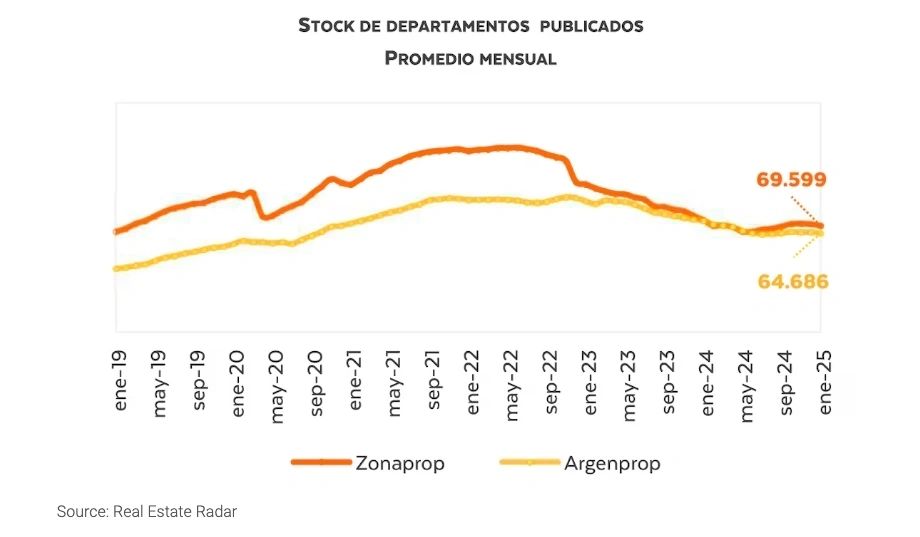

In the city of Buenos Aires there are about 103,000 properties for sale (of which about 70,000 are apartments), 35.6% less than the 160,000 available in May 2022 when they climbed to the historical level, since due to the rental law repealed by the current government, the owners did not dare to offer them for rent.

According to Zonaprop data, December saw a 1.6% monthly drop in supply , while year-on-year the decline was 5.1 percent . For its part, Argenprop documented a similar situation, with a monthly increase of 1.4% , although a decrease of 11.3% compared to the same period in 2023. These numbers contrast with the record level reached in 2022, which saw a 41.3 percent decline .

Lower availability compressed market absorption times.

“In December, the average time to sell properties was reduced to 1.5 years, a significant decrease compared to the previous scenario,” Achával said. This faster pace was favored by the exchange rate stabilization during the government of Javier Milei , who also announced measures that would strengthen the real estate sector, such as the elimination of the exchange rate restriction.

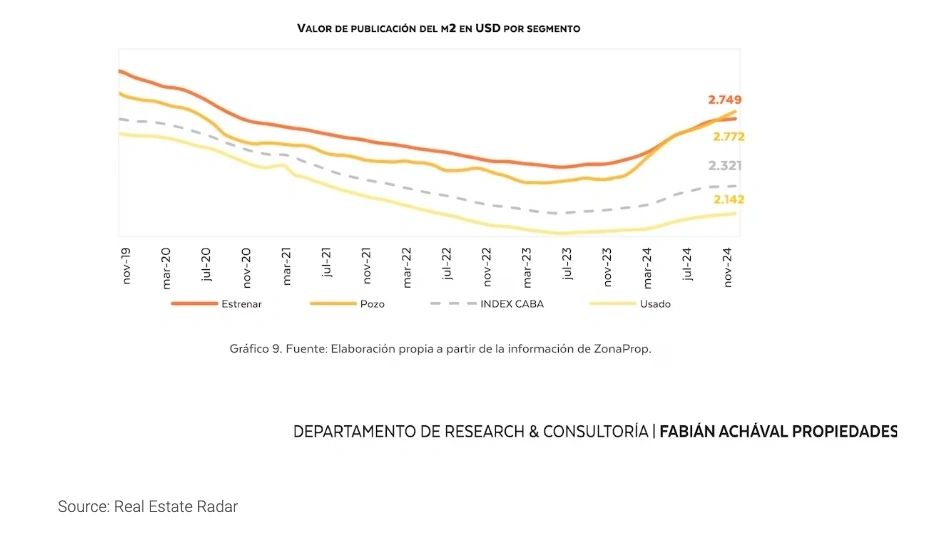

Achával pointed out: “The projects and units in the works lead this increase, with year-on-year variations of 17.8% and 11.3% respectively.”

In addition, the increases must include the direct impact of rising construction costs ( 150% year-on-year in pesos) and the appreciation of the exchange rate.

However, the dynamics vary depending on the type of property and its value. In apartments up to USD 100,000, the increases are more significant due to the high pent-up demand. On the other hand, used properties register a more moderate increase, 5.3% year-on-year.

According to Achával , “we should expect further consolidation of this segment in 2025 as the mortgage lending market gains prominence.”

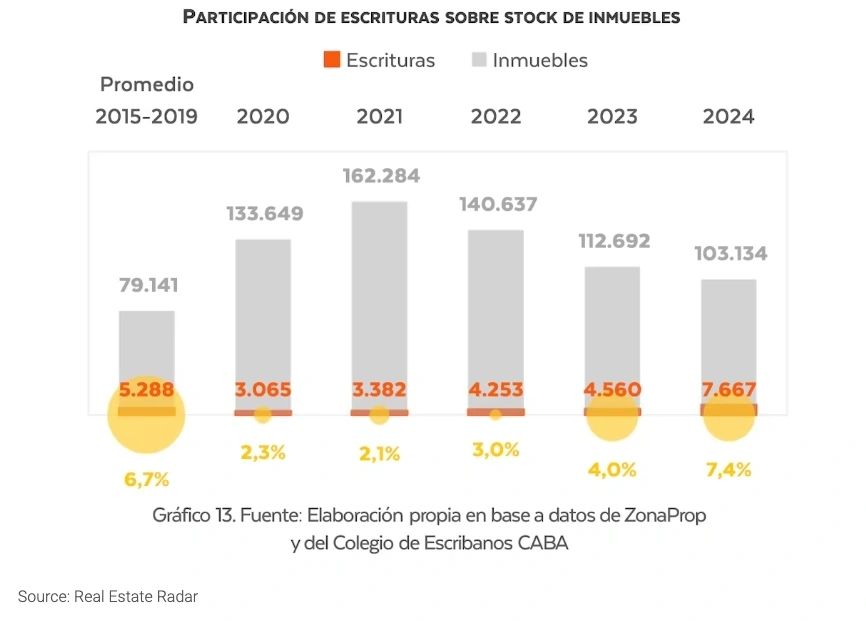

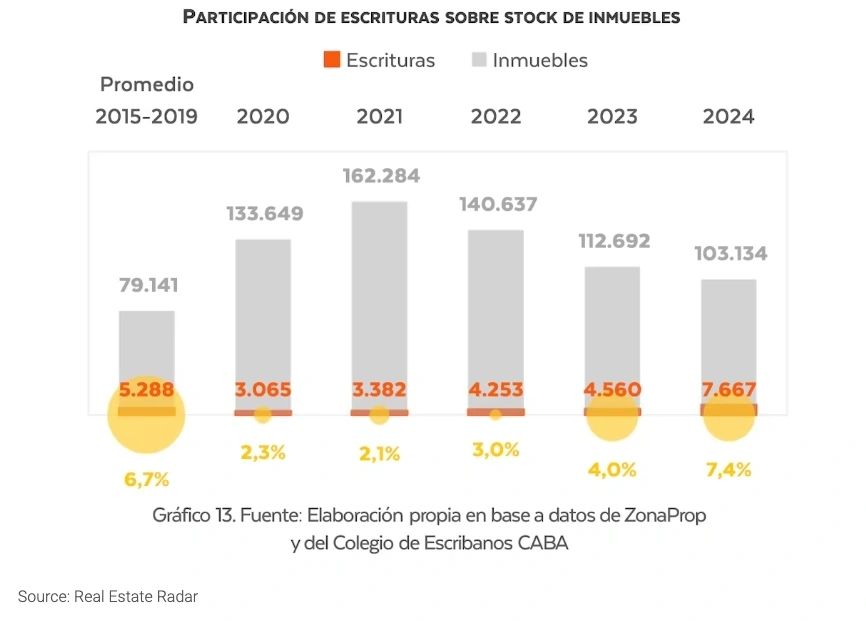

UVA credits offered since 2024 revitalized the sector, reaching 1,130 deeds in Buenos Aires with a year-on-year increase of an astonishing 527.8% , according to Radar Inmobiliario.

This type of financing already accounts for 15% of total operations , although it is still far from the figures experienced during the Macri era, when they reached 35% on average.

Achával considered that the increase in purchasing power measured in dollars will be key to extending this impact in 2025. “The salary in dollars increased strongly this last year, and we hope that more families will be able to take advantage of this tool.”

The outlook for the coming months points to a solid recovery, provided certain key conditions are maintained. On the one hand, analysts agree that demand will be supported by the development of new financing instruments and stable macroeconomic policies.

“The recovery of wages in dollars, greater access to mortgage loans and the possible elimination of the restrictions will positively change the game for the real estate market,” Achával emphasized.

As for supply, it is expected that it will continue to adjust to growing demand.

According to Argenprop, the real estate stock is still 38% higher than the mortgage loan boom of 2017 , a reserve that could balance inflationary pressure on prices, at least in the short term. In the medium term, convergence towards the historical levels of the Macri era could imply a reduction of an additional 37% compared to current figures.

The implementation of divisible mortgages ( which will allow the purchase of units in the project ) and measures aimed at the new development sector should not be overlooked either, as they are emerging as additional drivers for the placement of properties on the market.

"These initiatives will give a significant boost to the real estate development sector," concluded Achával, who also highlighted the importance of controlling inflation and achieving effective exchange rate unification.

www.buysellba.com

Source:

¿Por qué el mercado inmobiliario porteño sigue activo para operaciones de menos de USD 100.000?

La demanda en este segmento se mantiene, impulsada por el crédito hipotecario y una mayor estabilidad. Precios aún accesibles y plazos de venta más reducidos juegan a favor, confirmó un análisis

February 16, 2025

Demand in this segment remains stable, driven by mortgage credit and greater stability. Still affordable prices and shorter sales periods are in its favour, confirmed an analysis.

Units in the pit and properties for less than USD 100,000 lead the price increases (Illustrative Image Infobae)

The real estate market in Argentina shows signs of recovery after a period of more than 5 years of crisis. According to a private report, opportunities to acquire properties for less than USD 100,000 still persist and the coming months are expected to bring favorable dynamics for this segment.

Radar Inmobiliario, a work carried out by Fabián Achával Propiedades, calculated that in 2025 the number of operations could increase by 30%, driven mainly by mortgage loans, money laundering and -eventually- the elimination of the exchange rate restriction.

“Macroeconomic stability will be essential to sustain this growth,” Fabián Achával , CEO of the company, told Infobae .

One of the key aspects behind the current dynamics is the fluctuating supply of real estate, the paper highlighted.

In the city of Buenos Aires there are about 103,000 properties for sale (of which about 70,000 are apartments), 35.6% less than the 160,000 available in May 2022 when they climbed to the historical level, since due to the rental law repealed by the current government, the owners did not dare to offer them for rent.

According to Zonaprop data, December saw a 1.6% monthly drop in supply , while year-on-year the decline was 5.1 percent . For its part, Argenprop documented a similar situation, with a monthly increase of 1.4% , although a decrease of 11.3% compared to the same period in 2023. These numbers contrast with the record level reached in 2022, which saw a 41.3 percent decline .

Lower availability compressed market absorption times.

“In December, the average time to sell properties was reduced to 1.5 years, a significant decrease compared to the previous scenario,” Achával said. This faster pace was favored by the exchange rate stabilization during the government of Javier Milei , who also announced measures that would strengthen the real estate sector, such as the elimination of the exchange rate restriction.

Prices: upward trend and by segment

Listing prices have been on an upward trend for over a year. Zonaprop has accumulated 18 consecutive months of monthly increases (in dollars) , while Mercado Libre recorded a year-on-year increase of 10.4% in December.Achával pointed out: “The projects and units in the works lead this increase, with year-on-year variations of 17.8% and 11.3% respectively.”

In addition, the increases must include the direct impact of rising construction costs ( 150% year-on-year in pesos) and the appreciation of the exchange rate.

However, the dynamics vary depending on the type of property and its value. In apartments up to USD 100,000, the increases are more significant due to the high pent-up demand. On the other hand, used properties register a more moderate increase, 5.3% year-on-year.

According to Achával , “we should expect further consolidation of this segment in 2025 as the mortgage lending market gains prominence.”

Reactivation through mortgages

UVA credits offered since 2024 revitalized the sector, reaching 1,130 deeds in Buenos Aires with a year-on-year increase of an astonishing 527.8% , according to Radar Inmobiliario.

This type of financing already accounts for 15% of total operations , although it is still far from the figures experienced during the Macri era, when they reached 35% on average.

Achával considered that the increase in purchasing power measured in dollars will be key to extending this impact in 2025. “The salary in dollars increased strongly this last year, and we hope that more families will be able to take advantage of this tool.”

Projections and factors to consider in 2025

The outlook for the coming months points to a solid recovery, provided certain key conditions are maintained. On the one hand, analysts agree that demand will be supported by the development of new financing instruments and stable macroeconomic policies.

“The recovery of wages in dollars, greater access to mortgage loans and the possible elimination of the restrictions will positively change the game for the real estate market,” Achával emphasized.

As for supply, it is expected that it will continue to adjust to growing demand.

According to Argenprop, the real estate stock is still 38% higher than the mortgage loan boom of 2017 , a reserve that could balance inflationary pressure on prices, at least in the short term. In the medium term, convergence towards the historical levels of the Macri era could imply a reduction of an additional 37% compared to current figures.

The implementation of divisible mortgages ( which will allow the purchase of units in the project ) and measures aimed at the new development sector should not be overlooked either, as they are emerging as additional drivers for the placement of properties on the market.

"These initiatives will give a significant boost to the real estate development sector," concluded Achával, who also highlighted the importance of controlling inflation and achieving effective exchange rate unification.

www.buysellba.com